|

市场调查报告书

商品编码

1740969

自动注射器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Autoinjectors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

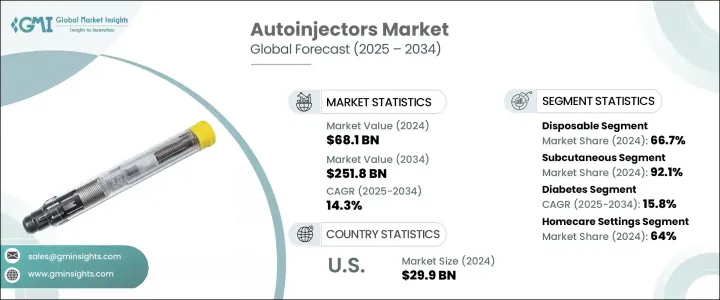

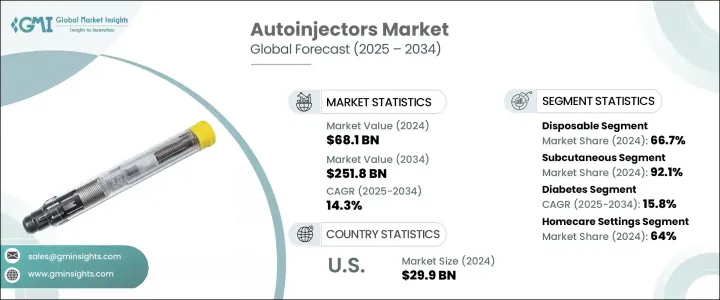

2024年,全球自动注射器市场规模达681亿美元,预计到2034年将以14.3%的复合年增长率成长,达到2,518亿美元。推动这一增长的主要因素包括糖尿病和过敏反应等慢性疾病的盛行率上升,以及仿製自动注射器供应的增加。这些医疗设备对于快速可靠地註射救命药物至关重要,而这对于管理糖尿病和严重过敏反应等疾病至关重要。

全球糖尿病病例(尤其是第1型和第2型糖尿病)的增加是推动自动注射器需求的关键因素之一。这些装置提供了一种高效且患者友好的胰岛素输送方法,使其成为需要定期注射的糖尿病患者的首选。除糖尿病外,过敏反应(通常由过敏原引发)的发生率不断上升,这显着增加了对用于输送肾上腺素的自动注射器的需求。自动注射器的便携性、易用性和精准的剂量控制能力使其在快速紧急治疗中发挥重要作用。随着这些疾病发病率的上升,预计自动注射器市场也将随之扩大。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 681亿美元 |

| 预测值 | 2518亿美元 |

| 复合年增长率 | 14.3% |

市场分为一次性自动注射器和可重复使用自动注射器。一次性自动注射器占据主导地位,2024 年的市占率为 66.7%。这些一次性设备因其便捷易用而格外引人注目。它们几乎无需维护,无需患者俱备特殊知识或技能即可操作。这些自动注射器设计为一次性使用,也降低了感染或污染的风险,确保了病患的安全。疫情过后,人们开始转向居家护理,尤其是糖尿病患者。这种变化进一步推动了人们对一次性自动注射器的偏好,因为患者更重视其便携性和在家中自行给药的易用性。

另一个重要因素是给药途径。皮下自动注射器在2024年占据92.1%的市场份额,占据市场主导地位。皮下注射比肌肉注射疼痛小,并且可以在家中自行注射,非常适合糖尿病等慢性疾病的患者。皮下注射也常用于生物製剂,包括胰岛素和单株抗体,这进一步推动了对这些设备的需求。

市场也根据疗法进行细分,其中糖尿病领域预计将实现最高成长率,预测期内复合年增长率达15.8%。这一增长归因于全球糖尿病病例的不断增加,这需要持续治疗。自动注射器提供了一种更舒适、更方便的胰岛素注射方法,促进了其广泛应用。此外,胰岛素输送设备的进步,例如剂量精度更高、追踪功能更完善的智慧自动注射器,正在提高患者的依从性,并支持该领域的成长。

就终端用户而言,家庭护理环境占据市场主导地位,2024年将占据64%的市场。病人自主性驱动的自我给药需求不断增长,是促成此转变的主要因素。自动注射器使慢性病患者能够在家中管理治疗,从而减少频繁前往医疗机构的需求。此外,远距医疗和远端监控的兴起使患者在家中使用自动注射器变得更加便捷,医护人员可以远端提供指导和支援。

2024年,美国以约299亿美元的收入领先北美市场。这主要是因为美国糖尿病和类风湿性关节炎等慢性病发生率高。随着越来越多的患者寻求自我治疗方案,自动注射器已成为管理这些疾病的日益流行的解决方案。

自动注射器市场竞争激烈,全球和地区性公司提供一系列解决方案,以满足日益增长的自我给药设备需求。主要参与者占据市场主导地位,约占整体市场份额的60%。这些公司不断创新以维持市场地位,推出旨在改善患者体验和提高治疗依从性的新产品和解决方案。此外,随着价格承受能力成为新兴市场的关键考量,本地製造商纷纷进军提供经济高效的替代方案,迫使国际公司调整定价策略,同时确保产品安全和合规性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 标靶治疗需求不断增长

- 全球通用自动注射器的供应情况

- 糖尿病和过敏性休克发生率不断上升

- 患者越来越倾向自行服药

- 产业陷阱与挑战

- 替代治疗方案的可用性

- 自动注射器定价过高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 一次性的

- 可重复使用的

第六章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 皮下

- 肌肉注射

第七章:市场估计与预测:按疗法,2021 - 2034 年

- 主要趋势

- 类风湿关节炎

- 多发性硬化症

- 过敏反应

- 糖尿病

- 其他疗法

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 居家照护环境

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Amgen

- Antares Pharma

- Becton, Dickinson and Company

- Eli Lilly and Company

- GlaxoSmithKline

- Halozyme

- Johnson & Johnson

- Mylan

- Novo Nordisk

- Owen Mumford

- SHL Medical

- Teva pharmaceuticals

- West Pharmaceutical Services

- Ypsomed

The Global Autoinjectors Market was valued at USD 68.1 billion in 2024 and is estimated to grow at a CAGR of 14.3% to reach USD 251.8 billion by 2034. The primary factors contributing to this growth include the rising prevalence of chronic conditions such as diabetes and anaphylaxis, as well as the increased availability of generic autoinjectors. These medical devices are essential for the quick and reliable administration of life-saving medications, which is crucial for managing conditions like diabetes and severe allergic reactions.

The increase in the number of diabetes cases worldwide, particularly type 1 and type 2, is one of the key drivers for the demand for autoinjectors. These devices offer an efficient and patient-friendly method for insulin delivery, making them a preferred option for people with diabetes who need regular injections. Alongside diabetes, the growing occurrence of anaphylactic reactions, typically triggered by allergens, has significantly boosted the demand for autoinjectors that deliver epinephrine. The portability, ease of use, and precise dosing capabilities of autoinjectors have made them invaluable in providing rapid emergency treatment. As the incidence of these conditions rises, the market for autoinjectors is expected to expand accordingly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.1 Billion |

| Forecast Value | $251.8 Billion |

| CAGR | 14.3% |

The market is categorized into disposable and reusable autoinjectors. Disposable autoinjectors are the dominant segment, holding a market share of 66.7% in 2024. These single-use devices are particularly appealing due to their convenience and ease of use. They require minimal maintenance, which eliminates the need for patients to have special knowledge or skills to operate them. The fact that these autoinjectors are designed for one-time use also reduces the risk of infection or contamination, ensuring patient safety. Following the pandemic, there has been a shift toward home-based care, particularly for diabetic patients. This change has further driven the preference for disposable autoinjectors, as patients value portability and ease of use in self-administering their medications at home.

Another important factor is the route of administration, with subcutaneous autoinjectors leading the market with a share of 92.1% in 2024. Subcutaneous injections are less painful than intramuscular ones, and they can be self-administered at home, making them highly suitable for patients managing chronic diseases like diabetes. Subcutaneous injections are also commonly used for biologics, including insulin and monoclonal antibodies, further driving the demand for these devices.

The market is also segmented based on therapy, with the diabetes segment expected to see the highest growth rate, reaching a CAGR of 15.8% during the forecast period. This growth is attributed to the increasing number of diabetes cases globally, which necessitate ongoing treatment. Autoinjectors offer a more comfortable and user-friendly method for insulin administration, promoting their widespread use. Moreover, advancements in insulin delivery devices, such as smart autoinjectors with improved dosing accuracy and tracking features, are enhancing patient adherence and supporting the growth of this segment.

When it comes to end users, homecare settings dominate the market, accounting for 64% of the market share in 2024. The rising demand for self-administration, driven by patient independence, is a major factor contributing to this shift. Autoinjectors allow patients with chronic conditions to manage their treatment at home, reducing the need for frequent visits to healthcare facilities. Additionally, the rise of telemedicine and remote monitoring has made it easier for patients to use autoinjectors at home, with healthcare professionals providing guidance and support from a distance.

In 2024, the U.S. led the North American market with a revenue of approximately USD 29.9 billion. This is largely due to the high incidence of chronic diseases, including diabetes and rheumatoid arthritis, in the country. As more patients seek self-administered treatment options, autoinjectors have become an increasingly popular solution for managing these conditions.

The autoinjectors market is highly competitive, with global and regional companies offering a range of solutions to meet the growing demand for self-administration devices. Key players dominate the market, contributing approximately 60% of the overall market share. These companies continually innovate to maintain their market position, introducing new products and solutions designed to improve patient experience and treatment adherence. Furthermore, as affordability becomes a key concern in emerging markets, local manufacturers are stepping in to offer cost-effective alternatives, forcing international companies to adjust their pricing strategies while ensuring product safety and regulatory compliance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for targeted therapies

- 3.2.1.2 Availability of generic autoinjectors globally

- 3.2.1.3 Increasing incidence of diabetes and anaphylaxis

- 3.2.1.4 Rising patient preference towards self-administration of medication

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative treatment options

- 3.2.2.2 High pricing of the autoinjectors

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Disposable

- 5.3 Reusable

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Subcutaneous

- 6.3 Intramuscular

Chapter 7 Market Estimates and Forecast, By Therapy, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Rheumatoid arthritis

- 7.3 Multiple sclerosis

- 7.4 Anaphylaxis

- 7.5 Diabetes

- 7.6 Other therapies

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital and clinics

- 8.3 Homecare settings

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Amgen

- 10.3 Antares Pharma

- 10.4 Becton, Dickinson and Company

- 10.5 Eli Lilly and Company

- 10.6 GlaxoSmithKline

- 10.7 Halozyme

- 10.8 Johnson & Johnson

- 10.9 Mylan

- 10.10 Novo Nordisk

- 10.11 Owen Mumford

- 10.12 SHL Medical

- 10.13 Teva pharmaceuticals

- 10.14 West Pharmaceutical Services

- 10.15 Ypsomed