|

市场调查报告书

商品编码

1740948

飞机液压系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Aircraft Hydraulic Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

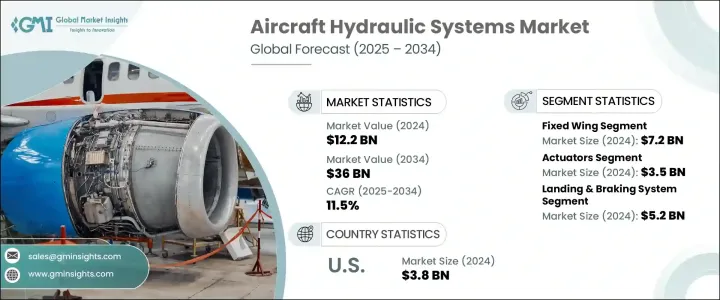

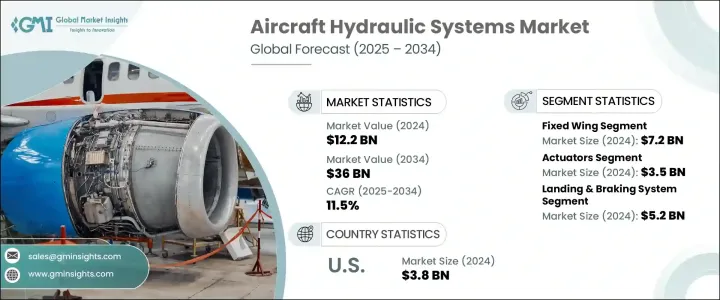

2024年,全球飞机液压系统市场规模达122亿美元,预计2034年将以11.5%的复合年增长率成长,达到360亿美元。这一成长主要得益于全球航空旅行需求的不断增长,以及商用、军用和无人机平台上液压系统整合度的不断提升。随着航空公司升级机队和政府增强国防能力,液压系统已成为确保营运效率、可靠性和安全性的关键。全球航空客运量的持续成长正迫使航太投资更先进的飞机,这反过来又推动了对先进液压作动系统的需求。这些系统对于飞机的各项功能至关重要,包括机动、飞行控制、煞车和起落架操作。

近年来,包括关税在内的地缘政治贸易紧张局势已导致供应链严重中断,尤其对于从海外采购的航太零件。这些变化迫使製造商和供应商透过多元化采购策略、本地生产和重新评估采购模式来适应,以缓解成本波动和延误。因此,向在地化和弹性供应链的转变正成为塑造市场格局的关键趋势。在技术方面,由于微型和电液系统的使用日益增多,市场正经历着强劲的发展势头。这些创新满足了无人机、自动驾驶飞机和城市空中交通工具等新兴应用对紧凑型节能解决方案日益增长的需求。此外,国防投资持续推动对高性能液压系统的需求,这些系统支援隐身、武器操控和增强型控制机制等先进飞机功能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 122亿美元 |

| 预测值 | 360亿美元 |

| 复合年增长率 | 11.5% |

就平台而言,市场细分为旋翼机、固定翼机和无人机 (UAV)。 2024 年,固定翼机市场规模达 72 亿美元,占据主导地位。新一代商用和国防飞机采购量的增加,以及现有机队的持续升级,推动了该细分市场的成长。空中交通流量的增加和军事预算的增加,促使人们采用技术先进的喷射机,这些飞机需要复杂的液压子系统来完成飞行控制、煞车和起落架展开等任务。

依组件划分,市场可分为储液器、帮浦、蓄压器、执行器、液压保险丝、阀门等。执行器在2024年成为表现最佳的细分市场,创造了35亿美元的收入。飞行控制系统对精度和可靠性的日益增长的需求,刺激了对紧凑、省油且能够提供高性能输出的下一代执行器的需求。随着现代飞机注重减轻重量和提高控制响应能力,製造商正在增加对电液执行器技术的投资,以满足不断变化的需求。

根据应用,市场包括飞行控制系统、推力反向系统、着陆和煞车系统以及其他功能。着陆和煞车系统领域是2024年贡献最大的领域,价值达52亿美元。这些系统对于飞机的安全运作至关重要,尤其是在飞机频繁起降的地区。更严格的安全法规进一步推动了需求,这些法规要求更先进的液压部件具备防滑功能、更强大的压力管理和内建冗余功能。

从地区来看,美国占了飞机液压系统市场的最大份额,2024 年市场规模达 38 亿美元。美国市场的主导地位可以归因于国防项目、商用航空升级以及航太技术研发投入的不断增加。此外,美国也受惠于主要航太製造商和供应商的持续发展,他们不断推动液压系统技术。这些公司正致力于轻量化结构、电液整合以及符合「更多电动飞机」(MEA)计画的系统。

市场竞争依然激烈,老牌跨国公司和创新新创公司都在争夺市场份额。领先的企业正积极专注于智慧液压技术、整合诊断以及专为电动和混合动力平台设计的解决方案。目前,业界明显转向开发能够提高燃油效率和环保性能,同时满足美国联邦航空管理局 (FAA)、欧洲航空安全局 (EASA) 和 AS9100 等全球安全标准的液压系统。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 全球航空客运量不断成长

- 机队的扩建与现代化

- 在商业、军事和无人机平台的应用日益增多

- 更高的功率重量比和负载处理能力

- 液压系统的技术进步

- 产业陷阱与挑战

- 来自电力和替代系统的竞争

- 维护和营运成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按平台,2021 年至 2034 年

- 主要趋势

- 固定翼

- 旋翼机

- 无人机

第六章:市场估计与预测:按组件,2021 年至 2034 年

- 主要趋势

- 水库

- 泵浦

- 累加器

- 执行器

- 液压保险丝

- 阀门

- 其他的

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 飞行控制系统

- 推力反向系统

- 着陆和煞车系统

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- AeroControlex

- Circor Aerospace

- Collins Aerospace

- Crane Aerospace and Electronics

- Eaton

- Gar Kenyon

- Liebherr Aerospace

- Moog

- Parker Hannifin

- PTI Technologies

- Safran

- Senior

- Triumph Group

- Woodward

The Global Aircraft Hydraulic Systems Market was valued at USD 12.2 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 36 billion by 2034. This growth is largely driven by the increasing global demand for air travel and the rising integration of hydraulic systems across commercial, military, and unmanned aerial vehicle platforms. As airlines upgrade fleets and governments ramp up defense capabilities, hydraulic systems have become critical for ensuring operational efficiency, reliability, and safety. The continued rise in global air passenger traffic is putting pressure on aerospace companies to invest in more sophisticated aircraft, which in turn is driving the need for advanced hydraulic actuation systems. These systems are essential for various aircraft functions, including maneuvering, flight control, braking, and landing gear operation.

Geopolitical trade tensions in recent years, including the introduction of tariffs, have caused significant disruption in the supply chain, particularly for aerospace components sourced from overseas. These changes forced manufacturers and suppliers to adapt through diversified sourcing strategies, local production, and reevaluation of procurement models to mitigate cost fluctuations and delays. As a result, the shift toward localized and resilient supply chains is becoming a crucial trend shaping the market landscape. On the technology front, the market is experiencing strong momentum due to the rising use of micro and electro-hydraulic systems. These innovations cater to the growing need for compact and energy-efficient solutions in emerging applications such as drones, autonomous aircraft, and urban air mobility vehicles. Moreover, defense investments continue to boost the demand for high-performance hydraulic systems that support advanced aircraft functionalities like stealth, weapons handling, and enhanced control mechanisms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $36 Billion |

| CAGR | 11.5% |

In terms of platform, the market is segmented into rotary wing, fixed wing, and unmanned aerial vehicles (UAVs). The fixed wing category led the market in 2024 with a valuation of USD 7.2 billion. The growth of this segment is fueled by an increase in procurement of new-generation commercial and defense aircraft as well as ongoing upgrades to existing fleets. Rising air traffic and expanded military budgets are encouraging the adoption of technologically advanced jets that require complex hydraulic subsystems for tasks such as flight control, braking, and gear deployment.

By component, the market is divided into reservoirs, pumps, accumulators, actuators, hydraulic fuses, valves, and others. Actuators emerged as the top-performing segment in 2024, generating USD 3.5 billion in revenue. The heightened need for accuracy and reliability in flight control systems is spurring demand for next-generation actuators that are compact, fuel-efficient, and capable of high-performance output. As modern aircraft focus on weight reduction and improved control responsiveness, manufacturers are increasingly investing in electro-hydraulic actuator technologies to meet evolving requirements.

On the basis of application, the market includes flight control systems, thrust reversal systems, landing and braking systems, and other functions. The landing and braking systems segment was the highest contributor in 2024, valued at USD 5.2 billion. These systems are essential for the safe operation of aircraft, especially in regions where aircraft perform frequent takeoffs and landings. Demand is further supported by stricter safety regulations, which require more advanced hydraulic components with features like anti-skid capabilities, improved pressure management, and built-in redundancies.

Regionally, the United States held the largest share of the aircraft hydraulic systems market, accounting for USD 3.8 billion in 2024. The dominance of the US market can be attributed to rising investments in defense programs, commercial aviation upgrades, and R&D efforts across aerospace technologies. The country also benefits from the presence of major aerospace manufacturers and suppliers who are consistently advancing hydraulic system technologies. These companies are placing emphasis on lightweight construction, electro-hydraulic integrations, and systems that align with More Electric Aircraft (MEA) initiatives.

Market competition remains intense, with both established multinational companies and innovative startups competing for share. Leading players are actively focusing on smart hydraulic technologies, integrated diagnostics, and solutions designed for electric and hybrid platforms. There is a noticeable shift toward developing hydraulic systems that offer enhanced fuel efficiency and environmental performance while meeting global safety standards such as FAA, EASA, and AS9100.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising global air passenger traffic

- 3.3.1.2 Expansion and modernization of aircraft fleets

- 3.3.1.3 Increased use in commercial, military, and UAV platforms

- 3.3.1.4 Higher power-to-weight ratios and load handling

- 3.3.1.5 Technological advancements in hydraulic systems

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Competition from electric and alternative systems

- 3.3.2.2 High maintenance and operational costs

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Platform, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Fixed wing

- 5.3 Rotary wing

- 5.4 Unmanned aerial vehicles

Chapter 6 Market Estimates and Forecast, By Component, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Reservoir

- 6.3 Pumps

- 6.4 Accumulators

- 6.5 Actuators

- 6.6 Hydraulic fuse

- 6.7 Valves

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Flight control system

- 7.3 Thrust reversal system

- 7.4 Landing & braking system

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AeroControlex

- 9.2 Circor Aerospace

- 9.3 Collins Aerospace

- 9.4 Crane Aerospace and Electronics

- 9.5 Eaton

- 9.6 Gar Kenyon

- 9.7 Liebherr Aerospace

- 9.8 Moog

- 9.9 Parker Hannifin

- 9.10 PTI Technologies

- 9.11 Safran

- 9.12 Senior

- 9.13 Triumph Group

- 9.14 Woodward