|

市场调查报告书

商品编码

1750269

卡车折臂起重机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Truck Mounted Knuckle Boom Cranes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

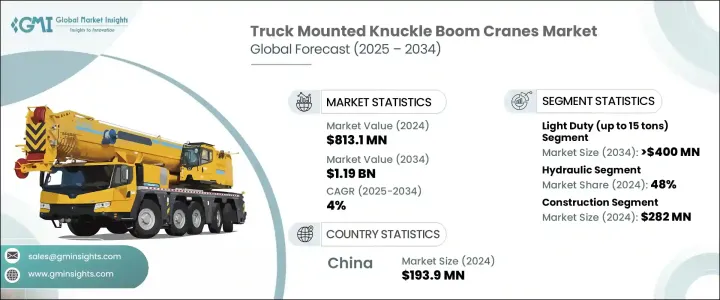

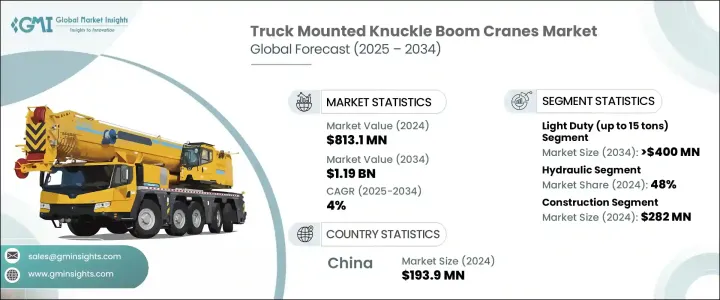

2024年,全球卡车式折臂起重机市场价值为8.131亿美元,预计到2034年将以4%的复合年增长率增长,达到11.9亿美元,这得益于公用事业、物流和建筑等多个行业对紧凑高效起重设备日益增长的需求。这些起重机安装在卡车上,在城市和偏远地区的项目地点具有高度的机动性和功能性。其铰接臂设计使其在空间受限的区域具有更好的机动性,使其成为现代基础设施和公用事业运营中不可或缺的一部分。

随着各行各业不断推动自动化和流程精简,技术升级的起重机系统正逐渐成为业界标准。远端控制功能、改进的负载管理和整合安全系统等功能正在优化施工现场的绩效。这些工具有助于减少人工工作量,同时提高生产效率和作业准确性。企业越来越多地投资于能够执行多项任务并减少劳动力依赖的多功能机器,这与折臂起重机的功能非常契合。此外,市场对支援精准操控、即时监控和节能效能的设备的兴趣也日益浓厚。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.131亿美元 |

| 预测值 | 11.9亿美元 |

| 复合年增长率 | 4% |

2024年,轻型起重机市场占据了40%的市场份额,预计到2034年将达到4亿美元。轻型车载折臂起重机(通常起重能力在15吨以下)是城市发展项目、电信升级和市政工程的首选。其结构紧凑、安装简单、营运成本低廉,对小型承包商和地方政府极具吸引力。在人口稠密或出入受限、大型设备不适用的地区,这类起重机尤其受到青睐。在新兴市场,电信基础设施和电气化项目投资的增加也推动了其应用。

2024年,液压动力系统市场占有48%的份额,因为这些系统因其强度、精度和适应性而广受认可。它们与现代感测器和负载控制技术的兼容性,使其在重型起重、精确定位和重复操作等高要求任务中表现更佳。使用者受益于平稳的运作、更佳的能源利用率和更低的机械应变,这使得液压起重机适用于多种应用。

受快速城市扩张和大量基础设施投资的推动,中国随车折臂起重机市场在2024年实现了1.939亿美元的产值。国家激励措施和国内製造能力持续支撑该地区该行业的强劲成长。中国大力推动工业化和智慧基础设施建设,刺激了对先进起重解决方案(例如随车折臂起重机)的需求。政府补贴以及旨在提升物流和施工能力的项目也促进了该行业的发展,使中国在此类起重机的生产和消费方面都处于领先地位。

为了提升市场份额和品牌影响力,Palfinger、Hiab、HMF Group 和 Manitex International 等领先公司正在投资配备智慧安全系统和远端资讯处理整合的先进起重机技术。 Amco Veba 和 CPS Group 正在透过全球合作伙伴关係和在地化製造策略进行扩张,以提高可及性并降低成本。 Action Construction Equipment 和 Mikron Hidrolik 专注于实现产品线多元化,以满足不断变化的客户需求。 ATLAS Group 和三一重工则着重研发,致力于开发高效能轻量化的起重机,进一步巩固其在全球市场的竞争地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 备件供应商

- 製造商

- 汽车底盘供应商

- 零件和技术供应商

- 经销商

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 对贸易的影响

- 定价和产品策略

- 技术与创新格局

- 当前技术趋势

- 远端资讯处理和车队管理集成

- 提高液压效率

- 远端起重机操作和控制

- 负载监控和防倾倒系统

- 新兴技术

- 电气化和混合动力推进系统

- 起重机自主操作

- 用于维护和培训的扩增实境(AR)

- 先进材料和轻量化设计

- 当前技术趋势

- 专利分析

- 监管格局

- 用例

- 重要新闻和倡议

- 价格趋势

- 驾驶

- 地区

- 成本細項分析

- 监管格局

- 对部队的影响

- 成长动力

- 整合先进的自动化和远端控制系统

- 小巧轻巧的设计创新

- 多功能液压系统的开发

- 改进的负载监控和安全功能

- 产业陷阱与挑战

- 初期投资及维护成本高

- 系统整合和操作员培训的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按起重能力,2021 - 2034 年

- 主要趋势

- 轻型(最高 15 吨)

- 中型(15-100吨)

- 重型(50吨以上)

第六章:市场估计与预测:按驱动力,2021 - 2034 年

- 主要趋势

- 油压

- 电的

- 柴油引擎

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 建造

- 物流和运输

- 实用工具

- 矿业

- 林业

- 其他的

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直销

- 经销商

第九章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Action Construction Equipment

- Amco Veba

- ATLAS Group

- Century Cranes

- Cormach

- CPS Group

- Fassi Gru

- FURUKAWA UNIC

- Heila Cranes

- Hiab

- Hidrokon

- HMF Group

- Iowa Mold Tooling

- JomacLTD

- Manitex International

- Mikron Hidrolik

- Nandan GSE

- Palfinger

- SANY

- Xuzhou BOB-LIFT Construction Machinery

The Global Truck Mounted Knuckle Boom Cranes Market was valued at USD 813.1 million in 2024 and is estimated to grow at a CAGR of 4% to reach USD 1.19 billion by 2034, driven by rising demand for compact and efficient lifting equipment across multiple sectors such as utilities, logistics, and construction. These cranes are mounted on trucks, enabling high mobility and functionality in urban and remote project locations. Their articulated arm design allows for better maneuverability in space-constrained areas, making them indispensable in modern infrastructure and utility operations.

As industries continue to automate and streamline their processes, technologically enhanced crane systems are becoming the standard. Features like remote-control functionality, improved load management, and integrated safety systems are optimizing job site performance. These tools help reduce manual workload while increasing productivity and job accuracy. Businesses are increasingly investing in multifunctional machines that can perform multiple tasks and reduce labor dependency, aligning well with the capabilities of knuckle boom cranes. Additionally, market interest is rising for equipment that supports precision handling, real-time monitoring, and energy-efficient performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $813.1 Million |

| Forecast Value | $1.19 Billion |

| CAGR | 4% |

In 2024, the light-duty crane segment held a notable 40% share and is forecasted to reach USD 400 million by 2034. Light-duty truck-mounted knuckle boom cranes, typically with a lifting capacity under 15 tons, are the preferred choice for urban development projects, telecom upgrades, and municipal work. Their compact build, simple setup, and lower operational costs make them attractive to small contractors and local authorities. These cranes are particularly favored in densely populated or restricted-access areas where larger equipment is impractical. In emerging markets, increased investment in telecom infrastructure and electrification programs boosts their adoption.

Hydraulic-powered systems segment held a 48% share in 2024 as these systems are widely recognized for their strength, precision, and adaptability. Their compatibility with modern sensors and load-control technologies enables better performance in demanding tasks like heavy lifting, accurate positioning, and repetitive operations. Users benefit from smooth operation, improved energy usage, and reduced mechanical strain, making hydraulic cranes suitable across several applications.

China Truck Mounted Knuckle Boom Cranes Market generated USD 193.9 million in 2024, driven by rapid urban expansion and significant infrastructure investment. National incentives and domestic manufacturing capacity continue to support the strong growth of this sector in the region. The country's aggressive push for industrialization and smart infrastructure initiatives has spurred demand for advanced lifting solutions such as truck-mounted knuckle boom cranes. Government-backed subsidies and projects aimed at enhancing logistics and construction capabilities have bolstered the sector, making China a leader in both production and consumption of these cranes.

To boost market share and brand presence, leading companies like Palfinger, Hiab, HMF Group, and Manitex International are investing in advanced crane technologies with smart safety systems and telematics integration. Amco Veba and CPS Group are expanding through global partnerships and localized manufacturing strategies to enhance accessibility and reduce costs. Action Construction Equipment and Mikron Hidrolik focus on diversifying product lines to meet evolving client needs. ATLAS Group and SANY emphasize R&D to develop high-efficiency, lightweight cranes, further reinforcing their competitive positions in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Spare parts providers

- 3.1.1.2 Manufacturers

- 3.1.1.3 Vehicle chassis suppliers

- 3.1.1.4 Component and Technology Suppliers

- 3.1.1.5 Distributors

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.1 Impact on trade

- 3.3 Pricing and product strategies

- 3.4 Technology & innovation landscape

- 3.4.1 Current Technological Trends

- 3.4.1.1 Telematics and fleet management integration

- 3.4.1.2 Hydraulic efficiency enhancements

- 3.4.1.3 Remote crane operation and control

- 3.4.1.4 Load monitoring and anti-tipping systems

- 3.4.2 Emerging Technologies

- 3.4.2.1 Electrification and hybrid propulsion systems

- 3.4.2.2 Autonomous crane operation

- 3.4.2.3 Augmented Reality (AR) for maintenance and training

- 3.4.2.4 Advanced materials and lightweight design

- 3.4.1 Current Technological Trends

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Use cases

- 3.8 Key news & initiatives

- 3.9 Price trend

- 3.9.1 Drive

- 3.9.2 Region

- 3.10 Cost breakdown analysis

- 3.11 Regulatory landscape

- 3.12 Impact on forces

- 3.12.1 Growth drivers

- 3.12.1.1 Integration of advanced automation and remote-control systems

- 3.12.1.2 Availability of compact and lightweight design innovations

- 3.12.1.3 Development of multi-functional hydraulic systems

- 3.12.1.4 Improved load monitoring and safety features

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 High initial investment and maintenance costs

- 3.12.2.2 Complexity in system integration and operator training

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Lifting Capacity, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Light duty (up to 15 tons)

- 5.3 Medium duty (15-100 tons)

- 5.4 Heavy duty (above 50 tons)

Chapter 6 Market Estimates & Forecast, By Drive, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Hydraulic

- 6.3 Electric

- 6.4 Diesel

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Logistics and transportation

- 7.4 Utilities

- 7.5 Mining

- 7.6 Forestry

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 North America

- 9.1.1 U.S.

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 South Korea

- 9.3.6 Southeast Asia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 South Africa

- 9.5.2 Saudi Arabia

- 9.5.3 UAE

Chapter 10 Company Profiles

- 10.1 Action Construction Equipment

- 10.2 Amco Veba

- 10.3 ATLAS Group

- 10.4 Century Cranes

- 10.5 Cormach

- 10.6 CPS Group

- 10.7 Fassi Gru

- 10.8 FURUKAWA UNIC

- 10.9 Heila Cranes

- 10.10 Hiab

- 10.11 Hidrokon

- 10.12 HMF Group

- 10.13 Iowa Mold Tooling

- 10.14 JomacLTD

- 10.15 Manitex International

- 10.16 Mikron Hidrolik

- 10.17 Nandan GSE

- 10.18 Palfinger

- 10.19 SANY

- 10.20 Xuzhou BOB-LIFT Construction Machinery