|

市场调查报告书

商品编码

1741005

汽车电子电气 (E-E) 架构市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive E-E (Electronic/Electrical) Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

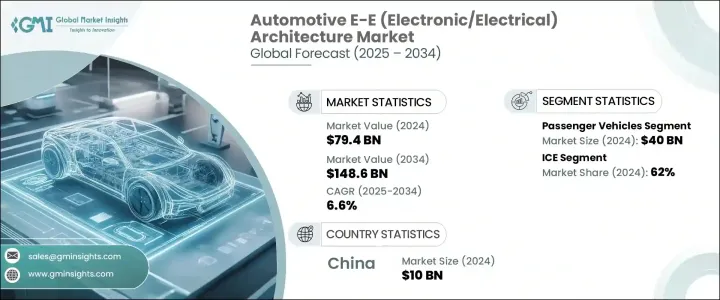

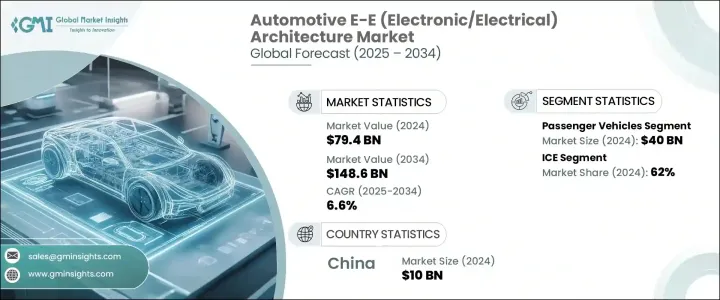

2024年,全球汽车电子电气架构市场规模达794亿美元,预计年复合成长率为6.6%,到2034年将达到1,486亿美元,这主要得益于电动车(EV)的普及、车辆互联互通的提升以及自动驾驶技术需求的不断增长。汽车电子电气架构支撑着现代车辆的关键功能,涵盖从动力系统和资讯娱乐系统到高级驾驶辅助系统(ADAS)和互联互通解决方案等方方面面。向区域化和集中式架构的转变,透过降低布线复杂性、提高资料处理速度以及实现人工智慧、机器学习和V2X通讯等先进技术的无缝集成,从而提升了车辆性能。

集中式运算平台对于支援连网和自动驾驶汽车中感测器、摄影机和通讯网路产生的海量资料至关重要。此外,永续出行的推动以及欧七和国六等更严格的监管标准,正促使汽车製造商重新设计其能源效率系统,以提高能源效率、网路安全性和合规性。此外,永续出行的推动以及欧七和国六等更严格的监管标准,正促使汽车製造商重新设计其能源效率系统,以提高能源效率、网路安全性和合规性。这些不断变化的法规不仅要求降低车辆排放,还对车辆安全性、互联互通性和资料安全提出了更高的标准。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 794亿美元 |

| 预测值 | 1486亿美元 |

| 复合年增长率 | 6.6% |

汽车电子电气架构市场主要按类型细分,其中分散式电子电气架构在2024年将占据领先地位,市场规模达367亿美元。分散式架构的特点是多个独立的电子控制单元(ECU)控制各种车辆功能,因其灵活性、易于整合和可扩展性而被广泛采用。这种设计使汽车製造商能够独立昇级特定的车辆系统,而无需彻底改造整个网路。然而,随着汽车日益软体定义化和资料密集化,汽车产业正逐渐转向域和分区架构,这些架构可提供集中控制、改进的资料管理、降低系统复杂性并减少布线成本。

按车型划分,乘用车在2024年占据了最大的市场份额,达到436亿美元。随着个人汽车配备高级驾驶辅助系统 (ADAS)、下一代资讯娱乐系统、车联网服务和电动动力系统等高端功能的需求不断增长,这一领域正在推动先进电子电气架构的采用。先进的架构能够实现各种车辆系统之间的无缝通信,增强驾驶辅助功能,改善车辆诊断,实现自动驾驶功能,并提升整体驾驶体验。

2024年,亚太地区汽车电气与电子架构市场规模达到279.5亿美元,这得益于电动车(EV)的快速普及、智慧城市计画以及中国、日本和韩国强大的汽车製造基地。中国凭藉其积极的电动车政策、广泛的智慧基础设施建设以及不断增长的本土电动车品牌,继续引领该地区市场。日本和韩国大力投资自动驾驶汽车技术和支援5G的V2X通讯系统,进一步推动了对先进电气与电子架构的需求。政府的激励措施、电动车普及补贴以及对下一代移动出行解决方案的大量研发投入,正在加速该地区现代化、可扩展的电气与电子架构系统的整合。

罗伯特·博世有限公司、大陆集团、安波福、采埃孚股份公司和电装株式会社等主要参与者正在积极投资研发,建立战略合作伙伴关係,并开发模组化、软体定义的电子电气平台,以保持竞争力。这些公司专注于增强网路安全、可扩展性和能源管理,这将定义全球下一代汽车电气和电子架构。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- EE 架构提供商

- 组件提供者

- 经销商

- 最终用途

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 定价分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 电动车(EV)需求不断成长

- 更加关注车辆安全和监管标准

- 高级驾驶辅助系统 (ADAS) 的采用率不断上升

- 对连网汽车和车对万物 (V2X) 通讯的需求

- 产业陷阱与挑战

- 开发先进 E/E 架构的复杂性与成本较高

- 与车辆连接性增强相关的网路安全风险

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 分散式E/E架构

- 领域 E/E 架构

- 区域架构

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:按推进方式,2021 - 2034 年

- 主要趋势

- 冰

- 电动车

- 纯电动车(BEV)

- 插电式混合动力电动车(PHEV)

- 混合动力电动车(HEV)

第八章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 电子控制单元(ECU)

- 配电箱

- 执行器和感测器

- 通讯介面

- 线束

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- Aptiv

- Continental

- Denso

- Faurecia

- Harman International

- Hitachi Astemo

- Hyundai Mobis

- Infineon Technologies

- Lear

- Magna International

- Marelli

- NXP Semiconductors

- Panasonic

- Renesas Electronics

- Robert Bosch

- STMicroelectronics

- Texas Instruments

- Valeo

- Visteon

- ZF Friedrichshafen

The Global Automotive E-E Architecture Market was valued at USD 79.4 billion in 2024 and is estimated to grow at a CAGR of 6.6%, reaching USD 148.6 billion by 2034, driven by the rising adoption of electric vehicles (EVs), increasing vehicle connectivity, and the growing demand for autonomous driving technologies. Automotive E-E (Electrical and Electronics) architecture underpins the critical functions of modern vehicles, managing everything from powertrains and infotainment to advanced driver-assistance systems (ADAS) and connectivity solutions. The shift towards zonal and centralized architectures enhances vehicle performance by reducing wiring complexity, improving data processing speeds, and enabling seamless integration of sophisticated technologies such as AI, machine learning, and V2X communication.

Centralized computing platforms are becoming essential for supporting the massive data generated by sensors, cameras, and communication networks in connected and autonomous vehicles. Moreover, the push for sustainable mobility and stricter regulatory standards, such as Euro 7 and China VI, is prompting automakers to redesign their E-E systems for greater energy efficiency, cybersecurity, and compliance. Moreover, the push for sustainable mobility and stricter regulatory standards, such as Euro 7 in Europe and China VI in Asia, is prompting automakers to redesign their E-E systems for greater energy efficiency, cybersecurity, and regulatory compliance. These evolving regulations demand not only lower vehicle emissions but also higher standards for vehicle safety, connectivity, and data security.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $79.4 Billion |

| Forecast Value | $148.6 Billion |

| CAGR | 6.6% |

The Automotive E-E Architecture Market is primarily segmented by type, with distributed E/E architecture leading in 2024, generating USD 36.7 billion. Distributed architectures, characterized by multiple independent electronic control units (ECUs) controlling various vehicle functions, have been widely adopted due to their flexibility, ease of integration, and scalability. This design allows automakers to independently upgrade specific vehicle systems without overhauling the entire network. However, as vehicles become increasingly software-defined and data-intensive, the industry is gradually transitioning toward domain and zonal architectures, which offer centralized control, improved data management, lower system complexity, and reduced wiring costs.

Based on vehicle type, passenger vehicles captured the largest market share in 2024, accounting for USD 43.6 billion. The rising demand for personal vehicles equipped with premium features such as Advanced Driver Assistance Systems (ADAS), next-generation infotainment systems, connectivity services, and electric powertrains is fueling the adoption of sophisticated E-E architectures in this segment. Advanced architectures allow seamless communication between various vehicle systems, enhancing driver assistance capabilities, improving vehicle diagnostics, enabling autonomous features, and elevating the overall driving experience.

Asia Pacific Automotive E-E Architecture Market reached USD 27.95 billion in 2024, driven by rapid electric vehicle (EV) adoption, smart city initiatives, and strong automotive manufacturing bases in China, Japan, and South Korea. China continues to lead the regional market due to its aggressive EV policies, extensive smart infrastructure development, and growing domestic EV brands. Japan and South Korea invest heavily in autonomous vehicle technologies and 5G-enabled V2X communication systems, further boosting the need for advanced E-E architectures. Government incentives, subsidies for EV adoption, and substantial RandD investments in next-generation mobility solutions are accelerating the integration of modern, scalable E-E systems across the region.

Major players such as Robert Bosch GmbH, Continental AG, Aptiv PLC, ZF Friedrichshafen AG, and Denso Corporation are actively investing in RandD, forming strategic partnerships, and developing modular, software-defined E-E platforms to stay competitive. The focus on enhancing cybersecurity, scalability, and energy management is set to define the next generation of automotive electrical and electronic architectures worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 E-E architecture providers

- 3.2.2 Component providers

- 3.2.3 Distributors

- 3.2.4 End Use

- 3.3 Impact of trump administration tariffs

- 3.3.1 Impact on trade

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (selling price)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Impact on trade

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Pricing analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for electric vehicles (EVs)

- 3.10.1.2 Increasing focus on vehicle safety and regulatory standards

- 3.10.1.3 Rising adoption of Advanced Driver Assistance Systems (ADAS)

- 3.10.1.4 Demand for connected cars and vehicle-to-everything (V2X) communication

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High complexity and cost of developing advanced E/E architectures

- 3.10.2.2 Cybersecurity risks associated with increasing vehicle connectivity

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Distributed E/E architecture

- 5.3 Domain E/E architecture

- 5.4 Zonal architecture

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric vehicles

- 7.3.1 Battery Electric Vehicles (BEV)

- 7.3.2 Plug-in Hybrid Electric Vehicles (PHEV)

- 7.3.3 Hybrid Electric Vehicles (HEV)

Chapter 8 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Electronic Control Units (ECUs)

- 8.3 Power distribution boxes

- 8.4 Actuators and sensors

- 8.5 Communication interfaces

- 8.6 Wiring harnesses

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Continental

- 10.3 Denso

- 10.4 Faurecia

- 10.5 Harman International

- 10.6 Hitachi Astemo

- 10.7 Hyundai Mobis

- 10.8 Infineon Technologies

- 10.9 Lear

- 10.10 Magna International

- 10.11 Marelli

- 10.12 NXP Semiconductors

- 10.13 Panasonic

- 10.14 Renesas Electronics

- 10.15 Robert Bosch

- 10.16 STMicroelectronics

- 10.17 Texas Instruments

- 10.18 Valeo

- 10.19 Visteon

- 10.20 ZF Friedrichshafen