|

市场调查报告书

商品编码

1807075

全球汽车轴承市场(按应用、轴承类型、电动车类型、车辆类型、售后市场和地区划分)- 预测至 2032 年Automotive Bearing Market by Bearing Type, Application, Vehicle Type, EV Type, Aftermarket and Region - Global Forecast to 2032 |

||||||

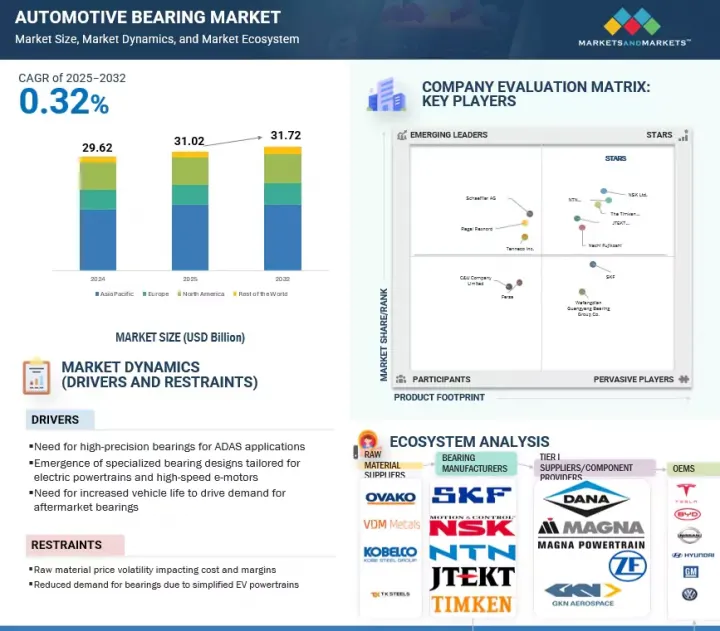

全球电动车轴承市场预计将从 2025 年的 58.1 亿美元成长到 2032 年的 128.2 亿美元,复合年增长率为 11.97%。

全球 ICE 汽车轴承市场预计将从 2025 年的 310.2 亿美元成长到 2032 年的 317.2 亿美元,复合年增长率为 0.32%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 单位数量 | 金额(百万美元),数量(百万单位) |

| 部分 | 按应用、按轴承类型、按电动车类型、按车辆类型、按售后市场、按地区 |

| 目标区域 | 亚太、欧洲、北美及其他地区 |

汽车轴承在减少摩擦、提高效率和确保引擎、变速箱和传动系统等关键车辆系统的耐用性方面发挥着至关重要的作用。涡轮增压和缸内喷油引擎的普及率日益提高,尤其是在亚太地区,这极大地推动了对能够承受高转速、高压力和高温度的高性能轴承的需求。

同时,日益严格的全球环境法规迫使汽车製造商优先考虑燃油经济性和减少排放气体,加速采用先进的轴承设计和下一代材料,例如陶瓷、高性能聚合物和混合复合材料。这些趋势不仅推动了轴承市场的演变,也强化了轴承在塑造汽车工程和永续旅行未来的关键作用。

随着汽车製造商优先考虑燃油效率、座舱舒适度和传动系统耐用性,对先进轴承解决方案(包括低扭力、降噪和高速设计)的需求正在稳步增长。电动乘用车的日益普及进一步加速了这一趋势,因为电动车需要高精度、低摩擦的轴承来支援电池续航里程和性能。为了满足这一需求,轴承製造商正在迅速创新并深化与原始设备製造商 (OEM) 的合作。例如,SKF 和舍弗勒合作开发用于电动车平台的下一代轮毂轴承,NSK 则推出了超音波抗疲劳轴承技术来延长产品寿命。 NTN 等製造商正在推出整合智慧感测器的轴承,用于高端乘用车的预测性维护。永续性的製造商正在探索陶瓷混合物、自润滑材料和轻质复合材料,以满足监管和环境目标。这使得乘用车市场成为汽车轴承规模最大、最具活力的细分市场。

强劲的国内需求和乘用车(尤其是豪华轿车和 SUV)出口的成长,支撑了稳定的轴承消费,尤其是内燃机汽车,其中轮毂、传动系统、变速箱和引擎应用占主导地位。儘管欧盟排放法规正在逐步提高电动车的普及率,但由于原始设备製造商注重效率、耐用性和轻量化设计,每年超过 370 万辆的汽车产量中大部分仍依赖传统轴承。欧盟技术标准等监管因素和美国对德国汽车加征关税等贸易压力正在影响生产策略和供应商合作。领先的轴承製造商,包括舍弗勒、斯凯孚、NSK、Stieber、Freudenberg 和 C&U Europe,为宝马和梅赛德斯-奔驰等主要原始设备製造商提供优质和专业的解决方案,其中许多是联合设计的。施韦因富特和巴伐利亚等主要生产和创新基地与汽车产业丛集紧密结合,支持即时供应和高性能滚动轴承(例如深沟球轴承、滚锥轴承和圆柱滚子轴承)的先进研发。德国汽车保有量的老化和根深蒂固的预防性保养文化造就了强劲的售后市场,但由于仿冒品引发的安全问题,人们呼吁加强品质验证措施。德国注重精密工程、高端汽车生产以及与供应商的紧密伙伴关係,使其成为欧洲领先的高性能轴承市场。

本报告研究了全球汽车轴承市场,并提供了按应用、轴承类型、电动车类型、车辆类型、售后市场和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 定价分析

- 贸易分析

- 生态系分析

- 供应链分析

- 技术分析

- 专利分析

- 汽车轴承的策略发展:电动动力传动系统、数位工程与协作生态系统

- 监管状况

- 案例研究分析

- 2025-2026年主要会议和活动

- 人工智慧的影响

- 主要相关人员和采购标准

- 影响我们客户业务的趋势和中断

- 美国2025年关税

第六章 汽车轴承市场(依应用)

- 介绍

- 轮毂

- 传播

- 传动系统

- 引擎

- 内部和外部

- 关键见解

第七章 汽车轴承市场(按轴承类型)

- 介绍

- 滚珠轴承

- 滚轮轴承

- 其他的

- 关键见解

第八章 汽车轴承市场(以电动车型式)

- 介绍

- 电动车

- PHEV

- 关键见解

第九章 汽车轴承市场(依车型)

- 介绍

- 搭乘用车

- 轻型商用车

- 大型商用车

- 关键见解

第十章 汽车轴承市场(按售后市场)

- 介绍

- 售后轮毂

- 售后变速箱

- 售后传动系统

- 售后发动机

- 售后内装和外饰

- 关键见解

第十一章 汽车轴承市场(按地区)

- 介绍

- 亚太地区

- 宏观经济展望

- 中国

- 印度

- 日本

- 韩国

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 宏观经济展望

- 法国

- 德国

- 义大利

- 西班牙

- 英国

- 其他的

- 其他地区

- 宏观经济展望

- 巴西

- 俄罗斯

- 南非

第十二章竞争格局

- 概述

- 主要参与企业的策略/优势

- 2024年市场占有率分析

- 顶级上市/公众公司的收益分析

- 估值和财务指标

- 品牌/产品比较

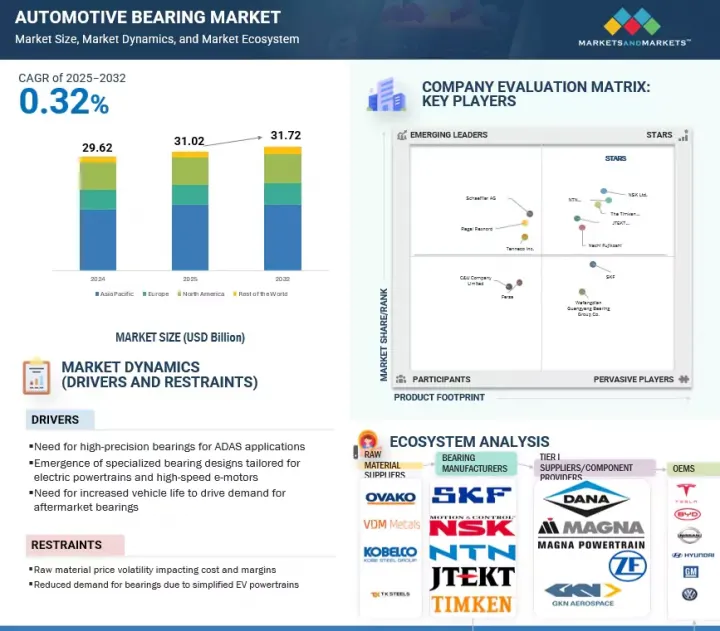

- 公司估值矩阵:2024 年关键参与企业

- 商业估值矩阵:2024 年中小企业

- 竞争场景

第十三章:公司简介

- 主要参与企业

- NSK LTD.

- NTN CORPORATION

- THE TIMKEN COMPANY

- JTEKT CORPORATION

- NACHI-FUJIKOSHI CORP.

- SCHAEFFLER AG

- SKF

- REGAL REXNORD CORPORATION

- WAFANGDIAN GUANGYANG BEARING GROUP CORPORATION LIMITED

- TENNECO INC.

- FERSA

- C&U COMPANY LIMITED

- 其他公司

- MINEBEAMITSUMI INC.

- ILJIN ELECTRONICS(I)PVT. LTD.

- NRB INDUSTRIAL BEARINGS LTD.

- RKB BEARING INDUSTRIES

- NAKANISHI MANUFACTURING CORPORATION

- EMERSON BEARING COMPANY

- ORS-ORTADOGU RULMAN SANAYI VE TIC. AS

- TSUBAKI NAKASHIMA CO. LTD.

- CW BEARING

- LYC PRIVATE LIMITED

- HARBIN BEARING MANUFACTURING CO., LTD.

- NEI LTD.(NBC BEARINGS)

- TATA STEEL

第十四章市场建议

第十五章 附录

The global automotive bearing market for EVs is projected to rise from USD 5.81 billion in 2025 to USD 12.82 billion by 2032, at a CAGR of 11.97%. The global automotive bearing market for ICE is projected to grow from USD 31.02 billion in 2025 to USD 31.72 billion by 2032, reflecting a modest CAGR of 0.32%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million), Volume (Million Units) |

| Segments | Bearing Type, Application, Vehicle Type, EV Type, Aftermarket, and Region |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

Automotive bearings play a vital role in reducing friction, enhancing efficiency, and ensuring the durability of critical vehicle systems, such as engines, transmissions, and drivelines. The rising adoption of turbocharged gasoline direct injection engines, particularly in Asia Pacific region, is significantly boosting the demand for high-performance bearings capable of withstanding high rotational speeds, extreme pressures, and elevated operating temperatures.

At the same time, increasingly stringent global environmental regulations are compelling automakers to prioritize fuel efficiency and lower emissions, which is accelerating the adoption of advanced bearing designs and next-generation materials, such as ceramics, high-performance polymers, and hybrid composites. Together, these trends are not only driving the evolution of the bearing market but also reinforcing its critical role in shaping the future of automotive engineering and sustainable mobility.

"By vehicle type, the passenger cars segment is projected to account for the largest share during the forecast period."

As automakers prioritize fuel efficiency, cabin comfort, and drivetrain durability, the demand for advanced bearing solutions, such as low-torque, noise-reducing, and high-speed designs, has grown steadily. The increasing adoption of electric passenger vehicles further accelerates this trend, as EVs require high-precision, friction-minimized bearings to support battery range and performance. Bearing manufacturers are innovating rapidly and deepening collaboration with OEMs to cater to this demand. For instance, SKF and Schaeffler have partnered to co-develop next-gen hub bearings for EV platforms, while NSK introduced ultrasonic fatigue-resistant bearing tech to enhance product lifespan. Players like NTN are launching smart sensor-embedded bearings for predictive maintenance in premium passenger models. With sustainability in focus, manufacturers are exploring ceramic hybrids, self-lubricating materials, and lightweight composites to meet regulatory and environmental goals. This makes the passenger cars segment the largest and most dynamic within the automotive bearings space.

"Germany is projected to lead the automotive bearing market in Europe during the forecast period."

Strong domestic demand for and rising export of passenger cars, particularly luxury sedans and SUVs, support a steady bearings consumption, especially for ICE vehicles where wheel hub, drivetrain, transmission, and engine applications dominate. Although EV adoption is gradually increasing under EU emission policies, the bulk of production, over 3.7 million vehicles annually, relies on conventional bearings, with OEMs focusing on efficiency, durability, and lightweight designs. Regulatory factors, including EU technical standards and external trade pressures, such as higher US tariffs on German vehicles, shape production strategies and supplier collaborations. Leading bearing manufacturers such as Schaeffler, SKF, NSK, Stieber, Freudenberg, and C&U Europe provide premium and specialized solutions to major OEMs like BMW and Mercedes-Benz, often through co-engineered designs. Key production and innovation hubs in regions like Schweinfurt and Bavaria enable close integration with automotive clusters, supporting just-in-time supply and advanced R&D in high-performance rolling element bearings, including deep groove ball, tapered roller, and cylindrical roller types. The aftermarket remains robust due to Germany's aging vehicle fleet and preventive maintenance culture, though counterfeit products present safety challenges, driving stronger quality verification measures. A strong focus on precision engineering, premium vehicle production, and close supplier partnerships is helping the country remain a key source of demand for high-performance bearings in Europe.

- By Company Type: OEMs - 35%, Tier I - 25%, Tier 2 - 40%

- By Designation: CXOs - 15%, Managers - 15%, Executives - 70%

- By Region: North America - 20%, Asia Pacific - 50%, Europe - 20 %, Rest of the World - 10%

The global automotive bearing market is dominated by established players such as NSK Ltd. (Japan), NTN Corporation (Germany), The Timken Company (USA), JTEKT Corporation (Japan), and Nachi Fujikoshi (Japan). These companies manufacture and supply automotive bearings for vehicles.

Research Coverage

The study covers the automotive bearing market by bearing type (Ball Bearing, Roller Bearing, and Other Bearings), application (Wheel Hub, Transmission System, Drivetrain, Engine, Interior & Exterior, and Other Applications), vehicle type (Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles), EV type (BEV and PHEV), and Aftermarket (Wheel Hub, Transmission System, Drivetrain, Engine, Interior & Exterior, and Other Applications). It also covers the competitive landscape and company profiles of major automotive bearing market ecosystem players.

Key Benefits of the Report

The study includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive bearing market ecosystem and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Additionally, the report will help stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (High precision bearings for ADAS applications, emergence of specialized bearing designs tailored for electric powertrains and high-speed e-motors, and increasing vehicle life to drive aftermarket bearing demand in automobiles), restraints (Raw material price volatility impacting costs and margins and reduced demand for bearings due to simplified EV powertrains), opportunities (Adoption of sensor-integrated bearings for condition-based monitoring and predictive maintenance and use of alternate materials like ceramics and polymers to boost efficiency and lifespan), and challenges (Persistent supply chain instability and extended lead times and declining replacement cycles due to long-lasting, sealed bearing units) influencing the growth of automotive bearing market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the automotive bearing market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the automotive bearing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like NSK Ltd. (Japan), NTN Corporation (Germany), The Timken Company (USA), JTEKT Corporation (Japan), and Nachi Fujikoshi (Japan)

- MnM Insights: Insights into the use of advanced materials for lightweight and corrosion-resistant design, EV-specific use cases (E-axles, in-wheel motors, thermal management, etc.), and ADAS/semi-autonomous application-related use cases

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Primary interviews from demand and supply sides

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Major objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE BEARING MARKET

- 4.2 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE

- 4.3 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE

- 4.4 AUTOMOTIVE BEARING MARKET, BY APPLICATION

- 4.5 AUTOMOTIVE BEARING MARKET, BY EV TYPE

- 4.6 AUTOMOTIVE BEARING MARKET, BY AFTERMARKET

- 4.7 AUTOMOTIVE BEARING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for high-precision bearings for ADAS applications

- 5.2.1.2 Emergence of specialized bearing designs tailored for electric powertrains and high-speed e-motors

- 5.2.1.3 Increasing vehicle life to drive demand for aftermarket bearings in automobiles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Reduced demand for bearings due to simplified EV powertrains

- 5.2.2.2 Declining replacement cycles due to long-lasting, sealed bearing units

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of sensor-integrated bearings for condition-based monitoring and predictive maintenance

- 5.2.3.2 Use of alternate materials like ceramics and polymers to boost efficiency and lifespan

- 5.2.4 CHALLENGES

- 5.2.4.1 Persistent supply chain instability and extended lead times

- 5.2.4.2 Raw material price volatility impacting costs and margins

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY APPLICATION

- 5.3.2 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY KEY PLAYER

- 5.3.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT SCENARIO (HS CODE 848210)

- 5.4.2 EXPORT SCENARIO (HS CODE 848210)

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 RAW MATERIAL SUPPLIERS

- 5.5.2 AUTOMOTIVE BEARING MANUFACTURERS

- 5.5.3 TIER I COMPANIES/COMPONENT PROVIDERS

- 5.5.4 AUTOMOTIVE OEMS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 RAW MATERIAL SUPPLIERS

- 5.6.2 TIER I COMPANIES/COMPONENT PROVIDERS

- 5.6.3 AUTOMOTIVE OEMS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Smart-sensored bearings as enablers of predictive maintenance architecture

- 5.7.1.2 Emerging role of magnetic bearings in electrified vehicle architectures

- 5.7.1.3 Electromagnetic bearings enabling adaptive ride and chassis stabilization

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Self-lubricating bearings with nano-coatings for electrified mobility

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Hybrid ceramic bearings for high-speed electric drivetrains

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 STRATEGIC DEVELOPMENTS IN AUTOMOTIVE BEARINGS: ELECTRIFIED POWERTRAINS, DIGITAL ENGINEERING, AND COLLABORATIVE ECOSYSTEMS

- 5.9.1 INTEGRATION OF BEARINGS WITH ELECTRIFIED POWERTRAIN ARCHITECTURE

- 5.9.1.1 Bearing systems for e-motors and compact EV architectures

- 5.9.1.2 Lubrication under thermal constraints in EV bearings

- 5.9.1.3 Miniaturized power, maximized performance: Bearings for integrated e-drives

- 5.9.2 DIGITAL TWINS AND SIMULATION IN BEARING DESIGN

- 5.9.2.1 Virtual load prediction in automotive bearings

- 5.9.2.2 Predictive failure modeling in bearing design

- 5.9.2.3 Simulation-driven prototyping in development of bearings

- 5.9.3 COLLABORATIVE BEARING ECOSYSTEM

- 5.9.3.1 Co-engineering bearings for electric and autonomous vehicles

- 5.9.3.2 Long-term sourcing contracts for supply of platform-centric bearings

- 5.9.3.3 Risk-sharing frameworks in bearing innovation partnerships

- 5.9.4 SUSTAINABILITY METRICS AND CIRCULAR ECONOMY POTENTIAL

- 5.9.4.1 Material use and reduction of emissions through remanufacturing of bearings

- 5.9.4.2 Re-engineering bearings for greener rulebook

- 5.9.1 INTEGRATION OF BEARINGS WITH ELECTRIFIED POWERTRAIN ARCHITECTURE

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY FRAMEWORK, BY COUNTRY

- 5.10.2.1 US

- 5.10.2.2 China

- 5.10.2.3 Japan

- 5.10.2.4 India

- 5.10.2.5 South Korea

- 5.10.2.6 Brazil

- 5.10.2.7 Europe

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SKF INSIGHT DEVELOPED SMART BEARING SYSTEM TO TURN CONVENTIONAL BEARINGS INTO SELF-MONITORING COMPONENTS

- 5.11.2 NTN CORPORATION DEVELOPED PIONEERING SENSOR INTEGRATED BEARING THAT EMBEDS SENSORS

- 5.11.3 SKF GROUP PARTNERED WITH VALEO TO DEVELOP HIGHLY INTEGRATED MAGNETIC SENSOR-BEARING UNIT TO ENABLE EFFICIENT STOP-START FUNCTION IN MICRO-HYBRID VEHICLES

- 5.11.4 TIMKEN COMPANY (US) DEVELOPED SENSOR PAC BEARING PACKAGE FOR INTEGRATED ABS & TRACTION CONTROL

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 IMPACT OF AI

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 US 2025 TARIFF

6 AUTOMOTIVE BEARING MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 WHEEL HUB

- 6.2.1 INTEGRATION OF ABS AND ESC SYSTEMS TO DRIVE MARKET

- 6.3 TRANSMISSION

- 6.3.1 SHIFT TOWARD AUTOMATIC TRANSMISSION TO IMPACT DEMAND

- 6.4 DRIVETRAIN

- 6.4.1 ADOPTION OF ALL-WHEEL-DRIVE (AWD) TO DRIVE DEMAND

- 6.5 ENGINE

- 6.5.1 GROWING ADOPTION OF TGDI OR LARGE ENGINES TO DRIVE DEMAND FOR ENGINE BEARINGS

- 6.6 INTERIOR & EXTERIOR

- 6.6.1 GROWING PREFERENCE FOR SUNROOFS, PREMIUM SEAT ADJUSTERS, AND MOTORIZED COMPONENTS TO BOOST DEMAND

- 6.7 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE

- 7.1 INTRODUCTION

- 7.2 BALL BEARING

- 7.2.1 NEED FOR LOW-MAINTENANCE COMPACT BEARINGS TO DRIVE MARKET

- 7.3 ROLLER BEARING

- 7.3.1 GROWING PREFERENCE FOR SUVS TO DRIVE DEMAND FOR ROLLER BEARINGS

- 7.4 OTHER BEARINGS

- 7.5 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE BEARING MARKET, BY EV TYPE

- 8.1 INTRODUCTION

- 8.2 BEV

- 8.2.1 POPULARITY OF BEVS TO DRIVE GROWTH IN DEMAND FOR EV-SPECIFIC BEARINGS

- 8.3 PHEV

- 8.3.1 GROWING PHEV SALES DUE TO DUAL POWERTRAINS TO FUEL DEMAND

- 8.4 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- 9.2 PASSENGER CARS

- 9.2.1 INCREASING DEMAND FOR PREMIUM CARS TO LEAD MARKET

- 9.3 LIGHT COMMERCIAL VEHICLES

- 9.3.1 DEMAND FOR ENHANCED LOAD CAPACITY AND THERMAL STABILITY TO DRIVE DEMAND FOR BEARINGS IN LCVS

- 9.4 HEAVY COMMERCIAL VEHICLES

- 9.4.1 GROWING DEMAND FOR AIR CONDITIONING IN CARS AND ADOPTION OF PREMIUM SAFETY FEATURES TO DRIVE DEMAND

- 9.5 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE BEARING MARKET, BY AFTERMARKET

- 10.1 INTRODUCTION

- 10.2 AFTERMARKET WHEEL HUB

- 10.2.1 INTEGRATION OF ABS AND ESC SYSTEMS TO DRIVE HIGH WHEEL HUB BEARING REPLACEMENTS

- 10.3 AFTERMARKET TRANSMISSION

- 10.3.1 COMPLEX GEAR SYSTEMS IN MODERN AUTOMATICS TO CREATE HIGH DEMAND

- 10.4 AFTERMARKET DRIVETRAIN

- 10.4.1 NEED FOR CONTINUOUS POWER TRANSFER AND LOAD VARIATIONS TO ACCELERATE MARKET

- 10.5 AFTERMARKET ENGINE

- 10.5.1 RISING VEHICLE AGE AND ENGINE DOWNSIZING TO INCREASE STRAIN ON REPLACEMENT BEARINGS

- 10.6 AFTERMARKET INTERIOR & EXTERIOR

- 10.6.1 RISING DEMAND FOR PREMIUM COMFORT FEATURES IN VEHICLES TO BOOST INTERIOR & EXTERIOR BEARING REPLACEMENTS

- 10.7 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE BEARING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 MACROECONOMIC OUTLOOK

- 11.2.2 CHINA

- 11.2.2.1 Rising adoption of advanced powertrain to fuel demand for high performance bearings

- 11.2.3 INDIA

- 11.2.3.1 Expanding vehicle ownership and production to drive growth in automotive bearings

- 11.2.4 JAPAN

- 11.2.4.1 Focus on precision engineering to drive demand for technologically advanced bearings

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Rising demand for refinement to drive growth in interior automotive bearings

- 11.3 NORTH AMERICA

- 11.3.1 MACROECONOMIC OUTLOOK

- 11.3.2 US

- 11.3.2.1 Innovation and EV adoption to drive steady growth in market

- 11.3.3 CANADA

- 11.3.3.1 Increased vehicle production and demand for aftermarket to accelerate growth

- 11.3.4 MEXICO

- 11.3.4.1 Strategic manufacturing growth to fuel surge in demand for automotive bearings

- 11.4 EUROPE

- 11.4.1 MACROECONOMIC OUTLOOK

- 11.4.2 FRANCE

- 11.4.2.1 Strict urban emission policies to spur fleet renewal and upgrades

- 11.4.3 GERMANY

- 11.4.3.1 Strong OEM-aftermarket collaboration to ensure steady supply and high-quality bearings

- 11.4.4 ITALY

- 11.4.4.1 Demand for luxury and high-performance vehicles to sustain premium bearings market

- 11.4.5 SPAIN

- 11.4.5.1 Regulatory incentives and upcoming EURO 7 standards to drive electrification to impact demand

- 11.4.6 UK

- 11.4.6.1 Premium vehicle production to drive demand for automotive bearings

- 11.4.7 REST OF EUROPE

- 11.5 REST OF THE WORLD

- 11.5.1 MACROECONOMIC OUTLOOK

- 11.5.2 BRAZIL

- 11.5.2.1 Government incentives and strong local manufacturing to drive market

- 11.5.3 RUSSIA

- 11.5.3.1 Rising vehicle production and technological complexity to drive market

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Growing demand for comfort features in vehicles to boost need for interior & exterior bearings

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Vehicle type footprint

- 12.7.5.4 Bearing type footprint

- 12.7.5.5 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: SMES, 2024

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 12.9.2 DEALS

- 12.9.3 EXPANSION

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 NSK LTD.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches/developments

- 13.1.1.3.2 Expansion

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices made

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 NTN CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches/developments

- 13.1.2.3.2 Expansion

- 13.1.2.3.3 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices made

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 THE TIMKEN COMPANY

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices made

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 JTEKT CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches/developments

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansion

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices made

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 NACHI-FUJIKOSHI CORP.

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices made

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 SCHAEFFLER AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Expansion

- 13.1.6.3.3 Other developments

- 13.1.7 SKF

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches/developments

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Expansion

- 13.1.7.3.4 Other developments

- 13.1.8 REGAL REXNORD CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 WAFANGDIAN GUANGYANG BEARING GROUP CORPORATION LIMITED

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 TENNECO INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 FERSA

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Expansion

- 13.1.12 C&U COMPANY LIMITED

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.1 NSK LTD.

- 13.2 OTHER PLAYERS

- 13.2.1 MINEBEAMITSUMI INC.

- 13.2.2 ILJIN ELECTRONICS (I) PVT. LTD.

- 13.2.3 NRB INDUSTRIAL BEARINGS LTD.

- 13.2.4 RKB BEARING INDUSTRIES

- 13.2.5 NAKANISHI MANUFACTURING CORPORATION

- 13.2.6 EMERSON BEARING COMPANY

- 13.2.7 ORS - ORTADOGU RULMAN SANAYI VE TIC. A.S.

- 13.2.8 TSUBAKI NAKASHIMA CO. LTD.

- 13.2.9 CW BEARING

- 13.2.10 LYC PRIVATE LIMITED

- 13.2.11 HARBIN BEARING MANUFACTURING CO., LTD.

- 13.2.12 NEI LTD. (NBC BEARINGS)

- 13.2.13 TATA STEEL

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 ASIA PACIFIC: KEY MARKET FOR AUTOMOTIVE BEARINGS

- 14.2 CONSUMER DEMAND AND INNOVATION IN AUTOMOTIVE INTERIOR BEARING MARKET

- 14.3 GROWTH OPPORTUNITIES IN SMART AUTOMOTIVE BEARINGS

- 14.4 GROWTH IN AUTOMOTIVE BEARINGS DUE TO RISING DEMAND FOR PHEVS

- 14.5 CONCLUSION

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

List of Tables

- TABLE 1 MARKET DEFINITION, BY BEARING TYPE

- TABLE 2 MARKET DEFINITION, BY APPLICATION

- TABLE 3 MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 4 MARKET DEFINITION, BY EV TYPE

- TABLE 5 MARKET DEFINITION, BY AFTERMARKET

- TABLE 6 CURRENCY EXCHANGE RATES, 2021-2024

- TABLE 7 AUTOMOTIVE BEARING MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 8 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY APPLICATION, 2021-2024 (USD)

- TABLE 9 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY KEY PLAYER, 2024 (USD)

- TABLE 10 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY REGION, 2021-2024 (USD)

- TABLE 11 IMPORT DATA FOR HS CODE 853670-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 853670-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 ROLE OF COMPANIES IN MARKET ECOSYSTEM

- TABLE 14 PATENT ANALYSIS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EURO-5 VS. EURO-6 VEHICLE EMISSION STANDARDS ON NEW EUROPEAN DRIVING CYCLE

- TABLE 20 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BEARING TYPES (%)

- TABLE 22 KEY BUYING CRITERIA FOR BEARING TYPES

- TABLE 23 AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 24 AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 25 AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 27 WHEEL HUB: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 28 WHEEL HUB: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 29 WHEEL HUB: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 WHEEL HUB: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 31 TRANSMISSION: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 32 TRANSMISSION: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 33 TRANSMISSION: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 TRANSMISSION: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 35 DRIVETRAIN: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 36 DRIVETRAIN: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 37 DRIVETRAIN: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 DRIVETRAIN: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 39 ENGINE: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 40 ENGINE: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 41 ENGINE: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 ENGINE: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 INTERIOR & EXTERIOR: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 44 INTERIOR & EXTERIOR: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 45 INTERIOR & EXTERIOR: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 INTERIOR & EXTERIOR: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE, 2021-2024 (MILLION UNITS)

- TABLE 48 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE, 2025-2032 (MILLION UNITS)

- TABLE 49 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE, 2021-2024 (USD MILLION)

- TABLE 50 AUTOMOTIVE BEARING MARKET, BY BEARING TYPE, 2025-2032 (USD MILLION)

- TABLE 51 AUTOMOTIVE BALL BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 52 AUTOMOTIVE BALL BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 53 AUTOMOTIVE BALL BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 AUTOMOTIVE BALL BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 55 AUTOMOTIVE ROLLER BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 56 AUTOMOTIVE ROLLER BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 57 AUTOMOTIVE ROLLER BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 AUTOMOTIVE ROLLER BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 AUTOMOTIVE BEARING MARKET FOR OTHER BEARINGS, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 60 AUTOMOTIVE BEARING MARKET FOR OTHER BEARINGS, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 61 AUTOMOTIVE BEARING MARKET FOR OTHER BEARINGS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE BEARING MARKET FOR OTHER BEARINGS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 AUTOMOTIVE BEARING MARKET, BY EV TYPE, 2021-2024 (MILLION UNITS)

- TABLE 64 AUTOMOTIVE BEARING MARKET, BY EV TYPE, 2025-2032 (MILLION UNITS)

- TABLE 65 AUTOMOTIVE BEARING MARKET, BY EV TYPE, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMOTIVE BEARING MARKET, BY EV TYPE, 2025-2032 (USD MILLION)

- TABLE 67 BEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 68 BEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 69 BEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 70 BEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 71 BEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2021-2024 (MILLION UNITS)

- TABLE 72 BEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2025-2032 (MILLION UNITS)

- TABLE 73 BEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2021-2024 (USD MILLION)

- TABLE 74 BEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2025-2032 (USD MILLION)

- TABLE 75 PHEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 76 PHEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 77 PHEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 78 PHEV: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 79 PHEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2021-2024 (MILLION UNITS)

- TABLE 80 PHEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2025-2032 (MILLION UNITS)

- TABLE 81 PHEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2021-2024 (USD MILLION)

- TABLE 82 PHEV: AUTOMOTIVE BEARING MARKET, BY KEY REGION, 2025-2032 (USD MILLION)

- TABLE 83 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE, 2021-2024 (MILLION UNITS)

- TABLE 84 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE, 2025-2032 (MILLION UNITS)

- TABLE 85 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 86 AUTOMOTIVE BEARING MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 87 PASSENGER CARS: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 88 PASSENGER CARS: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 89 PASSENGER CARS: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 PASSENGER CARS: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 91 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 92 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 93 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 LIGHT COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 95 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 96 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 97 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 HEAVY COMMERCIAL VEHICLES: AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 99 AFTERMARKET AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 100 AFTERMARKET AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 101 AFTERMARKET AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 AFTERMARKET AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 103 WHEEL HUB: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 104 WHEEL HUB: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 105 WHEEL HUB: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 WHEEL HUB: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 107 TRANSMISSION: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 108 TRANSMISSION: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 109 TRANSMISSION: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 TRANSMISSION: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 111 DRIVETRAIN: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 112 DRIVETRAIN: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 113 DRIVETRAIN: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 114 DRIVETRAIN: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 115 ENGINE: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 116 ENGINE: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 117 ENGINE: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 ENGINE: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 119 INTERIOR & EXTERIOR: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 120 INTERIOR & EXTERIOR: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 121 INTERIOR & EXTERIOR: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 INTERIOR & EXTERIOR: AFTERMARKET AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 123 AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 124 AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (MILLION UNITS)

- TABLE 125 AUTOMOTIVE BEARING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 127 ASIA PACIFIC: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 128 ASIA PACIFIC: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 129 ASIA PACIFIC: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 131 CHINA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 132 CHINA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 133 CHINA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 134 CHINA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 135 INDIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 136 INDIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 137 INDIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 138 INDIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 139 JAPAN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 140 JAPAN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 141 JAPAN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 142 JAPAN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 143 SOUTH KOREA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 144 SOUTH KOREA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 145 SOUTH KOREA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 SOUTH KOREA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 147 NORTH AMERICA: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 148 NORTH AMERICA: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 149 NORTH AMERICA: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 NORTH AMERICA: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 151 US: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 152 US: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 153 US: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 154 US: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 155 CANADA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 156 CANADA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 157 CANADA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 158 CANADA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 159 MEXICO: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 160 MEXICO: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 161 MEXICO: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 162 MEXICO: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 163 EUROPE: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 164 EUROPE: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 165 EUROPE: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 167 FRANCE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 168 FRANCE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 169 FRANCE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 170 FRANCE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 171 GERMANY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 172 GERMANY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 173 GERMANY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 GERMANY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 175 ITALY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 176 ITALY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 177 ITALY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 178 ITALY: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 179 SPAIN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 180 SPAIN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 181 SPAIN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 182 SPAIN: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 183 UK: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 184 UK: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 185 UK: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 186 UK: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 187 REST OF EUROPE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 188 REST OF EUROPE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 189 REST OF EUROPE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 190 REST OF EUROPE: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 191 REST OF THE WORLD: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 192 REST OF THE WORLD: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (MILLION UNITS)

- TABLE 193 REST OF THE WORLD: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 194 REST OF THE WORLD: AUTOMOTIVE BEARING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 195 BRAZIL: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 196 BRAZIL: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 197 BRAZIL: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 198 BRAZIL: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 199 RUSSIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 200 RUSSIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 201 RUSSIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 202 RUSSIA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 203 SOUTH AFRICA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 204 SOUTH AFRICA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (MILLION UNITS)

- TABLE 205 SOUTH AFRICA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 206 SOUTH AFRICA: AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 207 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- TABLE 208 MARKET SHARE ANALYSIS OF TOP KEY PLAYERS, 2024

- TABLE 209 AUTOMOTIVE BEARING MARKET: REGION FOOTPRINT, 2024

- TABLE 210 AUTOMOTIVE BEARING MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 211 AUTOMOTIVE BEARING MARKET: BEARING TYPE FOOTPRINT, 2024

- TABLE 212 AUTOMOTIVE BEARING MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 213 COMPETITIVE BENCHMARKING OF SMES

- TABLE 214 AUTOMOTIVE BEARING MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2023-MARCH 2025

- TABLE 215 AUTOMOTIVE BEARING MARKET: DEALS, JANUARY 2023-MARCH 2025

- TABLE 216 AUTOMOTIVE BEARING MARKET: EXPANSION, JANUARY 2023-MARCH 2025

- TABLE 217 AUTOMOTIVE BEARING MARKET: OTHER DEVELOPMENTS, JANUARY 2023-MARCH 2025

- TABLE 218 NSK LTD.: COMPANY OVERVIEW

- TABLE 219 NSK LTD.: PRODUCTS OFFERED

- TABLE 220 NSK LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 221 NSK LTD.: EXPANSION

- TABLE 222 NSK LTD.: OTHER DEVELOPMENTS

- TABLE 223 NTN CORPORATION: COMPANY OVERVIEW

- TABLE 224 NTN CORPORATION: PRODUCTS OFFERED

- TABLE 225 NTN CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 226 NTN CORPORATION: EXPANSION

- TABLE 227 NTN CORPORATION: OTHER DEVELOPMENTS

- TABLE 228 THE TIMKEN COMPANY: COMPANY OVERVIEW

- TABLE 229 THE TIMKEN COMPANY: PRODUCTS OFFERED

- TABLE 230 THE TIMKEN COMPANY: DEALS

- TABLE 231 THE TIMKEN COMPANY: OTHER DEVELOPMENTS

- TABLE 232 JTEKT CORPORATION: COMPANY OVERVIEW

- TABLE 233 JTEKT CORPORATION: PRODUCTS OFFERED

- TABLE 234 JTEKT CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 235 JTEKT CORPORATION: DEALS

- TABLE 236 JTEKT CORPORATION: EXPANSION

- TABLE 237 JTEKT CORPORATION: OTHER DEVELOPMENTS

- TABLE 238 NACHI-FUJIKOSHI CORP.: COMPANY OVERVIEW

- TABLE 239 NACHI-FUJIKOSHI CORP.: PRODUCTS OFFERED

- TABLE 240 SCHAEFFLER AG: COMPANY OVERVIEW

- TABLE 241 SCHAEFFLER AG: PRODUCTS OFFERED

- TABLE 242 SCHAEFFLER AG: DEALS

- TABLE 243 SCHAEFFLER AG: EXPANSION

- TABLE 244 SCHAEFFLER AG: OTHER DEVELOPMENTS

- TABLE 245 SKF: COMPANY OVERVIEW

- TABLE 246 SKF: PRODUCTS OFFERED

- TABLE 247 SKF: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 248 SKF: DEALS

- TABLE 249 SKF: EXPANSION

- TABLE 250 SKF: OTHER DEVELOPMENTS

- TABLE 251 REGAL REXNORD CORPORATION: COMPANY OVERVIEW

- TABLE 252 REGAL REXNORD CORPORATION: PRODUCTS OFFERED

- TABLE 253 REGAL REXNORD CORPORATION: DEALS

- TABLE 254 WAFANGDIAN GUANGYANG BEARING GROUP CORPORATION LIMITED.: COMPANY OVERVIEW

- TABLE 255 WAFANGDIAN GUANGYANG BEARING GROUP CORPORATION LIMITED.: PRODUCTS OFFERED

- TABLE 256 TENNECO INC.: COMPANY OVERVIEW

- TABLE 257 TENNECO INC.: PRODUCTS OFFERED

- TABLE 258 FERSA: COMPANY OVERVIEW

- TABLE 259 FERSA: PRODUCTS OFFERED

- TABLE 260 FERSA: DEALS

- TABLE 261 FERSA: EXPANSION

- TABLE 262 C&U COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 263 C&U COMPANY LIMITED: PRODUCTS OFFERED

- TABLE 264 MINEBEAMITSUMI INC.: COMPANY OVERVIEW

- TABLE 265 ILJIN ELECTRONICS (I) PVT. LTD.: COMPANY OVERVIEW

- TABLE 266 NRB INDUSTRIAL BEARINGS LTD.: COMPANY OVERVIEW

- TABLE 267 RKB BEARING INDUSTRIES: COMPANY OVERVIEW

- TABLE 268 NAKANISHI MANUFACTURING CORPORATION: COMPANY OVERVIEW

- TABLE 269 EMERSON BEARING COMPANY: COMPANY OVERVIEW

- TABLE 270 ORS - ORTADOGU RULMAN SANAYI VE TIC. A.S.: COMPANY OVERVIEW

- TABLE 271 TSUBAKI NAKASHIMA CO., LTD.: COMPANY OVERVIEW

- TABLE 272 CW BEARING: COMPANY OVERVIEW

- TABLE 273 LYC PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 274 HARBIN BEARING MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 275 NEI LTD. (NBC BEARINGS): COMPANY OVERVIEW

- TABLE 276 TATA STEEL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 4 RESEARCH METHODOLOGY

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION NOTES

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- FIGURE 10 AUTOMOTIVE BEARING MARKET OUTLOOK

- FIGURE 11 AUTOMOTIVE BEARING MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 12 AUTOMOTIVE BEARING MARKET, BY APPLICATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 13 KEY PLAYERS IN AUTOMOTIVE BEARING MARKET

- FIGURE 14 INCREASING DEMAND FOR SUVS AND PREMIUM INTERIORS TO DRIVE MARKET

- FIGURE 15 PASSENGER CARS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 BALL BEARING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 DRIVETRAIN SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 18 BEV SEGMENT TO EXHIBIT SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 19 DRIVETRAIN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 ASIA PACIFIC TO BE LARGEST MARKET IN 2025

- FIGURE 21 AUTOMOTIVE BEARING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 ESTIMATED ADAS PENETRATION IN PASSENGER CARS SEGMENT, 2020-2035

- FIGURE 23 ELECTRIC VEHICLE SALES, 2020-2024 (USD MILLION)

- FIGURE 24 PLACEMENT OF BEARINGS IN ELECTRIC VEHICLE MOTORS

- FIGURE 25 MACHINE LEARNING-BASED BEARING FAULT DETECTION PROCESS

- FIGURE 26 ADVANCED BEARING MATERIALS FOR SPECIALIZED APPLICATIONS

- FIGURE 27 GLOBAL AVERAGE PRICE OF COPPER, 2021-2024 (USD/METRIC TON)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY APPLICATION, 2021-2024 (USD)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE BEARINGS, BY REGION, 2021-2024 (USD)

- FIGURE 30 IMPORT DATA FOR HS CODE 848210-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 848210-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 ECOSYSTEM ANALYSIS

- FIGURE 33 SUPPLY CHAIN ANALYSIS

- FIGURE 34 SENSOR-INTEGRATED BEARINGS FOR REAL-TIME SYSTEM INTELLIGENCE

- FIGURE 35 ACTIVE MAGNETIC BEARINGS FOR FRICTIONLESS DRIVETRAIN INNOVATION

- FIGURE 36 EVOLUTION OF SMART CHASSIS SYSTEMS WITH ELECTROMAGNETIC SUSPENSION BEARINGS

- FIGURE 37 NANO-COATED AND SELF-LUBRICATING BEARINGS FOR EV APPLICATIONS

- FIGURE 38 PATENT ANALYSIS, 2015-2025

- FIGURE 39 LUBRICATION UNDER PRESSURE: BEARINGS IN HIGH-HEAT ELECTRIC POWERTRAINS

- FIGURE 40 BEARINGS FOR COMPACT EV DRIVETRAIN ARCHITECTURES

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR BEARING TYPES

- FIGURE 42 KEY BUYING CRITERIA FOR BEARING TYPES

- FIGURE 43 TRENDS & DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 44 AVERAGE TARIFF APPLIED ON SELECTED COUNTRIES BY US

- FIGURE 45 INTERIOR & EXTERIOR SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 46 APPLICATION OF BEARINGS IN WHEEL HUBS

- FIGURE 47 APPLICATION OF BEARINGS IN TRANSMISSION

- FIGURE 48 APPLICATION OF BEARINGS IN DRIVETRAIN

- FIGURE 49 BALL BEARING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 50 BALL BEARINGS USED ACROSS VEHICLE SYSTEMS FOR SMOOTH PERFORMANCE

- FIGURE 51 BEV SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 52 PASSENGER CARS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 53 BEARINGS USED IN POWERTRAIN, ENGINE, AND WHEEL HUB IN PASSENGER CARS: USE CASES

- FIGURE 54 DRIVETRAIN SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 55 AUTOMOTIVE BEARING MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 56 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 57 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 58 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 59 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 60 ASIA PACIFIC: AUTOMOTIVE BEARING MARKET SNAPSHOT

- FIGURE 61 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 62 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 63 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 64 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 65 NORTH AMERICA: AUTOMOTIVE BEARING MARKET SNAPSHOT

- FIGURE 66 EUROPE: AUTOMOTIVE BEARING MARKET, BY COUNTRY/REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 67 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 68 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 69 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 70 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 71 REST OF THE WORLD: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 72 REST OF THE WORLD: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 73 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 74 REST OF THE WORLD: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 75 BRAZIL TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 76 MARKET SHARE ANALYSIS OF TOP AUTOMOTIVE BEARING MANUFACTURERS, 2024

- FIGURE 77 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 78 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 79 FINANCIAL METRICS OF TOP FIVE PLAYERS, 2025

- FIGURE 80 BRAND/PRODUCT COMPARISON

- FIGURE 81 AUTOMOTIVE BEARING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 82 AUTOMOTIVE BEARING MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 83 AUTOMOTIVE BEARING MARKET: COMPANY EVALUATION MATRIX (SMES), 2024

- FIGURE 84 NSK LTD.: COMPANY SNAPSHOT

- FIGURE 85 NTN CORPORATION: COMPANY SNAPSHOT

- FIGURE 86 THE TIMKEN COMPANY: COMPANY SNAPSHOT

- FIGURE 87 JTEKT CORPORATION: COMPANY SNAPSHOT

- FIGURE 88 NACHI-FUJIKOSHI CORP.: COMPANY SNAPSHOT

- FIGURE 89 SCHAEFFLER AG: COMPANY SNAPSHOT

- FIGURE 90 SKF: COMPANY SNAPSHOT

- FIGURE 91 REGAL REXNORD CORPORATION: COMPANY SNAPSHOT