|

市场调查报告书

商品编码

1740762

除冰车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测De-Icing Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

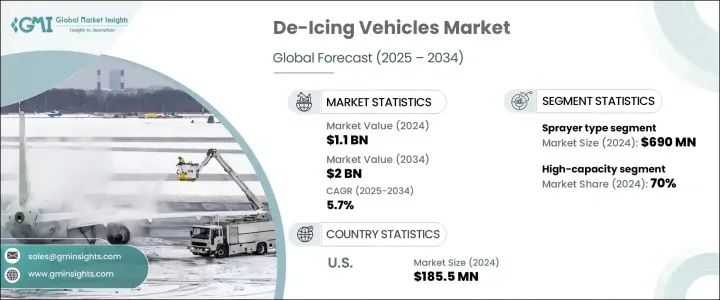

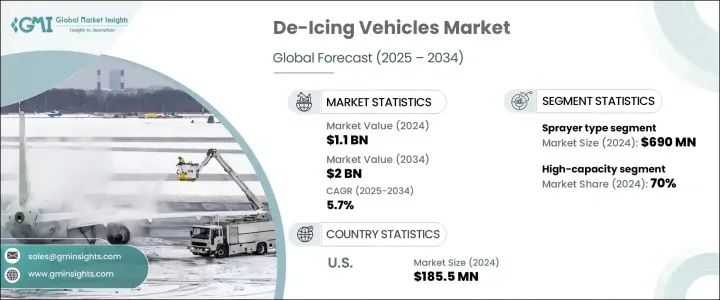

2024年,全球除冰车市场规模达11亿美元,预计2034年将以5.7%的复合年增长率成长,达到20亿美元。这一增长主要源于空中交通流量的增加、机场基础设施的扩建以及寒冷地区日益严格的安全法规。这些专用车辆透过清除关键表面的冰雪和霜冻,在确保冬季飞机安全运行方面发挥着至关重要的作用。机场、航空公司和地面服务供应商正在大力投资现代化除冰系统,以提高合规性并最大限度地减少与天气相关的延误。随着全球航空旅行的增加,对冬季有效营运的需求也日益增长,尤其是在易受恶劣天气影响的地区。新一代除冰车不仅设计更有效率,在製造过程中也充分考虑了永续性,采用了电动传动系统和环保的流体系统。车队管理系统中自动化和数位化整合的应用也有助于缩短回应时间并提高整体效率,使营运商能够更精确、更快速地处理冬季营运。

技术进步在重新定义除冰作业格局方面发挥关键作用。新兴技术包括混合动力和电动车,以及配备热成像系统的车辆,以便更准确地探测冰层。人工智慧正被用于预测维护需求并减少停机时间。这些创新正在延长车辆的使用寿命并降低维护成本。人们关注的正转向不仅能在恶劣天气下表现良好,还能提供长期可靠性和环保效率的车辆。随着机场努力减少碳足迹,智慧技术与清洁能源的整合正成为采购策略的核心组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 20亿美元 |

| 复合年增长率 | 5.7% |

从技术角度来看,市场细分为喷雾器型和撒布机型车辆。喷雾器型车辆在2024年占据主导地位,创造了约6.9亿美元的收入。这些车辆对于航空安全至关重要,因为它们可以将液体除冰剂直接喷洒到飞机跑道和路面上。由于其精准度高,并且能够在能见度低和冰冻条件下有效运行,它们被广泛应用于民用和军用航空枢纽。喷雾器型车辆配备高性能配置,例如隔热罐、加热喷桿和可调节喷嘴,可确保均匀施药并最大程度地减少浪费。它们与GPS追踪和即时液体监测等自动化系统的整合提高了效率并减少了人工干预。

依油箱容量,市场可分为高、中、低容量车辆。高容量除冰车在2024年占据了最大的市场份额,占整体市场的70%。这些车辆因其能够快速运输和分配大量除冰液的能力而成为繁忙国际机场的首选。它们尤其适用于大规模作业,覆盖范围广,停机时间短,并且能够在极端条件下运作。其大型储液罐和高效的喷洒机制使其成为高流量环境中不可或缺的部件,因为快速週转至关重要。

市场也依车辆类型细分:自走式、车用式和牵引式。其中,自走式除冰车在2024年占据主导地位。这些车辆具有卓越的机动性和速度,使地勤人员能够独立作业,无需外部牵引支援。它们能够有效覆盖宽阔的跑道区域,并在狭窄的机场区域具有更强的机动性,因此非常受欢迎,尤其是在大型国际机场。它们的内建控制系统、先进的流体管理和自主功能在时间敏感的作业中提供了强大的性能优势。

按应用细分,商业机场领域在2024年占据市场主导地位,占据了最高的收入份额。这些机场的交通量最大,需要快速应付恶劣天气,以避免航班中断。高效的除冰作业对于确保乘客安全和最大程度减少延误至关重要。随着全球互联互通的不断增强和航线的不断拓展,商业机场正在大力投资现代化的除冰车队,以便在冬季高峰期高效地管理多架飞机。这些车辆能够快速、广泛地覆盖,有助于在恶劣天气下保持运作的连续性。

从地区来看,美国在北美除冰车市场占据主导地位,2024 年估值达 1.855 亿美元,预计到 2034 年复合年增长率将达到 5.9% 左右。这主要得益于美国机场网路密集,冬季天气频繁,需要高度可靠且有效率的地面支援设备。区域和国际机场对可靠、大规模除冰作业的需求持续推动对先进除冰车系统的需求。

市场的主要参与者包括 JBT Corporation、Global Ground Support、Mallaghan Engineering、Polar Mobility、Oshkosh、PrimeFlight、TLD、Textron GSE、Vestergaard 和威海广泰机场。这些公司专注于透过创新、合併和提升生产能力来实现策略性成长。他们致力于开发更聪明、更环保、更耐用的除冰解决方案,以满足全球机场地面运作不断变化的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 价格趋势

- 地区

- 类型

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 空中交通日益增加,航空安全法规日益严格

- 扩大机场基础设施和地面处理业务

- 除冰设备和自动化技术的进步

- 环保节能除冰解决方案的需求

- 产业陷阱与挑战

- 传统除冰液的环境问题

- 季节性需求波动影响全年获利能力

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 自走式除冰车

- 车载除冰车

- 牵引式除冰车

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 喷雾器类型

- 吊具类型

第七章:市场估计与预测:按储槽容量,2021 - 2034 年

- 主要趋势

- 高容量

- 中等容量

- 容量低

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业机场

- 军用机场

- 直升机停机坪和直升机场

- 货运机场

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aebi Schmidt

- Bertoli

- Douglas

- EINSA

- Global Ground Support

- Ground Support Specialists

- Hydro Engineering

- Idrobase

- JBT

- Mallaghan

- Oshkosh

- Polar Mobility

- PrimeFlight

- Rheinmetall

- Textron GSE

- Timsan

- Trecan Combustion

- Vestergaard

- Volkan Firefighting

- Weihai Guangtai

The Global De-Icing Vehicles Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 2 billion by 2034. This growth is driven by a combination of rising air traffic, expansion of airport infrastructure, and increasingly strict safety regulations in colder regions. These specialized vehicles play a vital role in ensuring the safe operation of aircraft during winter by removing ice, snow, and frost from critical surfaces. Airports, airlines, and ground handling service providers are investing heavily in modern de-icing systems to enhance regulatory compliance and minimize weather-related delays. As global air travel increases, so does the need for effective winter operations, especially in regions prone to severe weather. New-age de-icing vehicles are not only designed to be more efficient but are also built with sustainability in mind, incorporating electric drivetrains and eco-conscious fluid systems. The adoption of automation and digital integration into fleet management systems has also contributed to quicker response times and better overall efficiency, enabling operators to handle winter operations with greater precision and speed.

Technological advancements are playing a key role in redefining the landscape of de-icing operations. Emerging technologies include hybrid and electric models, as well as vehicles fitted with thermal imaging systems for more accurate detection of ice. Artificial intelligence is being employed to predict maintenance needs and reduce operational downtime. These innovations are extending vehicle lifespans and lowering maintenance costs. The focus is shifting toward vehicles that not only perform well in adverse weather but also offer long-term reliability and environmental efficiency. With airports striving to reduce their carbon footprint, the integration of smart technologies and cleaner energy sources is becoming a core component of procurement strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2 Billion |

| CAGR | 5.7% |

In terms of technology, the market is segmented into sprayer-type and spreader-type vehicles. The sprayer-type category took the lead in 2024, generating revenue of approximately USD 690 million. These vehicles are essential for aviation safety, as they apply liquid de-icing agents directly to aircraft runways and surfaces. They are widely used across civilian and military aviation hubs due to their precision and ability to operate effectively under poor visibility and freezing conditions. Sprayer-type vehicles come with high-performance features such as insulated tanks, heated booms, and adjustable spray nozzles, ensuring uniform application with minimal waste. Their integration with automated systems like GPS tracking and real-time fluid monitoring improves their efficiency and reduces manual intervention.

Based on tank capacity, the market is categorized into high, medium, and low-capacity vehicles. High-capacity de-icing vehicles held the largest market share in 2024, accounting for 70% of the overall market. These units are preferred in busy international airports due to their ability to carry and dispense larger volumes of de-icing fluid quickly. They are particularly beneficial for large-scale operations, providing broad coverage, reduced downtime, and the capability to perform under extreme conditions. Their large fluid reservoirs and efficient spraying mechanisms make them indispensable in high-traffic environments where quick turnaround is crucial.

The market is also segmented by vehicle type: self-propelled, truck-mounted, and towable units. Among these, self-propelled de-icing vehicles dominated in 2024. These vehicles offer superior mobility and speed, allowing ground crews to operate independently without the need for external towing support. Their efficiency in covering expansive runway areas and enhanced maneuverability in tight airport zones make them highly desirable, especially in major international airports. Their built-in control systems, advanced fluid management, and autonomous features provide a strong performance advantage during time-sensitive operations.

When broken down by application, the commercial airport segment led the market in 2024, securing the highest revenue share. These airports see the most significant traffic volume and demand rapid response to adverse weather to avoid flight disruptions. Efficient de-icing operations are essential for ensuring passenger safety and minimizing delays. With growing global connectivity and expanding flight routes, commercial airports are heavily investing in modern de-icing fleets capable of managing multiple aircraft efficiently during peak winter seasons. These vehicles provide fast, wide-area coverage that helps maintain operational continuity during harsh weather.

Regionally, the United States dominated the North America de-icing vehicles market with a valuation of USD 185.5 million in 2024 and is projected to grow at a CAGR of around 5.9% through 2034. This is largely due to the country's dense network of airports and the frequent winter weather conditions that demand highly reliable and efficient ground support equipment. The need for dependable, large-scale de-icing operations at regional and international airports continues to drive demand for advanced vehicle systems.

Key players in the market include JBT Corporation, Global Ground Support, Mallaghan Engineering, Polar Mobility, Oshkosh, PrimeFlight, TLD, Textron GSE, Vestergaard, and Weihai Guangtai Airport. These companies are focused on strategic growth through innovation, mergers, and enhanced production capabilities. Their efforts are centered on developing smarter, greener, and more durable de-icing solutions tailored to the changing needs of airport ground operations worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Price trend

- 3.6.1 Region

- 3.6.2 Type

- 3.7 Cost breakdown analysis

- 3.8 Key news & initiatives

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing air traffic and stringent aviation safety regulations

- 3.9.1.2 Expansion of airport infrastructure and ground handling operations

- 3.9.1.3 Technological advancements in de-icing equipment and automation

- 3.9.1.4 Demand for eco-friendly and energy-efficient de-icing solutions

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Environmental concerns over traditional de-icing fluids

- 3.9.2.2 Seasonal demand fluctuations affecting year-round profitability

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Self-propelled de-icing vehicles

- 5.3 Truck-mounted de-icing vehicles

- 5.4 Towable de-icing vehicles

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Sprayer type

- 6.3 Spreader type

Chapter 7 Market Estimates & Forecast, By Tank Capacity, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 High capacity

- 7.3 Medium capacity

- 7.4 Low capacity

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Commercial airports

- 8.3 Military airports

- 8.4 Helipads and heliports

- 8.5 Cargo airports

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aebi Schmidt

- 10.2 Bertoli

- 10.3 Douglas

- 10.4 EINSA

- 10.5 Global Ground Support

- 10.6 Ground Support Specialists

- 10.7 Hydro Engineering

- 10.8 Idrobase

- 10.9 JBT

- 10.10 Mallaghan

- 10.11 Oshkosh

- 10.12 Polar Mobility

- 10.13 PrimeFlight

- 10.14 Rheinmetall

- 10.15 Textron GSE

- 10.16 Timsan

- 10.17 Trecan Combustion

- 10.18 Vestergaard

- 10.19 Volkan Firefighting

- 10.20 Weihai Guangtai