|

市场调查报告书

商品编码

1740766

汽车无线模组市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Wireless Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

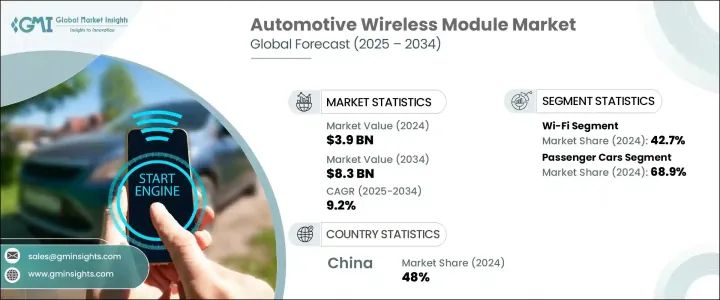

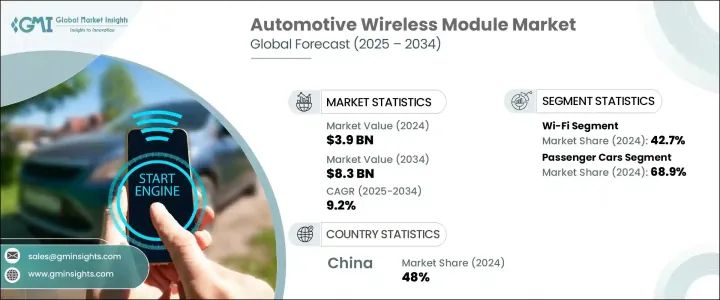

2024年,全球汽车无线模组市场规模达39亿美元,预计2034年将以9.2%的复合年增长率成长,达到83亿美元。这得归功于消费者对连网汽车日益增长的需求,以及5G和V2X通讯等下一代无线技术的快速部署。随着汽车产业向数位转型迈进,无线模组正成为提供更智慧、更安全、更互联驾驶体验的关键组件。从支援无缝资讯娱乐系统到支援预测性维护和远端诊断,这些模组正在重塑汽车与环境和使用者的互动方式。

汽车製造商正加倍重视无线连接功能,以提升便利性、安全性和效能。现今的消费者不仅追求先进的引擎或时尚的设计,他们还期望车辆能够提供与智慧型手机同等水平的连接性。高速无线技术的整合正在改变驾驶和乘客与车辆的互动方式,为汽车製造商创造新的价值主张。人们对自动驾驶、电气化和互联服务的日益关注,推动了对高频宽、低延迟通讯系统的需求。无线模组如今被视为智慧交通系统的支柱,支援即时导航、车队追踪、远端软体更新和智慧城市整合等功能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 83亿美元 |

| 复合年增长率 | 9.2% |

向始终互联汽车的转变正在重新定义整个汽车行业的期望。如今,购车者的需求已超越传统的远端资讯处理,他们希望获得即时交通资料、基于行动应用程式的车辆控制、串流媒体娱乐和即时车辆健康更新。这些功能依赖强大的无线通讯模组,以确保车辆、云端和其他互联基础设施之间的不间断互动。 5G 和 V2X(车对万物)通讯的日益普及进一步加剧了对先进无线解决方案的需求。这些技术预计将在车辆、基础设施、行人和更广泛的移动生态系统之间建立超可靠、低延迟的连接。随着安全法规的演变和自动化水准的提高,对一致、高速资料传输的需求只会增长,这迫使汽车製造商优先考虑在每款车型中整合无线模组。

在众多可用的连接选项中,Wi-Fi 继续引领汽车无线模组市场,到 2024 年将占据 42.7% 的市场份额。预计这一主导地位将持续下去,并在整个预测期内保持两位数的强劲成长潜力。 Wi-Fi 仍然是资料密集型应用的首选技术,例如无线 (OTA) 更新、视讯串流、导航和车载连线。汽车製造商正在使用 Wi-Fi 模组进行即时诊断并提供软体增强功能,而无需亲自前往服务中心。在电动和混合动力汽车中,支援 Wi-Fi 的系统还可以帮助监控电池使用情况、优化性能并实现与充电站的无缝通讯。随着人们对更聪明、更环保的汽车的需求不断增长,Wi-Fi 在管理和分析能源系统中的作用变得越来越重要。

乘用车占据汽车无线模组市场主导地位,2024 年占 68.9%。由于从高端轿车到紧凑型掀背车等所有车型互联功能的快速发展和标准化,该细分市场占据了市场领先地位。如今,消费者已经习惯将基于云端的资讯娱乐系统、基于应用程式的控制、预测性诊断和语音辅助功能融入驾驶体验。汽车製造商正在将无线模组嵌入到车辆架构中,以更有效地提供这些功能并提升整体客户满意度。随着竞争加剧,即使是入门车型也配备了先进的互联解决方案,这提高了人们对车载技术的基本期望。

2024年,中国汽车无线模组市场规模达7.786亿美元,占全球市场份额的48%。中国市场占据主导地位,源自于其积极推动互联互通和自动驾驶出行,并依赖全球最大的汽车製造生态系统。中国对高技术电动车的需求不断增长,加上政府的慷慨激励措施和5G基础设施的快速部署,正推动V2X和无线通讯模组的广泛应用。国内汽车製造商正藉此良机,整合智慧功能,拓展在国内外市场的影响力。中国对汽车电子的持续投入及其对数位转型的重视,预计将进一步巩固其在汽车无线连接领域的全球领先地位。

高通技术、Mobileye、法雷奥、英伟达、爱信精机、电装、罗伯特·博世、大陆集团、博格华纳和采埃孚等领先企业正透过专注于创新和策略合作来加速其市场布局。这些企业正在增强其无线平台以支援 5G 和 V2X 应用,整合人工智慧功能,并为电动车和自动驾驶汽车推出可扩展、高效的模组。透过在地化生产和扩展基于云端的服务,他们力求在互联互通、自动化和即时资料交换驱动的快速变化的市场格局中保持领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 原物料供应商

- 汽车OEM

- 配销通路

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 定价分析

- 推进系统

- 地区

- 对部队的影响

- 成长动力

- 连网汽车需求不断成长

- 5G 和 V2X 通讯的采用率不断提高

- 物联网和智慧移动的进步

- 消费者对车载功能的需求增加

- 产业陷阱与挑战

- 先进无线模组成本高

- 网路安全和资料隐私问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依连结性,2021 - 2034 年

- 主要趋势

- 无线上网

- 蓝牙

- 蜂巢

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- 越野车

- 商用车

- 轻型

- 中型

- 重负

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

- 插电式混合动力

- 油电混合车

- 燃料电池电动车

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 导航

- 远端资讯处理

- 资讯娱乐

- 车辆安全和紧急服务

- 其他的

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Aisin Seiki

- Autotalks

- BorgWarner

- Continental

- Delphi Technologies

- Denso

- Harman International

- Huawei Technologies

- Infineon Technologies

- Magna International

- Mobileye

- NVIDIA

- NXP Semiconductors

- Panasonic

- Qualcomm Technologies

- Renesas Electronics

- Robert Bosch

- Skyworks Solutions

- VALEO

- ZF Friedrichshafen

The Global Automotive Wireless Module Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 8.3 billion by 2034, driven by increasing consumer demand for connected vehicles and the rapid deployment of next-generation wireless technologies like 5G and V2X communication. As the automotive industry experiences a major shift toward digital transformation, wireless modules are becoming essential components in delivering smarter, safer, and more connected driving experiences. From enabling seamless infotainment systems to supporting predictive maintenance and remote diagnostics, these modules are reshaping how vehicles interact with their environment and users.

Automakers are doubling down on wireless connectivity features to enhance convenience, safety, and performance. Today's consumers are not just looking for advanced engines or sleek designs-they expect their vehicles to offer the same level of connectivity as their smartphones. The integration of high-speed wireless technologies is transforming the way drivers and passengers interact with their vehicles, creating new value propositions for automakers. The increasing focus on autonomous driving, electrification, and connected services is fueling the demand for high-bandwidth, low-latency communication systems. Wireless modules are now seen as the backbone of intelligent transportation systems, enabling features like real-time navigation, fleet tracking, remote software updates, and smart city integration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 9.2% |

The shift toward always-connected vehicles is redefining expectations across the automotive landscape. Car buyers today demand more than traditional telematics-they want access to live traffic data, mobile app-based vehicle control, streaming entertainment, and real-time vehicle health updates. These capabilities rely on robust wireless communication modules that ensure uninterrupted interaction between the vehicle, cloud, and other connected infrastructure. The growing rollout of 5G and V2X (vehicle-to-everything) communication is further intensifying the need for advanced wireless solutions. These technologies promise ultra-reliable, low-latency connections between vehicles, infrastructure, pedestrians, and the broader mobility ecosystem. As safety regulations evolve and automation levels rise, the need for consistent, high-speed data transmission will only grow-pushing automakers to prioritize wireless module integration in every model.

Among the many connectivity options available, Wi-Fi continues to lead the automotive wireless module market, commanding a 42.7% share in 2024. This dominance is expected to continue, with strong potential for double-digit growth throughout the forecast period. Wi-Fi remains the go-to technology for data-heavy applications like over-the-air (OTA) updates, video streaming, navigation, and in-vehicle connectivity. Automakers are using Wi-Fi modules to perform real-time diagnostics and deliver software enhancements without requiring physical visits to service centers. In electric and hybrid vehicles, Wi-Fi-enabled systems also help monitor battery usage, optimize performance, and enable seamless communication with charging stations. As the push for smarter, greener vehicles gains momentum, the role of Wi-Fi in managing and analyzing energy systems is becoming increasingly critical.

Passenger vehicles dominate the automotive wireless module market, representing a 68.9% share in 2024. This segment leads the market thanks to the rapid evolution and standardization of connected features across all vehicle classes-from premium sedans to compact hatchbacks. Consumers are now accustomed to having cloud-based infotainment systems, app-based controls, predictive diagnostics, and voice-assisted functions as part of their driving experience. Automakers are embedding wireless modules into vehicle architecture to deliver these features more effectively and boost overall customer satisfaction. As competition intensifies, even entry-level models are being equipped with advanced connectivity solutions, raising the baseline expectations for in-car technology.

The China Automotive Wireless Module Market generated USD 778.6 million in 2024, capturing a 48% share globally. China's dominance stems from its aggressive push toward connected and autonomous mobility, supported by the world's largest automotive manufacturing ecosystem. The country's rising demand for tech-savvy electric vehicles, coupled with generous government incentives and rapid 5G infrastructure rollout, is fueling high adoption of V2X and wireless communication modules. Domestic automakers are leveraging this momentum to integrate smart features and expand their presence in both domestic and international markets. China's continued investment in automotive electronics and its emphasis on digital transformation are expected to further cement its position as a global leader in wireless vehicle connectivity.

Leading companies such as Qualcomm Technologies, Mobileye, VALEO, NVIDIA, Aisin Seiki, Denso, Robert Bosch, Continental, BorgWarner, and ZF Friedrichshafen are accelerating their market presence by focusing on innovation and strategic partnerships. These players are enhancing their wireless platforms to support 5G and V2X applications, integrating AI capabilities, and rolling out scalable, power-efficient modules for EVs and autonomous vehicles. By localizing production and expanding cloud-based service offerings, they aim to stay ahead in a fast-changing market landscape driven by connectivity, automation, and real-time data exchange.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End Use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for connected vehicles

- 3.10.1.2 Rising adoption of 5G and V2X communication

- 3.10.1.3 Advancements in IoT and smart mobility

- 3.10.1.4 Increased consumer demand for in-car features

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High cost of advanced wireless modules

- 3.10.2.2 Cybersecurity and data privacy concerns

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Wi-Fi

- 5.3 Bluetooth

- 5.4 Cellular

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchback

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light duty

- 6.3.2 Medium duty

- 6.3.3 Heavy duty

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

- 7.4.1 PHEV

- 7.4.2 HEV

- 7.4.3 FCEV

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Navigation

- 8.3 Telematics

- 8.4 Infotainment

- 8.5 Vehicle safety and emergency services

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 Autotalks

- 11.3 BorgWarner

- 11.4 Continental

- 11.5 Delphi Technologies

- 11.6 Denso

- 11.7 Harman International

- 11.8 Huawei Technologies

- 11.9 Infineon Technologies

- 11.10 Magna International

- 11.11 Mobileye

- 11.12 NVIDIA

- 11.13 NXP Semiconductors

- 11.14 Panasonic

- 11.15 Qualcomm Technologies

- 11.16 Renesas Electronics

- 11.17 Robert Bosch

- 11.18 Skyworks Solutions

- 11.19 VALEO

- 11.20 ZF Friedrichshafen