|

市场调查报告书

商品编码

1750262

汽车钥匙连锁电缆市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Automotive Key Interlock Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

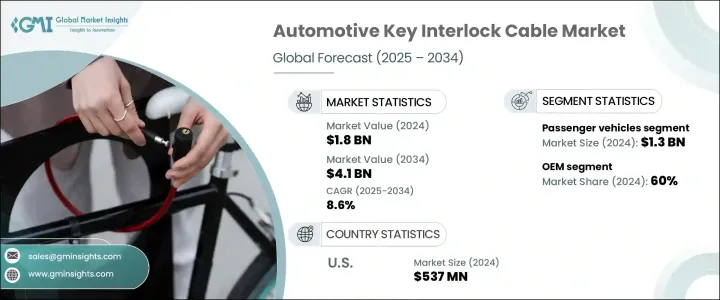

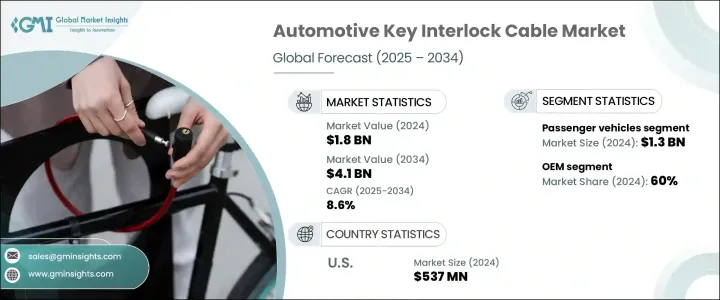

2024年,全球汽车钥匙连锁线缆市场规模达18亿美元,预计到2034年将以8.6%的复合年增长率成长,达到41亿美元。这得益于汽车安全预期的提高、自动变速箱系统整合度的不断提升以及汽车行业安全法规的日益严格。汽车製造商正在将先进的联锁系统嵌入车辆,以防止意外换檔,从而提高安全性并满足合规性要求。随着车辆设计日益复杂,这些线缆已成为确保驾驶员控制的关键部件,尤其是在必须将换檔操作与点火状态绑定的系统中。商用车和乘用车(包括电动车)对此类线缆的采用率都在增加。

随着汽车在先进驾驶辅助技术和半自动驾驶系统方面的不断发展,对高性能、紧凑耐用的钥匙联锁解决方案的需求也日益增长。这些线缆能够可靠地控制换檔功能,并减少潜在的驾驶失误,使其成为安全关键型汽车系统的关键部件。製造商也专注于增强抗拉强度和耐恶劣环境条件等特性,使线缆能够在各种应力条件下高效运作。联锁系统已成为各种平台现代车辆架构的基石。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 41亿美元 |

| 复合年增长率 | 8.6% |

2024年,乘用车市场规模达到13亿美元,这得益于电动自行车、电动滑板车和小型电动车等紧凑型出行解决方案需求的不断增长,其中许多解决方案都配备了联锁线缆以增强安全性。轻便、可折迭的车辆尤其受到寻求实用、安全出行方式的城市居民和行动办公人士的青睐。这些连锁电缆在车辆不使用时起到至关重要的作用,可以防止车辆移动,并提供额外的防盗保护,尤其是在共享空间内。

从销售管道来看,受对增强车辆安全性和技术复杂性日益增长的需求推动,原始设备製造商 (OEM) 在 2024 年占据了 60% 的市场份额。 OEM 处于这项创新的前沿,将关键的连锁拉索作为整合组件整合到各种车型中。它们能够与现有系统无缝相容,并确保可靠的性能,使其成为现代车辆设计的重要组成部分。连锁技术的不断进步,包括智慧和自动锁定机制的开发,正促使OEM提供的拉索越来越受到青睐。

由于强劲的汽车行业、严格的安全法规以及电动车和自动驾驶汽车的高普及率,美国汽车钥匙联锁电缆市场在2024年实现了5.37亿美元的产值。随着市场的不断扩张,美国製造商正在大力投资研发,以打造更先进、更耐用、更有效率的连锁系统。持续的技术创新,加上旨在提高车辆安全性的监管力度的加强,确保了美国将继续在汽车钥匙连锁电缆市场中保持领先地位。

Suprajit、Orscheln、HI-Lex、Linamar、DURA、Ficosa、Kongsberg、Cablecraft、Kuster 和 Kongsberg(已删除重复)等主要参与者正透过专注于策略合作、产品客製化和扩大生产规模来巩固其市场地位。这些公司投资研发,以提高产品寿命及其与不断发展的车辆架构的兼容性,同时利用与原始设备製造商的合作伙伴关係来确保长期供应协议。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 价格趋势

- 地区

- 电缆

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 日益重视车辆安全法规

- 自动变速箱车辆的普及率增加

- 电动车和自动驾驶汽车的成长

- 电缆设计的技术进步

- 产业陷阱与挑战

- 高度依赖汽车产业週期

- 原料成本上涨

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 商用车

- 轻型商用车

- 平均血红素 (MCV)

- 丙型肝炎病毒

第六章:市场估计与预测:依功能划分,2021 - 2034 年

- 主要趋势

- 自动钥匙联锁

- 手动钥匙联锁

- 遥控钥匙联锁

第七章:市场估计与预测:按电缆,2021 - 2034

- 主要趋势

- 机械电缆

- 电缆

- 混合电缆

- 智慧电缆

- 客製化电缆

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车安全系统

- 点火系统

- 传动系统

- 其他的

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Aisin Seiki

- AutoCable

- Cablecraft Motion

- Curtiss-Wright

- DURA

- Shiloh

- Ficosa

- HI-Lex

- JOPP Automotive

- Kongsberg

- Kuster

- Linamar

- Ningbo Gaofa.

- Orscheln

- Shanghai Jinyi

- Sila Group

- Suprajit

- TOKAIRIKA

- Yazaki

- Zhejiang Sinyuan

The Global Automotive Key Interlock Cable Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 4.1 billion by 2034, fueled by heightened vehicle safety expectations, the growing integration of automatic transmission systems, and stricter safety regulations in the automotive sector. Automakers are embedding advanced interlock systems into vehicles to prevent unintended gear shifts, enhancing safety and meeting compliance demands. As vehicle design becomes more sophisticated, these cables serve as crucial components for ensuring driver control, especially in systems where gear operation must be tied to ignition status. The adoption of these cables is growing in both commercial and passenger vehicle segments, including electric vehicles.

As vehicles continue to evolve with advanced driver-assist technologies and semi-autonomous systems, the demand for high-performance, compact, and durable key interlock solutions is accelerating. These cables offer reliable control over gear shift functions and reduce potential driver error, making them essential for safety-critical automotive systems. Manufacturers are also focusing on features such as enhanced tensile strength and resistance to harsh environmental conditions, allowing cables to operate efficiently under variable stresses. Interlock systems have become a cornerstone in modern vehicle architectures across various platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $4.1 Billion |

| CAGR | 8.6% |

The passenger vehicles segment generated USD 1.3 billion in 2024, driven by the rising demand for compact mobility solutions such as e-bikes, electric scooters, and small electric cars-many of which feature interlock cables for enhanced safety. Lightweight, foldable vehicles have become particularly popular among urban dwellers and mobile workers seeking practical, secure transportation. These interlock cables play a crucial role by preventing vehicle movement when not in use and offering additional theft protection, especially in shared spaces.

From a sales channel perspective, original equipment manufacturers (OEMs) held 60% of the market share in 2024, driven by the growing demand for enhanced vehicle safety and technological sophistication. OEMs are at the forefront of this innovation, integrating key interlock cables as integral components in a wide range of vehicle models. Their ability to provide seamless compatibility with existing systems and ensure reliable performance makes them an essential part of modern vehicle design. The constant advancements in interlock technology, including the development of smart and automated locking mechanisms, are contributing to the increased preference for OEM-supplied cables.

United States Automotive Key Interlock Cable Market generated USD 537 million in 2024 due to its strong automotive sector, rigorous safety regulations, and high adoption rates of electric and autonomous vehicles. As the market continues to expand, U.S. manufacturers are heavily investing in research and development to create more advanced, durable, and efficient interlock systems. This ongoing technological innovation, coupled with increased regulatory enforcement aimed at improving vehicle safety, ensures that the U.S. will remain a leader in the automotive key interlock cable market.

Key players such as Suprajit, Orscheln, HI-Lex, Linamar, DURA, Ficosa, Kongsberg, Cablecraft, Kuster, and Kongsberg (duplicate removed) are reinforcing their market position by focusing on strategic collaborations, product customization, and expanding their production footprint. These companies invest in research to improve product longevity and compatibility with evolving vehicle architectures while leveraging partnerships with OEMs to secure long-term supply agreements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Price trend

- 3.6.1 Region

- 3.6.2 Cable

- 3.7 Cost breakdown analysis

- 3.8 Key news & initiatives

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising emphasis on vehicle safety regulations

- 3.9.1.2 Increased adoption of automatic transmission vehicles

- 3.9.1.3 Growth in electric and autonomous vehicles

- 3.9.1.4 Technological advancements in cable design

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High dependence on automotive industry cycles

- 3.9.2.2 Rising raw material costs

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicle

- 5.3 Commercial vehicles

- 5.3.1 LCV

- 5.3.2 MCV

- 5.3.3 HCV

Chapter 6 Market Estimates & Forecast, By Functionality, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Automatic key interlock

- 6.3 Manual key interlock

- 6.4 Remote key interlock

Chapter 7 Market Estimates & Forecast, By Cable, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Mechanical cables

- 7.3 Electrical cables

- 7.4 Hybrid cables

- 7.5 Smart cables

- 7.6 Customized cables

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Automotive security system

- 8.3 Ignition system

- 8.4 Transmission system

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 AutoCable

- 11.3 Cablecraft Motion

- 11.4 Curtiss-Wright

- 11.5 DURA

- 11.6 Shiloh

- 11.7 Ficosa

- 11.8 HI-Lex

- 11.9 JOPP Automotive

- 11.10 Kongsberg

- 11.11 Kuster

- 11.12 Linamar

- 11.13 Ningbo Gaofa.

- 11.14 Orscheln

- 11.15 Shanghai Jinyi

- 11.16 Sila Group

- 11.17 Suprajit

- 11.18 TOKAIRIKA

- 11.19 Yazaki

- 11.20 Zhejiang Sinyuan