|

市场调查报告书

商品编码

1740839

乳房健康市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Udder Health Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

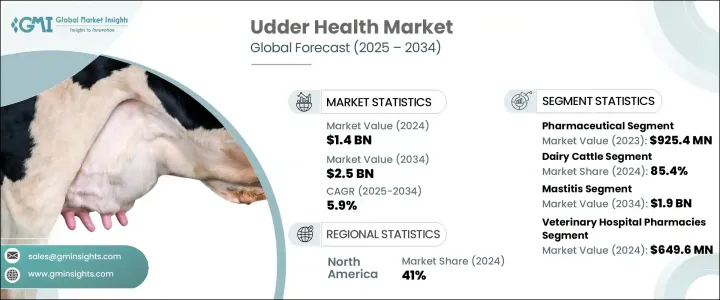

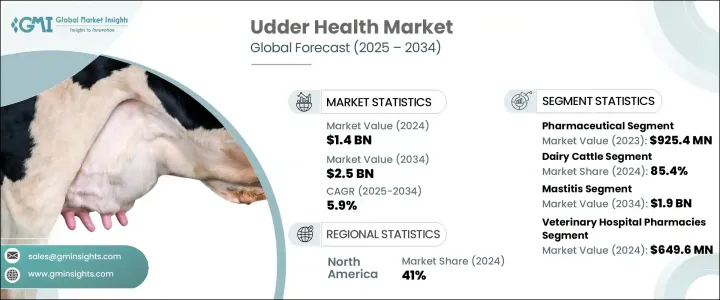

2024 年全球乳房健康市场价值为 14 亿美元,预计到 2034 年将以 5.9% 的复合年增长率增长,达到 25 亿美元,这得益于人们对乳房疾病(尤其是乳腺炎)日益增长的担忧,以及全球对乳製品的需求激增。随着全球乳牛养殖规模的扩大和密集化,主动进行乳房健康管理比以往任何时候都更重要。乳房炎仍然是影响乳牛的最常见和最昂贵的疾病之一,会导致产奶量大幅下降、兽医费用增加以及长期的牛群健康问题。农民更重视早期发现和预防,以保持获利能力和动物福利。此外,全球对永续农业实践的推动正在改变乳房健康市场,鼓励采用传统抗生素的替代品。

主要乳製品生产国的监管机构正在加强对抗菌药物使用的管控,这进一步加速了对创新疗法、疫苗、益生菌和免疫增强解决方案的需求。人工智慧驱动的健康监测、精准治疗平台和先进的畜群管理系统等技术正在重塑农民处理乳房健康的方式。随着消费者对符合道德采购且不含抗生素的乳製品的需求不断增长,在技术创新、农业实践不断发展以及动物福利和食品安全意识不断提高的共同推动下,未来十年市场将迎来强劲增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 14亿美元 |

| 预测值 | 25亿美元 |

| 复合年增长率 | 5.9% |

乳房炎是乳牛群中常见的疾病,持续推动对有效诊断、治疗和预防解决方案的需求。随着乳牛养殖业的密集程度不断提高,标靶抗生素和非侵入性疗法等新型治疗方法正在开发,以最大限度地降低抗生素抗药性。疫苗、益生菌和免疫疗法领域的突破性进展,透过减少慢性感染和提高产奶量,显着改善了牛群健康状况。现代疫苗在预防乳房炎和其他乳房感染方面正变得非常有效,而益生菌和免疫刺激疗法已被证明对于维持乳牛健康的微生物群至关重要。这些进步不仅提高了动物福利,还透过降低抗生素依赖促进了更永续的乳牛养殖。

市场细分为药品和补充剂。 2023年,药品市场收入达9.254亿美元,这得益于乳房感染发病率的上升以及人们对抗生素抗药性的担忧加剧。人工智慧处方系统的日益普及,提高了治疗的精确度和畜群的健康状况,进一步支撑了药品产业的成长。

就动物种类而言,乳牛在2024年占据了85.4%的市场份额,占据了市场主导地位。对早期诊断技术、遗传学和抗病性的投资不断增加,正在重塑畜群管理实践。在全球抗生素限制措施的背景下,农民越来越多地采用益生菌和免疫疗法药物,而人工智慧驱动的监控和自动化挤奶系统也越来越受到青睐。

2024年,北美乳房健康市场占全球收入的41%,预计2025年至2034年的复合年增长率将达到5.8%。美国强劲的牛奶产量推动了对先进乳房健康解决方案的需求,包括精密工具和永续管理策略。由美国食品药物管理局(FDA)和美国农业部(USDA)主导的减少抗生素使用的监管措施,进一步推动了疫苗、益生菌和免疫刺激疗法的普及。

全球乳房健康产业的主要参与者包括默克、BouMatic、AHV International、Albert Kerbl、勃林格殷格翰、诗华动物保健、艺康、礼来动物保健、利拉伐、G Shepherd 动物保健、维克和硕腾。这些公司正在投资创新疗法以解决抗生素抗药性问题,扩展人工智慧和自动化诊断能力,与兽医诊所和农民合作以提高产品采用率,并透过环保产品开发和农民教育计画加强永续发展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球乳製品消费量和产量不断增长

- 提高对乳房健康管理的认识

- 兽医诊断和治疗的进展

- 产业陷阱与挑战

- 乳製品业抗生素使用的严格规定

- 乳房健康治疗和诊断成本高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 製药

- 抗生素

- 疫苗

- 抗发炎药物

- 乳头消毒剂

- 乳房内输注

- 其他药品

- 补充

- 维生素和矿物质

- 益生菌和益生元

- 其他补充剂

第六章:市场估计与预测:依动物类型,2021-2034 年

- 主要趋势

- 乳牛

- 其他动物类型

第七章:市场估计与预测:依疾病类型,2021-2034

- 主要趋势

- 乳腺炎

- 临床乳腺炎

- 亚临床性乳腺炎

- 其他疾病类型

第 8 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 兽医院药房

- 零售药局

- 其他分销管道

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AHV International

- Albert Kerbl

- Boehringer Ingelheim

- BouMatic

- Ceva Sante Animale

- DeLaval

- Ecolab

- Elanco Animal Health

- G Shepherd Animal Health

- Merck

- Virbac

- Zoetis

The Global Udder Health Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 2.5 billion by 2034, driven by rising concerns over udder diseases, especially mastitis, along with the surging global demand for dairy products. As dairy farming operations expand and intensify worldwide, the importance of proactive udder health management is becoming more critical than ever. Mastitis remains one of the most common and costly diseases affecting dairy cows, leading to significant losses in milk production, increased veterinary expenses, and long-term herd health issues. Farmers are focusing more on early detection and prevention to maintain profitability and animal welfare. Moreover, the global push for sustainable farming practices is transforming the udder health market, encouraging the adoption of alternatives to traditional antibiotics.

Regulatory bodies across major dairy-producing nations are enforcing stricter controls on antimicrobial use, further accelerating the demand for innovative treatments, vaccines, probiotics, and immune-boosting solutions. Technologies such as AI-driven health monitoring, precision treatment platforms, and advanced herd management systems are reshaping how farmers approach udder health. With consumer demand rising for ethically sourced and antibiotic-free dairy products, the market is set to experience robust growth over the next decade, supported by a combination of technological innovations, evolving farming practices, and increasing awareness about animal welfare and food safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 5.9% |

Mastitis, a frequent concern in dairy herds, continues to drive demand for effective diagnostic, therapeutic, and preventive solutions. As dairy farming grows more intensive, new treatments such as targeted antibiotics and non-invasive therapies are being developed to minimize antimicrobial resistance. Breakthroughs in vaccines, probiotics, and immunotherapies are significantly improving herd health by reducing chronic infections and boosting milk yields. Modern vaccines are becoming highly effective at preventing mastitis and other udder infections, while probiotics and immune-stimulant therapies are proving crucial for maintaining a healthy microbiome in dairy cows. These advancements are not only enhancing animal welfare but are also promoting more sustainable dairy farming by lowering antibiotic reliance.

The market is segmented into pharmaceutical products and supplements. The pharmaceutical segment generated USD 925.4 million in 2023, fueled by the growing incidence of udder infections and heightened concerns over antimicrobial resistance. The rising adoption of AI-powered prescription systems is enhancing treatment precision and herd health, further supporting growth in the pharmaceutical sector.

In terms of animal type, dairy cattle dominated the market with an 85.4% share in 2024. Rising investments in early diagnostic technologies, genetics, and disease resistance are reshaping herd management practices. Farmers are increasingly adopting probiotics and immunotherapy drugs amid global antibiotic restrictions, with AI-driven monitoring and automated milking systems gaining traction.

North America Udder Health Market accounted for 41% of global revenue in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Strong milk production across the U.S. is fueling the demand for advanced udder health solutions, including precision tools and sustainable management strategies. Regulatory pushes to reduce antibiotic use, led by the FDA and USDA, are further boosting the uptake of vaccines, probiotics, and immune-stimulant therapies.

Major players in the global udder health industry include Merck, BouMatic, AHV International, Albert Kerbl, Boehringer Ingelheim, Ceva Sante Animale, Ecolab, Elanco Animal Health, DeLaval, G Shepherd Animal Health, Virbac, and Zoetis. These companies are investing in innovative treatments to address antimicrobial resistance concerns, expanding AI and automation capabilities for diagnostics, partnering with veterinary clinics and farmers to improve product adoption, and enhancing sustainability efforts through eco-friendly product development and farmer education initiatives.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising dairy consumption and production globally

- 3.2.1.2 Increased awareness about udder health management

- 3.2.1.3 Advancements in veterinary diagnostics and treatment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulations on antibiotic use in dairy industry

- 3.2.2.2 High cost of udder health treatments and diagnostics

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Antibiotics

- 5.2.2 Vaccines

- 5.2.3 Anti-inflammatory drugs

- 5.2.4 Teat disinfectants

- 5.2.5 Intramammary infusions

- 5.2.6 Other pharmaceuticals

- 5.3 Supplement

- 5.3.1 Vitamins and minerals

- 5.3.2 Probiotics and prebiotics

- 5.3.3 Other supplements

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dairy cattle

- 6.3 Other animal types

Chapter 7 Market Estimates and Forecast, By Disease Type, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Mastitis

- 7.2.1 Clinical mastitis

- 7.2.2 Sub-clinical mastitis

- 7.3 Other disease types

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AHV International

- 10.2 Albert Kerbl

- 10.3 Boehringer Ingelheim

- 10.4 BouMatic

- 10.5 Ceva Sante Animale

- 10.6 DeLaval

- 10.7 Ecolab

- 10.8 Elanco Animal Health

- 10.9 G Shepherd Animal Health

- 10.10 Merck

- 10.11 Virbac

- 10.12 Zoetis