|

市场调查报告书

商品编码

1750270

半导体整流器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Semiconductor Rectifiers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

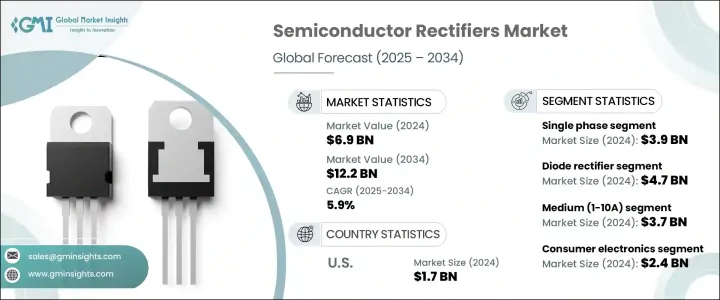

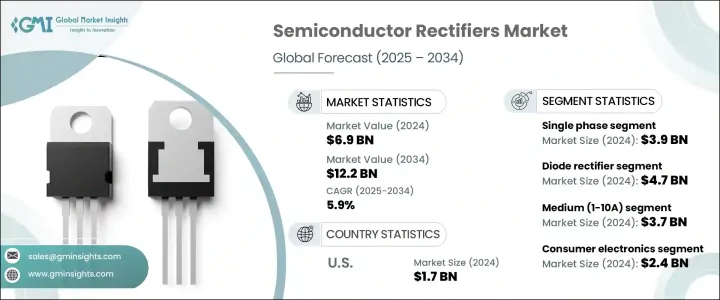

2024年,全球半导体整流器市场规模达69亿美元,预计到2034年将以5.9%的复合年增长率成长,达到122亿美元,这得益于全球消费性电子产品消费的成长以及再生能源部署的激增。清洁能源系统中产生直流电的设备需要将直流电转换为交流电——而整流器在电源逆变器和转换器中发挥至关重要的作用。

然而,贸易政策——尤其是川普政府时期对从中国进口的半导体元件征收的关税——给全球供应链带来了巨大的动盪。这些关税不仅增加了进口成本,还对整个产业产生了连锁反应,包括定价不一致、产品部署週期延长以及利润率压缩。为此,许多製造商开始多元化其供应商网络,并探索近岸外包策略以最大限度地降低风险。虽然其目的是刺激国内生产并减少对进口的依赖,但短期后果是市场波动加剧,市场势头放缓,生产计划也变得复杂。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 69亿美元 |

| 预测值 | 122亿美元 |

| 复合年增长率 | 5.9% |

根据产品细分,单相整流器市场在2024年创造了39亿美元的市场规模。由于其处理低功耗转换的效率高、体积小巧,并且易于整合到标准化电路设计中,单相整流器在消费性电子产品和家用电器中得到了广泛的应用。其价格实惠、灵活性高,使其成为大众市场应用的理想选择,这些应用注重成本和简洁性,同时又不牺牲性能。

同时,二极体整流器以其类型领先,2024 年估值达 47 亿美元。由于其简约的设计和高能效,这些元件仍然是各种中低功率系统不可或缺的一部分。它们在再生能源基础设施(包括太阳能逆变器和电动车充电器)中的应用日益广泛,凸显了它们在扩展需要可靠性和空间效率的下一代电源解决方案方面发挥的作用。

2024年,美国半导体整流器市场产值达17亿美元,这得益于其成熟的工业基础,支撑着航太、国防和电信等依赖高性能、长寿命电子元件的产业。联邦政府推出的激励措施进一步巩固了美国半导体製造业的领先地位,旨在增强关键技术领域的自力更生能力,并缓解地缘政治供应中断的影响。

全球半导体整流器市场的主要参与者,包括德州仪器、安森美半导体、意法半导体、英飞凌科技、瑞萨电子和东芝,正在采取多管齐下的策略来巩固其市场地位。这些公司投资研发,以提高整流器技术的效率并缩小其尺寸。在贸易条件有利的地区,製造能力的扩张也正在进行中。 ABB 和恩智浦半导体等公司正在进行策略合作,以拓宽其应用组合,而微芯科技和 IXYS 则正在探索人工智慧整合电源解决方案。此外,罗姆半导体和三菱电机等公司专注于垂直整合和地理多元化,以降低供应链风险并确保在高需求领域稳定交付。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 消费性电子产品需求不断成长

- 汽车电气化日益发展

- 扩大再生能源基础设施

- 5G和下一代通讯网络

- 资料中心和云端运算的激增

- 产业陷阱与挑战

- 先进整流器的初始成本较高

- 热管理和可靠性问题

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 单相

- 三相

第六章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 二极体整流器

- 闸流管整流器

第七章:市场估计与预测:按功率等级,2021 - 2034 年

- 主要趋势

- 低(小于 1 A)

- 中(1-10 A)

- 高(超过 10 A)

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 汽车

- 消费性电子产品

- 电力和公用事业

- IT和电信

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- ABB

- ASI semiconductor

- Infineon technologies

- IXYS

- Microchip technology

- Mitsubishi electric

- NXP semiconductor

- ON semiconductor

- Renesas electronics

- Rohm semiconductor

- STMicroelectronics

- Taiwan semiconductor

- Texas instruments

- Toshiba

The Global Semiconductor Rectifiers Market was valued at USD 6.9 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 12.2 billion by 2034, fueled by increasing global consumption of consumer electronics and a surge in renewable energy deployment. Devices generating direct current in clean energy systems require conversion to alternating current-an area where rectifiers play a crucial role in power inverters and converters.

However, trade policies- notably the tariffs imposed on semiconductor components imported from China during the Trump administration-introduced substantial turbulence into the global supply chain. These tariffs not only increased import costs but also caused ripple effects across the industry, including inconsistent pricing, prolonged product deployment cycles, and squeezed profit margins. As a response, many manufacturers began diversifying their supplier networks and exploring nearshoring strategies to minimize risk. While the intent was to stimulate domestic production and reduce reliance on imports, the short-term consequence was a period of volatility that slowed market momentum and complicated production planning.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.9 Billion |

| Forecast Value | $12.2 Billion |

| CAGR | 5.9% |

Based on product segmentation, single-phase rectifiers segment generated USD 3.9 billion in 2024. Their extensive use in consumer electronics and residential setups stems from their efficiency in handling low-power conversions, compact footprint, and ease of integration into standardized circuit designs. Their affordability and flexibility make them an ideal fit for mass-market applications that prioritize cost and simplicity without sacrificing performance.

Meanwhile, diode rectifiers led by type with a valuation of USD 4.7 billion in 2024. These components remain integral to a broad range of low-to-mid power systems due to their minimalistic design and high energy efficiency. Their growing use in renewable energy infrastructure, including solar power inverters and electric vehicle chargers, underscores their role in scaling next-generation power solutions that demand reliability and space efficiency.

United States Semiconductor Rectifiers Market generated USD 1.7 billion in 2024, attributed to a mature industrial base that supports sectors like aerospace, defense, and telecommunications-industries that depend on high-performance and long-lasting electronic components. Further boosting this leadership are federal incentives promoting domestic semiconductor fabrication, which aim to enhance self-reliance in critical technology areas and mitigate geopolitical supply disruptions.

Key players in the Global Semiconductor Rectifiers Market, including Texas Instruments, ON Semiconductor, STMicroelectronics, Infineon Technologies, Renesas Electronics, and Toshiba, are adopting multi-pronged strategies to reinforce their market position. These companies invest in R&D to enhance efficiency and reduce form factor in rectifier technologies. Expansion of manufacturing capacities in regions with favorable trade conditions is also underway. Firms like ABB and NXP Semiconductor are entering strategic collaborations to broaden their application portfolios, while Microchip Technology and IXYS are exploring AI-integrated power solutions. Additionally, players like Rohm Semiconductor and Mitsubishi Electric focus on vertical integration and geographic diversification to mitigate supply chain risks and ensure stable delivery in high-demand sectors.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key components

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for consumer electronics

- 3.3.1.2 Growing electrification of automobiles

- 3.3.1.3 Expansion of renewable energy infrastructure

- 3.3.1.4 5G and next-gen communication networks

- 3.3.1.5 Surge in data centres and cloud computing

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High initial cost of advanced rectifiers

- 3.3.2.2 Thermal management and reliability issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 (USD Billion & Billion Units)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Three phase

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion & Billion Units)

- 6.1 Key trends

- 6.2 Diode rectifiers

- 6.3 Thyristor rectifiers

Chapter 7 Market Estimates and Forecast, By Power Rating, 2021 - 2034 (USD Billion & Billion Units)

- 7.1 Key trends

- 7.2 Low (less than 1 A)

- 7.3 Medium (1-10 A)

- 7.4 High (over 10 A)

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion & Billion Units)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Power and utility

- 8.5 It and telecom

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion & Billion Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 ASI semiconductor

- 10.3 Infineon technologies

- 10.4 IXYS

- 10.5 Microchip technology

- 10.6 Mitsubishi electric

- 10.7 NXP semiconductor

- 10.8 ON semiconductor

- 10.9 Renesas electronics

- 10.10 Rohm semiconductor

- 10.11 STMicroelectronics

- 10.12 Taiwan semiconductor

- 10.13 Texas instruments

- 10.14 Toshiba