|

市场调查报告书

商品编码

1741045

电动汽车接触器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Vehicle Contactor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

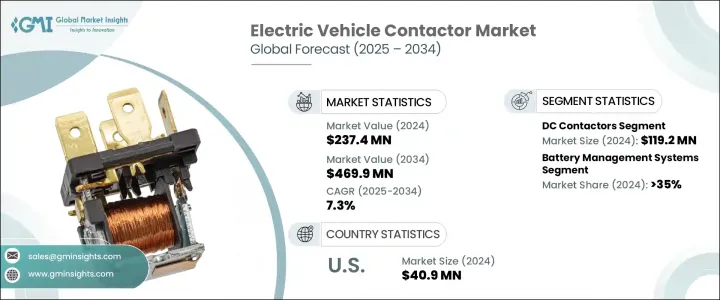

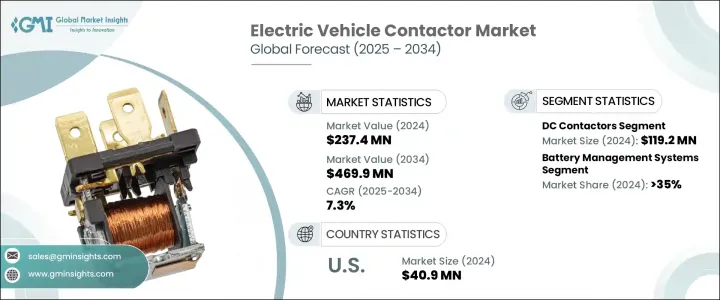

2024年,全球电动车接触器市场规模达2.374亿美元,预计到2034年将以7.3%的复合年增长率成长,达到4.699亿美元。这主要得益于电动车需求的不断增长,以及对高压接触器的需求,而高压接触器对于安全管理电源至关重要。在政府激励措施和排放法规的推动下,电动车的普及率不断提高,也加剧了对这些零件的需求。电动车製造商正在安装坚固耐用的接触器,以确保高压电路安全管理,使其车辆符合更严格的环保标准。

接触器对于调节电池与电动车 (EV) 内部其他重要係统(包括充电站、逆变器和电池管理系统)之间的电流至关重要。它们的作用是确保安全且有效率的电源管理,使车辆的各个部件能够最佳运作。随着全球减少碳排放的努力不断加强,人们明显转向电动传动系统,这进一步推动了电动车应用中对可靠接触器的需求。这些组件确保了从储能到配电的无缝运行,从而促进了全球电动车的普及。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2.374亿美元 |

| 预测值 | 4.699亿美元 |

| 复合年增长率 | 7.3% |

2024年,直流接触器市值为1.192亿美元。这些接触器专为处理高压电流而设计,确保电池和电力电子设备之间的电力传输顺畅。其设计着重即使在极端工作条件下也能保持高性能。直流接触器能够承受快速开关循环,经久耐用,电压损耗极小,是电动车的理想选择,因为稳定的性能对电动车至关重要。这种可靠性提高了电动车的效率,使其成为电动车产业不可或缺的一部分。

电池管理系统 (BMS) 是电动车接触器市场的另一个主要应用,预计到 2024 年将占据 35% 的市场。这些系统用于监控和管理电池的充电状态、温度和整体健康状况,这对于确保最佳性能、延长电池寿命以及防止过度充电和过热等安全问题至关重要。随着电动车的日益先进,对高效可靠的电池管理系统的需求也日益增长,这进一步增加了对确保电池与其他车辆系统之间顺畅互动的接触器的需求。

2024年,北美电动车接触器市场规模达4,090万美元。北美仍然是电动车产业的主导者,许多主要汽车製造商在车辆系统和电动车充电基础设施中严重依赖高压接触器。随着电动车需求的持续成长,承包商在提供安全可靠的电源管理解决方案方面的作用变得更加关键,这巩固了其在电动车生态系统中的重要地位。

全球电动车接触器市场的主要参与者包括:三菱电机株式会社、西门子、ABB、松下株式会社、罗克韦尔自动化、沙尔特宝、施耐德电气、泰科电子、GEYA 电气设备供应、伊顿、卡洛·佳乐、富士电机 FA 部件与系统有限公司、LS 电气、电气设备供应、加氏科技公司(LKA) SpA。为了巩固市场地位,电动车接触器领域的公司正专注于产品创新,强调开发节能、耐用和紧凑的接触器,以满足电动车产业日益增长的需求。他们也投资扩大全球生产和分销网络,以满足新兴市场的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 对贸易的影响

- 展望与未来考虑

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 交流接触器

- 直流接触器

第六章:市场规模及预测:按电压,2021 - 2034

- 主要趋势

- 高电压(>60V)

- 低电压(≤60V)

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 电池管理系统

- 逆变器

- 暖气、通风和空调(HVAC)

- 充电系统

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- Carlo Gavazzi

- Eaton

- Fuji Electric FA Components & Systems Co., Ltd.

- GEYA Electrical Equipment Supply

- KA Schmersal GmbH & Co. KG

- L&T

- LOVATO Electric SpA

- LS ELECTRIC

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Rockwell Automation

- Schaltbau

- Schneider Electric

- Sensata Technologies, Inc.

- Siemens

- TE Connectivity

- Toshiba International Corporation

The Global Electric Vehicle Contactor Market was valued at USD 237.4 million in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 469.9 million by 2034, driven by the growing demand for electric vehicles, the need for high-voltage contactors, which are critical in managing the power safely. The increasing adoption of electric vehicles, spurred by government incentives and emission regulations, has intensified the demand for these components. EV manufacturers are installing robust contactors to ensure that high-voltage circuits are safely managed, allowing their vehicles to comply with stricter environmental standards.

Contactors are crucial in regulating the power flow between the battery and other essential systems within electric vehicles (EVs), including charging stations, inverters, and battery management systems. Their role ensures safe and efficient power management, enabling the vehicle's various components to function optimally. As global efforts to reduce carbon emissions intensify, there is a noticeable shift towards electric drivetrains, further driving the demand for reliable contactors in EV applications. These components ensure seamless operation, from energy storage to distribution, contributing to the growing adoption of electric vehicles worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $237.4 Million |

| Forecast Value | $469.9 Million |

| CAGR | 7.3% |

The DC contactor segment was valued at USD 119.2 million in 2024. These contactors are engineered to handle high-voltage currents, ensuring smooth power flow between the battery and power electronics. Their design focuses on maintaining high performance, even under extreme operating conditions. The ability to endure rapid switching cycles, high durability, and minimal voltage loss makes DC contactors ideal for EVs, where consistent performance is essential. This reliability enhances the efficiency of electric vehicles, making DC contactors indispensable in the industry.

Battery management systems (BMS) are another major application in the electric vehicle contactor market, accounting for a 35% share in 2024. These systems monitor and manage the battery's state of charge, temperature, and overall health, which is vital for ensuring optimal performance, extending battery life, and preventing safety issues like overcharging and overheating. As electric vehicles become more advanced, the demand for efficient and reliable battery management systems is rising, further increasing the need for contactors that ensure smooth interaction between the battery and other vehicle systems.

North America Electric Vehicle Contactor Market generated USD 40.9 million in 2024. North America remains a dominant player in the EV industry, with many key automakers relying heavily on high-voltage contactors in vehicle systems and EV charging infrastructure. As the demand for electric vehicles continues to expand, the role of contractors in providing safe and reliable power management solutions becomes even more critical, reinforcing their essential position in the EV ecosystem.

Key players in the Global Electric Vehicle Contactor Market include: Mitsubishi Electric Corporation, Siemens, ABB, Panasonic Corporation, Rockwell Automation, Schaltbau, Schneider Electric, TE Connectivity, GEYA Electrical Equipment Supply, Eaton, Carlo Gavazzi, Fuji Electric FA Components & Systems Co., Ltd., LS ELECTRIC, K.A. Schmersal GmbH & Co. KG, Toshiba International Corporation, Sensata Technologies, Inc., L&T, and LOVATO Electric S.p.A. To strengthen their market position, companies in the electric vehicle contactor sector are focusing on product innovation, emphasizing the development of energy-efficient, durable, and compact contactors that meet the growing demands of the EV industry. They are also investing in expanding their global production and distribution networks to cater to emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 AC contactor

- 5.3 DC contactor

Chapter 6 Market Size and Forecast, By Voltage, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 High voltage (>60V)

- 6.3 Low voltage (≤60V)

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Battery management systems

- 7.3 Inverters

- 7.4 Heating, Ventilation, and Air Conditioning (HVAC)

- 7.5 Charging systems

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Carlo Gavazzi

- 9.3 Eaton

- 9.4 Fuji Electric FA Components & Systems Co., Ltd.

- 9.5 GEYA Electrical Equipment Supply

- 9.6 K.A. Schmersal GmbH & Co. KG

- 9.7 L&T

- 9.8 LOVATO Electric S.p.A.

- 9.9 LS ELECTRIC

- 9.10 Mitsubishi Electric Corporation

- 9.11 Panasonic Corporation

- 9.12 Rockwell Automation

- 9.13 Schaltbau

- 9.14 Schneider Electric

- 9.15 Sensata Technologies, Inc.

- 9.16 Siemens

- 9.17 TE Connectivity

- 9.18 Toshiba International Corporation