|

市场调查报告书

商品编码

1740797

脑梗塞治疗市场机会、成长动力、产业趋势分析及2025-2034年预测Cerebral Infarction Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

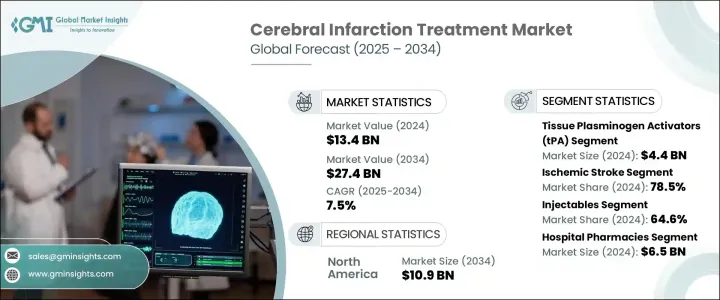

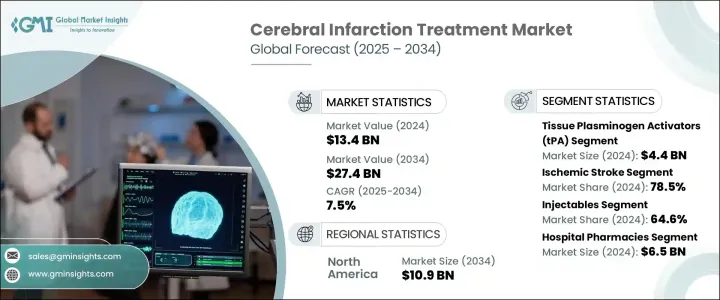

2024 年全球脑梗塞治疗市场价值为 134 亿美元,预计到 2034 年将以 7.5% 的复合年增长率增长至 274 亿美元。由于中风盛行率不断上升以及人们越来越意识到及时治疗的重要性,该市场正在稳步增长。脑梗塞是一种因脑部血流中断引起的中风,会导致组织损伤,如果不及时治疗,可造成长期残疾或死亡。这种中断通常是由于血栓阻塞血管,使脑细胞缺氧和必需营养素。随着全球医疗基础设施和诊断能力的提高,早期发现和更有效的治疗方法正在出现,从而推动了对治疗介入的需求。此外,临床研究的进展和神经系统疾病资金的增加正在加速创新疗法和治疗方案的开发,推动市场扩张。随着老年人口的增长以及高血压和糖尿病等风险因素的激增,对更灵敏、更有效的脑梗塞治疗方案的需求持续增长。急救系统和快速反应治疗方案的出现显着改善了患者的预后,从而提升了市场的长期潜力。

依药物类别划分,脑梗塞治疗市场分为组织纤溶酶原激活剂 (tPA)、抗凝血剂、抗血小板剂、抗惊厥剂和其他药物。 2023 年的市场总收入为 126 亿美元。仅 tPA 细分市场在 2024 年就创造了 44 亿美元的收入,预计在整个预测期内的复合年增长率为 7.8%。组织纤溶酶原激活剂透过分解纤维蛋白(参与血块形成的核心蛋白)来帮助溶解血块,从而重建脑部血流并最大限度地减少缺氧相关的损害。研究表明,在症状出现的最初几个小时内使用 tPA 可以显着改善復原情况、减少致残率并提高整体治疗效果。由于这些疗法高效且能够减少长期神经系统损伤,现已被认为是急诊中风治疗方案中必不可少的疗法。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 134亿美元 |

| 预测值 | 274亿美元 |

| 复合年增长率 | 7.5% |

按类型分类,市场分为缺血性中风和出血性中风。缺血性中风占主导地位,2024 年的收入为 105 亿美元,占整个市场的 78.5%。这种主导地位归因于缺血性中风的全球发生率高于其他类型。血栓溶解和血栓切除等治疗方法越来越多地被采用,以恢復血流并限制神经系统损伤。抗血小板药物(阿斯匹灵、氯吡格雷)和抗凝血剂(包括达比加群和利伐沙班)等药物是常规处方,用于预防復发,特别是对于有潜在心血管危险因子的患者。早期治疗可显着改善运动、言语和认知能力的恢復,有助于降低长期残疾的可能性,从而支持市场成长。

根据给药途径,市场细分为口服和注射疗法。 2024年,注射剂占据了整个市场的64.6%的份额。这些疗法因其快速起效和精准的剂量控製而受到急诊治疗的青睐,这对于急性中风治疗至关重要。静脉注射使医护人员能够快速将溶栓药物直接输送到血液中,在时间紧迫的情况下提供快速的治疗效果。注射适用于救护车和医院环境,这提升了其在现代中风护理系统中的价值,使其成为即时干预策略的基石。

在分销管道方面,医院药房在2024年占据了最大的收入份额,创造了65亿美元的收入。这些机构在医疗监督下提供直接获取救命药物的途径,这对于需要紧急治疗的治疗尤其重要。医院药局在病患教育方面也发挥关键作用,提供药物类型、给药方法和副作用的指导。它们与医疗团队的整合确保了患者更好地遵守治疗计划,从而改善了患者的治疗效果。此外,药物管理和支持计画等服务有助于促进长期治疗成功。

从区域来看,北美已成为领先市场,2024年营收达54亿美元,预计2034年将增加至109亿美元。美国是最大的贡献者,2023年收入达47亿美元。该地区高昂的医疗支出、先进的医疗基础设施以及日益提升的中风护理意识,使其保持了主导地位。该地区心血管疾病发生率的不断上升,进一步刺激了对有效治疗的需求。

主要市场参与者(约占总份额的45%)包括雅培实验室、勃林格殷格翰、罗氏製药和诺和诺德等公司。这些公司凭藉着策略性产品创新、强大的经销网络和监管专业知识,持续引领市场。与医疗机构和公共卫生组织的合作正在促进研究工作,并提高治疗的可近性。宣传活动和数位平台日益增长的影响力也鼓励更多人及时寻求治疗,从而促进市场成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病盛行率上升

- 药物研发创新

- 加大中风治疗的研发力道

- 老年人口不断增加

- 产业陷阱与挑战

- 药物的不良反应

- 严格的监管框架

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 管道分析

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 组织纤溶酶原激活剂(tPA)

- 抗凝血剂

- 抗血小板

- 抗惊厥药

- 其他药物类别

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 缺血性中风

- 出血性中风

第七章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 注射剂

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Abbott Laboratories

- Amgen

- Amneal Pharmaceuticals

- AstraZeneca

- Boehringer Ingelheim

- Bayer

- Biogen

- Daiichi Sankyo Company

- F. Hoffmann-La Roche

- Merck & Co.

- Novartis

- Novo Nordisk

- Otsuka Holdings

- Pfizer

- Sanofi

The Global Cerebral Infarction Treatment Market was valued at USD 13.4 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 27.4 billion by 2034. This market is witnessing steady growth due to the increasing prevalence of stroke and rising awareness about the importance of timely treatment. Cerebral infarction, a form of stroke caused by an interruption in blood flow to the brain, leads to tissue damage and, if left untreated, can result in long-term disability or death. This interruption is typically caused by a blood clot blocking a vessel, depriving brain cells of oxygen and essential nutrients. As medical infrastructure and diagnostic capabilities improve globally, earlier detection and more effective treatments are becoming available, pushing the demand for therapeutic interventions. Additionally, advances in clinical research and increased funding for neurological disorders are accelerating the development of innovative therapies and treatment options, driving market expansion. With a growing geriatric population and a surge in risk factors like hypertension and diabetes, the demand for more responsive and effective cerebral infarction treatments continues to climb. The emergence of emergency care systems and rapid-response treatment options has significantly influenced patient outcomes, thus boosting the market's long-term potential.

By drug class, the cerebral infarction treatment market is segmented into tissue plasminogen activators (tPA), anticoagulants, antiplatelets, anticonvulsants, and other drugs. The total market revenue for 2023 was USD 12.6 billion. The tPA segment alone generated USD 4.4 billion in 2024 and is expected to grow at a CAGR of 7.8% throughout the forecast period. Tissue plasminogen activators help dissolve blood clots by breaking down fibrin, a core protein involved in clot formation, thus reestablishing blood flow to the brain and minimizing oxygen loss-related damage. Administering tPA within the first few hours of symptom onset has been shown to significantly improve recovery, reduce disability, and enhance overall treatment outcomes. These therapies are now considered essential in emergency stroke protocols due to their efficiency and ability to reduce long-term neurological impairment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.4 Billion |

| Forecast Value | $27.4 Billion |

| CAGR | 7.5% |

When categorized by type, the market is divided into ischemic stroke and hemorrhagic stroke. Ischemic stroke dominated the segment with a revenue of USD 10.5 billion in 2024, accounting for 78.5% of the total market. This dominance is attributed to the high global incidence of ischemic strokes compared to other types. Treatments like thrombolysis and thrombectomy are increasingly adopted to restore blood flow and limit neurological damage. Medications such as antiplatelets (aspirin, clopidogrel) and anticoagulants (including dabigatran and rivaroxaban) are routinely prescribed to prevent recurrence, particularly in patients with underlying cardiovascular risk factors. Early treatment greatly improves motor, speech, and cognitive recovery, which helps reduce the chances of long-term disability, thereby supporting market growth.

Based on the route of administration, the market is segmented into oral and injectable therapies. Injectables accounted for a significant 64.6% share of the total market in 2024. These therapies are favored in emergency settings due to their fast action and precise dosage control, essential for acute stroke treatment. Intravenous administration allows healthcare providers to quickly deliver clot-dissolving medications directly into the bloodstream, providing rapid therapeutic effects when time is critical. Their suitability in ambulances and hospital environments enhances their value in modern stroke care systems, making injectables a cornerstone of immediate intervention strategies.

In terms of distribution channels, hospital pharmacies held the largest revenue share in 2024, generating USD 6.5 billion. These settings offer direct access to life-saving drugs under medical supervision, particularly important for treatments requiring urgent attention. Hospital pharmacies also play a key role in patient education, offering guidance on medication types, administration methods, and side effects. Their integration with healthcare teams ensures better adherence to treatment plans, improving patient outcomes. Additionally, services such as medication management and support programs foster long-term treatment success.

Regionally, North America emerged as a leading market, with a revenue of USD 5.4 billion in 2024 and a projected rise to USD 10.9 billion by 2034. The United States was the largest contributor, with USD 4.7 billion in revenue in 2023. The region's high healthcare expenditure, advanced medical infrastructure, and increased awareness about stroke care have helped it maintain its dominant position. The growing incidence of cardiovascular conditions in this region further fuels the need for effective treatments.

Key market players-accounting for roughly 45% of the total share-include companies such as Abbott Laboratories, Boehringer Ingelheim, F. Hoffmann-La Roche, and Novo Nordisk. These companies continue to lead the market through strategic product innovations, robust distribution networks, and regulatory expertise. Partnerships with healthcare institutions and public health organizations are facilitating research efforts and improving treatment accessibility. Awareness campaigns and the growing influence of digital platforms are also encouraging more individuals to seek timely treatment, thus contributing to market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cardiovascular diseases

- 3.2.1.2 Innovation in drug development

- 3.2.1.3 Increasing R&D for stroke therapeutics

- 3.2.1.4 Growing number of geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Adverse effects of medications

- 3.2.2.2 Stringent regulatory framework

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to Consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of Manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pipeline analysis

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tissue plasminogen activators (tPA)

- 5.3 Anticoagulants

- 5.4 Antiplatelets

- 5.5 Anticonvulsants

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ischemic stroke

- 6.3 Hemorrhagic stroke

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Amgen

- 10.3 Amneal Pharmaceuticals

- 10.4 AstraZeneca

- 10.5 Boehringer Ingelheim

- 10.6 Bayer

- 10.7 Biogen

- 10.8 Daiichi Sankyo Company

- 10.9 F. Hoffmann-La Roche

- 10.10 Merck & Co.

- 10.11 Novartis

- 10.12 Novo Nordisk

- 10.13 Otsuka Holdings

- 10.14 Pfizer

- 10.15 Sanofi