|

市场调查报告书

商品编码

1740988

能源和公用事业碳管理系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Energy and Utility Carbon Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

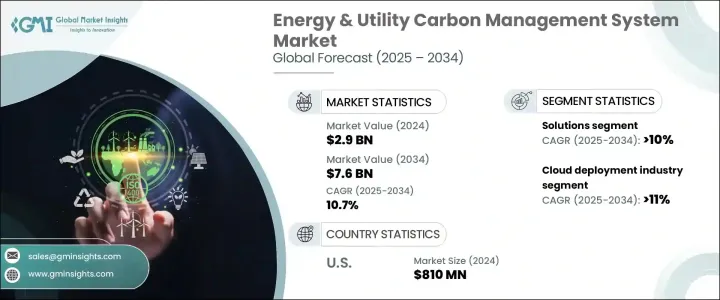

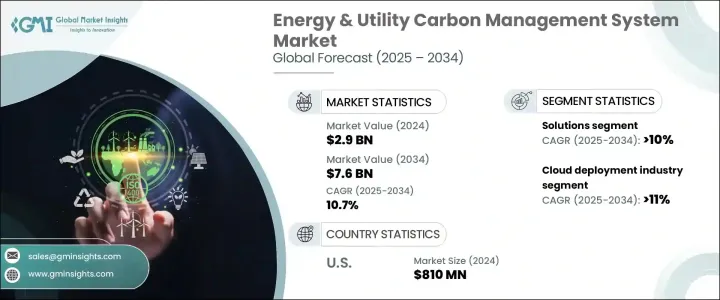

2024年,全球能源和公用事业碳管理系统市场规模达到29亿美元,预计到2034年将以10.7%的复合年增长率增长,达到76亿美元,这得益于能源行业排放法规的收紧和碳合规要求的不断提高。随着全球各行各业积极推进净零排放目标,能源和公用事业公司面临越来越大的压力,需要采用数位碳管理平台来确保准确、即时地追踪排放。市场正在经历一场重大转型,永续性正成为一项核心业务要务,而非一项可有可无的倡议。

企业正在将碳情报直接整合到其营运框架中,以保持竞争力、满足气候资讯揭露要求,并与监管机构和利害关係人建立更牢固的关係。日益向分散式、再生能源发电的转变进一步加速了对先进碳追踪技术的需求。此外,对ESG标准和绿色融资的日益重视,使得碳管理能力对于确保投资和提升市场信誉至关重要。随着环境政策的演变和公众监督的加强,未能将其碳策略与全球预期相符的企业可能会失去市场份额和投资者信心。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 29亿美元 |

| 预测值 | 76亿美元 |

| 复合年增长率 | 10.7% |

随着分散式和再生能源模式的步伐加快,企业高度依赖精准的碳追踪系统来实现合规性和内部永续发展目标。精准的报告工具已成为帮助企业满足气候相关资讯揭露要求并迈向净零排放目标不可或缺的工具。科技的快速发展降低了实施碳管理平台的成本和复杂性,即使是规模较小的公用事业公司也能将排放监测纳入日常营运。

人工智慧和区块链技术驱动的数位解决方案价格日益亲民,进一步推动了市场成长。这些创新技术能够即时追踪排放,增强资料报告,提高可扩展性,同时降低营运成本。然而,贸易政策和关税结构的转变正在影响供应链,导致碳管理解决方案的部署可能出现延迟。一些公司正在探索国内采购或其他生产策略,但此类倡议可能需要额外的时间和资金,这可能会影响全球贸易动态。

预计到2034年,能源和公用事业碳管理系统市场中的解决方案部分将以10%的复合年增长率成长。对于旨在满足动态监管需求的公用事业公司而言,能够即时洞察碳排放、能源消耗和环境绩效的数位平台正变得至关重要。整合的人工智慧分析和预测模型可协助企业在保持合规性的同时,推动主动的减碳策略。

预计基于云端的碳管理平台将超过本地部署,到 2034 年的复合年增长率将达到 11%。云端解决方案提供经济高效、灵活的工具存取、即时排放审计和无缝可扩展性,帮助公用事业公司以更快的速度和更高的可靠性满足不断变化的合规性要求。

2024年,美国能源和公用事业碳管理系统市场规模达8.1亿美元,这得益于联邦和州政府日益增长的监管压力、ESG合规要求以及利益相关者对碳报告透明度的要求。企业正在将碳情报融入营运之中,以引领永续发展工作并实现雄心勃勃的脱碳目标。

全球能源和公用事业碳管理系统市场的主要参与者包括 Salesforce、Enablon、施耐德电气、Locus Technologies、Trinity Consultants、Carbon Footprint Ltd.、SAP、New Era Cleantech、Accuvio、IBM、Envirosoft、ESP、Enviance、NativeEnergy、Energy、Daksome Software、Capel、Daksome、Intex、Iativesometrix、Capie、Daksome Software、Capel、Daksome、Capel、Iaksome Software、Capie、Daksome Software、Capel。为了增强市场影响力,各公司正优先考虑数位转型,大力投资人工智慧驱动的工具、即时排放分析和可自订的云端平台,以服务大型企业和中型公用事业公司。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 川普政府关税对贸易和整体产业的影响

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 解决方案

- 服务

第六章:市场规模及预测:依部署,2021 - 2034 年

- 主要趋势

- 云

- 本地

第七章:市场规模及预测:依地区 2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- Accuvio

- Carbon Footprint Ltd.

- Dakota Software

- Enablon

- EnergyCap.

- Engie

- Enviance

- Envirosoft

- ESP

- IBM

- Intelex

- Isometrix

- Locus Technlogies

- NativeEnergy

- New Era Cleantech

- Salesforce

- SAP

- Schneider Electric

- Trinity Consultants

The Global Energy and Utility Carbon Management System Market reached USD 2.9 billion in 2024 and is projected to grow at a CAGR of 10.7% to reach USD 7.6 billion by 2034, fueled by the tightening of emissions regulations and rising carbon compliance mandates across the energy sector. As industries worldwide push toward aggressive net-zero goals, energy and utility companies are facing mounting pressure to adopt digital carbon management platforms that ensure accurate, real-time tracking of emissions. The market is witnessing a significant transformation, with sustainability becoming a core business imperative rather than an optional initiative.

Companies are integrating carbon intelligence directly into their operational frameworks to maintain competitiveness, meet climate disclosure requirements, and build stronger relationships with regulators and stakeholders. A growing shift toward decentralized, renewable-based power generation further accelerates demand for advanced carbon tracking technologies. Moreover, the increasing emphasis on ESG standards and green financing has made carbon management capabilities essential for securing investments and boosting market credibility. As environmental policies evolve and public scrutiny intensifies, businesses that fail to align their carbon strategies with global expectations risk losing both market share and investor confidence.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 billion |

| Forecast Value | $7.6 billion |

| CAGR | 10.7% |

As the transition to decentralized and renewable power models gathers pace, companies rely heavily on precision carbon tracking systems to achieve regulatory compliance and internal sustainability goals. Precision reporting tools have become indispensable for helping firms meet climate-related disclosure mandates and move toward net-zero emissions targets. Rapid technological evolution has lowered the cost and complexity of implementing carbon management platforms, enabling even smaller utilities to integrate emissions monitoring into daily operations.

Market growth is further propelled by the rising affordability of digital solutions powered by artificial intelligence and blockchain technologies. These innovations allow real-time emissions tracking, enhanced data reporting, and improved scalability while also reducing operational overhead. However, shifting trade policies and changing tariff structures are impacting supply chains, causing potential delays in the deployment of carbon management solutions. Some companies are exploring domestic sourcing or alternative production strategies, although such moves may require additional time and capital, potentially affecting global trade dynamics.

The solutions segment within the energy and utility carbon management system market is projected to grow at a CAGR of 10% through 2034. Digital platforms delivering real-time insights into carbon output, energy consumption, and environmental performance are becoming essential for utilities aiming to meet dynamic regulatory demands. Integrated AI analytics and predictive modeling help organizations drive proactive carbon mitigation strategies while maintaining compliance.

Cloud-based carbon management platforms are anticipated to outpace on-premises deployments, growing at a CAGR of 11% through 2034. Cloud solutions offer cost-effective, flexible access to tools, real-time emissions auditing, and seamless scalability, helping utilities meet evolving compliance requirements with greater speed and reliability.

The United States Energy and Utility Carbon Management System Market generated USD 810 million in 2024, driven by mounting federal and state regulatory pressure, ESG compliance mandates, and stakeholder demands for transparency in carbon reporting. Companies are embedding carbon intelligence into operations to lead sustainability efforts and achieve ambitious decarbonization targets.

Major players in the Global Energy and Utility Carbon Management System Market include Salesforce, Enablon, Schneider Electric, Locus Technologies, Trinity Consultants, Carbon Footprint Ltd., SAP, New Era Cleantech, Accuvio, IBM, Envirosoft, ESP, Enviance, NativeEnergy, EnergyCap, Dakota Software, Intelex, Isometrix, and Engie. To strengthen market presence, companies are prioritizing digital transformation, investing heavily in AI-driven tools, real-time emissions analytics, and customizable, cloud-based platforms to serve both large enterprises and mid-sized utilities.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Impact of trump administration tariffs on trade & overall industry

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Solutions

- 5.3 Services

Chapter 6 Market Size and Forecast, By Deployment, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Cloud

- 6.3 On-premises

Chapter 7 Market Size and Forecast, By Region 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 South Africa

- 7.5.3 UAE

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Accuvio

- 8.2 Carbon Footprint Ltd.

- 8.3 Dakota Software

- 8.4 Enablon

- 8.5 EnergyCap.

- 8.6 Engie

- 8.7 Enviance

- 8.8 Envirosoft

- 8.9 ESP

- 8.10 IBM

- 8.11 Intelex

- 8.12 Isometrix

- 8.13 Locus Technlogies

- 8.14 NativeEnergy

- 8.15 New Era Cleantech

- 8.16 Salesforce

- 8.17 SAP

- 8.18 Schneider Electric

- 8.19 Trinity Consultants