|

市场调查报告书

商品编码

1740816

汽车凸轮轴市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Camshaft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

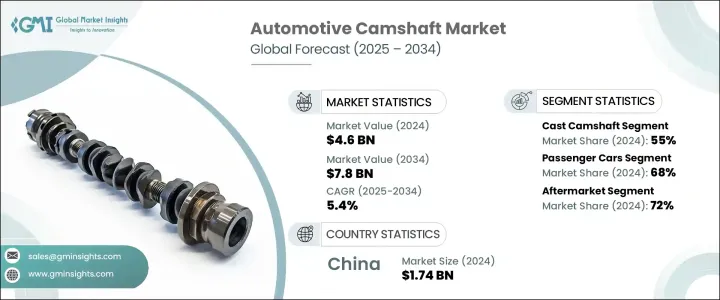

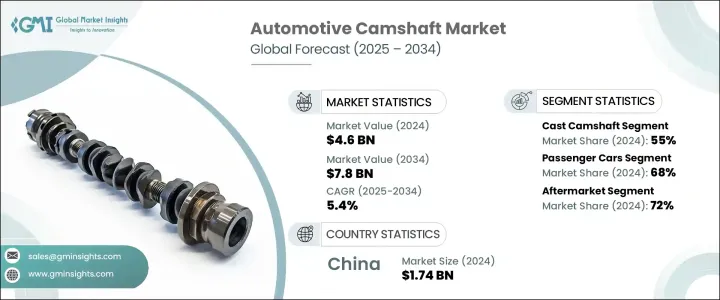

2024年,全球汽车凸轮轴市场规模达46亿美元,预计2034年将以5.4%的复合年增长率成长,达到78亿美元。这一增长主要源于全球对高性能引擎日益增长的需求以及汽车产量的持续增长。乘用车和商用车製造商都在采用现代引擎技术,将凸轮轴置于引擎性能提升战略的核心位置。汽车製造商正在投资新一代凸轮轴设计,该设计融合了轻量化材料、精密工程以及可变气门正时等先进技术。这些创新有助于优化动力输出、提高燃油效率并减少排放,同时确保各类车辆加速更平顺、反应更灵敏。凸轮轴还有助于延长引擎寿命,因此它不仅对高性能车型至关重要,对日常用车也同样重要。人们对提升引擎性能和燃油经济性的关注日益增长,这不仅限于北美。不断增长的可支配收入、不断增长的汽车保有量以及对高效汽车日益增长的需求,正在推动亚太和拉丁美洲新兴市场对凸轮轴的需求强劲增长。这一普遍趋势正在帮助塑造全球凸轮轴开发和製造的未来。

汽车凸轮轴市场按产品细分为铸造、锻造和组装凸轮轴。铸造凸轮轴在2024年占据约55%的市场份额,预计到2034年将以超过6%的复合年增长率成长。其广泛应用归因于其成本效益高且易于大量生产。铸造凸轮轴仍然是大规模生产的首选,尤其对于经济型和中檔车型。铸造技术的进步,例如改进的冶金方法和模具设计,有助于提高铸造凸轮轴的性能和耐用性。这些发展使铸造凸轮轴比锻造凸轮轴更具竞争力,进一步巩固了其主导地位。铸造凸轮轴的生产成本远低于锻造凸轮轴,这是其在已开发和新兴汽车市场都广受欢迎的关键因素。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 46亿美元 |

| 预测值 | 78亿美元 |

| 复合年增长率 | 5.4% |

就车型而言,凸轮轴市场分为乘用车和商用车。乘用车在2024年占据最大份额,占市场份额的68%,预计到2034年,该细分市场的复合年增长率将超过5%。汽车产量的成长,尤其是在发展中地区,将继续支撑这一趋势。随着涡轮增压和可变气门正时等技术的进步,引擎系统也变得越来越先进,对能够跟上这些改进的凸轮轴的需求也不断增长。严格的排放标准也促使汽车製造商整合更先进的凸轮轴技术。继续使用内燃机的混合动力和电动车进一步刺激了对旨在平衡性能和效率的客製化凸轮轴的需求。

就销售通路而言,市场分为原始设备製造商 (OEM) 和售后市场。售后市场在 2024 年占据主导地位,市占率为 72%,预计 2025 年至 2034 年的复合年增长率将超过 6%。越来越多的车主选择自行升级和客製化,这提升了售后凸轮轴产品的普及度。这些组件可透过电商平台轻鬆购买,方便消费者比较产品、阅读评论并做出明智的购买决策。 SUV、皮卡和越野车型等车辆对高性能组件的需求尤其推动了这一细分市场的发展。製造商正透过性能特定的凸轮轴创新来满足这一需求,以满足动力和燃油效率方面的需求。

2024年,中国在亚太地区占据主导地位,占据约38%的市场份额,创造了17.4亿美元的市场收入。持续成长的汽车保有量以及政府大力推行节能交通的政策,持续推动了对现代凸轮轴技术的需求。中国强大的汽车製造生态系统也在确保OEM和售后市场通路需求稳定方面发挥重要作用。城市消费者越来越青睐耐用且价格实惠的凸轮轴,以提升汽车性能,这支持了这个关键地区售后市场的扩张。

汽车凸轮轴领域的领导企业包括全球主要製造商,他们正透过精密工程和高强度材料不断突破极限。这些企业专注于智慧型凸轮轴系统和整合可变气门正时功能,使引擎能够适应不同的驾驶条件并提高燃油效率。随着这些技术在混合动力和未来汽车平台中变得至关重要,凸轮轴仍然是满足现代能源效率和排放标准的关键部件,同时确保所有车型的引擎可靠且性能卓越。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 原物料供应商

- 汽车OEM

- 配销通路

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 价格趋势分析

- 产品

- 地区

- 成本細項分析

- 对部队的影响

- 成长动力

- 全球汽车产量不断成长

- 引擎设计的技术进步

- 对性能和豪华汽车的需求增加

- 材料和製造工艺的改进

- 油电混合车采用

- 产业陷阱与挑战

- 製造业的资本投入高

- 向电动车(EV)转变

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 铸造凸轮轴

- 锻造凸轮轴

- 组装凸轮轴

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车

- 中型商用车

- 重型商用车

第七章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第九章:公司简介

- Aichi Forge

- Camshaft Machine

- Comp Performance

- Crane Cams

- Elgin Industries

- Engine Power Components

- Estas Camshaft

- Hirschvogel

- JD Norman

- KAUTEX TEXTRON

- Linamar

- Mahle

- Musashi Seimitsu

- Piper Cams

- Precision Camshafts

- Riken

- Schaeffler

- Shadbolt

- ThyssenKrupp

- Varroc Group

The Global Automotive Camshaft Market was valued at USD 4.6 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 7.8 billion by 2034. This growth is being fueled by the increasing need for high-performance engines and the consistent rise in vehicle production across the globe. Both passenger and commercial vehicle manufacturers are adopting modern engine technologies, placing camshafts at the core of engine enhancement strategies. Automakers are investing in next-generation camshaft designs that integrate lightweight materials, precision engineering, and advanced technologies like variable valve timing. These innovations help optimize power output, enhance fuel efficiency, and reduce emissions while ensuring smoother acceleration and improved responsiveness in various vehicle classes. Camshafts are also instrumental in extending engine longevity, making them essential not just for high-performance models but also for everyday vehicles. The growing interest in enhanced engine performance and fuel economy is not limited to North America. Rising disposable income, increased vehicle ownership, and a growing demand for efficient vehicles are driving strong demand in emerging markets across Asia-Pacific and Latin America. This widespread trend is helping to shape the future of camshaft development and manufacturing around the world.

The automotive camshaft market is segmented by product into cast, forged, and assembled camshafts. Cast camshafts accounted for approximately 55% of the market in 2024 and are projected to grow at a CAGR of over 6% through 2034. Their widespread use is attributed to their cost-efficiency and the ease of mass production. Cast camshafts continue to be the top choice for large-scale manufacturing, particularly for vehicles in the economy and mid-range segments. Advancements in casting techniques, such as improved metallurgical methods and mold designs, are helping enhance the performance and durability of cast camshafts. These developments make cast versions more competitive with forged alternatives, further solidifying their dominance. Cast camshafts are substantially more affordable to produce than forged ones, a key factor contributing to their adoption in both developed and emerging automotive markets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 5.4% |

When it comes to vehicle types, the camshaft market is divided into passenger cars and commercial vehicles. Passenger cars held the largest share in 2024, accounting for 68% of the market, and this segment is expected to grow at a CAGR of more than 5% through 2034. Increasing vehicle production, especially in developing regions, continues to support this trend. As engine systems become more advanced with technologies like turbocharging and variable valve timing, the demand for camshafts that can keep up with these improvements is rising. Stringent emissions standards are also encouraging automakers to integrate more sophisticated camshaft technologies. Hybrid and electric vehicles that continue to use internal combustion engines further boost the demand for custom-engineered camshafts designed to balance performance and efficiency.

In terms of sales channels, the market is categorized into original equipment manufacturers (OEMs) and the aftermarket. The aftermarket segment dominated in 2024 with a market share of 72% and is projected to grow at a CAGR of more than 6% from 2025 to 2034. A growing number of vehicle owners are turning to do-it-yourself upgrades and customizations, increasing the popularity of aftermarket camshaft products. These components are easily accessible via e-commerce platforms, allowing consumers to compare products, read reviews, and make informed purchases. The need for high-performance components in vehicles such as SUVs, pickup trucks, and off-road models is especially driving this segment. Manufacturers are responding to the demand with performance-specific camshaft innovations that cater to power and fuel efficiency needs.

In 2024, China held a dominant position in the Asia-Pacific region, capturing about 38% of the total market and generating USD 1.74 billion in revenue. Continued growth in vehicle ownership and the government's push toward energy-efficient transportation are sustaining demand for modern camshaft technologies. The robust automotive manufacturing ecosystem in the country also plays a significant role in ensuring consistent demand across both OEM and aftermarket channels. Urban consumers are increasingly seeking durable and affordable camshafts for performance upgrades, which supports the expansion of the aftermarket segment in this key region.

Leading companies in the automotive camshaft space include major global manufacturers that are pushing boundaries with precision engineering and high-strength materials. These players are focused on smart camshaft systems and integrating variable valve timing features, which allow engines to adapt to different driving conditions and improve fuel usage. With these technologies becoming vital in hybrid and future vehicle platforms, camshafts remain a critical component in meeting modern efficiency and emissions standards while ensuring reliable and high-performing engines across all vehicle categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing trend analysis

- 3.9.1 Product

- 3.9.2 Region

- 3.10 Cost breakdown analysis

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising global vehicle production

- 3.11.1.2 Technological advancements in engine design

- 3.11.1.3 Increased demand for performance and luxury vehicles

- 3.11.1.4 Improvements in materials and manufacturing

- 3.11.1.5 Hybrid vehicle adoption

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High capital investment for manufacturing

- 3.11.2.2 Shifts toward electric vehicles (EVs)

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Cast camshaft

- 5.3 Forged camshaft

- 5.4 Assembled camshaft

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light commercial vehicles

- 6.3.2 Medium commercial vehicles

- 6.3.3 Heavy commercial vehicles

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 Saudi Arabia

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Aichi Forge

- 9.2 Camshaft Machine

- 9.3 Comp Performance

- 9.4 Crane Cams

- 9.5 Elgin Industries

- 9.6 Engine Power Components

- 9.7 Estas Camshaft

- 9.8 Hirschvogel

- 9.9 JD Norman

- 9.10 KAUTEX TEXTRON

- 9.11 Linamar

- 9.12 Mahle

- 9.13 Musashi Seimitsu

- 9.14 Piper Cams

- 9.15 Precision Camshafts

- 9.16 Riken

- 9.17 Schaeffler

- 9.18 Shadbolt

- 9.19 ThyssenKrupp

- 9.20 Varroc Group