|

市场调查报告书

商品编码

1740791

硝化抑制剂及脲酶抑制剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Nitrification and Urease Inhibitors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

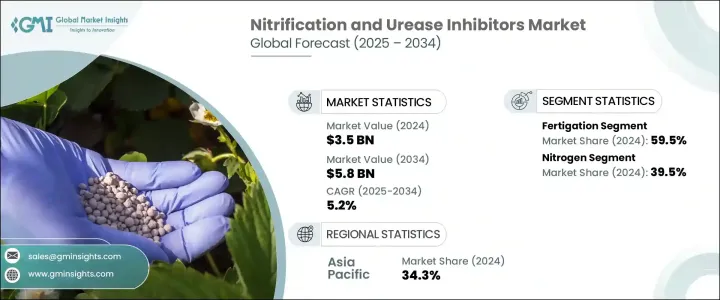

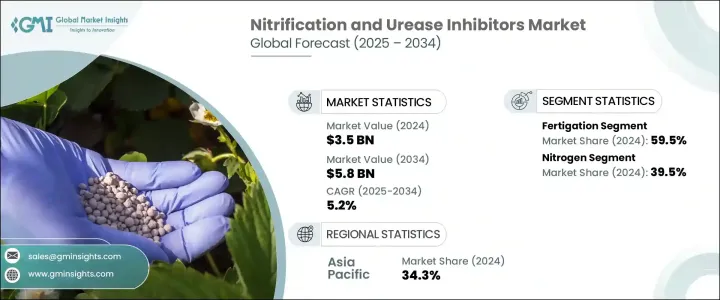

2024年,全球硝化抑制剂和脲酶抑制剂市场规模达35亿美元,预计2034年将以5.2%的复合年增长率成长,达到58亿美元。这得益于农业领域对提高氮肥利用效率日益增长的需求以及向永续农业实践的转变。环境和经济压力迫使农业部门采取更有效率的养分管理策略,该市场正呈现强劲成长动能。随着全球人口成长和可耕地日益稀缺,农民正在寻找创新工具,以优化投入品使用,同时又不影响作物产量。硝化抑制剂和脲酶抑制剂正成为关键的解决方案,它们能够增强肥料性能,并有助于防止氮素因淋溶和挥发而流失。这些抑制剂不仅因其能够改善土壤健康和水质,还因其能够透过减少浪费和提高单位面积产量来提高盈利能力而日益受到青睐。此外,全球对温室气体排放和水污染的担忧进一步推动了需求,使这些产品成为现代精准农业系统中不可或缺的一部分。随着该产业持续投资于更智慧、更能适应气候的技术,市场将受益于永续发展目标和经济可行性的融合,为农业企业和小规模农户创造机会。

多年来,农民面临氮素挥发和淋溶造成的损失这一严峻挑战,不仅降低了肥料利用率,也对环境造成了危害。为此,农业部门正在迅速采用抑制剂,以改善养分保留并减少有害排放。北美和亚太等主要农业地区的政府正积极支持这项转变,透过补贴和永续发展措施推广氮稳定剂的使用。这些努力旨在创造一个更具韧性、对环境更负责的农业体系。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 35亿美元 |

| 预测值 | 58亿美元 |

| 复合年增长率 | 5.2% |

对于注重成本的农民来说,这些抑制剂能够在不增加投入成本的情况下最大限度地提高作物产量,这是一项极具吸引力的投资。肥沃农田的竞争日益激烈,加上人们对土壤退化和水污染的担忧日益加剧,可靠的氮肥管理解决方案的重要性日益凸显。除了环境效益外,这些产品还与不断发展的农艺实践相契合,例如定制肥料混合物以及叶面喷施和水肥一体化等先进的施用方法,从而促进了其在各种农业环境中的广泛应用。

2024年,灌溉施肥占了59.5%的市场份额,这反映出其作为首选施肥方法的受欢迎程度。这种方法将施肥与灌溉结合,实现了精准且一致的养分分配。灌溉施肥在自动化农业系统以及高价值作物种植者中尤其受欢迎,因为在这些领域,效率和一致性至关重要。用于灌溉施肥的抑制剂的水溶性、稳定性以及对pH值和温度变化的响应能力日益增强,使其成为精准农业应用的理想选择。

在不同类型的养分中,氮抑制剂在2024年占据了最大的市场份额,占总市场份额的39.5%。这一强劲表现凸显了优化氮肥利用和抑制养分流失到环境的关键性。这些抑制剂能够使氮在土壤中保持更长时间的有效性,从而帮助作物更有效地吸收养分,提高产量,同时减少对水体和生态系统的负面影响。因此,氮抑制剂现已成为全球永续养分管理策略的核心要素。

2024年,亚太地区引领全球市场,占据34.3%的市场份额,这得益于该地区农业活动的活跃、积极的政府政策以及对先进农业实践日益增长的需求。在强而有力的政策框架和激励措施的支持下,该地区各国正在大力推广能够最大程度减少氮流失并提高作物产量的技术。同时,在严格的环境法规和精准农业技术的广泛应用的推动下,北美和欧洲市场继续保持稳健成长。

索尔维公司、巴斯夫公司、陶氏化学、科氏化肥公司和杜邦等产业领导者正积极拓展市场,开发针对区域农业需求的客製化解决方案。这些公司正在与化肥製造商和农业科技公司建立合作伙伴关係,投资于持久有效的生物基技术,并支持农民教育计画。透过创新与合作,他们在塑造永续农业的未来方面发挥着至关重要的作用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供应方影响(原料)

- 需求面影响(销售价格)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 抑制剂与先进肥料技术的整合

- 对永续和生态友善农业的需求不断增长

- 生物基和双功能配方的创新

- 产业陷阱与挑战

- 农民的认知与采用有限

- 产品成本高且可近性有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依方法,2021 年至 2034 年

- 主要趋势

- 水肥一体化

- 叶面

第六章:市场估计与预测:按营养成分,2021 年至 2034 年

- 主要趋势

- 氮

- 氨

- 硝酸盐

- 尿素

- 其他的

第七章:市场估计与预测:依作物类型,2021 年至 2034 年

- 主要趋势

- 粮食作物

- 经济作物

- 园艺

- 纤维作物

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- BASF SE

- Dow

- DuPont

- Solvay SA

- Koch Fertilizers LLC

- Evonik

- National Fertilizers Limited

- Nico Orgo Manures

- Compo Expert GmbH

- Eco Agro

The Global Nitrification and Urease Inhibitors Market was valued at USD 3.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 5.8 billion by 2034, driven by the growing urgency to enhance nitrogen use efficiency in agriculture and the increasing shift toward sustainable farming practices. This market is witnessing strong momentum as both environmental and economic pressures compel the agricultural sector to adopt more efficient nutrient management strategies. As the global population rises and arable land becomes scarcer, farmers are looking for innovative tools to optimize input usage without compromising crop yields. Nitrification and urease inhibitors are emerging as critical solutions, offering enhanced fertilizer performance and helping prevent nitrogen loss through leaching and volatilization. These inhibitors are gaining traction not only for their ability to support soil health and water quality but also for their role in improving profitability by reducing waste and boosting yield per acre. Moreover, global concerns over greenhouse gas emissions and water pollution have further propelled demand, making these products essential in modern precision agriculture systems. As the industry continues to invest in smarter, climate-resilient technologies, the market is set to benefit from the convergence of sustainability goals and economic viability, creating opportunities for both agribusinesses and small-scale farmers.

Over the years, farmers have faced significant challenges with nitrogen loss caused by volatilization and leaching, which not only reduce fertilizer efficiency but also harm the environment. In response, the agriculture sector is rapidly adopting inhibitors that improve nutrient retention and reduce harmful emissions. Governments in major agricultural regions like North America and Asia Pacific are actively supporting this shift through subsidies and sustainability initiatives that promote the use of nitrogen stabilizers. These efforts aim to create a more resilient and environmentally responsible agricultural system.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.5 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 5.2% |

For cost-conscious farmers, the ability to maximize crop yield without inflating input costs makes these inhibitors a highly attractive investment. The growing competition for fertile farmland, coupled with rising concerns about soil degradation and water contamination, has elevated the importance of reliable nitrogen management solutions. In addition to environmental benefits, these products align with evolving agronomic practices such as customized fertilizer blends and advanced delivery methods like foliar sprays and fertigation, encouraging widespread adoption across diverse farming environments.

In 2024, the fertigation segment accounted for a dominant 59.5% share of the market, reflecting its popularity as a preferred application method. This approach integrates fertilizer delivery with irrigation, allowing for precise and consistent nutrient distribution. Fertigation is especially popular in automated farming systems and among growers of high-value crops, where efficiency and consistency are critical. Inhibitors designed for fertigation are becoming increasingly water-soluble, stable, and responsive to varying pH levels and temperatures, making them ideal for precision agriculture applications.

Among the different nutrient types, nitrogen inhibitors captured the largest market share in 2024, holding 39.5% of the total. This strong performance underscores the critical importance of optimizing nitrogen use and curbing nutrient losses to the environment. By keeping nitrogen available in the soil for longer periods, these inhibitors help crops absorb nutrients more efficiently, boosting productivity while reducing negative impacts on water bodies and ecosystems. As a result, nitrogen inhibitors are now a central element in sustainable nutrient management strategies around the world.

The Asia Pacific region led the global market in 2024, securing a 34.3% share, thanks to its high agricultural activity, proactive government policies, and increasing demand for advanced farming practices. Countries across the region are pushing for technologies that minimize nitrogen runoff and improve crop performance, backed by strong policy frameworks and incentives. Meanwhile, markets in North America and Europe continue to demonstrate solid growth, driven by strict environmental regulations and widespread adoption of precision farming technologies.

Leading industry players such as Solvay S.A., BASF SE, Dow, Koch Fertilizers LLC, and DuPont are actively expanding their market reach by developing customized solutions tailored to regional agricultural needs. These companies are forging partnerships with fertilizer manufacturers and agri-tech firms, investing in long-lasting, bio-based technologies, and supporting farmer education programs. Through innovation and collaboration, they are playing a crucial role in shaping the future of sustainable agriculture.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Impact on trade

- 3.1.8 Trade volume disruptions

- 3.2 Retaliatory measures

- 3.3 Impact on the industry

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.3.1.1 Price volatility in key materials

- 3.3.1.2 Supply chain restructuring

- 3.3.1.3 Production cost implications

- 3.3.1 Supply-Side impact (Raw Materials)

- 3.4 Demand-Side impact (Selling Price)

- 3.4.1 Price transmission to end markets

- 3.4.2 Market share dynamics

- 3.4.3 Consumer response patterns

- 3.5 Key companies impacted

- 3.6 Strategic industry responses

- 3.6.1 Supply chain reconfiguration

- 3.6.2 Pricing and product strategies

- 3.6.3 Policy engagement

- 3.7 Outlook and Future considerations

- 3.8 Supplier landscape

- 3.9 Profit margin analysis

- 3.10 Key news & initiatives

- 3.11 Regulatory landscape

- 3.12 Impact forces

- 3.12.1 Growth drivers

- 3.12.1.1 Integration of inhibitors with advanced fertilizer technologies

- 3.12.1.2 Rising demand for sustainable and eco-friendly agriculture

- 3.12.1.3 Innovation in bio-based and dual-function formulations

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 Limited awareness and adoption among farmers

- 3.12.2.2 High product cost and limited accessibility

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Method, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fertigation

- 5.3 Foliar

Chapter 6 Market Estimates and Forecast, By Nutrient, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Nitrogen

- 6.3 Ammonia

- 6.4 Nitrate

- 6.5 Urea

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Crop Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food crop

- 7.3 Cash crop

- 7.4 Horticulture

- 7.5 Fibre crop

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BASF SE

- 9.2 Dow

- 9.3 DuPont

- 9.4 Solvay S.A

- 9.5 Koch Fertilizers LLC

- 9.6 Evonik

- 9.7 National Fertilizers Limited

- 9.8 Nico Orgo Manures

- 9.9 Compo Expert GmbH

- 9.10 Eco Agro