|

市场调查报告书

商品编码

1740847

汽车后行李箱释放电缆市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Boot Release Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

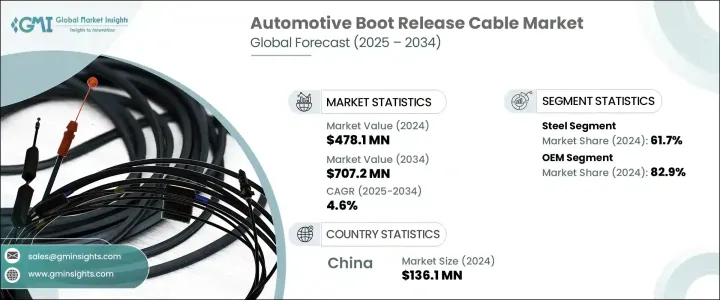

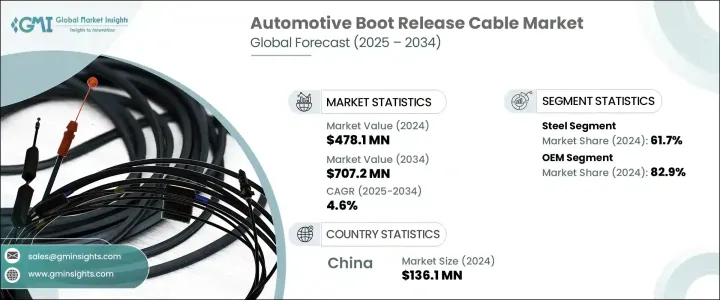

2024 年全球汽车后备箱释放拉线市场价值为 4.781 亿美元,预计到 2034 年将以 4.6% 的复合年增长率增长,达到 7.072 亿美元,这得益于全球汽车产量的增长和对先进车辆出入解决方案日益增长的需求。随着汽车设计的发展和消费者对与汽车更无缝互动的要求,后行李箱出入系统发生了显着变化。后行李箱释放拉线曾经是简单的机械部件,现在却在为各种车型提供更聪明、更安全、更有效率的后行李箱出入方面发挥着至关重要的作用。随着汽车製造商继续拥抱智慧出行和电动车技术,智慧后行李箱系统的整合正成为汽车设计的关键特征。消费者期望方便和快捷,而汽车製造商则透过部署将机械可靠性与尖端电子设备相结合的高性能拉线系统来应对这一需求。

人们对连网科技汽车的日益青睐,也影响汽车製造商设计诸如后行李箱开启等存取功能的方式。从基于手势的触发器到基于行动应用程式的功能,如今的消费者渴望的不仅仅是手动控制桿,他们更希望系统能够与他们的数位生活方式和谐地协同工作。这种需求推动着汽车后行李箱释放线缆系统的创新,以增强安全性、舒适性和使用者体验。这些发展在电动车和混合动力车中尤其明显,在这些汽车中,效率、轻量化设计和智慧整合是创新的前沿。汽车製造商如今正在利用即使在频繁使用和严苛环境条件下也能保持高耐用性和高性能的技术。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.781亿美元 |

| 预测值 | 7.072亿美元 |

| 复合年增长率 | 4.6% |

为了满足不断发展的标准,製造商正转向使用先进材料和更聪明的工程实践。轻质、耐腐蚀和高强度材料正成为行李箱释放拉索生产的标准。这些材料不仅延长了产品的使用寿命,还能透过减轻整体重量来提高车辆效率。钢材仍然是首选材料,2024 年其市场份额接近 61.7%,预计到 2034 年将以 5% 的复合年增长率增长。钢材的强度、经济性和抗疲劳性使其成为承受重复性机械应力部件的理想选择,尤其是在需要频繁打开后行李箱的商用和乘用电动车中。

从分销角度来看, OEM细分市场在 2024 年占据全球主导地位,占据 82.9% 的市场份额,预计在整个预测期内仍将保持领先地位。如今,汽车製造商已将先进的后备箱开启系统视为标准组件,并在生产过程中集成,以增强安全性和便利性。 OEM 正增加对混合机电解决方案的投资,这些解决方案与车辆门禁的未来发展相契合,旨在为最终用户提供更聪明、更安全、更直观的功能。这种转变在致力于透过从首次互动开始就提升用户体验来保持竞争力的全球汽车品牌中尤为明显。

中国正逐渐成为最具影响力的区域市场,2024年占全球汽车线束市场收入的57.6%,预计到2034年将达到1.361亿美元。中国庞大的汽车产量,加上其强大的汽车零件生态系统,使其在全球市场中占据战略优势。中国领先的供应商正专注于製造高精度、耐腐蚀且安全性更高的线束系统,以满足国际标准和需求。持续的研发投入和智慧製造实践,进一步巩固了中国作为全球先进汽车线束技术中心的地位。

为了在这个竞争激烈的领域保持领先地位,THB集团、Universal Cable、Leoni AG、Nexans Auto Electric、Birla Cable、Kei Industry、TE Connectivity、Polycab、住友电工和Sterlite Technologies等主要参与者正专注于设计轻量化、多功能的缆线释放系统。这些公司正在透过策略联盟扩大其全球影响力,并利用自动化和新一代材料提升製造能力。他们共同关注性能、耐用性以及与智慧汽车平台的兼容性,确保他们始终与汽车行业不断变化的需求保持一致。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 原物料供应商

- 汽车OEM

- 配销通路

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 定价分析

- 推进系统

- 地区

- 对部队的影响

- 成长动力

- 越来越重视车辆安全与门禁系统

- 安装简便,维护成本低

- OEM偏好模组化组件

- 全球汽车产量成长

- 产业陷阱与挑战

- 转向电子和智慧行李箱系统

- 更换频率低

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 钢

- 铝

- 塑胶

- 其他的

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 掀背车

- SUV

- 商用车

- 轻型

- 中型

- 重负

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 汽油

- 柴油引擎

- 电的

- 插电式混合动力

- 油电混合车

- 燃料电池电动车

第八章:市场估计与预测:按销售管道,2021 - 2034 年

- 主要趋势

- 原始设备製造商

- 售后市场

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Auto7

- Birla Cable

- Chuhatsu

- CMA

- Dorman Products

- Dura Automotive Systems

- GEMO

- HI-LEX

- Infac Corporation

- Kei Industries

- Kongsberg Automotive

- L&P Automotive Group

- Leoni AG

- Nexans Auto Electric

- Polycab

- Sterlite Technology

- Sumitomo Electric Industries

- TE connectivity

- THB Group

- Universal Cable

The Global Automotive Boot Release Cable Market was valued at USD 478.1 million in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 707.2 million by 2034, fueled by rising global vehicle production and the growing demand for advanced vehicle access solutions. As vehicle designs evolve and consumers demand more seamless interactions with their automobiles, trunk access systems have seen a notable transformation. Boot release cables, once simple mechanical components, are now playing a vital role in enabling smarter, more secure, and more efficient trunk access across a wide range of vehicle categories. As automakers continue to embrace smart mobility and electric vehicle technologies, the integration of intelligent trunk systems is becoming a critical feature in vehicle design. Consumers expect convenience and speed, and vehicle manufacturers are responding by deploying high-performance cable systems that blend mechanical reliability with cutting-edge electronics.

The increasing preference for connected, tech-savvy vehicles is shaping how automakers design access features like trunk openings. From gesture-based triggers to mobile app-based functionalities, today's consumers want more than manual levers-they want systems that work in harmony with their digital lifestyles. This demand is driving innovation in automotive boot release cable systems that offer enhanced security, comfort, and user experience. These developments are especially visible in electric and hybrid vehicles, where efficiency, lightweight design, and smart integration are at the forefront of innovation. Automakers are now leveraging technologies that can support high durability and performance even under frequent usage and challenging environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $478.1 Million |

| Forecast Value | $707.2 Million |

| CAGR | 4.6% |

To meet the evolving standards, manufacturers are shifting toward the use of advanced materials and smarter engineering practices. Lightweight, corrosion-resistant, and high-tensile materials are becoming standard in boot release cable production. These materials not only improve product longevity but also enhance vehicle efficiency by reducing overall weight. Steel remains the top choice among materials, capturing nearly 61.7% share of the market in 2024 and projected to grow at a CAGR of 5% through 2034. Its strength, affordability, and resistance to fatigue make it ideal for parts subject to repetitive mechanical stress, especially in commercial and passenger electric vehicles that require frequent trunk access.

In terms of distribution, the OEM segment dominated the global landscape in 2024, accounting for an 82.9% market share, and is expected to maintain its lead through the forecast period. Vehicle manufacturers now treat advanced boot release systems as standard components, integrating them during production to enhance both security and convenience. OEMs are increasingly investing in hybrid mechanical-electronic solutions that align with the future of vehicle access-offering smarter, safer, and more intuitive features for the end user. This shift is particularly prominent among global automotive brands that aim to stay competitive by improving user experience from the first point of interaction.

China is emerging as the most influential regional market, representing 57.6% of global revenue in 2024, with projections hitting USD 136.1 million by 2034. The country's high volume of vehicle production, combined with its robust automotive components ecosystem, gives it a strategic edge in the global market. Leading suppliers in China are focusing on manufacturing high-precision, corrosion-resistant, and safety-enhanced cable systems to meet international standards and demand. Continuous investments in R&D and smart manufacturing practices further strengthen China's position as a global hub for advanced automotive cable technologies.

To stay ahead in this competitive space, major players like THB Group, Universal Cable, Leoni AG, Nexans Auto Electric, Birla Cable, Kei Industry, TE Connectivity, Polycab, Sumitomo Electric Industries, and Sterlite Technologies are focusing on designing lightweight, multi-functional boot release cable systems. These companies are expanding their global presence through strategic alliances and improving their manufacturing capabilities with automation and next-gen materials. Their collective focus on performance, durability, and compatibility with smart vehicle platforms ensures they remain aligned with the evolving needs of the automotive industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End-use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing emphasis on vehicle security & access systems

- 3.10.1.2 Easy installation and low maintenance

- 3.10.1.3 OEM preference for modular components

- 3.10.1.4 Global vehicle production growth

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Shift towards electronic & smart trunk systems

- 3.10.2.2 Low replacement frequency

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Steel

- 5.3 Aluminium

- 5.4 Plastic

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchbacks

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light duty

- 6.3.2 Medium duty

- 6.3.3 Heavy duty

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

- 7.5 PHEV

- 7.6 HEV

- 7.7 FCEV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEMs

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Auto7

- 10.2 Birla Cable

- 10.3 Chuhatsu

- 10.4 CMA

- 10.5 Dorman Products

- 10.6 Dura Automotive Systems

- 10.7 GEMO

- 10.8 HI-LEX

- 10.9 Infac Corporation

- 10.10 Kei Industries

- 10.11 Kongsberg Automotive

- 10.12 L&P Automotive Group

- 10.13 Leoni AG

- 10.14 Nexans Auto Electric

- 10.15 Polycab

- 10.16 Sterlite Technology

- 10.17 Sumitomo Electric Industries

- 10.18 TE connectivity

- 10.19 THB Group

- 10.20 Universal Cable