|

市场调查报告书

商品编码

1830045

全球碳捕获材料市场(按工艺、材料、技术、最终用户和地区划分)- 预测至 2030 年Carbon Capture Materials Market by Material, Process, Technique, End-Use Industry & Region - Forecast to 2030 |

||||||

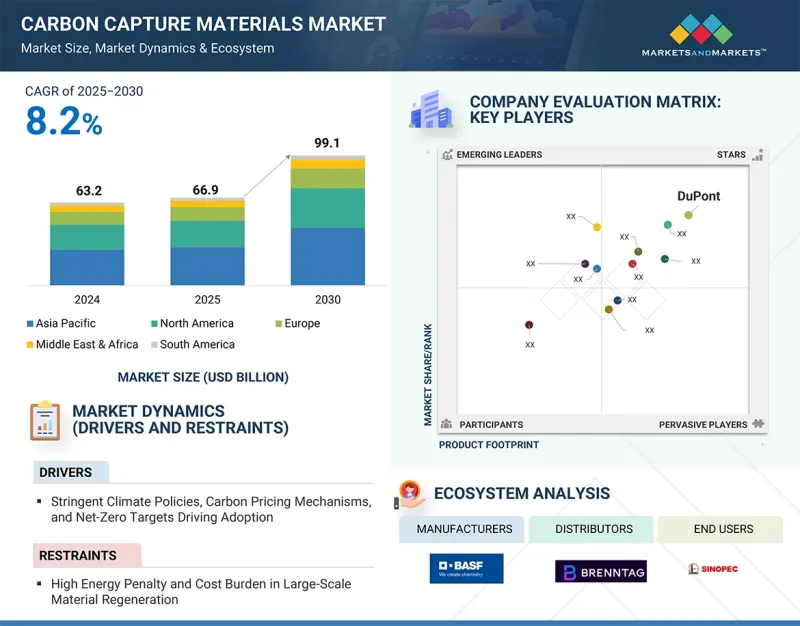

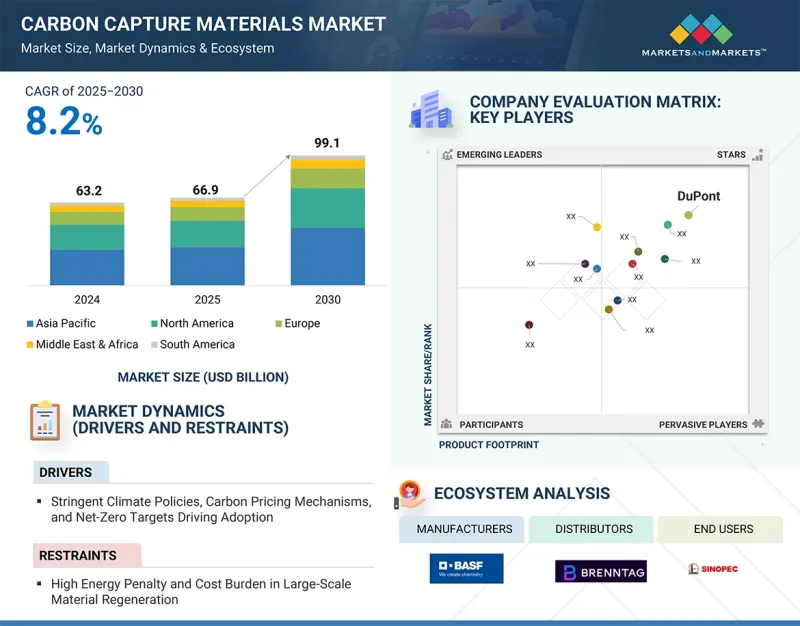

碳捕获材料市场规模预计将从 2025 年的 669.047 亿美元成长到 2030 年的 990.985 亿美元,预测期内复合年增长率为 8.2%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元/十亿美元)、数量(千吨) |

| 部分 | 按工艺、材料、技术、最终用户和地区 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、南美 |

推动碳捕获材料市场发展的关键因素包括严格的气候政策、日益增长的企业永续性承诺以及技术进步。严格的政府法规迫使各行各业减少温室气体排放,从而推动了对高效能碳捕获材料的需求。致力于实现净零目标的公司越来越重视永续材料和碳减排,推动了市场采用。

此外,生物基和循环碳捕获材料的技术创新正在提高效率、降低成本、增强环境效益并扩大使用案例。这些因素正在创造有利的市场条件,并透过吸引整个产业的投资来支持快速成长,以减轻气候变迁的影响并遵守环境法规。

液体溶剂(包括胺基和碱基溶液)因其在捕获工业排放中的二氧化碳方面已证实的高效性和多功能性,成为碳捕获市场中增长最快的材料。胺基溶剂因其对二氧化碳分子的高亲和性而得到了数十年的广泛应用,从而能够有效地捕获二氧化碳。它们能够吸收烟气中常见的二氧化碳,即使在低浓度下也是如此。这一良好的业绩记录使其在燃烧后碳捕获过程中具有可靠性,尤其是在碳排放备受关注的发电和工业领域。

溶剂配方的进步显着提高了再生能源需求并降低了营业成本,使这些解决方案在经济上可行。技术创新也正在解决溶剂的缺点,例如劣化和腐蚀,并提高这些材料的耐用性和生命週期。同时,碱性溶剂具有与二氧化碳反应速度更快、适用于各种製程条件等优势,拓宽了它们的工业应用范围。液体溶剂系统因其灵活性而实现了显着增长,使其无需进行大量改造即可整合到现有的工业设备中。这些溶剂可以适应废气成分和温度的变化,并可根据特定的製程需求进行客製化。全球强大的减少碳排放监管压力也促使各行各业采用这些成熟的溶剂技术。

吸附技术凭藉其高能源效率、多功能性以及与可扩展脱碳解决方案的契合度,成为碳捕获市场中成长最快的製程环节。吸附技术利用沸石和金属有机骨架等固体材料,从气流中捕获二氧化碳,捕获效率高达 90%,通常比吸收製程节省 30% 的能耗。其快速成长的驱动力在于其在燃烧后和直接空气捕获中的适用性,能够应对从发电厂到环境空气的各种排放源。吸附技术的模组化和紧凑系统使其能够轻鬆整合到现有的工业设施中,例如水泥厂和钢铁厂,从而降低改造成本。高容量、高选择性的吸附剂创新技术提升了性能,为从小型到大型应用提供了经济高效的製程。对负排放技术日益增长的需求,加上碳定价等支持性政策,正在加速其应用,尤其是在净零排放目标严格的地区。吸附剂的环境效益,例如与液体溶剂相比减少化学废弃物,进一步增强了其吸引力。吸附技术具有处理低浓度二氧化碳的能力,并且在物料输送方面不断改进,是成长最快的工艺,满足了对高效、可扩展的碳捕获解决方案的迫切需求。

燃烧前碳捕集是碳捕集市场中成长最快的技术,因为它具备多项关键优势,使其高效且有望实现大规模脱碳。与燃烧后捕集不同,燃烧前碳捕集技术透过气化或重整过程将石化燃料转化为氢气和二氧化碳的混合物(称为合成气),在燃烧前去除二氧化碳。这会产生高二氧化碳浓度和压力的气流,大大提高了透过物理或化学吸收方法捕捉的便利性和效率。高二氧化碳浓度意味着燃烧前捕集所需的设备和分离能耗更低,与其他方法相比,降低了资本和营业成本。该製程产生的氢气是一种清洁燃料,是一种有价值的产品,可支持更广泛的能源转型,即向低碳氢化合物经济转型。此外,燃烧前碳捕集可以整合到专为清洁能源生产而设计的新工厂和工业设施中,使其成为符合全球脱碳趋势的前瞻性方法。虽然气化系统的初始投资高于传统系统,但其捕获效率提高、能源成本降低和燃料品质改善等长期效益正推动其发展。此外,随着工业界寻求排放,燃烧前技术提供了以相对较低的成本捕获大量二氧化碳的有效解决方案。

石油和天然气产业是全球二氧化碳排放的重要贡献者,由于减少二氧化碳排放的压力越来越大,它是碳捕获市场中成长最快的终端产业。该产业在其上游、中游和下游环节中运行许多碳密集型流程,使捕碳封存(CCS) 成为有效减少排放的重要技术。成长的主要驱动力之一是 CCS 能够在解决环境问题的同时继续使用石化燃料,支援产业转型为低碳营运而不会中断生产。市场的一个关键驱动力是 CCS 与提高采收率(EOR) 技术的结合。将捕获的二氧化碳注入成熟油田以加强石油开采,可实现减少排放和提高资源回收率的双重好处。这种协同作用为采用 CCS 创造了经济奖励,使其比其他产业更具经济可行性。此外,监管要求和全球净零承诺迫使石油和天然气公司大力投资碳捕获技术,以满足气候变迁目标和相关人员的永续性期望。提高捕集效率、降低成本并确保二氧化碳安全封存的技术进步正在进一步加速该产业的应用。包括二氧化碳运输和封存网路在内的大型基础设施计划正在支持石油和天然气领域碳捕集与封存(CCS)倡议的扩展。该行业对永续性的关注,加上政府的奖励和碳市场的变化,使石油和天然气成为碳捕集的高成长领域。

本报告研究了全球碳捕获材料市场,按工艺、材料、技术、最终用户和地区进行细分,并提供了参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 生成式人工智慧/人工智慧对碳捕获材料市场的影响

第六章 产业趋势

- 介绍

- 影响客户业务的趋势/中断

- 供应链分析

- 2025年美国关税对碳捕获材料市场的影响

- 定价分析

- 投资金筹措场景

- 生态系分析

- 技术分析

- 专利分析

- 贸易分析

- 2025年至2027年的主要会议和活动

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 宏观经济展望

- 案例研究分析

7. 碳捕获材料市场(按工艺)

- 介绍

- 吸附

- 吸收

第八章 碳捕获材料市场(按材料)

- 介绍

- 液体溶剂

- 强溶剂

- 电影

9. 碳捕获材料市场(依技术)

- 介绍

- 燃烧前捕集

- 燃烧后回收

- 富氧燃料回收

- 直接空气捕获

第 10 章 碳捕获材料市场(依最终使用者)

- 介绍

- 发电

- 石油和天然气

- 化工/石化

- 金属和采矿

- 工业的

- 其他的

第11章碳捕获材料市场(按地区)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 法国

- 英国

- 西班牙

- 俄罗斯

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十二章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 市占率分析

- 收益分析

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 竞争场景

第十三章:公司简介

- 主要参与企业

- BASF

- DOW

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- TOSOH CORPORATION

- AIR PRODUCTS AND CHEMICALS, INC.

- ZEOCHEM AG

- ECOLAB

- SVANTE TECHNOLOGIES INC.

- CALGON CARBON CORPORATION

- 其他公司

- BOYCE CARBON

- JALON

- SPIRITUS

- CARBON ACTIVATED CORPORATION

- WARTSILA

- CLARIANT AG

第十四章 附录

The carbon capture materials market is projected to grow from USD 66,904.7 million in 2025 to USD 99,098.5 million by 2030, registering a CAGR of 8.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | Process, Material, End-Use Industries, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

key factors accelerating the carbon capture materials market include stringent climate policies, rising corporate sustainability commitments, and technological advancements. Stringent government regulations compel industries to reduce greenhouse gas emissions, driving demand for efficient carbon capture materials. Corporations aiming to meet net-zero targets increasingly prioritize sustainable materials and carbon reduction, boosting market adoption.

Additionally, ongoing innovation in bio-derived and circular carbon capture materials improves efficiency, reduces costs, and enhances environmental benefits, expanding use cases. These factors create favorable market conditions, attracting investments and supporting rapid growth across industries seeking to mitigate climate impact and comply with environmental mandates.

"Liquid solvents are the fastest-growing material segment of the carbon capture materials market in terms of value."

Liquid solvents, including amine-based and alkaline-based solutions, are the fastest-growing materials in the carbon capture market due to their proven efficiency and versatility in capturing CO2 from industrial emissions. Amine-based solvents have been widely used for decades because of their high affinity for CO2 molecules, enabling effective. Absorptions, even at low concentrations, are typically found in flue gases. This established track record makes them highly reliable for post-combustion carbon capture processes, particularly in power generation and industrial sectors where carbon emissions are a major concern.

Advancements in solvent formulations have significantly improved their regeneration energy requirements, reducing operational costs and making these solutions more economically viable. Innovations are addressing drawbacks such as solvent degradation and corrosion, enhancing the durability and lifecycle of these materials. Alkaline-based solvents, on the other hand, offer benefits including faster reaction rates with CO2 and suitability for use in different process conditions, which broadens their industrial applicability. The flexibility of liquid solvent systems to be integrated into existing industrial setups without extensive modifications is a major growth driver. These solvents can be tailored for specific process needs, adapting to varying flue gas compositions and temperatures. The strong regulatory push for carbon emission reductions globally also incentivizes industries to adopt these mature solvent technologies.

"Absorptions are the fastest-growing process segment of the carbon capture materials market in terms of value."

Adsorptions are the fastest-growing process segment in the carbon capture market due to their energy efficiency, versatility, and alignment with scalable decarbonization solutions. Utilizing solid materials like zeolites or metal-organic frameworks, adsorptions capture CO2 from gas streams with capture efficiencies up to 90%, requiring significantly less energy, often 30% lower than absorption processes. Its rapid growth is driven by its applicability in both post-combustion and direct air capture, addressing diverse emission sources from power plants to ambient air. Adsorptions' modular and compact systems enable easy integration into existing industrial setups, such as cement or steel facilities, reducing retrofitting costs. Innovations in high-capacity, selective sorbents enhance performance, making the process cost-effective for small- and large-scale applications. The growing demand for negative emissions technologies, coupled with supportive policies like carbon pricing, accelerates adoption, particularly in regions with stringent net-zero goals. Adsorptions' environmental benefits, including reduced chemical waste compared to liquid solvents, further boost their appeal. Its ability to handle low CO2 concentrations and continuous improvements in material durability make Adsorptions the fastest-growing process, addressing the urgent need for efficient, scalable carbon capture solutions.

"Pre-combustion is the fastest-growing technique segment of the carbon capture materials market in terms of value."

Pre-combustion carbon capture is the fastest-growing technique in the carbon capture market due to several key advantages that make it highly efficient and promising for large-scale decarbonization. Unlike post-combustion capture, pre-combustion technology removes CO2 before combustion by converting fossil fuels into a mixture of hydrogen and carbon dioxide (known as syngas) through a gasification or reforming process. This results in a gas stream with a higher concentration and pressure of CO2, which significantly enhances the ease and efficiency of capture using physical or chemical absorption methods. This higher concentration of CO2 means pre-combustion capture requires smaller equipment and less energy for separation, reducing both the capital and operational costs compared to other techniques. The process produces hydrogen, a clean-burning fuel, as a valuable byproduct, supporting the broader energy transition toward low-carbon hydrogen economies. Furthermore, pre-combustion capture can be integrated into new plants and industrial facilities designed for clean energy production, making it a forward-looking approach aligned with global decarbonization trends. Though the initial investment for the gasification process is higher than that of conventional systems, the long-term benefits of greater capture efficiency, lower energy penalties, and enhanced fuel quality are driving its growth. Additionally, as industries seek to reduce emissions from hard-to-abate sectors like power generation and heavy industry, pre-combustion technology offers an effective solution capable of capturing large volumes of CO2 at relatively lower cost.

"Oil & gas is the fastest-growing end-use industry segment of the carbon capture materials market in terms of value."

The oil & gas industry is the fastest-growing end-use sector in the carbon capture market because of its significant contribution to global CO2 emissions and the increasing pressure to lower its carbon footprint. This industry operates many carbon-intensive processes across upstream, midstream, and downstream segments, making carbon capture and storage (CCS) an essential technology for effectively reducing emissions. One of the main drivers of growth is CCS's ability to allow continued fossil fuel use while addressing environmental concerns, supporting the industry's transition to lower-carbon operations without stopping production. A major factor boosting the market is the integration of CCS with enhanced oil recovery (EOR) techniques. Captured CO2 is injected into mature oil fields to boost oil extraction, providing the dual benefit of reducing emissions and increasing resource recovery. This synergy creates economic incentives for adopting CCS, making it more financially practical than in other sectors. Additionally, regulatory requirements and global net-zero commitments compel oil and gas companies to heavily invest in carbon capture technologies to meet climate goals and stakeholder sustainability expectations. Technological advances that improve capture efficiency, cut costs, and ensure safe CO2 storage are further speeding up adoption in this sector. Large-scale infrastructure projects, including CO2 transportation and storage networks, support the expansion of CCS initiatives in oil and gas. The industry's focus on sustainability, along with government incentives and changing carbon markets, places oil and gas as a high-growth area within the carbon capture landscape.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the carbon capture materials market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 15%, Europe - 10%, Asia Pacific - 65%, Middle East & Africa - 7%, South America - 3%.

The key players in the carbon capture materials market include Ecolab (US), BASF (Germany), DOW (US), MITSUBISHI HEAVY INDUSTRIES, LTD (Japan), Solvay (Belgium), Air Products and Chemicals, Inc. (US), Tosoh Corporation (Japan), Honeywell International Inc. (US), and Zeochem (Switzerland). The study includes an in-depth competitive analysis of these key players in the carbon capture materials market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for carbon capture materials by process, technique, material, end-use industry, and region, and estimates the overall market value across various regions. It also provides a detailed analysis of key industry players to provide insights into their business overviews, products and services, key strategies, and expansions associated with the carbon capture materials market.

Key Benefits of Buying This Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the carbon capture materials market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers (Stringent Climate Policies, Carbon Pricing Mechanisms, and Net-Zero Targets Driving Adoption), restraints (High Energy Penalty and Cost Burden in Large-Scale Material Regeneration), opportunities (Innovation of Bio-Derived and Circular Carbon Capture Materials), and challenges (Supply-Chain Reliability & Plant-Retrofit Compatibility Constraints).

- Market Penetration: Comprehensive information on the carbon capture materials market offered by top players in the carbon capture materials market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, partnerships, agreements, and collaborations in the market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the carbon capture materials market across regions.

- Market Capacity: Production capacities of companies producing carbon capture materials market are provided wherever available, with upcoming capacities for the carbon capture materials market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the carbon capture materials market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CARBON CAPTURE MATERIALS MARKET

- 4.2 CARBON CAPTURE MATERIALS MARKET, BY MATERIAL

- 4.3 CARBON CAPTURE MATERIALS MARKET, BY PROCESS

- 4.4 CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE

- 4.5 CARBON CAPTURE MATERIALS MARKET, BY END USER

- 4.6 CARBON CAPTURE MATERIALS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising decarbonization pressure in energy-intensive industries

- 5.2.1.2 Stringent climate policies, carbon pricing mechanisms, and net-zero targets

- 5.2.2 RESTRAINTS

- 5.2.2.1 High energy requirement and cost burden in large-scale material regeneration

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of bio-derived and circular carbon capture materials

- 5.2.3.2 Integration of capture systems with utilization and mineralization technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain reliability and plant-retrofit compatibility constraints

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI/AI ON CARBON CAPTURE MATERIALS MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 IMPACT OF 2025 US TARIFFS ON CARBON CAPTURE MATERIALS MARKET

- 6.4.1 INTRODUCTION

- 6.4.2 KEY TARIFF RATES

- 6.4.3 PRICE IMPACT ANALYSIS

- 6.4.4 IMPACT ON COUNTRY/REGION

- 6.4.4.1 US

- 6.4.4.2 Europe

- 6.4.4.3 Asia Pacific

- 6.4.5 IMPACT ON END-USE INDUSTRIES

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY MATERIAL, 2021-2024

- 6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYER, BY MATERIAL, 2024

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 ECOSYSTEM ANALYSIS

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.9.2 PATENTS GRANTED

- 6.9.3 PATENT PUBLICATION TRENDS

- 6.9.4 INSIGHTS

- 6.9.5 LEGAL STATUS OF PATENTS

- 6.9.6 JURISDICTION ANALYSIS

- 6.9.7 TOP APPLICANTS

- 6.9.8 LIST OF MAJOR PATENTS

- 6.10 TRADE ANALYSIS

- 6.10.1 EXPORT SCENARIO (HS CODE 380210)

- 6.10.2 IMPORT SCENARIO (HS CODE 380210)

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2027

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 TARIFF ANALYSIS

- 6.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.3 REGULATIONS AND STANDARDS RELATED TO CARBON CAPTURE MATERIALS

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 THREAT OF NEW ENTRANTS

- 6.13.2 THREAT OF SUBSTITUTES

- 6.13.3 BARGAINING POWER OF SUPPLIERS

- 6.13.4 BARGAINING POWER OF BUYERS

- 6.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

- 6.15 MACROECONOMIC OUTLOOK

- 6.15.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.16 CASE STUDY ANALYSIS

- 6.16.1 TECHNOLOGY ANALYSIS OF CARBON CAPTURE MATERIALS: KEY AND COMPLEMENTARY TECHNOLOGIES SHAPING MARKET EVOLUTION

- 6.16.2 ADVANCED NANOSTRUCTURED MATERIALS FOR INDUSTRIAL CARBON CAPTURE

7 CARBON CAPTURE MATERIALS MARKET, BY PROCESS

- 7.1 INTRODUCTION

- 7.2 ADSORPTION

- 7.2.1 INCREASING DEMAND FOR ENERGY-EFFICIENT AND REGENERABLE MATERIALS IN INDUSTRIAL CARBON CAPTURE SYSTEMS TO DRIVE DEMAND

- 7.3 ABSORPTION

- 7.3.1 GROWING DEPLOYMENT OF SOLVENT-BASED CO2 CAPTURE SYSTEMS IN LARGE-SCALE POWER PLANTS AND INDUSTRIAL FACILITIES TO FUEL DEMAND

8 CARBON CAPTURE MATERIALS MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 LIQUID SOLVENTS

- 8.2.1 ADVANCEMENTS IN SOLVENT FORMULATIONS TO DRIVE DEMAND

- 8.2.2 AMINE-BASED SOLUTIONS

- 8.2.3 ALKALINE SOLUTIONS

- 8.3 STRONG SOLVENTS

- 8.3.1 GROWING EMPHASIS ON ENVIRONMENTALLY SUSTAINABLE AND REUSABLE MATERIALS TO FUEL DEMAND

- 8.3.2 ZEOLITES

- 8.3.3 ACTIVATED CARBON

- 8.3.4 CALCIUM-BASED SORBENTS

- 8.3.5 METAL-ORGANIC FRAMEWORKS

- 8.4 MEMBRANES

- 8.4.1 ABILITY TO SELECTIVELY SEPARATE CO2 FROM FLUE GASES OR INDUSTRIAL STREAMS TO PROPEL DEMAND

- 8.4.2 POLYMERIC MEMBRANES

9 CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE

- 9.1 INTRODUCTION

- 9.2 PRE-COMBUSTION CAPTURE

- 9.2.1 RISING DEMAND FOR HYDROGEN AS CLEAN FUEL TO DRIVE MARKET

- 9.3 POST-COMBUSTION CAPTURE

- 9.3.1 RETROFITTING POTENTIAL IN EXISTING POWER PLANTS AND INDUSTRIES TO DRIVE DEMAND

- 9.4 OXYFUEL COMBUSTION CAPTURE

- 9.4.1 HIGHER CO2 PURITY AND SIMPLIFIED CAPTURE PROCESSES TO PROPEL MARKET

- 9.5 DIRECT AIR CAPTURE

- 9.5.1 INCREASING GLOBAL EMPHASIS ON ACHIEVING NET-ZERO CARBON TARGETS TO DRIVE DEMAND

10 CARBON CAPTURE MATERIALS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 POWER

- 10.2.1 RISING EMISSION REDUCTION MANDATES AND CARBON-NEUTRALITY TARGETS TO ACCELERATE DEMAND

- 10.3 OIL & GAS

- 10.3.1 COMPLIANCE WITH EMISSION REDUCTION MANDATES TO DRIVE DEMAND

- 10.4 CHEMICAL & PETROCHEMICAL

- 10.4.1 RISING NEED TO DECARBONIZE ENERGY-INTENSIVE CHEMICAL PRODUCTION TO PROPEL DEMAND

- 10.5 METALS & MINING

- 10.5.1 INCREASING PRESSURE TO DECARBONIZE ENERGY-INTENSIVE SMELTING, REFINING, AND MINERAL PROCESSING OPERATIONS TO FUEL DEMAND

- 10.6 INDUSTRIAL

- 10.6.1 DECARBONIZATION REQUIREMENTS ACROSS DIVERSE INDUSTRIAL OPERATIONS TO BOOST DEMAND

- 10.7 OTHER END USERS

- 10.7.1 WASTE WATER TREATMENT

- 10.7.2 AGRICULTURE

11 CARBON CAPTURE MATERIALS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Extensive industrial activity and government-backed decarbonization goals to drive market

- 11.2.2 JAPAN

- 11.2.2.1 Focus on development of hydrogen economy to drive market

- 11.2.3 INDIA

- 11.2.3.1 High coal dependency and industrial emissions to fuel demand

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Government-backed CCUS pilot projects in heavy industries to propel demand

- 11.2.5 REST OF ASIA PACIFIC

- 11.2.1 CHINA

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Federal incentives under Inflation Reduction Act (IRA) and 45Q tax credits to drive adoption

- 11.3.2 CANADA

- 11.3.2.1 Stringent carbon pricing policies and large-scale CCUS infrastructure to fuel demand

- 11.3.3 MEXICO

- 11.3.3.1 Alignment with North American CCUS strategies and potential for industrial decarbonization to accelerate demand

- 11.3.1 US

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Ambitious climate neutrality targets and industrial decarbonization mandates to drive demand

- 11.4.2 ITALY

- 11.4.2.1 National decarbonization strategies and EU-funded CCS pilot projects to fuel demand

- 11.4.3 FRANCE

- 11.4.3.1 Expansion of industrial CCS initiatives and regulatory frameworks to drive demand

- 11.4.4 UK

- 11.4.4.1 High emphasis on negative emissions technologies and direct air capture pilot programs to fuel demand

- 11.4.5 SPAIN

- 11.4.5.1 High R&D support and innovation-driven policies to drive market

- 11.4.6 RUSSIA

- 11.4.6.1 Emerging CCU economic viability and CO2-EOR opportunities to drive demand

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Strategic focus on large-scale CCUS infrastructure to drive demand

- 11.5.1.2 UAE

- 11.5.1.2.1 Strategic focus on blue hydrogen production and large-scale industrial CCUS projects to fuel demand

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Government incentives to reduce coal-related emissions to drive adoption

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Robust legislative framework and abundant geological storage resources to fuel market growth

- 11.6.2 ARGENTINA

- 11.6.2.1 Growing industrial initiatives and supportive regulatory measures to propel market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS

- 12.4 REVENUE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Material footprint

- 12.6.5.3 Process footprint

- 12.6.5.4 End-user footprint

- 12.6.5.5 Region footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 BASF

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 DOW

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 HONEYWELL INTERNATIONAL INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 TOSOH CORPORATION

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 AIR PRODUCTS AND CHEMICALS, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 ZEOCHEM AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 ECOLAB

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 SVANTE TECHNOLOGIES INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 CALGON CARBON CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.1 BASF

- 13.2 OTHER PLAYERS

- 13.2.1 BOYCE CARBON

- 13.2.2 JALON

- 13.2.3 SPIRITUS

- 13.2.4 CARBON ACTIVATED CORPORATION

- 13.2.5 WARTSILA

- 13.2.6 CLARIANT AG

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF CARBON CAPTURE MATERIALS, BY REGION, 2021-2024 (USD/KILOTON)

- TABLE 2 AVERAGE SELLING PRICE TREND OF CARBON CAPTURE MATERIALS, BY MATERIAL, 2021-2024 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF CARBON CAPTURE MATERIALS OFFERED BY KEY PLAYERS, BY MATERIAL, 2024 (USD/KILOTON)

- TABLE 4 ROLES OF COMPANIES IN CARBON CAPTURE MATERIALS ECOSYSTEM

- TABLE 5 CARBON CAPTURE MATERIALS MARKET: KEY TECHNOLOGIES

- TABLE 6 CARBON CAPTURE MATERIALS MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 7 CARBON CAPTURE MATERIALS MARKET: TOTAL NUMBER OF PATENTS, 2015-2024

- TABLE 8 CARBON CAPTURE MATERIALS: LIST OF MAJOR PATENT OWNERS, 2015-2024

- TABLE 9 CARBON CAPTURE MATERIALS: LIST OF MAJOR PATENTS, 2015-2024

- TABLE 10 EXPORT DATA RELATED TO HS CODE 380210-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 11 IMPORT DATA RELATED TO HS CODE 380210-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 12 CARBON CAPTURE MATERIALS MARKET: KEY CONFERENCES AND EVENTS, 2025-2027

- TABLE 13 TARIFFS RELATED TO CARBON CAPTURE MATERIALS, 2024

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 CARBON CAPTURE MATERIALS MARKET: REGULATIONS AND STANDARDS

- TABLE 20 CARBON CAPTURE MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 23 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 24 CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 25 CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 26 CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 27 CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 28 CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 29 CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 30 CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 31 CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 32 CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 33 CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 34 CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (KILOTON)

- TABLE 35 CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (KILOTON)

- TABLE 36 CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 37 CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 38 CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 39 CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 40 CARBON CAPTURE MATERIALS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 CARBON CAPTURE MATERIALS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 CARBON CAPTURE MATERIALS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 43 CARBON CAPTURE MATERIALS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 44 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 45 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 47 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 48 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 49 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 51 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 52 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 53 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 54 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 55 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 56 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 57 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 58 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (KILOTON)

- TABLE 59 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (KILOTON)

- TABLE 60 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 61 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 62 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 63 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 64 CHINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 65 CHINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 66 CHINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 67 CHINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 68 JAPAN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 69 JAPAN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 70 JAPAN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 71 JAPAN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 72 INDIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 73 INDIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 74 INDIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 75 INDIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 76 SOUTH KOREA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 77 SOUTH KOREA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 78 SOUTH KOREA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 79 SOUTH KOREA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 80 REST OF ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 81 REST OF ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 82 REST OF ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 83 REST OF ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 84 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 87 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 88 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 91 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 92 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 95 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 96 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (KILOTON)

- TABLE 99 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (KILOTON)

- TABLE 100 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 103 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 104 US: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 105 US: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 106 US: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 107 US: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 108 CANADA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 109 CANADA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 111 CANADA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 112 MEXICO: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 113 MEXICO: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 114 MEXICO: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 115 MEXICO: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 116 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 119 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 120 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 121 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 123 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 124 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 127 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 128 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (KILOTON)

- TABLE 131 EUROPE CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (KILOTON)

- TABLE 132 EUROPE CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 135 EUROPE CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 136 GERMANY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 137 GERMANY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 138 GERMANY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 139 GERMANY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 140 ITALY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 141 ITALY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 142 ITALY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 143 ITALY: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 144 FRANCE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 145 FRANCE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 146 FRANCE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 147 FRANCE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 148 UK: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 149 UK: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 150 UK: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 151 UK: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 152 SPAIN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 153 SPAIN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 154 SPAIN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 155 SPAIN: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 156 RUSSIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 157 RUSSIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 158 RUSSIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 159 RUSSIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 160 REST OF EUROPE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 161 REST OF EUROPE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 163 REST OF EUROPE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 164 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 167 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 168 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 171 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 172 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 175 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 176 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (KILOTON)

- TABLE 180 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 184 SAUDI ARABIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 185 SAUDI ARABIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 186 SAUDI ARABIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 187 SAUDI ARABIA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 188 UAE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 189 UAE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 190 UAE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 191 UAE: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 192 REST OF GCC COUNTRIES: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 193 REST OF GCC COUNTRIES: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 194 REST OF GCC COUNTRIES: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 195 REST OF GCC COUNTRIES: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 196 SOUTH AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 199 SOUTH AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 204 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 205 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 206 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 207 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 208 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 209 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 210 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 211 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 212 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 213 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 214 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 215 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 216 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 217 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 218 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2021-2024 (KILOTON)

- TABLE 219 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY TECHNIQUE, 2025-2030 (KILOTON)

- TABLE 220 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 221 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 222 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 223 SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 224 BRAZIL: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 225 BRAZIL: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 226 BRAZIL: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 227 BRAZIL: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 228 ARGENTINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 229 ARGENTINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 230 ARGENTINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 231 ARGENTINA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 232 REST OF SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (USD MILLION)

- TABLE 233 REST OF SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 234 REST OF SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2021-2024 (KILOTON)

- TABLE 235 REST OF SOUTH AMERICA: CARBON CAPTURE MATERIALS MARKET, BY END USER, 2025-2030 (KILOTON)

- TABLE 236 CARBON CAPTURE MATERIALS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MAY 2025

- TABLE 237 CARBON CAPTURE MATERIALS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 238 CARBON CAPTURE MATERIALS MARKET: MATERIAL FOOTPRINT

- TABLE 239 CARBON CAPTURE MATERIALS MARKET: PROCESS FOOTPRINT

- TABLE 240 CARBON CAPTURE MATERIALS MARKET: END-USER FOOTPRINT

- TABLE 241 CARBON CAPTURE MATERIALS MARKET: REGION FOOTPRINT

- TABLE 242 CARBON CAPTURE MATERIALS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 243 CARBON CAPTURE MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 244 CARBON CAPTURE MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 245 CARBON CAPTURE MATERIALS MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 246 CARBON CAPTURE MATERIALS MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 247 BASF: COMPANY OVERVIEW

- TABLE 248 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 BASF: DEALS

- TABLE 250 DOW: COMPANY OVERVIEW

- TABLE 251 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 BASF: EXPANSIONS

- TABLE 253 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 254 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 256 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 257 MITSUBISHI HEAVY INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 258 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 259 TOSOH CORPORATION: COMPANY OVERVIEW

- TABLE 260 TOSOH CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 262 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 263 AIR PRODUCTS AND CHEMICALS, INC.: EXPANSIONS

- TABLE 264 ZEOCHEM: COMPANY OVERVIEW

- TABLE 265 ZEOCHEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 ECOLAB: COMPANY OVERVIEW

- TABLE 267 ECOLAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 ECOLAB: DEALS

- TABLE 269 SVANTE TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 270 SVANTE TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 SVANTE TECHNOLOGIES INC.: DEALS

- TABLE 272 CALGON CARBON CORPORATION: COMPANY OVERVIEW

- TABLE 273 CALGON CARBON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 BOYCE CARBON: COMPANY OVERVIEW

- TABLE 275 JALON: COMPANY OVERVIEW

- TABLE 276 SPIRITUS: COMPANY OVERVIEW

- TABLE 277 CARBON ACTIVATED CORPORATION: COMPANY OVERVIEW

- TABLE 278 WARTSILA: COMPANY OVERVIEW

- TABLE 279 CLARIANT AG: COMPANY OVERVIEW

List of Figures

- FIGURE 1 CARBON CAPTURE MATERIALS MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CARBON CAPTURE MATERIALS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2024

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 CARBON CAPTURE MATERIALS MARKET: DATA TRIANGULATION

- FIGURE 9 MEMBRANES SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 10 ABSORPTION SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 POST-COMBUSTION SEGMENT TO RECORD HIGHEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 12 OIL & GAS SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 GROWING USE OF CARBON CAPTURE MATERIALS IN OIL & GAS AND POWER INDUSTRIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 15 SOLID SOLVENTS SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 16 ABSORPTION SEGMENT TO REGISTER FAST GROWTH DURING FORECAST PERIOD

- FIGURE 17 POST-COMBUSTION SEGMENT TO REGISTER FASTEST GROWTH FROM 2025 TO 2030

- FIGURE 18 OIL & GAS SEGMENT TO REGISTER FASTEST GROWTH FROM 2025 TO 2030

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 CARBON CAPTURE MATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 USE OF GENERATIVE AI IN CARBON CAPTURE MATERIALS MARKET

- FIGURE 22 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 23 CARBON CAPTURE MATERIALS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF CARBON CAPTURE MATERIALS, BY REGION, 2021-2024 (USD/KILOTON)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF CARBON CAPTURE MATERIALS OFFERED BY KEY PLAYERS, BY MATERIAL, 2024 (USD/KILOTON)

- FIGURE 26 CARBON CAPTURE MATERIALS MARKET: INVESTMENT AND FUNDING SCENARIO, 2023-2025 (USD BILLION)

- FIGURE 27 CARBON CAPTURE MATERIALS: ECOSYSTEM ANALYSIS

- FIGURE 28 NUMBER OF PATENTS GRANTED, 2015-2024

- FIGURE 29 CARBON CAPTURE MATERIALS MARKET: LEGAL STATUS OF PATENTS

- FIGURE 30 PATENT ANALYSIS FOR CARBON CAPTURE MATERIALS, BY JURISDICTION, 2015-2024

- FIGURE 31 TOP COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 32 EXPORT DATA OF HS CODE 380210-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 33 IMPORT DATA OF HS CODE 380210-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 34 CARBON CAPTURE MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 37 ABSORPTION SEGMENT TO HOLD LARGER SHARE OF CARBON CAPTURE MATERIALS MARKET IN 2025

- FIGURE 38 MEMBRANES SEGMENT TO LEAD CARBON CAPTURE MATERIALS MARKET IN 2025

- FIGURE 39 POST-COMBUSTION SEGMENT TO HOLD LARGEST SHARE OF CARBON CAPTURE MATERIALS MARKET IN 2025

- FIGURE 40 OIL & GAS SEGMENT TO HOLD LARGEST SHARE OF CARBON CAPTURE MATERIALS MARKET IN 2025

- FIGURE 41 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 42 ASIA PACIFIC: CARBON CAPTURE MATERIALS MARKET SNAPSHOT

- FIGURE 43 NORTH AMERICA: CARBON CAPTURE MATERIALS MARKET SNAPSHOT

- FIGURE 44 EUROPE: CARBON CAPTURE MATERIALS MARKET SNAPSHOT

- FIGURE 45 CARBON CAPTURE MATERIALS MARKET SHARE ANALYSIS, 2024

- FIGURE 46 CARBON CAPTURE MATERIALS MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2021-2024 (USD BILLION)

- FIGURE 47 CARBON CAPTURE MATERIALS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 48 CARBON CAPTURE MATERIALS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 CARBON CAPTURE MATERIALS MARKET: COMPANY FOOTPRINT

- FIGURE 50 CARBON CAPTURE MATERIALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 CARBON CAPTURE MATERIALS MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 52 CARBON CAPTURE MATERIALS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2020-2024

- FIGURE 53 BASF: COMPANY SNAPSHOT

- FIGURE 54 DOW: COMPANY SNAPSHOT

- FIGURE 55 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 56 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 57 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT