|

市场调查报告书

商品编码

1740970

软管灌装机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Tube Filling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

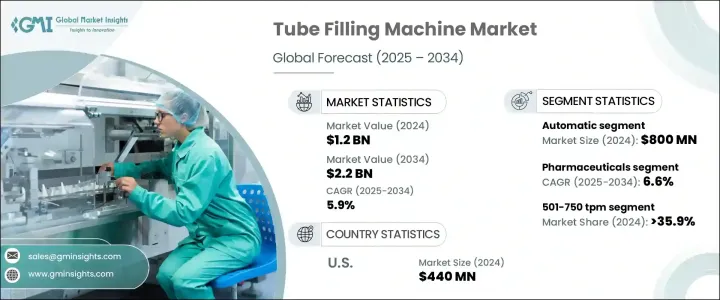

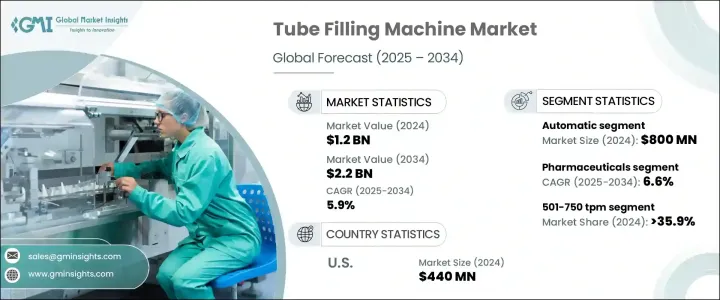

2024年,全球软管灌装机市场规模达12亿美元,预计2034年将以5.9%的复合年增长率成长至22亿美元。这一成长主要得益于各行各业对自动化日益增长的需求以及包装技术的进步。消费品产业尤其推动着这一转变,因为企业正在寻求采用更精确、更有效率、更具可扩展性的製造流程。软管灌装机对于满足这些需求至关重要,它能够灵活地包装各种产品,包括个人护理用品、药品和食品。这些机器不仅提高了生产效率,还能透过确保精确填充来最大限度地减少浪费,最终降低营运成本。此外,消费者对卫生、单剂量和便携式包装解决方案的日益青睐,也推动了软管灌装系统的需求成长。这一趋势在食品和饮料等各个行业都很明显,其中定量调味品和一次性牙膏正变得越来越受欢迎。随着软管包装产品需求的成长,软管灌装机市场也不断扩大。

2024年,自动软管灌装机市场营收达8亿美元,预计到2034年复合年增长率将达到6.2%。自动化转型势头强劲,尤其是在食品、製药和化妆品等高速、大量生产至关重要的产业。自动软管灌装机在灌装、密封和贴标等过程中最大限度地减少人机交互,在提高生产效率方面发挥关键作用。这不仅可以确保更快的生产速度,还能提高一致性并减少错误。这些机器配备了自动软管进料和精确填充控制等先进功能,可协助製造商提高生产效率并降低人力成本。自动化系统日益普及也得益于创新技术,这些创新技术使这些机器能够处理各种尺寸和材质的软管,进一步提升了其在各个领域的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 5.9% |

光是製药业,2024 年就从软管灌装机创造了 5 亿美元的收入,预计到 2034 年的复合年增长率为 6.6%。製药业对软管灌装机的需求尤其强劲,因为该行业对精准无菌包装的需求至关重要。软管灌装机确保乳膏、软膏和凝胶等产品在无菌环境中准确填充,这对于维护产品品质和安全至关重要。全自动系统在製药製造业的应用简化了作业流程,降低了污染风险,并提高了整体生产效率。随着产业持续将安全和品质放在首位,软管灌装机也不断发展,以满足更严格的监管标准和消费者期望。

2024 年,每分钟 501-750 支管 (tpm) 细分市场占据了软管灌装机市场的 35.9% 以上,预计到 2034 年将以 6.1% 的速度成长。这个细分市场因其能够适应各种产品、软管尺寸和黏度而受到青睐,对于生产各种产品或计划向市场推出新产品的公司来说,这使其成为理想之选。 501-750 tpm 机器在生产能力和成本效率之间取得了平衡,为希望优化软管填充操作的中型企业提供了一个有吸引力的选择。虽然大容量机器可以提供更快的吞吐量,但它们的价格不菲,对某些公司来说可能难以负担。相较之下,501-750 tpm 机器经济可行,无需过多资源即可提高产量。

北美,尤其是美国,以2024年4.4亿美元的估值引领市场,预计2025年至2034年的复合年增长率将达到7%。美国拥有庞大且高度自动化的消费品包装产业,该产业严重依赖软管灌装机来包装盥洗用品、化妆品和药品等产品。製造业自动化是该地区发展的关键驱动力,越来越多的企业投资于机器人软管填充系统,该系统可自动装载、填充、密封和喷码软管。这些自动化系统对于提高生产效率和降低人力成本至关重要。

几家关键企业主导软管灌装机产业,占据15-20%的市场。为了保持竞争优势,这些公司专注于研发和产品创新。此外,永续发展趋势日益增长,一些製造商优先考虑环保机器设计,以减少对环境的影响。随着自动化和永续发展的不断进步,软管灌装机市场将持续扩张,为企业提供所需的工具,以满足各行各业对高品质、高效包装产品日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 定价分析

- 技术与创新格局

- 重要新闻和倡议

- 监管格局

- 製造商

- 经销商

- 零售商

- 衝击力

- 成长动力

- 跨产业自动化

- 包装产业的技术进步

- 不断扩张的製药和化妆品产业

- 工业4.0技术的融合

- 产业陷阱与挑战

- 高成本投资

- 定期维护

- 成长动力

- 技术与创新格局

- 成长潜力分析

- 监管格局

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 半自动

- 自动的

第六章:市场估计与预测:依产能,2021 年至 2034 年

- 主要趋势

- 低于 250 tpm

- 251-500 转/分

- 501-750 吨/分钟

- 750 tpm 以上

第七章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 製药

- 化妆品

- 食品和饮料

- 化学品

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

第九章:公司简介

- Accutek Packaging Equipment Company

- Advanced Dynamics

- Aligned Machinery

- APACKS Packaging

- Axomatic

- BellatRx

- Bischoff & Munneke

- Blenzor India

- Busch Machinery

- Caelsons Industries

- GGM Group

- Gustav Obermeyer

- Harish Pharma Engineering

- Makwell Machinery

- ProSys Servo Filling Systems

The Global Tube Filling Machine Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 2.2 billion by 2034. This growth is fueled by the increasing demand for automation across industries, as well as advancements in packaging technology. The consumer goods sector, in particular, is driving this shift as businesses seek to adopt more precise, efficient, and scalable manufacturing processes. Tube filling machines are critical in meeting these demands, offering flexibility in packaging a wide range of products, including personal care items, pharmaceuticals, and food products. These machines not only improve production efficiency but also minimize waste by ensuring precise filling, ultimately reducing operational costs over time. Additionally, the rising consumer preference for hygienic, single-dose, and portable packaging solutions is contributing to the growing demand for tube-filling systems. This trend is evident across various sectors, including food and beverages, where portion-controlled dressings and single-serve toothpaste are becoming increasingly popular. As the demand for tube-packaged products grows, the market for tube filling machines is expanding in response.

In 2024, the automatic tube filling machine segment generated a revenue of USD 800 million and is expected to experience a CAGR of 6.2% through 2034. The shift toward automation is gaining momentum, particularly in industries like food, pharmaceuticals, and cosmetics, where high-speed, high-volume production is essential. Automatic tube filling machines play a key role in enhancing production efficiency by minimizing human interaction during processes like filling, sealing, and labeling. This not only ensures a faster production pace but also improves consistency and reduces errors. These machines are equipped with advanced features, such as automatic tube feeding and precise filling control, which help manufacturers achieve higher productivity and lower labor costs. The growing adoption of automated systems is also fueled by innovations that allow these machines to handle a wide range of tube sizes and materials, further boosting their appeal in various sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 5.9% |

The pharmaceutical sector alone generated USD 500 million in revenue from tube filling machines in 2024, with an expected CAGR of 6.6% through 2034. The demand for tube filling machines is particularly strong in the pharmaceutical industry, where the need for precise and sterile packaging is critical. Tube filling machines ensure that products such as creams, ointments, and gels are filled accurately in sterile environments, which is crucial for maintaining product quality and safety. The adoption of fully automated systems in pharmaceutical manufacturing has streamlined operations, reduced the risk of contamination, and improved overall production efficiency. As the industry continues to prioritize safety and quality, tube filling machines are evolving to meet stricter regulatory standards and consumer expectations.

The 501-750 tubes per minute (tpm) segment accounted for more than 35.9% of the tube filling machine market in 2024 and is expected to grow at a rate of 6.1% until 2034. This segment is favored due to its ability to accommodate a broad range of products, tube sizes, and viscosities, making it ideal for companies that produce various products or are planning to introduce new items to the market. The 501-750 tpm machines strike a balance between production capacity and cost efficiency, offering an attractive option for mid-sized businesses looking to optimize their tube-filling operations. While high-capacity machines offer faster throughput, they come with a significant price tag, which can be prohibitive for some companies. In contrast, the 501-750 tpm machines are economically viable and offer improved production without requiring excessive resources.

North America, particularly the United States, leads the market with a valuation of USD 440 million in 2024 and is expected to grow at a CAGR of 7% from 2025 to 2034. The U.S. has a large and highly automated consumer packaged goods industry, which is heavily reliant on tube filling machines for packaging products like toiletries, cosmetics, and medicines. Automation in manufacturing is a key driver in the region, with companies increasingly investing in robotic tube filling systems that offer automatic loading, filling, sealing, and coding of tubes. These automated systems are integral to increasing production efficiency and reducing labor costs.

Several key players dominate the tube filling machine industry, holding 15-20% of the market share. To maintain a competitive edge, these companies are focusing on research and development and product innovation. There is also a growing trend toward sustainability, with some manufacturers prioritizing eco-friendly machine designs to reduce environmental impact. With the ongoing advancements in automation and sustainability, the tube filling machine market is set to continue expanding, offering businesses the tools they need to meet the growing demand for high-quality, efficiently packaged products across various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Pricing analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Manufacturers

- 3.9 Distributors

- 3.10 Retailers

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Automation across industries

- 3.11.1.2 Technological advancement in packaging industry

- 3.11.1.3 The expanding pharmaceutical and cosmetics industries

- 3.11.1.4 Integration of Industry 4.0 technologies

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High-cost investment

- 3.11.2.2 Regular maintenance

- 3.11.1 Growth drivers

- 3.12 Technology & innovation landscape

- 3.13 Growth potential analysis

- 3.14 Regulatory landscape

- 3.15 Pricing analysis

- 3.16 Porter's analysis

- 3.17 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 – 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Semi-automatic

- 5.3 Automatic

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 – 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Less than 250 tpm

- 6.3 251-500 tpm

- 6.4 501-750 tpm

- 6.5 Above 750 tpm

Chapter 7 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Pharmaceutical

- 7.3 Cosmetics

- 7.4 Food & beverages

- 7.5 Chemicals

Chapter 8 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Accutek Packaging Equipment Company

- 9.2 Advanced Dynamics

- 9.3 Aligned Machinery

- 9.4 APACKS Packaging

- 9.5 Axomatic

- 9.6 BellatRx

- 9.7 Bischoff & Munneke

- 9.8 Blenzor India

- 9.9 Busch Machinery

- 9.10 Caelsons Industries

- 9.11 GGM Group

- 9.12 Gustav Obermeyer

- 9.13 Harish Pharma Engineering

- 9.14 Makwell Machinery

- 9.15 ProSys Servo Filling Systems