|

市场调查报告书

商品编码

1740845

石墨烯涂层渔具市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Graphene Coated Fishing Gear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

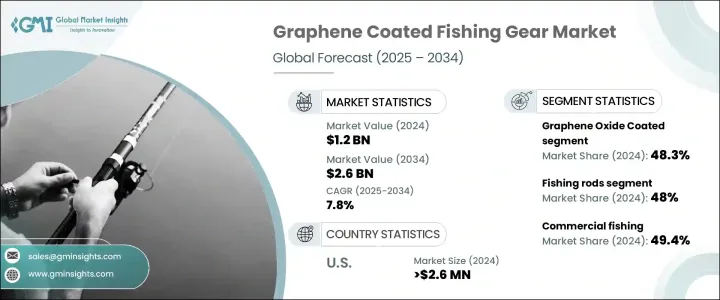

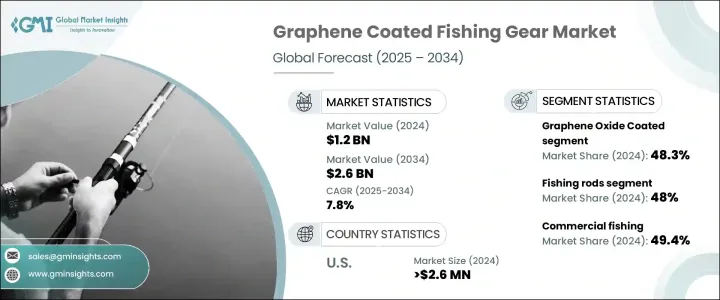

2024年,全球石墨烯涂层渔具市场规模达12亿美元,预计到2034年将以7.8%的复合年增长率成长,达到26亿美元。这一成长轨迹主要源自于休閒和商业领域对先进渔具日益增长的需求。钓客和商业渔民都在寻求轻便、高性能的工具,这些工具既要坚固耐用,又要兼顾灵敏度和灵活性。石墨烯涂层以其卓越的机械性能而闻名,凭藉其卓越的重量强度比,满足了这些需求。这使得渔具不仅更加耐用,而且反应更快——这些特性对于追求持久耐用和高性能渔具的用户来说至关重要。

休閒和竞技钓鱼群体日益增长的兴趣,进一步提升了石墨烯涂层的吸引力。随着越来越多的用户意识到石墨烯涂层渔具的益处,其需求也持续成长。对创新和耐用性的追求,促使许多製造商将石墨烯作为战略性产品升级融入渔具之中。这些涂层能够提高灵敏度,减少长时间使用带来的疲劳,并显着延长产品使用寿命。由于钓客通常追求精准度、耐用性和反应速度,石墨烯涂层渔具正迅速成为首选。此外,随着商业捕鱼作业规模的不断扩大,对坚固耐用且耐腐蚀渔具的需求也日益增长。产品性能与市场需求之间的这种契合,推动了该领域的大量投资和产品开发。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 7.8% |

2024年,市场按产品类型细分为鱼竿、钓线轮、鱼线、渔网和陷阱以及其他产品。其中,鱼竿占最大份额,贡献了48%的市场总值。其主导地位源自于其在运动钓鱼和休閒钓鱼中的广泛应用。石墨烯涂层在鱼竿製造中被越来越多地采用,以在不增加重量的情况下增强强度和柔韧性。这使得它们成为寻求能够重复使用并在各种钓鱼条件下可靠运行的装备的钓鱼者的首选。增强的耐用性和机械弹性,加上更高的灵敏度,使石墨烯涂层钓竿成为市场上的高端产品。

根据材料类型,2024 年的市场细分为氧化石墨烯涂层、石墨烯奈米片 (GNP)、还原氧化石墨烯 (rGO) 等。氧化石墨烯涂层产品占最大市场份额,为 48.3%,其次是基于 rGO 的涂层。氧化石墨烯涂层的受欢迎程度源自于其在聚合物基质中优异的分散性,以及强大的机械性能和阻隔功能。这些涂层特别适用于需要防潮防腐的钓竿、钓线轮和钓线。氧化石墨烯材料的另一个显着优势是易于整合到现有的製造系统中,为生产商提供了一种经济高效的产品改进途径,无需进行大规模的营运变更。

按应用领域划分,2024 年的市场细分为运动钓鱼、商业钓鱼、休閒钓鱼和其他。商业钓鱼占据主导地位,占 49.4%。其主要原因是商业作业中常见的重型设备和严苛的环境。该领域使用的渔具必须能够承受长期暴露在恶劣的海洋环境中并频繁操作。石墨烯涂层可以延长设备寿命,减少更换或维修需求,从而降低营运成本。这使得它们成为寻求简化维护週期和延长渔具使用寿命的商业船队营运商越来越受欢迎的选择。

在美国,石墨烯涂层渔具的需求显着成长。这归因于人们越来越意识到使用兼具强度和长期耐用性的高性能材料的优势。美国的商业和休閒渔业都越来越倾向于采用能够确保可靠性、效率和卓越用户体验的先进渔具。市场竞争环境持续鼓励创新,许多公司专注于扩展其石墨烯增强产品线,以满足不断变化的消费者偏好。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

註:以上贸易统计仅针对重点国家。

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对耐用且持久的钓鱼设备的需求不断增长

- 技术进步和研发资金

- 产业陷阱与挑战

- 生产和材料成本高

- 缺乏行业意识和采用

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 钓竿

- 钓鱼捲轴

- 钓鱼线

- 网和陷阱

- 其他的

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 氧化石墨烯涂层

- 还原氧化石墨烯(rGO)

- 石墨烯奈米片(GNP)

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 商业捕鱼

- 钓鱼运动

- 休閒娱乐

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Century Fishing

- Garware Technical Fibres Ltd.

- mackenzieflyfishing

- MITO Materials

- Moonshine Rod Company

- St. Croix Fly

- Vision Group Oy

The Global Graphene Coated Fishing Gear Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 2.6 billion by 2034. This growth trajectory is largely driven by the increasing demand for advanced fishing equipment in both recreational and commercial sectors. Anglers and commercial fishers alike are seeking lightweight, high-performance tools that offer strength without sacrificing sensitivity or flexibility. Graphene-based coatings, known for their superior mechanical attributes, are meeting these needs by offering exceptional weight-to-strength ratios. This results in gear that is not only more durable but also highly responsive-qualities that are becoming essential for users demanding long-lasting and performance-driven fishing equipment.

Increased interest from recreational and competitive fishing communities has amplified the appeal of graphene coatings. As more users become aware of the benefits offered by graphene-infused gear, the demand continues to expand. The push for innovation and durability has driven many manufacturers to incorporate graphene into fishing tools as a strategic product upgrade. These coatings enhance sensitivity, reduce fatigue during prolonged use, and significantly increase the product lifespan. With anglers often seeking precision, durability, and responsiveness, graphene-coated gear is quickly becoming the preferred choice. Moreover, as commercial fishing operations continue to scale, the requirement for robust and corrosion-resistant tools is growing. This alignment between product capability and market demand has fueled substantial investments and product developments in the sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 7.8% |

In 2024, the market was segmented by product type into fishing rods, reels, lines, nets & traps, and others. Among these, fishing rods accounted for the largest share, contributing 48% to the total market value. Their dominance is due to their extensive use in both sport and leisure fishing. Graphene coatings are being increasingly adopted in rod manufacturing to reinforce strength and flexibility without increasing weight. This makes them highly desirable for anglers looking for equipment that can endure repeated use and perform reliably across various fishing conditions. Enhanced durability and mechanical resilience, paired with increased sensitivity, are positioning graphene-coated rods as a premium offering in the market.

Based on material type, the market in 2024 was segmented into Graphene Oxide Coated, Graphene Nanoplatelets (GNPs), Reduced Graphene Oxide (rGO), and others. Graphene Oxide Coated products held the largest market share at 48.3%, followed by rGO-based coatings. The preference for graphene oxide coatings stems from their excellent dispersion characteristics in polymer matrices, along with robust mechanical properties and barrier functions. These coatings are particularly suitable for rods, reels, and lines, where protection from moisture and corrosion is essential. Another significant advantage is the ease with which graphene oxide materials can be integrated into current manufacturing systems, offering producers a cost-effective path to product enhancement without large-scale operational changes.

By application, the 2024 market was broken down into sports fishing, commercial fishing, recreational, and others. Commercial fishing led the segment with a share of 49.4%. The primary reason for this dominance is the heavy equipment usage and demanding environments common in commercial operations. Gear used in this segment must withstand prolonged exposure to harsh marine conditions and frequent handling. Graphene coatings extend equipment life and reduce the need for replacements or repairs, thereby cutting operational costs. This has made them an increasingly popular choice for commercial fleet operators looking to streamline maintenance cycles and enhance gear longevity.

In the United States, demand for graphene-coated fishing gear has seen notable growth. This is attributed to the rising awareness about the advantages of using high-performance materials that offer both strength and long-term durability. Both the commercial and recreational fishing sectors in the US are showing a growing inclination toward adopting advanced gear that ensures reliability, efficiency, and superior user experience. The market's competitive environment continues to encourage innovation, with numerous companies focusing on expanding their graphene-enhanced product lines to capture evolving consumer preferences.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (hs code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for durable and long-lasting fishing equipment

- 3.7.1.2 Technological advancements and r&d funding

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High production and material costs

- 3.7.2.2 Lack of industry awareness and adoption

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fishing rods

- 5.3 Fishing reels

- 5.4 Fishing lines

- 5.5 Nets & traps

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Graphene oxide coated

- 6.3 Reduced graphene oxide (rGO)

- 6.4 Graphene nanoplatelets (GNPs)

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial fishing

- 7.3 Sports fishing

- 7.4 Recreational

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Century Fishing

- 9.2 Garware Technical Fibres Ltd.

- 9.3 mackenzieflyfishing

- 9.4 MITO Materials

- 9.5 Moonshine Rod Company

- 9.6 St. Croix Fly

- 9.7 Vision Group Oy