|

市场调查报告书

商品编码

1740833

汽车轮毂主轴市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Wheel Spindle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

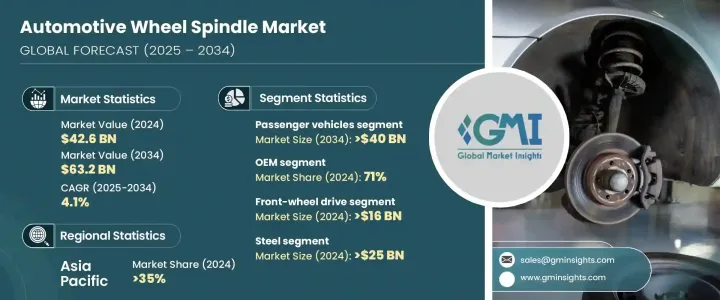

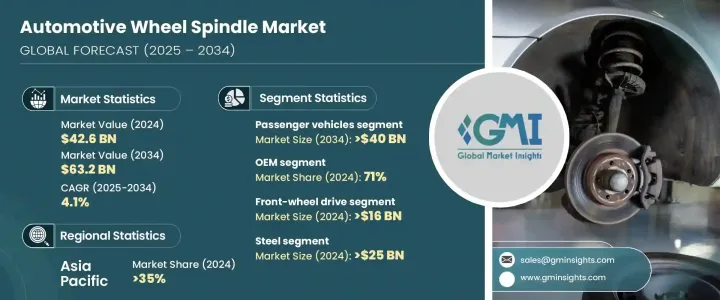

2024年,全球汽车轮毂主轴市场规模达426亿美元,预计到2034年将以4.1%的复合年增长率成长,达到632亿美元。这主要得益于汽车产业復苏,尤其是发展中国家汽车产量的增加。随着製造商扩大生产以满足不断增长的消费者需求,对轮毂主轴等关键零件的需求也随之增长。电动车和混合动力车的转型也有助于推动这一市场的发展。由于电动马达产生的扭力模式不同,以及电池增加的重量,电动车 (EV) 需要重新设计轮毂组件。由于製造商希望优化性能和效率,这种转变对轻量化、高强度的轮毂主轴产生了强劲的需求。

此外,由于人们越来越倾向于车辆翻新而非购买新车,尤其是在北美和欧洲等地区,售后市场也经历了显着成长。随着车辆老化,许多消费者和车队营运商选择更换或升级车轮主轴等零件,以延长车辆使用寿命,同时避免购买新车的高昂成本。这种趋势在汽车保有量大、车辆维护文化浓厚的市场尤其普遍,这些市场优先考虑成本效益和永续性。这些地区对替换零件的需求不断增长,推动了售后市场的成长,使其成为整体市场的重要组成部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 426亿美元 |

| 预测值 | 632亿美元 |

| 复合年增长率 | 4.1% |

2024年,乘用车市场规模达280亿美元,预计到2034年将达到400亿美元,这得益于全球乘用车需求远高于商用车。製造商采用创新的主轴设计,以满足消费者对乘坐舒适性、安全性和操控精度日益增长的期望。电动车和混合动力车的兴起,也推动了对性能更佳、轻量化的先进主轴的需求。

根据最终用途,市场分为原始设备製造商 (OEM) 和售后市场。 OEMOEM在 2024 年占据 71% 的市场份额,预计在整个预测期内将继续成长。 OEM 是车轮主轴需求的主要驱动力,因为主轴在组装过程中会被整合到新车中。电动车对轻量化主轴的日益关注,促使 OEM 更加依赖技术娴熟的主轴供应商。这些长期合约在提供稳定性的同时,也鼓励了主轴技术和设计的创新。

2024年,亚太地区汽车轮毂主轴市场占35%的市场份额,其中中国占主导地位。由于强大的製造业基础和电动车产量的不断增长,中国汽车产业正在快速扩张。政府推动电动车普及的政策进一步推动了对高性能、轻量化主轴的需求。本地供应商集群以及研发投入正在推动主轴技术的创新。

全球汽车轮毂主轴产业的领导者包括采埃孚股份公司、现代摩比斯、蒂森克虏伯股份公司、日立阿斯泰莫、麦格纳国际、舍弗勒股份公司和捷太格特公司。为了巩固市场地位,汽车轮毂主轴行业的企业专注于多种策略,包括与原始设备製造商 (OEM) 建立战略合作伙伴关係、推进轻量化和高性能材料的研发以及拓展在新兴市场的製造能力。此外,企业正在大力投资创新,以满足电动车製造商的特定需求,这些製造商正在寻求客製化解决方案来提高汽车效率。此外,许多企业正在改进其供应链网络,以确保及时交付主轴并最大限度地减少生产延误,从而帮助它们在快速成长的市场中保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 售后市场供应商和经销商

- 最终用户

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 价格传导至终端市场

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 成本分析

- 定价分析

- 产品

- 地区

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 全球汽车产量不断成长

- 向电动车(EV)转变

- 售后市场需求不断成长

- ADAS、自动驾驶系统等车辆技术的快速进步

- 产业陷阱与挑战

- 原物料价格波动

- 供应链中断

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第六章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 前主轴

- 后主轴

- 转向节主轴

第七章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 钢

- 铝

- 复合材料

第八章:市场估计与预测:以轮驱动,2021 - 2034 年

- 主要趋势

- 前轮驱动(FWD)

- 后轮驱动(RWD)

- 全轮驱动(AWD)

第九章:市场估计与预测:按应用,2021 - 2034

- 主要趋势

- 悬挂系统

- 转向系统

第十章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十二章:公司简介

- American Axle & Manufacturing Holdings

- Benteler Automotive

- Bharat Forge

- BRIST Axle Systems

- Cardone Industries

- Dana

- GKN Automotive

- Hitachi Astemo

- Hyundai Mobis

- JTEKT

- Linamar

- Magna International

- MAT Foundry Group

- Meritor

- MevoTech

- NSK

- NTN

- Schaeffler

- ThyssenKrupp

- ZF Friedrichshafen

The Global Automotive Wheel Spindle Market was valued at USD 42.6 billion in 2024 and is estimated to grow at 4.1% CAGR to reach USD 63.2 billion by 2034 driven by the recovery of the automotive sector, particularly in developing nations, which is increasing vehicle production. As manufacturers scale production to meet the rising consumer demand, the need for essential components like wheel spindles grows correspondingly. The shift toward electric and hybrid vehicles is also helpful in driving this market. Electric vehicles (EVs) require new designs for wheel assemblies due to different torque patterns produced by electric motors and the added weight from batteries. This transition creates strong demand for lightweight, high-strength wheel spindles, as manufacturers look to optimize performance and efficiency.

Moreover, the aftermarket segment is experiencing significant growth due to the increasing preference for vehicle refurbishment over purchasing new models, particularly in regions like North America and Europe. As vehicles age, many consumers and fleet operators choose to replace or upgrade parts, such as wheel spindles, to extend the lifespan of their vehicles while avoiding the high costs of new purchases. This trend is particularly prevalent in markets with large vehicle populations and strong vehicle maintenance cultures, where cost-effectiveness and sustainability are prioritized. The rising demand for replacement parts in these regions is driving the growth of the aftermarket segment, making it an essential part of the overall market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.6 Billion |

| Forecast Value | $63.2 Billion |

| CAGR | 4.1% |

The passenger vehicle segment accounted for USD 28 billion in 2024 and is expected to reach USD 40 billion by 2034 attributed to the high global demand for passenger cars compared to commercial vehicles. Manufacturers adopt innovative spindle designs to meet growing consumer expectations for ride comfort, safety, and handling precision. The rise of electric and hybrid automobiles contributes to the demand for advanced spindles with improved performance and lightweight characteristics.

Based on end-use, the market is divided into original equipment manufacturers (OEM) and aftermarket segments. The OEM segment accounted for 71% share in 2024 and is expected to continue growing throughout the forecast period. OEMs are the primary drivers of wheel spindle demand, as spindles are integrated into new vehicles during the assembly process. The growing focus on lightweight spindles for electric vehicles pushes OEMs to rely more heavily on skilled spindle suppliers. These long-term contracts provide stability while encouraging innovation in spindle technology and design.

Asia Pacific Automotive Wheel Spindle Market held a 35% share in 2024, with China leading the region. The country's automotive industry is expanding rapidly, driven by a strong manufacturing base and the increasing production of electric vehicles. Government policies that promote electric vehicle adoption are further driving demand for high-performance, low-weight spindles. Local supplier clusters, along with investments in research and development, are fueling innovation in spindle technology.

The leading companies in the Global Automotive Wheel Spindle Industry include ZF Friedrichshafen AG, Hyundai Mobis, ThyssenKrupp AG, Hitachi Astemo, Magna International, Schaeffler AG, and JTEKT Corporation. To strengthen their market presence, companies in the automotive wheel spindle industry focus on several strategies. These include forming strategic partnerships with OEMs, advancing research and development in lightweight and high-performance materials, and expanding their manufacturing capabilities in emerging markets. Additionally, companies are investing heavily in innovation to meet the specific needs of electric vehicle manufacturers, which are seeking tailored solutions to enhance the efficiency of their vehicles. Furthermore, many players are improving their supply chain networks to ensure timely delivery of spindles and minimize production delays, helping them to maintain a competitive edge in a fast-growing market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Aftermarket suppliers and distributors

- 3.2.4 End users

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on the Industry

- 3.3.2.1 Price volatility in key materials

- 3.3.2.2 Supply chain restructuring

- 3.3.2.3 Price transmission to end markets

- 3.3.3 Strategic industry responses

- 3.3.3.1 Supply chain reconfiguration

- 3.3.3.2 Pricing and product strategies

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Cost analysis

- 3.8 Pricing analysis

- 3.8.1 Product

- 3.8.2 Region

- 3.9 Patent analysis

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising global vehicle production

- 3.11.1.2 Shift toward Electric Vehicles (EVs)

- 3.11.1.3 Growing aftermarket demand

- 3.11.1.4 Rapid advancements in vehicle technologies such as ADAS, autonomous systems

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 Raw material price volatility

- 3.11.2.2 Supply chain disruptions

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicle (LCV)

- 5.3.2 Medium Commercial Vehicle (MCV)

- 5.3.3 Heavy Commercial Vehicle (HCV)

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Front spindle

- 6.3 Rear spindle

- 6.4 Steering knuckle spindle

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Steel

- 7.3 Aluminum

- 7.4 Composite materials

Chapter 8 Market Estimates & Forecast, By Wheel Drive, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Front-Wheel Drive (FWD)

- 8.3 Rear-Wheel Drive (RWD)

- 8.4 All-Wheel Drive (AWD)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Suspension system

- 9.3 Steering system

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 American Axle & Manufacturing Holdings

- 12.2 Benteler Automotive

- 12.3 Bharat Forge

- 12.4 BRIST Axle Systems

- 12.5 Cardone Industries

- 12.6 Dana

- 12.7 GKN Automotive

- 12.8 Hitachi Astemo

- 12.9 Hyundai Mobis

- 12.10 JTEKT

- 12.11 Linamar

- 12.12 Magna International

- 12.13 MAT Foundry Group

- 12.14 Meritor

- 12.15 MevoTech

- 12.16 NSK

- 12.17 NTN

- 12.18 Schaeffler

- 12.19 ThyssenKrupp

- 12.20 ZF Friedrichshafen