|

市场调查报告书

商品编码

1741012

液化氢储存市场机会、成长动力、产业趋势分析及2025-2034年预测Liquefied Hydrogen Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

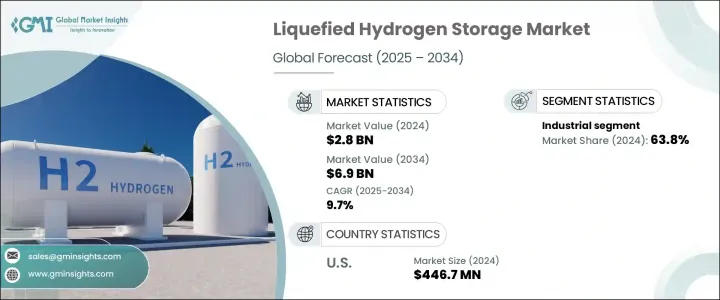

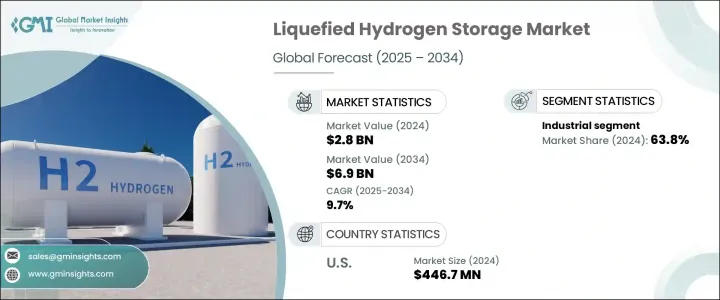

2024年,全球液化氢储存市场规模达28亿美元,预计到2034年将以9.7%的复合年增长率成长,达到69亿美元,这得益于全球日益转向清洁能源的趋势。随着脱碳努力的加强,液化氢正成为重塑未来能源格局的关键因素。各国政府、企业和消费者正齐心协力,寻求更干净、更有效率的解决方案,这为氢能技术的发展创造了肥沃的土壤。液化氢储存是这项转变的核心,它为再生能源整合提供了可扩展、高效且经济的解决方案。低温技术、更智慧的监控系统和紧凑型设计的突破,正在推动该行业朝着更高的可靠性和可承受性迈进。将过剩的再生能源以氢气形式储存并在需求高峰时利用的能力,正在解决与间歇性和电网稳定性相关的关键挑战。随着各国大力投资基础建设升级和能源韧性,液化氢储存将成为各行各业不可或缺的一部分。私部门的创新、公共资金和有利的监管框架正在融合,释放前所未有的成长机会,标誌着全球能源经济的重大转变。

向液化氢的转型已超越工业运营,并在交通运输、储能和分散式发电领域取得了强劲进展。全球各国政府正在加速这项进程,提供补贴和政策诱因,鼓励采用更环保的技术。日益严格的排放法规使氢能解决方案在运输、发电和重工业领域越来越有吸引力。液化氢储存在这些快速发展的应用中正获得强劲发展,为符合全球气候目标的长期永续能源解决方案奠定了基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 28亿美元 |

| 预测值 | 69亿美元 |

| 复合年增长率 | 9.7% |

随着化学、炼油和高热製造等行业整合氢能以逐步淘汰化石燃料,工业领域在2024年将占据63.8%的主导份额。液氢因其更高的能量密度仍然是首选,使其成为大规模储存和高效运作的理想选择。对大容量、远端储能日益增长的需求,也使液态氢成为专注于零排放性能的运输系统的颠覆性技术。在工业领域应对空间和效率限制方面,液氢在紧凑的储存框架内提供更大能量输出的能力至关重要。随着间歇性再生能源的加速扩张,氢在平衡供需方面的作用对于确保电网稳定正变得越来越重要。

2024年,美国液化氢储存市场规模达到4.467亿美元,这得益于氢能基础设施(尤其是加氢站和大型储存项目)的强劲投资。先进的製造能力以及日益壮大的电动车和氢能汽车产业正在推动需求成长。包括能源部主导的联邦措施正在积极支持研发工作,以增强未来储存的可扩展性和可靠性。

为了保持竞争力,FuelCell Energy、Cockerill Jingli、ITM Power、SSE、Air Products and Chemicals、ENGIE、Linde、McPhy Energy、Air Liquide、Gravitricity、GKN 和 Nel 等公司正在加倍投入创新和策略合作。关键策略包括扩大产能、推动低温绝缘技术、投资长期研究以及成立合作企业以加速部署和实现产品多样化。积极参与政府支持的计画也有助于这些企业获得资金,并在新兴市场建立先发优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 贸易管理关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略展望

- 创新与永续发展格局

第五章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 工业的

- 运输

- 固定式

- 其他的

第六章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 荷兰

- 俄罗斯

- 亚太地区

- 中国

- 日本

- 印度

第七章:公司简介

- Air Liquide

- Air Products and Chemicals

- Cockerill Jingli

- ENGIE

- FuelCell Energy

- GKN

- Gravitricity

- ITM Power

- Linde

- McPhy Energy

- Nel

- SSE

The Global Liquefied Hydrogen Storage Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 6.9 billion by 2034, driven by the growing worldwide shift toward cleaner energy alternatives. As decarbonization efforts intensify, liquefied hydrogen is becoming a key player in reshaping the future energy landscape. Governments, corporations, and consumers are aligning to demand cleaner, more efficient solutions, creating fertile ground for hydrogen technologies. Liquefied hydrogen storage is at the heart of this transformation, providing a scalable, efficient, and cost-effective solution for renewable energy integration. Breakthroughs in cryogenic technologies, smarter monitoring systems, and compact designs are pushing the industry toward higher reliability and affordability. The ability to store excess renewable energy as hydrogen and utilize it when demand peaks is solving critical challenges related to intermittency and grid stability. As nations invest heavily in infrastructure upgrades and energy resilience, liquefied hydrogen storage is poised to become indispensable across industries. Private-sector innovation, public funding, and favorable regulatory frameworks are converging to unlock unprecedented growth opportunities, signaling a pivotal shift in the global energy economy.

The transition to liquefied hydrogen is extending beyond industrial operations and making strong inroads into mobility, energy storage, and distributed power generation. Worldwide government initiatives are accelerating the momentum, offering subsidies and policy incentives to adopt greener technologies. Tightening emission regulations are making hydrogen solutions increasingly attractive across transportation, power generation, and heavy industry. Liquefied hydrogen storage is gaining strong traction in these fast-evolving applications, setting the stage for long-term, sustainable energy solutions that align with global climate targets.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $6.9 Billion |

| CAGR | 9.7% |

The industrial sector accounted for a dominant 63.8% share in 2024 as sectors like chemicals, refineries, and high-heat manufacturing integrate hydrogen to phase out fossil-based fuels. Liquefied hydrogen remains the preferred choice due to its higher energy density, making it ideal for large-scale storage and high-efficiency operations. The growing need for high-capacity, long-range energy storage is also making liquefied hydrogen a game-changer for transportation systems focused on zero-emission performance. Its ability to deliver extended energy outputs within compact storage frameworks is critical as industries tackle space and efficiency constraints. As the expansion of intermittent renewable energy sources accelerates, hydrogen's role in balancing supply and demand is becoming even more vital to ensuring grid stability.

The United States Liquefied Hydrogen Storage Market reached USD 446.7 million in 2024, fueled by robust investment in hydrogen infrastructure, especially in fueling stations and large storage projects. Advanced manufacturing capabilities and the growing electric and hydrogen vehicle industries are propelling demand. Federal initiatives, including those led by the Department of Energy, are aggressively supporting R&D efforts to enhance storage scalability and reliability for the future.

To stay competitive, companies like FuelCell Energy, Cockerill Jingli, ITM Power, SSE, Air Products and Chemicals, ENGIE, Linde, McPhy Energy, Air Liquide, Gravitricity, GKN, and Nel are doubling down on innovation and strategic partnerships. Key strategies include expanding production capacities, advancing cryogenic insulation technologies, investing in long-term research, and forming collaborative ventures to fast-track deployment and product diversification. Active participation in government-backed programs is also helping these players secure funding and build early-mover advantages across emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trade administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 Industrial

- 5.3 Transportation

- 5.4 Stationary

- 5.5 Others

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 Germany

- 6.3.2 UK

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Netherlands

- 6.3.6 Russia

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

Chapter 7 Company Profiles

- 7.1 Air Liquide

- 7.2 Air Products and Chemicals

- 7.3 Cockerill Jingli

- 7.4 ENGIE

- 7.5 FuelCell Energy

- 7.6 GKN

- 7.7 Gravitricity

- 7.8 ITM Power

- 7.9 Linde

- 7.10 McPhy Energy

- 7.11 Nel

- 7.12 SSE