|

市场调查报告书

商品编码

1750522

电动车直流接触器市场机会、成长动力、产业趋势分析及2025-2034年预测Electric Vehicle DC Contactor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

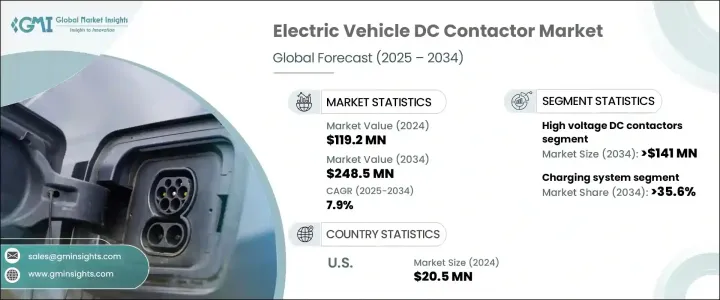

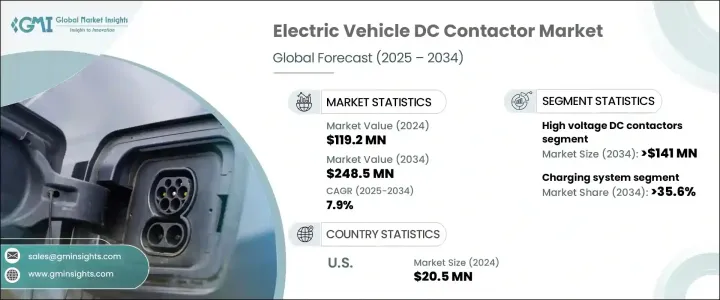

2024年,全球电动车直流接触器市场规模达1.192亿美元,预计到2034年将以7.9%的复合年增长率成长,达到2.485亿美元。受全球电动车普及率不断提高以及直流接触器技术不断进步的推动,市场规模正在不断扩张。市场对更紧凑、更有效率、更耐用的接触器的需求日益增长,创新的重点在于提升车辆性能,同时满足严格的安全、能源效率和永续性监管要求。

现代电动动力传动系统和辅助系统依赖性能卓越的先进直流接触器。这些接触器的设计最大程度地减少了触点磨损,确保了更长的使用寿命,并配备了改进的消弧功能,从而提高了安全性和可靠性。这些创新对于电动车 (EV) 至关重要,因为高效率和耐用性对于动力传动系统和辅助系统至关重要。直流接触器的持续发展使汽车製造商能够满足严格的安全、能源效率和环境标准,使其成为推动永续交通发展不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.192亿美元 |

| 预测值 | 2.485亿美元 |

| 复合年增长率 | 7.9% |

随着全球电动车转型的加速,高压直流接触器市场规模预计到2034年将达到1.41亿美元。高压直流接触器透过管理电池和其他高压组件之间的电流,在确保电动车的安全性和可靠性方面发挥着至关重要的作用。高压和大电流接触器技术的进步提高了充电速度并改善了热管理。

同时,电动车直流接触器市场中的暖通空调 (HVAC) 应用领域预计到 2034 年的复合年增长率将达到 7.3%。随着电动车的能源效率不断提高,对可靠热管理系统的需求也日益增长。 HVAC 系统是维持电动车舒适性并最大限度降低能耗的关键零件。直流接触器对于管理这些系统相关的频繁开关和变化的电流负载至关重要,尤其是在紧凑型和高效能汽车设计趋势日益增强的今天。

美国电动车直流接触器市场规模达2,050万美元,这得益于电动车普及率的上升以及政府对清洁交通的持续支持。随着相关政策鼓励电动车普及以及绿色技术投资,这一上升趋势预计将持续下去。美国政府的倡议,例如针对製造商和消费者的税收优惠和补贴,催化了电动车产业的成长,从而推动了对可靠直流接触器的需求。此外,美国在直流接触器的设计和製造方面也取得了显着进步,创新技术提高了效率、安全性和成本效益。

全球电动车直流接触器行业的领导者包括 ABB、伊顿、富士电机、三菱电机、施耐德电气、西门子、森萨塔科技和 TE Connectivity。这些公司正在透过开发满足电动车产业不断发展的需求的尖端技术来塑造市场。为了加强市场占有率,电动车直流接触器市场的公司专注于持续创新。他们在研发上投入巨资,以提高产品的效率、安全性和耐用性,使其产品更可靠,适用于高性能电动车。与汽车製造商、公用事业公司和充电基础设施提供者建立策略合作伙伴关係是提高市场渗透率的关键。此外,该公司正专注于提供具有成本效益的解决方案,以满足日益增长的电动车零件需求,同时扩大其在新兴市场的影响力。透过优先考虑可持续和可扩展的解决方案,这些公司在快速发展的电动车产业中占据了长期成长的有利地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 供给侧影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:按电压,2021 - 2034

- 主要趋势

- 高电压(>60V)

- 低电压(≤60V)

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 电池管理系统

- 逆变器

- 暖气、通风和空调 (HVAC)

- 充电系统

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- ABB

- Carlo Gavazzi

- Eaton

- Fuji Electric

- Geya

- L&T

- Lovato Electric

- LS Electric

- Mitsubishi Electric

- Panasonic

- Rockwell Automation

- Schaltbau

- Schmersal

- Schneider Electric

- Sensata Technologies

- Siemens

- TE Connectivity

- Toshiba

The Global Electric Vehicle DC Contactor Market was valued at USD 119.2 million in 2024 and is estimated to grow at a CAGR of 7.9% to reach USD 248.5 million by 2034, driven by the increasing adoption of electric vehicles across the globe, along with continuous advancements in DC contactor technologies, is driving the market's expansion. The demand for more compact, efficient, and durable contactors is growing, with innovations focused on enhancing vehicle performance while meeting stringent regulatory requirements for safety, energy efficiency, and sustainability.

Modern electric powertrains and auxiliary systems rely on advanced DC contactors that offer superior performance. These contactors are designed with minimal contact wear, ensuring longer operational lifespans, and are equipped with improved arc suppression features that enhance safety and reliability. Such innovations are critical for electric vehicles (EVs), where high efficiency and durability are essential for the powertrain and auxiliary systems. The continued evolution of DC contactors allows automakers to meet stringent safety, energy efficiency, and environmental standards, making them an integral part of the drive toward sustainable transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $119.2 Million |

| Forecast Value | $248.5 Million |

| CAGR | 7.9% |

The high-voltage DC contactors market segment is expected to reach USD 141 million by 2034, as the global shift toward electric mobility intensifies. High-voltage DC contactors play a critical role in ensuring the safety and reliability of electric vehicles by managing the flow of electricity between the battery and other high-voltage components. Advancements in high-voltage and high-current contactor technology have enabled faster charging speeds and improved thermal management.

In parallel, the HVAC (Heating, Ventilation, and Air Conditioning) application segment within the Electric Vehicle DC Contactor Market is projected CAGR of 7.3% through 2034. With electric vehicles becoming more energy-efficient, the need for reliable thermal management systems is escalating. The HVAC system is a key component for maintaining comfort within electric vehicles while minimizing energy consumption. DC contactors are essential in managing the frequent switching and varying current loads associated with these systems, especially as the trend toward compact and high-efficiency vehicle designs intensifies.

U.S. Electric Vehicle DC Contactor Market was valued at USD 20.5 million, fueled by the rise in electric vehicle adoption and the ongoing government support for clean transportation. This upward trajectory is set to continue as policies incentivize EV adoption and investments in green technologies. The U.S. government's initiatives, such as tax incentives and grants for manufacturers and consumers, have catalyzed the growth of the EV industry and, consequently, the demand for reliable DC contactors. In addition, the country is seeing significant advancements in the design and manufacturing of DC contactors, with innovations that improve efficiency, safety, and cost-effectiveness.

Leading players in the Global Electric Vehicle DC Contactor Industry include ABB, Eaton, Fuji Electric, Mitsubishi Electric, Schneider Electric, Siemens, Sensata Technologies, and TE Connectivity. These companies are shaping the market by developing cutting-edge technologies that meet the evolving needs of the electric vehicle industry. To strengthen their market presence, companies in the electric vehicle DC contactor market focus on continuous innovation. They invest heavily in research and development to enhance product efficiency, safety, and durability, making their products more reliable for high-performance electric vehicles. Strategic partnerships with automotive manufacturers, utility companies, and charging infrastructure providers are key to increasing market penetration. Additionally, companies are focusing on offering cost-effective solutions to meet the growing demand for electric vehicle components while expanding their presence in emerging markets. By prioritizing sustainable and scalable solutions, these companies are well-positioned for long-term growth in the rapidly evolving electric vehicle industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (Raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (Raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1.1 Price transmission to end markets

- 3.2.3.1.2 Market share dynamics

- 3.2.3.1.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future Considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Voltage, 2021 - 2034, (USD Million)

- 5.1 Key trends

- 5.2 High voltage (>60V)

- 5.3 Low voltage (≤60V)

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, (USD Million)

- 6.1 Key trends

- 6.2 Battery management systems

- 6.3 Inverters

- 6.4 Heating, Ventilation, and Air conditioning (HVAC)

- 6.5 Charging systems

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 UK

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Carlo Gavazzi

- 8.3 Eaton

- 8.4 Fuji Electric

- 8.5 Geya

- 8.6 L&T

- 8.7 Lovato Electric

- 8.8 LS Electric

- 8.9 Mitsubishi Electric

- 8.10 Panasonic

- 8.11 Rockwell Automation

- 8.12 Schaltbau

- 8.13 Schmersal

- 8.14 Schneider Electric

- 8.15 Sensata Technologies

- 8.16 Siemens

- 8.17 TE Connectivity

- 8.18 Toshiba