|

市场调查报告书

商品编码

1740891

电动汽车电池组市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测EV Battery Pack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

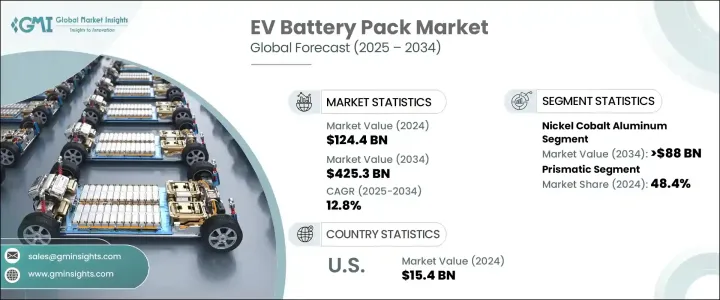

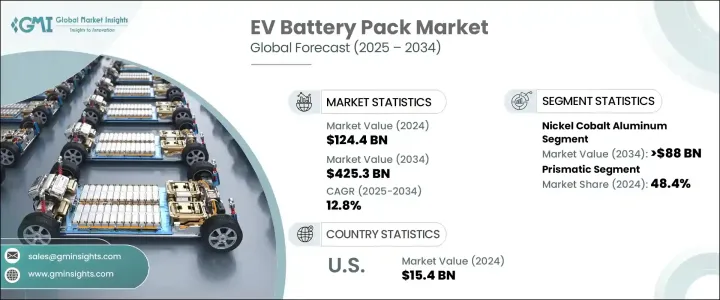

2024年,全球电动车电池组市场规模达1,244亿美元,预计到2034年将以12.8%的复合年增长率成长,达到4,253亿美元。这得归功于电动车出行模式的加速发展、环境法规的不断完善以及强有力的政策支持。随着各国加强排放标准并推动永续交通的发展,对高性能电动车的需求正在飙升。政府推出的补贴、税收抵免以及针对製造商和终端用户的激励措施等倡议,正在进一步推动电动车在全球的普及。汽车製造商正在迅速扩展其电动车产品组合,以满足日益增长的消费者期望,进一步提升了对高效可靠电池系统的需求。

锂离子、镍钴铝 (NCA) 和固态技术等电池化学技术的进步正在提高能量密度、缩短充电时间并延长电池的整体使用寿命。随着储能技术的不断发展,消费者和汽车製造商都对大规模电动车整合表现出更大的信心,从而创造了一个充满活力且竞争激烈的市场格局。电池研发投资的增加、区域超级工厂的建立以及整个供应链的战略合作伙伴关係,正在为未来十年的产业持续成长奠定基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1244亿美元 |

| 预测值 | 4253亿美元 |

| 复合年增长率 | 12.8% |

随着电动车的普及,汽车製造商正在扩大产能并重新设计车辆架构,以整合更紧凑、更有效率的电池组。电动车製造的激增加剧了对先进电池技术的需求,这些技术需要在更小、更轻的体积内平衡功率、寿命和能量密度。汽车製造商正在与电池生产商建立策略联盟,以确保稳定的供应,并利用化学和设计方面的创新。製造商还优先考虑轻量化材料和模组化电池系统,以在不影响安全性的情况下提升整体性能并最大限度地延长续航里程。

镍钴铝 (NCA) 电池化学技术持续获得强劲发展,预计到 2034 年,电动车备用电池市场规模将达到 880 亿美元。 NCA 电池以其高能量密度、轻量化和长循环寿命而闻名,正在帮助汽车製造商在保持高效运行的同时提升电动车性能。其快速充电能力和卓越的热稳定性使其成为支持日益壮大的快速充电站网路的理想选择,最终缓解消费者的续航里程焦虑,并提高电动车的整体普及率。

2024年,方形电池占据了48.4%的市场份额,为汽车製造商提供了设计灵活性,使其能够打造更时尚、更安全的电池组,同时最大限度地提高储存容量。方形电池的坚固外壳能够增强对物理损坏和膨胀的保护,从而延长电池寿命。随着汽车设计向安全性和续航里程优先发展,领先的电动车製造商正在与方形电池生产商签订长期供应协议,并组成合资企业,以满足不断增长的需求。

到2024年,美国电动车电池组市场规模将达到154亿美元,占13.1%的市场。 2022年《通膨削减法案》等联邦立法,以及人们对清洁能源解决方案日益增长的认识,持续推动美国国内製造业和投资的发展。老牌汽车製造商不断扩展其电动车产品组合,进一步刺激了该地区对先进高效电池系统的需求。

全球电动车电池组市场企业采取的关键策略包括区域扩张、长期供应链合作以及对下一代电池技术的大力投资。优先进行研发以提高能量密度和安全性,与汽车製造商和原材料供应商建立合作关係,以及确保关键矿产资源的安全,这些倡议正在帮助各大品牌打造富有韧性的生态系统,以满足全球电动车市场日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:以电池形式,2021 - 2034

- 主要趋势

- 圆柱形

- 小袋

- 棱柱形

第六章:市场规模及预测:依电池化学,2021 - 2034 年

- 主要趋势

- 磷酸锂

- 镍钴铝

- 镍锰钴

- 锂锰氧化物

- 其他的

第七章:市场规模及预测:依推进类型,2021 - 2034

- 主要趋势

- 纯电动车

- 插电式混合动力

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- FRIWO

- LG Energy Solution

- Octillion Power Systems

- Panasonic

- PMBL Limited

- Rivian

- Rapport

- Samsung

- TOSHIBA

- VARTA

The Global EV Battery Pack Market was valued at USD 124.4 billion in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 425.3 billion by 2034, fueled by the accelerating shift toward electric mobility, rising environmental regulations, and robust policy support. As countries tighten emission norms and push for sustainable transportation, the demand for high-performance electric vehicles is skyrocketing. Government initiatives such as subsidies, tax credits, and incentives for manufacturers and end-users are further propelling EV adoption worldwide. Automakers are rapidly expanding their EV portfolios to meet growing consumer expectations, increasing the need for efficient and reliable battery systems.

Advances in battery chemistries like lithium-ion, nickel cobalt aluminum (NCA), and solid-state technologies are improving energy density, reducing charging times, and extending the overall lifespan of batteries. As energy storage technology evolves, both consumers and automakers are showing greater confidence in mass EV integration, creating a dynamic and competitive market landscape. Increasing investments in battery R&D, establishment of regional gigafactories, and strategic partnerships across the supply chain are laying the foundation for sustained industry growth over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $124.4 Billion |

| Forecast Value | $425.3 Billion |

| CAGR | 12.8% |

As the shift toward electric mobility gains momentum, automakers are scaling up production capabilities and redesigning vehicle architectures to integrate more compact, high-efficiency battery packs. This surge in EV manufacturing is intensifying demand for advanced battery technologies that balance power, longevity, and energy density within a smaller, lighter footprint. Automakers are forming strategic alliances with battery producers to ensure consistent supply and leverage innovations in chemistry and design. Manufacturers are also prioritizing lightweight materials and modular battery systems to enhance overall performance and maximize driving range without compromising safety.

Nickel cobalt aluminum (NCA) battery chemistry continues to gain strong traction, with the EV Backup Market expected to reach USD 88 billion by 2034. Known for high energy density, lightweight properties, and long cycle life, NCA batteries are helping automakers enhance EV performance while maintaining efficiency. Their fast-charging capability and superior thermal stability make them ideal for supporting the growing network of rapid charging stations, ultimately easing range anxiety for consumers and strengthening overall EV adoption rates.

Prismatic battery cells held a commanding 48.4% share in 2024, offering automakers design flexibility to create sleeker, safer battery packs while maximizing storage capacity. The rigid casing of prismatic cells provides enhanced protection against physical damage and swelling, contributing to extended battery life. Leading EV manufacturers are securing long-term supply agreements and forming joint ventures with prismatic cell producers to meet surging demand as vehicle designs evolve to prioritize safety and range.

The U.S. EV Battery Pack Market generated USD 15.4 billion by 2024, claiming a 13.1% share. Federal legislation like the Inflation Reduction Act of 2022, along with growing awareness of clean energy solutions, continues to boost domestic manufacturing and investment. Established automakers expanding their EV portfolios are further fueling the need for advanced, high-efficiency battery systems across the region.

Key strategies adopted by companies in the Global EV Battery Pack Market include regional expansion, long-term supply chain partnerships, and significant investment in next-generation battery technologies. Prioritizing R&D to enhance energy density and safety, building collaborations with automakers and raw material suppliers, and securing critical minerals are helping brands create resilient ecosystems that meet the surging global demand for electric vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Battery Form, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Cylindrical

- 5.3 Pouch

- 5.4 Prismatic

Chapter 6 Market Size and Forecast, By Battery Chemistry, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Lithium iron phosphate

- 6.3 Nickel cobalt aluminum

- 6.4 Nickel manganese cobalt

- 6.5 Lithium manganese oxide

- 6.6 Others

Chapter 7 Market Size and Forecast, By Propulsion Type, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 BEV

- 7.3 PHEV

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Spain

- 8.3.4 UK

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 FRIWO

- 9.2 LG Energy Solution

- 9.3 Octillion Power Systems

- 9.4 Panasonic

- 9.5 PMBL Limited

- 9.6 Rivian

- 9.7 Rapport

- 9.8 Samsung

- 9.9 TOSHIBA

- 9.10 VARTA