|

市场调查报告书

商品编码

1740975

建筑修补复合材料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Construction Repair Composites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

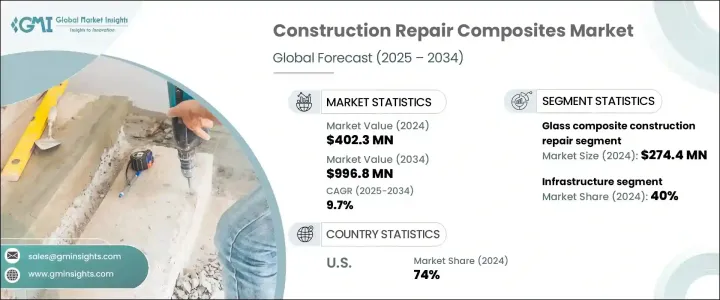

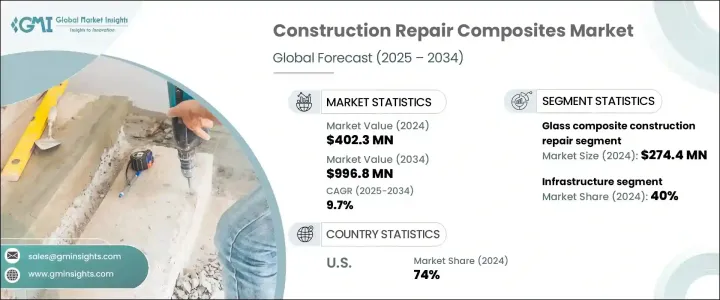

2024年,全球建筑修復复合材料市场规模达4.023亿美元,预计到2034年将以9.7%的复合年增长率成长,达到9.968亿美元,这主要得益于影响全球建筑趋势的几个关键因素。由于对永续建筑材料的投资不断增加、复合材料製造技术的进步以及老化基础设施修復力度的加大,该市场正呈现强劲成长动能。随着城市发展加速,永续性成为首要任务,复合材料正逐渐成为建筑环境修復应用的首选解决方案。

随着对耐用且经济高效的解决方案的需求日益增长,复合材料已成为传统建筑材料的重要替代品。其在强度、耐腐蚀性和使用寿命方面的卓越性能日益受到建筑业的认可。在许多基础设施老化的地区,复合材料明显转向使用修復和加固老化结构。发展中国家快速的城市扩张也加剧了市场需求,因为它不仅带来了新建基础设施的压力,也带来了升级现有基础设施的压力。此外,智慧城市的发展使先进材料成为优先事项,复合材料在旨在降低长期维护成本和提高永续性的现代修復应用中发挥着至关重要的作用。政府对公共基础设施更新的投资进一步推动了复合材料的应用,尤其是在那些需要在严苛环境条件下维持长期性能的领域。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.023亿美元 |

| 预测值 | 9.968亿美元 |

| 复合年增长率 | 9.7% |

依纤维类型划分,建筑修补复合材料市场可分为碳纤维、玻璃纤维和其他纤维。 2024年,玻璃纤维占据市场主导地位,营收达2.744亿美元,预计到2034年复合年增长率约为9.9%。玻璃纤维复合材料因其兼具经济实惠、耐用性和机械强度等优势,持续受到市场青睐。这类复合材料通常用于加固和修復各种建筑构件,与传统材料相比,可延长使用寿命并减少维护需求。

玻璃纤维复合材料广泛应用于梁、柱和地基等结构构件的修復,其优异的强度和弹性使其在实际应用上具有显着优势。树脂灌注和拉挤等製造技术的进步,提升了这些材料的结构性能,使其更加可靠,并能满足各种建筑修復需求。其轻量特性也简化了安装,降低了人工成本并缩短了专案工期。这使得玻璃纤维成为商业和住宅修復应用的理想选择,尤其是在结构完整性和长期耐用性至关重要的情况下。

从应用角度来看,建筑修復复合材料市场可分为住宅建筑、商业建筑、工业设施和基础设施。其中,基础设施领域在2024年占据了约40%的市场。关键基础设施的修復和加固是推动该领域复合材料应用的主要驱动力。复合材料越来越多地被应用于修復项目中,以增强结构弹性并延长老化系统的使用寿命。

在基础设施网路成熟的地区,在不损害旧结构完整性的情况下进行修復的需求推动了高效能复合材料的使用。尤其是碳纤维复合材料,在要求高抗拉强度和轻量化的专案中,其需求日益增长。这些特性使其成为加固必须承受巨大荷载同时保持结构效率的部件的理想选择。其防腐蚀性能也使其适用于经常暴露于潮湿或化学物质的环境。

北美仍然是建筑修復复合材料市场的领先地区,其中美国在2024年约占该地区74%的市场份额,创造约1.03亿美元的收入。美国市场受益于联邦政府透过以修復和永续性为重点的政策措施对基础设施现代化的大力支持。旨在振兴基础设施的立法努力正在转化为对兼具强度和耐用性的先进修復材料的需求成长。

复合材料因其能够满足基础设施更新的技术要求,同时又符合环保目标而备受青睐。从交通网络到公共事业,人们越来越倾向于选择能够最大程度减少停机时间并延长结构寿命的解决方案。这种日益增长的偏好正在推动纤维增强复合材料在全国范围内的创新和广泛应用。

全球建筑修补复合材料市场的主要参与者包括 Chomarat、巴斯夫、Creative Composites、陶氏、Fosroc、Dextra、汉高、马贝、欧文斯科宁、Rockwool、Master Builders Solutions、圣戈班、Simpson Strong-Tie、西卡和 Sireg Geotech。这些公司专注于材料创新、拓展产品线并建立策略合作伙伴关係,以巩固其在竞争日益激烈、品质导向的市场中的地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素。

- 利润率分析。

- 中断

- 未来展望

- 製成品

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 基础设施老化,需翻新

- 城市化和基础设施的快速发展

- 产业陷阱与挑战

- 极端条件下的性能变化

- 来自传统材料的竞争

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依纤维类型,2021 - 2034 年

- 主要趋势

- 玻璃纤维

- 碳纤维

- 其他(芳纶纤维等)

第六章:市场估计与预测:按树脂类型,2021 - 2034

- 主要趋势

- 热固性树脂

- 聚酯纤维

- 环氧树脂

- 乙烯基酯

- 聚氨酯

- 其他(酚类等)

- 热塑性树脂

- 聚丙烯

- 聚酰胺

- 聚碳酸酯

- 其他(聚醚醚酮等)

第七章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 纺织品/布料

- 盘子

- 钢筋

- 网

- 其他(黏合剂等)

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 住宅建筑

- 商业建筑

- 工业设施

- 基础设施

- 桥樑

- 道路和高速公路

- 隧道

- 管道和供水系统

- 其他(海洋基础建设等)

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 间接销售

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- BASF

- Chomarat

- Creative Composites

- Dextra

- Dow

- Fosroc

- Henkel

- Mapei

- Master Builders Solutions

- Owens Corning

- Rockwool

- Saint-Gobain

- Sika

- Simpson Strong-Tie

- Sireg Geotech

The Global Construction Repair Composites Market was valued at USD 402.3 million in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 996.8 million by 2034, driven by several key factors shaping global construction trends. The market is witnessing strong momentum due to growing investments in sustainable construction materials, technological progress in composite manufacturing, and increasing efforts to rehabilitate aging infrastructure. As urban development accelerates and sustainability becomes a top priority, composite materials are emerging as a preferred solution for repair applications in the built environment.

The rising need for durable and cost-efficient solutions has positioned composites as a valuable alternative to traditional construction materials. Their superior performance in terms of strength, corrosion resistance, and longevity is increasingly recognized across the construction industry. In many regions with aging infrastructure, there is a clear shift toward the use of composite materials to repair and reinforce deteriorating structures. Rapid urban expansion in developing countries also contributes to market demand, as it creates pressure to not only build new infrastructure but also upgrade existing ones. Additionally, the shift toward smart city development has made advanced materials a priority, with composites playing a vital role in modern repair applications aimed at reducing long-term maintenance costs and improving sustainability. Government investments in public infrastructure renewal are further fueling the adoption of composites, especially in sectors that require long-term performance under challenging environmental conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $402.3 Million |

| Forecast Value | $996.8 Million |

| CAGR | 9.7% |

By fiber type, the construction repair composites market is segmented into carbon fiber, glass fiber, and others. In 2024, the glass fiber segment dominated the market, accounting for USD 274.4 million in revenue, and is projected to grow at a CAGR of around 9.9% through 2034. Glass fiber composites continue to gain traction because they offer a combination of affordability, durability, and mechanical strength. These composites are commonly used to reinforce and repair a wide range of construction components, providing extended service life and reduced maintenance compared to conventional options.

Glass fiber composites are widely applied in repairing structural elements such as beams, columns, and foundations, where their strength and resilience offer a practical advantage. Advancements in fabrication techniques, including resin infusion and pultrusion, have improved the structural performance of these materials, making them more reliable and adaptable to diverse construction repair needs. Their lightweight nature also simplifies installation, cutting down labor costs and project timeframes. This makes glass fiber a compelling choice for both commercial and residential repair applications, particularly when structural integrity and long-term durability are critical.

In terms of application, the construction repair composites market is divided into residential buildings, commercial buildings, industrial facilities, and infrastructure. Among these, the infrastructure segment held a substantial share of around 40% in 2024. Repair and strengthening of critical infrastructure are primary drivers of composite adoption in this category. Composite materials are increasingly integrated into repair projects to enhance structural resilience and extend the operational lifespan of aging systems.

In regions with mature infrastructure networks, the need to rehabilitate old structures without compromising their integrity is pushing the use of high-performance composites. Carbon fiber composites, in particular, are experiencing rising demand in projects requiring high tensile strength and minimal weight. These characteristics make them ideal for reinforcing components that must bear substantial loads while remaining structurally efficient. Their non-corrosive properties also make them suitable for environments where exposure to moisture or chemicals is common.

North America remains a leading region in the construction repair composites market, with the United States accounting for roughly 74% of the regional market share in 2024 and generating about USD 103 million in revenue. The U.S. market is benefiting from strong federal support for infrastructure modernization through policy initiatives focused on rehabilitation and sustainability. Legislative efforts aimed at infrastructure revitalization are translating into heightened demand for advanced repair materials that deliver both strength and durability.

Composite materials are being embraced for their ability to meet the technical requirements of infrastructure renewal while also aligning with environmental goals. From transportation networks to public utilities, there is a growing preference for solutions that minimize downtime and extend structure lifespans. This growing preference is fueling innovation and wider adoption of fiber-reinforced composites across the country.

Key players operating in the global construction repair composites market include Chomarat, BASF, Creative Composites, Dow, Fosroc, Dextra, Henkel, Mapei, Owens Corning, Rockwool, Master Builders Solutions, Saint-Gobain, Simpson Strong-Tie, Sika, and Sireg Geotech. These companies are focusing on material innovation, expanding product lines, and forging strategic partnerships to strengthen their position in a market that is becoming increasingly competitive and quality-driven.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Aging infrastructure and need for renovation

- 3.6.1.2 Urbanization and rapid infrastructure development

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Performance variability in extreme conditions

- 3.6.2.2 Competition from traditional materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Fiber Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Glass fiber

- 5.3 Carbon fiber

- 5.4 Others (aramid fiber etc.)

Chapter 6 Market Estimates & Forecast, By Resin Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Thermoset resins

- 6.2.1 Polyester

- 6.2.2 Epoxy

- 6.2.3 Vinyl ester

- 6.2.4 Polyurethane

- 6.2.5 Others (phenolic etc.)

- 6.3 Thermoplastic resins

- 6.3.1 Polypropylene

- 6.3.2 Polyamide

- 6.3.3 Polycarbonate

- 6.3.4 Others (polyetheretherketone etc.)

Chapter 7 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Textile/fabric

- 7.3 Plate

- 7.4 Rebar

- 7.5 Mesh

- 7.6 Others (adhesive etc.)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Residential buildings

- 8.3 Commercial buildings

- 8.4 Industrial facilities

- 8.5 Infrastructure

- 8.5.1 Bridges

- 8.5.2 Roads and highways

- 8.5.3 Tunnels

- 8.5.4 Pipes and water systems

- 8.5.5 Others (marine Infrastructure etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 BASF

- 11.2 Chomarat

- 11.3 Creative Composites

- 11.4 Dextra

- 11.5 Dow

- 11.6 Fosroc

- 11.7 Henkel

- 11.8 Mapei

- 11.9 Master Builders Solutions

- 11.10 Owens Corning

- 11.11 Rockwool

- 11.12 Saint-Gobain

- 11.13 Sika

- 11.14 Simpson Strong-Tie

- 11.15 Sireg Geotech