|

市场调查报告书

商品编码

1740829

电动汽车电池冷却板市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Vehicle Battery Cooling Plate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

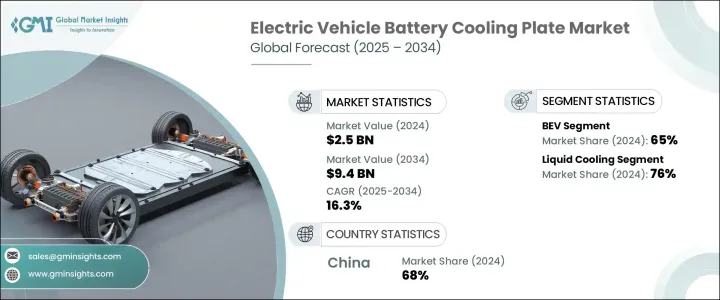

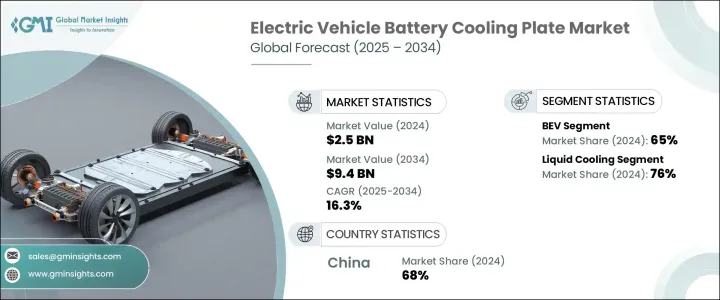

2024年,全球电动车电池冷却板市场价值为25亿美元,预计到2034年将以16.3%的复合年增长率成长,达到94亿美元。这得归功于电动车出行方式的加速转变、全球排放法规的日益严格、政府对电动车生产的激励措施以及积极的脱碳目标。随着电动车成为主流,对高效能热管理系统的需求也随之激增。随着电动车电池的性能日益强大和复杂,保持最佳温度对于电池的性能、安全性和寿命至关重要。冷却板,尤其是液冷系统,已成为电池组中处理快速充电和高负荷使用过程中高热负荷的关键组件。

随着电动车生态系统的成熟,热管理解决方案不再只是可选的附加组件,而是实现具有竞争力的车辆续航里程、电池耐用性和消费者信任的不可或缺的部分。消费者对电动车安全意识的不断增强、长续航电动车型的日益普及以及全球快速充电网路的扩张,进一步推动了汽车製造商和电池製造商大力投资先进的冷却技术。此外,对车辆轻量化和空间优化的追求也推动了紧凑型高效电池冷却设计的创新,使其成为下一代电动车平台中不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 25亿美元 |

| 预测值 | 94亿美元 |

| 复合年增长率 | 16.3% |

世界各国政府在推动电动车技术发展方面发挥至关重要的作用,尤其是在电池热管理系统方面。各国透过大力投资研发,推动旨在提升电动车性能、安全性和能源效率的创新。资金计画通常用于开发先进的冷却系统,例如液冷电池板,这有助于优化电池健康状况并延长续航里程。透过为製造商和研究机构提供财政诱因和补贴,各国政府正在加快开发更有效率的冷却解决方案,这对于电动车市场的快速扩张至关重要。

电动车电池冷却板市场按车型细分为纯电动车 (BEV)、插电式混合动力电动车 (PHEV) 和混合动力电动车 (HEV)。 2024 年,纯电动车 (BEV) 占据主导地位,市占率达 65%,预计到 2034 年将以 17.1% 的复合年增长率成长。由于纯电动车完全依赖电池,且没有内燃机,因此需要卓越的热管理系统来确保最佳性能和电池寿命。在排放法规日益严格和消费者兴趣日益增长的推动下,纯电动车 (BEV) 的快速增长正推动对先进冷却解决方案的巨大需求。

按技术划分,市场可分为空气冷却、液体冷却和PCM冷却。液体冷却在2024年占据了76%的市场份额,并有望凭藉其卓越的高热负荷管理能力继续保持主导地位。液冷系统比空气冷却提供更好的温度控制,从而实现更快的充电速度和更长的电池寿命,使其成为长续航、高性能电动车的首选。

2024年,中国以68%的市占率领先全球市场,创造了约8.4亿美元的收入。其领先地位得益于强大的电动车製造能力、强大的电池生产基础设施以及政府积极推动电动车出行的政策。

全球电动车电池冷却板市场的知名企业包括三花集团、博伊德、博格华纳、莫迪恩製造公司、日本轻金属、德纳、Senior Flexonics、马勒、索格菲集团和法雷奥。这些公司正在大力投资液体冷却技术创新,扩大产品组合,与汽车製造商合作,探索环保材料,并与政府机构建立伙伴关係,以增强其市场影响力并顺应全球永续发展趋势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 零件製造商

- 电池製造商

- 原物料供应商

- 零件供应商

- 售后服务提供者

- 经销商

- 最终用途

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动车普及率不断上升

- 电池冷却技术的进步

- 政府激励措施和政策

- 快速充电需求不断成长

- 产业陷阱与挑战

- 製造成本高

- 复杂设计集成

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 纯电动车

- 插电式混合动力

- 油电混合车

第六章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 液体

- 空气

- 脉衝编码调变

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 铝

- 铜

- 不銹钢

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Aavid Thermalloy

- Alfa Laval

- Boyd

- BorgWarner

- CapTherm Systems

- Dana

- Granges

- Koolance

- MAHLE

- Modine Manufacturing Company

- Nemak

- Nippon Light Metal

- Samsung SDI

- Sanhua Holding Group

- Senior Flexonics

- SGL Carbon SE

- Sogefi

- Valeo

- Zhejiang Yinlun Machinery

The Global Electric Vehicle Battery Cooling Plate Market was valued at USD 2.5 billion in 2024 and is estimated to grow at a CAGR of 16.3% to reach USD 9.4 billion by 2034, driven by the accelerating shift toward electric mobility, stricter global emission regulations, government incentives supporting EV production, and aggressive decarbonization goals. As electric vehicle adoption becomes mainstream, the demand for highly efficient thermal management systems is surging. With EV batteries becoming more powerful and complex, maintaining optimal temperatures has become critical for performance, safety, and battery lifespan. Cooling plates, especially liquid-cooled systems, have emerged as essential components in battery packs to handle high thermal loads during fast charging and heavy usage.

As the EV ecosystem matures, thermal management solutions are no longer just optional add-ons but integral to achieving competitive vehicle range, battery durability, and consumer trust. Growing consumer awareness about EV safety, the rising popularity of long-range electric models, and the expansion of fast-charging networks worldwide are further pushing automakers and battery manufacturers to invest heavily in advanced cooling technologies. Additionally, the push for vehicle lightweighting and space optimization has led to innovations in compact, high-efficiency battery cooling designs, making them indispensable in next-gen EV platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Billion |

| Forecast Value | $9.4 Billion |

| CAGR | 16.3% |

Governments across the world are playing a crucial role in advancing EV technologies, particularly in battery thermal management systems. By making substantial investments in research and development, countries are fueling innovations aimed at enhancing the performance, safety, and energy efficiency of EVs. Funding initiatives are frequently directed toward the development of advanced cooling systems like liquid-cooled battery plates, which help optimize battery health and extend driving range. Through financial incentives and subsidies for manufacturers and research institutions, governments are fast-tracking the development of more efficient cooling solutions essential for the rapid expansion of the EV market.

The electric vehicle battery cooling plate market is segmented by vehicle type into BEV, PHEV, and HEV. In 2024, BEVs accounted for a dominant 65% share and are expected to expand at a CAGR of 17.1% through 2034. Since BEVs rely entirely on electric batteries and lack internal combustion engines, they demand superior thermal management systems to ensure optimal performance and battery longevity. The surging growth of BEVs, supported by tightening emission regulations and increasing consumer interest, is driving significant demand for advanced cooling solutions.

By technology, the market is segmented into air cooling, liquid cooling, and PCM cooling. Liquid cooling captured a commanding 76% share in 2024 and is set to maintain dominance due to its superior ability to manage high thermal loads. Liquid-cooled systems offer better temperature control than air cooling, enabling faster charging and longer battery life, making them the preferred choice for long-range, high-performance EVs.

China led the global market in 2024 with a 68% share, generating around USD 840 million in revenue. Its leadership is fueled by robust EV manufacturing capabilities, strong battery production infrastructure, and proactive government policies promoting electric mobility.

Prominent players in the Global Electric Vehicle Battery Cooling Plate Market include Sanhua Group, Boyd, BorgWarner, Modine Manufacturing Company, Nippon Light Metal, Dana, Senior Flexonics, MAHLE, Sogefi Group, and Valeo. These companies are heavily investing in innovations around liquid cooling technologies, expanding product portfolios, collaborating with automakers, exploring eco-friendly materials, and forming partnerships with government bodies to strengthen their market presence and align with global sustainability trends.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component manufacturers

- 3.2.2 Battery manufacturers

- 3.2.3 Raw material supplier

- 3.2.4 Component supplier

- 3.2.5 Aftermarket service provider

- 3.2.6 Distributor

- 3.2.7 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (selling price)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising adoption of electric vehicles

- 3.9.1.2 Advancements in battery cooling technology

- 3.9.1.3 Government incentives and policies

- 3.9.1.4 Rising demand for fast charging

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High manufacturing cost

- 3.9.2.2 Complex design integration

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 BEV

- 5.3 PHEV

- 5.4 HEV

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Air

- 6.4 PCM

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Aluminium

- 7.3 Copper

- 7.4 Stainless steel

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Aavid Thermalloy

- 10.2 Alfa Laval

- 10.3 Boyd

- 10.4 BorgWarner

- 10.5 CapTherm Systems

- 10.6 Dana

- 10.7 Granges

- 10.8 Koolance

- 10.9 MAHLE

- 10.10 Modine Manufacturing Company

- 10.11 Nemak

- 10.12 Nippon Light Metal

- 10.13 Samsung SDI

- 10.14 Sanhua Holding Group

- 10.15 Senior Flexonics

- 10.16 SGL Carbon SE

- 10.17 Sogefi

- 10.18 Valeo

- 10.19 Zhejiang Yinlun Machinery