|

市场调查报告书

商品编码

1740938

商用车曲轴市场机会、成长动力、产业趋势分析及2025-2034年预测Commercial Vehicle Crankshaft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

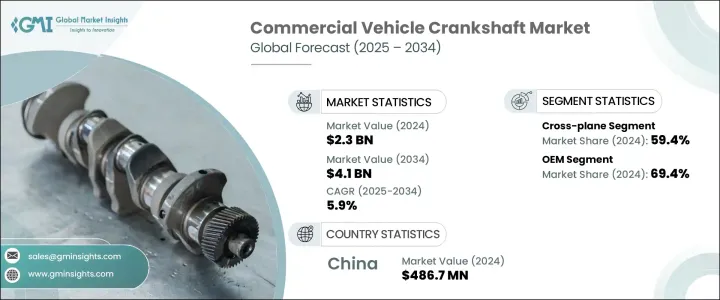

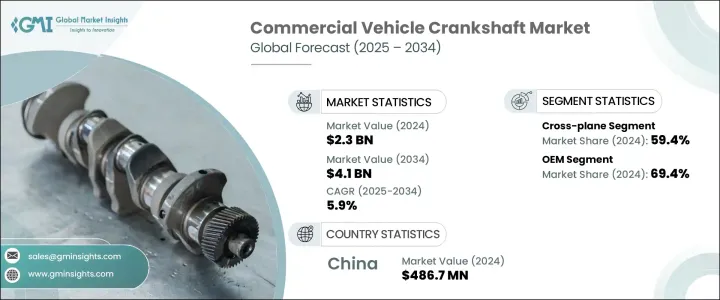

2024年,全球商用车曲轴市场规模达23亿美元,预计到2034年将以5.9%的复合年增长率增长,达到41亿美元,这主要得益于商用车产量的增长以及全球运输和物流行业的快速扩张。随着全球各行各业竞相实现零排放目标,对更有效率、更清洁的汽车技术的需求正在为整个曲轴产业带来巨大的发展动力。对混合动力、电动和过渡动力系统日益增长的需求正在重塑材料需求和性能预期,促使製造商创新更轻、更耐用的曲轴解决方案。车队营运商正加大对下一代商用车的投资,这些车辆将传统内燃机系统与电动平台结合,这推动了对兼具效率和可靠性的高性能零件的需求。不断变化的供应链动态、更严格的排放法规以及对燃油经济性的日益关注,迫使原始设备製造商和供应商重新构想传统的曲轴设计。为了满足全球车队日益增长的标准,各公司正将资源投入更智慧的预测性维护技术、轻量化合金和精密製造技术。车辆到电网 (V2G) 系统的日益普及,尤其是在物流卡车和公车等重型车辆领域,进一步凸显了对先进曲轴设计的持续需求,这种设计既能支持可持续性,又能最大限度地提高引擎性能。

商业车队日益融入智慧电网系统也影响着曲轴的设计需求。在过渡阶段,参与V2G网路的车辆仍然严重依赖内燃机或混合动力发动机,因此曲轴对降低排放和提高燃油效率至关重要。这一趋势与汽车产业更广泛的转型趋势直接相关,即传统系统与面向未来的行动出行解决方案的整合。在整个价值链中,原始设备製造商和零件製造商正优先开发轻量化、高强度、耐热性和抗振性更强的曲轴。同时,北美、欧洲和亚洲地区旨在减少排放的监管激励措施正在加速对高性能曲轴技术的投资。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 23亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 5.9% |

2024年,平面曲轴市场占据主导地位,占据59.4%的市场份额,这主要归功于其卓越的减振性能、扭矩一致性和动态平衡性。这些特性对于长途卡车、工业客车以及其他在极端负载条件下、在各种地形条件下运行的重型车辆至关重要。平面曲轴还增强了与大排气量引擎和混合动力引擎的兼容性,确保平稳的扭力输出,这对于实现最佳燃油效率和驾驶性能至关重要。

从销售管道的角度来看,OEM 在 2024 年占据了 69.4% 的主导份额,预计到 2034 年将以 6.8% 的复合年增长率增长。 OEM 越来越多地与曲轴製造商合作,共同开发优先考虑强度、抗疲劳性和热效率的特定应用锻造设计。

中国商用车曲轴市场占全球54.2%的市场份额,2024年市场规模达4.867亿美元,位居全球之冠。中国市场主导地位源自于其庞大的商用车生产规模和垂直整合的供应链。在政府措施、技术熟练的劳动力资源以及强大的OEM合作伙伴关係的支持下,重庆、济南和广州等城市已成为重要的製造业中心。对自动化锻造生产线、机器人加工和严格品质控制的投资正在巩固中国的领导地位。

全球市场的主要参与者包括巴拉特锻造公司、蒂森克虏伯、马勒、莱茵金属、凯洛格曲轴公司、克劳尔凸轮与设备公司、NSI曲轴公司、采埃孚、新日铁和天润工业技术。产业领导者正优先研发高强度、低重量的材料,加强数控自动化,与原始设备製造OEM建立更深入的合作关係,并推进数位化整合以追踪维护并优化排放性能,从而跟上商业移动出行领域不断发展的步伐。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 製造商

- 原物料供应商

- 汽车OEM

- 配销通路

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 定价分析

- 推进系统

- 地区

- 衝击力

- 成长动力

- 商用车需求不断成长

- 运输和物流业的扩张

- 采用轻量高强度材料

- 商用车曲轴技术的持续进步

- 产业陷阱与挑战

- 製造成本高

- 供应链中断

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按曲轴,2021 - 2034 年

- 主要趋势

- 平面

- 交叉平面

- 模组化的

第六章:市场估计与预测:依资料,2021 - 2034 年

- 主要趋势

- 锻钢

- 铸铁/钢

- 机械加工坯料

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 天然气

第八章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 原始设备製造商

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Aichi Steel

- Atlas Industries

- Bharat Forge

- Bharat gears

- Bryan Tools & Engineering

- China Zhongwang Holdings

- CIE Automotive

- Crower Cams & Equipment Company

- Indian Crankshaft Manufacturing Company (ICM)

- Kellogg Crankshaft Company

- MAHLE

- Metalurgica Riosulense S/A

- Molnar Technologies

- Nippon Steel

- NSI Crankshaft

- Rheinmetall

- Teksid

- thyssenkrupp

- Tianrun Crankshaft

- ZF Friedrichshafen

The Global Commercial Vehicle Crankshaft Market was valued at USD 2.3 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 4.1 billion by 2034, driven by rising commercial vehicle production and the rapid expansion of global transportation and logistics sectors. As industries worldwide race toward zero-emission targets, the need for more efficient, cleaner vehicle technologies is creating significant momentum across the crankshaft industry. The growing demand for hybrid, electric, and transitional powertrains is reshaping material requirements and performance expectations, pushing manufacturers to innovate lighter, more durable crankshaft solutions. Fleet operators are increasingly investing in next-generation commercial vehicles that bridge traditional internal combustion systems with electrified platforms, boosting the need for high-performance components that deliver both efficiency and reliability. Evolving supply chain dynamics, stricter emissions regulations, and a heightened focus on fuel economy are compelling OEMs and suppliers to reimagine traditional crankshaft designs. Companies are now channeling resources into smarter predictive maintenance technologies, lightweight alloys, and precision manufacturing techniques to meet the rising standards of global fleets. The growing adoption of vehicle-to-grid (V2G) systems, particularly in heavy-duty segments like logistics trucks and buses, further highlights the ongoing need for advanced crankshaft designs that support sustainability while maximizing engine performance.

Increased integration of commercial fleets into smart grid systems is also influencing crankshaft design requirements. Vehicles participating in V2G networks still depend heavily on internal combustion or hybrid engines during this transitional phase, making it crucial for crankshafts to support lower emissions and enhanced fuel efficiency. This trend ties directly into the broader automotive shift toward blending legacy systems with future-forward mobility solutions. Across the value chain, OEMs and component manufacturers are prioritizing the development of lightweight, high-strength crankshafts with better heat resistance and vibration control. At the same time, regulatory incentives across North America, Europe, and Asia targeting emissions reduction are accelerating investments in high-performance crankshaft technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 5.9% |

In 2024, the cross-plane crankshaft segment dominated with a 59.4% market share, largely because of its superior vibration damping, torque consistency, and dynamic balance. These features are vital for long-haul trucks, industrial buses, and other heavy-duty vehicles that operate under extreme load conditions across diverse terrains. Cross-plane crankshafts also enhance compatibility with large displacement and hybrid engines, ensuring smooth torque delivery critical for optimal fuel efficiency and drivability.

From a sales channel standpoint, OEMs accounted for a commanding 69.4% share in 2024 and are projected to grow at a CAGR of 6.8% through 2034. OEMs are increasingly collaborating with crankshaft manufacturers to co-develop application-specific forged designs that prioritize strength, fatigue resistance, and thermal efficiency.

China Commercial Vehicle Crankshaft Market led globally with a 54.2% share, generating USD 486.7 million in 2024. The country's dominance stems from its massive commercial vehicle production scale and vertically integrated supply chain. Cities like Chongqing, Jinan, and Guangzhou have emerged as key manufacturing hubs, supported by government initiatives, skilled labor pools, and strong OEM partnerships. Investments in automated forging lines, robotic machining, and stringent quality control are reinforcing China's leadership position.

Key players in the global market include Bharat Forge, thyssenkrupp, MAHLE, Rheinmetall, Kellogg Crankshaft Company, Crower Cams & Equipment, NSI Crankshaft, ZF Friedrichshafen, Nippon Steel, and Tianrun Industrial Technology. Industry leaders are prioritizing R&D for high-strength, low-weight materials, enhancing CNC automation, forging deeper OEM collaborations, and advancing digital integration to track maintenance and optimize emissions performance, keeping pace with the evolving landscape of commercial mobility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End-use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for commercial vehicles

- 3.10.1.2 Expansion of transportation and logistics sector

- 3.10.1.3 Adoption of lightweight and high-strength materials

- 3.10.1.4 Ongoing technological advancements in commercial vehicle crankshaft

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High manufacturing cost

- 3.10.2.2 Supply chain disruption

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Crankshaft, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Flat plane

- 5.3 Cross plane

- 5.4 Modular

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Forged steel

- 6.3 Cast iron/steel

- 6.4 Machined billet

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Natural gas

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Light Commercial Vehicles (LCV)

- 8.3 Medium Commercial Vehicles (MCV)

- 8.4 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aichi Steel

- 11.2 Atlas Industries

- 11.3 Bharat Forge

- 11.4 Bharat gears

- 11.5 Bryan Tools & Engineering

- 11.6 China Zhongwang Holdings

- 11.7 CIE Automotive

- 11.8 Crower Cams & Equipment Company

- 11.9 Indian Crankshaft Manufacturing Company (ICM)

- 11.10 Kellogg Crankshaft Company

- 11.11 MAHLE

- 11.12 Metalurgica Riosulense S/A

- 11.13 Molnar Technologies

- 11.14 Nippon Steel

- 11.15 NSI Crankshaft

- 11.16 Rheinmetall

- 11.17 Teksid

- 11.18 thyssenkrupp

- 11.19 Tianrun Crankshaft

- 11.20 ZF Friedrichshafen