|

市场调查报告书

商品编码

1740894

滴滤咖啡机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Drip Coffee Maker Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

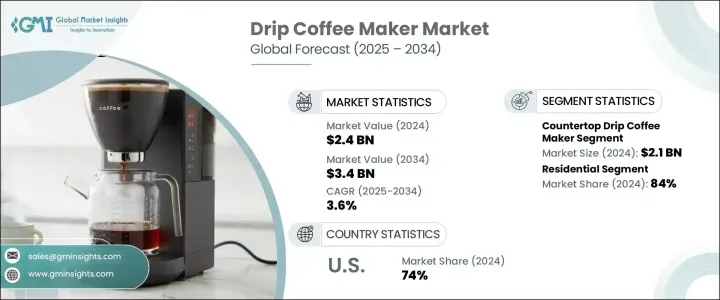

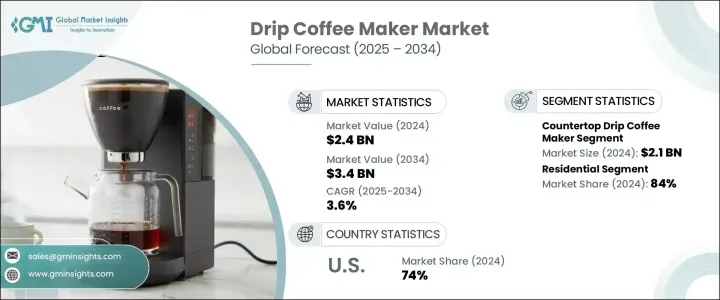

2024年,全球滴滤咖啡机市场规模达24亿美元,预计2034年将以3.6%的复合年增长率成长至34亿美元。全球咖啡消费量的成长,以及居家冲泡咖啡的日益流行,持续影响市场前景。随着消费者追求便利性、经济性和更好的风味品质,滴滤咖啡机在成熟经济体和发展中经济体都越来越受欢迎。可支配收入的提高、快速的城市化进程以及不断发展的咖啡文化(尤其是在亚太和拉丁美洲等地区)是推动这一成长的主要动力。咖啡作为全球消费量最大的饮品之一,对滴滤咖啡机等家用冲泡设备的需求也持续成长。消费者对精品咖啡日益增长的兴趣,以及对在家中体验咖啡师风格体验的渴望,正推动着消费者选择能够提供更多控制和个人化体验的咖啡机。可编程设定、可调节冲泡浓度和内建研磨器等功能已不再被视为奢侈品,而是现代用户的期望。

根据机器类型,市场分为便携式和桌上型滴滤咖啡机。 2024年,桌上型咖啡机占据主导地位,创造了21亿美元的收入。预计2025年至2034年期间,该类别的复合年增长率约为3.8%。这些机器专为频繁和大容量使用而设计,使其成为家庭、办公室和共享空间的首选。增强的冲泡功能,例如多种浓度设定、温度控制以及最多可冲泡12杯或更多咖啡,使其非常适合日常使用。消费者更倾向于兼具实用性和智慧功能的机器,使他们能够精准轻鬆地冲泡热咖啡或冰咖啡。现在许多型号都配备了冲泡延时定时器、可编程咖啡壶和增强风味的冲泡技术等功能,反映出人们正在转向更个性化的冲泡体验。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 34亿美元 |

| 复合年增长率 | 3.6% |

市场也按最终用户细分为住宅和商业领域。 2024年,住宅领域占据了84%的主导份额,这得益于生活方式的改变、快节奏的工作环境以及人们对高品质家庭冲泡咖啡日益增长的兴趣。住宅买家越来越寻求易于操作、配备智慧功能且适合个人或家庭使用的先进滴滤咖啡机。随着智慧家庭和连网设备的兴起,能够与语音助理和家庭自动化系统整合的咖啡机正迅速普及。相较之下,商业领域则更注重冲泡速度、容量和效率,以满足咖啡馆、餐厅和办公室等场所的顾客高需求。

从分销角度来看,市场分为线上和线下通路。 2024年,线下零售持续保持领先地位,这得益于许多消费者在购买前倾向于实体查看产品。实体店,包括厨房电器零售商和百货公司,为顾客提供亲身体验,并让他们能够接触到经验丰富的销售人员。然而,线上管道因其便利性、丰富的产品种类和详尽的客户回馈而日益受到青睐。消费者正在转向能够在家中舒适地比较价格、评估规格和阅读用户评论的平台。教学影片和产品演示进一步增强了消费者信心,使电子商务成为该市场日益强大的分销工具。

从地理分布来看,美国在全球滴滤咖啡机市场占据主导地位,约占北美市场份额的74%,2024年市场收入达6.1亿美元。咖啡消费量的激增,加上家庭冲泡解决方案的需求不断增长,以及智慧技术与家电的融合,共同推动了美国市场的成长。年轻一代对咖啡的偏好以及咖啡相关零售业的扩张,也对此成长趋势做出了重要贡献。美国消费者行为持续偏向便利性和客製化,促使製造商不断创新,推出更智慧、更以用户为中心的咖啡机。

到2024年,滴滤咖啡机市场的领导企业合计占据约15%至20%的市场。这些公司将继续透过策略合作伙伴关係、产品线扩展以及併购来推动成长,以扩大其影响力并保持竞争优势。随着竞争加剧,製造商正在投资创新和设计,以满足日益精通科技、注重品质的消费者群体不断变化的偏好。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 咖啡消费量增加

- 家庭酿酒趋势日益兴起

- 产业陷阱与挑战

- 替代咖啡机的可用性

- 转向精品咖啡和冲泡方法

- 成长动力

- 消费者购买行为分析

- 人口趋势

- 影响购买决策的因素

- 产品偏好

- 首选价格范围

- 首选配销通路

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依机器类型,2021-2034 年

- 主要趋势

- 便携式滴滤咖啡机

- 檯面滴滤咖啡机

第六章:市场估计与预测:依营运模式,2021-2034 年

- 主要趋势

- 自动的

- 手动的

第七章:市场估计与预测:依杯子容量,2021-2034

- 主要趋势

- 最多 10 杯

- 10到20杯

- 20杯以上

第八章:市场估计与预测:按功率,2021-2034

- 主要趋势

- 500瓦以下

- 500至1000瓦

- 1000瓦以上

第九章:市场估计与预测:按价格,2021-2034

- 主要趋势

- 低的

- 中等的

- 高的

第 10 章:市场估计与预测:按最终用途,2021-2034 年

- 主要趋势

- 住宅

- 商业的

- 办公室

- 咖啡厅

- 餐厅

- 其他(教育机构等)

第 11 章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 在线的

- 电子商务网站

- 公司拥有的网站

- 离线

- 超市/大卖场

- 专卖店

- 其他(百货公司等)

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十三章:公司简介

- Black & Decker

- Breville

- Budan

- Capresso

- Cuisinart

- De'Longhi

- Glen Appliances

- Hamilton Beach

- Koninklijke Philips

- Krups

- Melitta

- Morphy Richards

- Smeg

- Sybo Kitchen

- Wonderchef

The Global Drip Coffee Maker Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 3.6% to reach USD 3.4 billion by 2034. Growing coffee consumption worldwide, along with the increasing trend of brewing coffee at home, continues to shape the outlook of the market. As consumers seek convenience, affordability, and better flavor quality, drip coffee makers are becoming more popular in both mature and developing economies. Higher disposable incomes, rapid urbanization, and the evolving coffee culture-particularly in regions like Asia Pacific and Latin America-are major drivers behind this growth. With coffee maintaining its place as one of the most consumed beverages globally, the demand for home-use brewing appliances like drip coffee makers is rising at a consistent pace. The growing interest in specialty coffee and the desire for barista-style experiences at home is pushing consumers toward machines that offer more control and personalization. Features like programmable settings, adjustable brew strengths, and built-in grinders are no longer considered luxuries but expectations among modern users.

Based on machine type, the market is divided into portable and countertop drip coffee makers. In 2024, the countertop segment dominated the category, generating USD 2.1 billion in revenue. It is projected to grow at a CAGR of approximately 3.8% from 2025 to 2034. These machines are designed for frequent and higher-volume use, making them a preferred choice for homes, offices, and shared spaces. Enhanced brewing features such as multiple strength settings, temperature control, and the ability to serve up to 12 cups or more make them highly functional for daily use. Consumers are leaning towards machines that combine both utility and smart functionality, enabling them to brew hot or iced coffee with precision and ease. Many models now include features like brew delay timers, programmable carafes, and flavor-enhancing infusion technologies, reflecting a shift toward more tailored brewing experiences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 3.6% |

The market is also segmented by end user into residential and commercial sectors. The residential segment held a dominant share of 84% in 2024, fueled by changing lifestyles, fast-paced work environments, and increasing interest in high-quality home brewing. Residential buyers are increasingly seeking advanced drip coffee makers that are easy to operate, equipped with smart features, and suitable for personal or family use. With the rise in smart homes and connected devices, machines that can be integrated with voice assistants and home automation systems are quickly gaining popularity. In contrast, the commercial segment prioritizes brewing speed, volume, and efficiency to meet high customer demand in cafes, restaurants, and office setups.

Distribution-wise, the market is classified into online and offline channels. Offline retail continued to lead in 2024, supported by the preference of many consumers to physically examine products before making a purchase. Brick-and-mortar stores, including kitchen appliance retailers and department stores, offer customers a hands-on experience and access to knowledgeable sales staff. However, the online segment is gaining traction due to its convenience, wide product range, and detailed customer feedback. Consumers are turning to platforms where they can compare prices, evaluate specifications, and read user reviews from the comfort of their homes. Instructional videos and product demos further enhance consumer confidence, making e-commerce an increasingly powerful distribution tool in this market.

Geographically, the United States led the global drip coffee maker market, accounting for roughly 74% of the North American share and generating USD 610 million in revenue in 2024. The surge in coffee consumption, along with growing demand for home brewing solutions and the integration of smart technology into appliances, has fueled market growth in the country. The preference for coffee among younger demographics and the expansion of coffee-related retail have also contributed significantly to this upward trend. Consumer behavior in the US continues to favor convenience and customization, pushing manufacturers to innovate and offer smarter, more user-centric machines.

Leading players in the drip coffee maker market collectively held a combined share of around 15% to 20% in 2024. These companies continue to drive growth through strategic partnerships, product line expansion, and mergers and acquisitions aimed at increasing their reach and maintaining competitive advantage. As competition intensifies, manufacturers are investing in innovation and design to meet the evolving preferences of a more tech-savvy and quality-conscious consumer base.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing coffee consumption

- 3.6.1.2 Rising home brewing trend

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Availability of alternative coffee machine

- 3.6.2.2 Shift toward specialty coffee and brewing methods

- 3.6.1 Growth drivers

- 3.7 Consumer buying behavior analysis

- 3.7.1 Demographic trends

- 3.7.2 Factors affecting buying decisions

- 3.7.3 Product Preference

- 3.7.4 Preferred price range

- 3.7.5 Preferred distribution channel

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Portable drip coffee maker

- 5.3 Countertop drip coffee maker

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Automatic

- 6.3 Manual

Chapter 7 Market Estimates & Forecast, By Cup Capacity, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 10 cups

- 7.3 10 to 20 cups

- 7.4 Above 20 cups

Chapter 8 Market Estimates & Forecast, By Power, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Below 500 Watt

- 8.3 500 to 1000 Watt

- 8.4 Above 1000 Watt

Chapter 9 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High

Chapter 10 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.3.1 Offices

- 10.3.2 Cafes

- 10.3.3 Restaurants

- 10.3.4 Others (educational institutes etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Online

- 11.2.1 E-commerce website

- 11.2.2 Company owned website

- 11.3 Offline

- 11.3.1 Supermarkets/hypermarkets

- 11.3.2 Specialty stores

- 11.3.3 Others (department stores etc.)

Chapter 12 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Black & Decker

- 13.2 Breville

- 13.3 Budan

- 13.4 Capresso

- 13.5 Cuisinart

- 13.6 De'Longhi

- 13.7 Glen Appliances

- 13.8 Hamilton Beach

- 13.9 Koninklijke Philips

- 13.10 Krups

- 13.11 Melitta

- 13.12 Morphy Richards

- 13.13 Smeg

- 13.14 Sybo Kitchen

- 13.15 Wonderchef