|

市场调查报告书

商品编码

1644657

整流器:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Rectifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

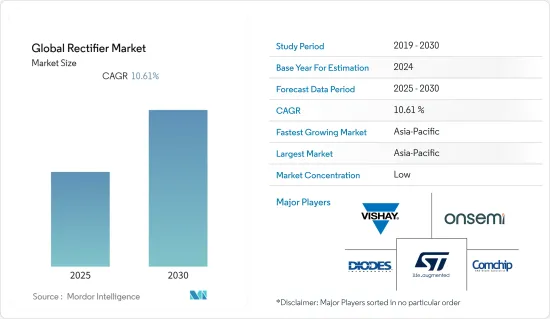

预计预测期内全球整流器市场将以 10.61% 的复合年增长率成长。

整流器通常用作电路保护器,以防止人为错误导致电子元件中的电源电压反转。此外,笔记型电脑、行动电话和个人电脑等消费性设备越来越多地使用高频整流来提高能源效率,这也推动了市场的发展。

消费性电子产品销售的成长进一步推动了研究市场的成长。例如,根据印度零售商协会的数据,2021财年第三季家用电器和电器产品的销售额与去年同期相比成长了23.5%。

汽车电子产品在汽车中央控制、高性能电动方向盘、煞车系统、充电和座椅控制等汽车应用中的日益广泛使用推动了市场的发展。电子元件日益小型化以及政府采取各种现代化配电和发电基础设施措施等其他因素也有望推动市场发展。

然而,由于谐波含量导致的输入线电流失真以及与半导体整流器相关的高成本等技术问题正在阻碍所研究市场的成长。

COVID-19 正在影响主要电子品牌的全球供应链。中国是各种电子输入耗材的最大生产国和出口国之一,包括整流器、电容器和二极体。由于中国持续停产,美国、欧洲多家电子製造商被迫停止成品生产,导致电子产品出现供需缺口。

整流器市场趋势

汽车领域占据主要市场占有率

整流器产业的主要终端用户之一是汽车产业。由于使用传统内燃机的汽车需要更少的电气元件,因此整流器市场受到汽车行业日益改进的技术的影响。

由于电动车(EV)和自动驾驶汽车技术的日益普及,市场上的大多数供应商都在增加对汽车产业的投资。随着整流器越来越多地用于电动车(EV)的车载充电和电池管理系统(BMS),预计需求将会成长。此外,政府强制推行 ADAS(高级驾驶辅助系统)的规定以及汽车製造业越来越多地采用智慧技术也支持了所研究市场的成长。

例如,根据国际能源总署的数据,2021 年全球电动车销量将达到 660 万辆。电动车占全球汽车销量的9%。

全球电池电动车(BEV)的销量仍然很低,但技术进步、充电基础设施的发展和多样化的 BEV 车型可能会继续以比整体汽车行业更快的速度成长。即使汽车总销量保持不变,这种成长也可能推动整流器的使用。

为了满足日益增长的环保解决方案的需求,大多数国家都在推广使用电动车。例如,欧盟制定了一个雄心勃勃的目标,即到2050年成为气候中和的大陆。欧盟最近宣布的 7,500 亿欧元奖励策略就证明了这一点,其中包括 200 亿欧元用于促进清洁汽车销售。

此外,欧盟计划在 2025 年安装约一百万个电动和氢动力汽车充电站,因为整流器在电动车充电器中发挥关键作用。预计这些趋势将支持所调查市场的成长。

亚太地区成长强劲

亚太地区是整流器市场成长最快的地区之一,这得益于全部区域汽车产业对基于整流器的电子元件和可再生能源产品的需求大幅增加。

中国是整流器的主要製造商之一,当地企业占有较大份额。此外,中国整流器製造商在过去几年中扩张迅速,专注于为消费性电子产品提供产品。

根据国际能源总署(IEA)的数据,到2030年,电动车将占全球汽车销量的70%,在中国这一比例为42%(不包括两轮车和三轮车)。此外,到2030年,日本将占据电动车市场的21%,其次是欧洲(26%)和美国(57%)。

各国政府正在製定多项法规,以促进全部区域电动车的普及,这为研究市场的成长创造了有利的市场环境。例如,中国政府已经开始逐步淘汰卡车等现代商用车辆的柴油。到 2040 年,该国计划彻底淘汰柴油和汽油汽车。

此外,根据Business Korea报导,美国之间正在进行的贸易战正在影响三星电子等韩国整流器製造商,该製造收益依赖中国。

随着中国、韩国、印度和新加坡对整流器和其他必需家电产品的需求不断增长,许多公司正在亚太地区建立生产工厂。充足的原材料供应、低廉的推出和人事费用都是鼓励企业在该地区建立製造工厂的有利因素。

整流器产业概况

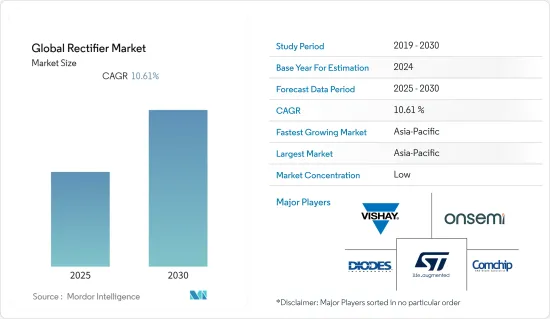

全球整流器市场竞争激烈,有多家整流器製造商提供产品。供应商不断投资于产品和技术创新,以进一步扩大其市场占有率。此外,供应商正在收购销售这些产品的其他公司,以增加其市场占有率。市场的主要参与者包括 Vishay Intertechnology, Inc.、Semiconductor Components Industries, LLC、Diodes Incorporated 和 STMicroelectronics。

2022 年 4 月 - Diodes Incorporated 推出了一套采用超小晶片尺寸封装 (CSP) 的新型高萧特基整流器。根据该公司介绍,DIODES SDM5U45EP3(5A、45V)、DIODES SDM4A40EP3(4A、40V)和 DIODES SDT4U40EP3(4A、40V)实现了业界最高的电流密度,满足了市场对更小、更强大的电子系统的需求。

2022 年 4 月 - Diodes Incorporated 推出了 DIODES APR34910,这是一款低二次侧同步整流开关,用于行动电话、笔记型电脑和机上盒的电源转接器。 APR34910 可降低次级整流器中的功率损耗,提高效率并提供具有低 10mΩ RDS(ON) 和 100V N 通道 MOSFET 的高效能解决方案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 汽车领域各种应用对整流二极体的需求不断增加

- 扩大新兴国家的智慧电网普及率

- 市场限制

- 新冠疫情对供应链配送的影响

第六章 市场细分

- 按类型

- 单相整流器

- 三相整流器

- 按范围

- 0.5-3.0安培

- 3.1 至 35 安培

- 35 安培或以上

- 按应用

- 电力和公共事业

- 车

- 资讯科技/电信

- 家电

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Vishay Intertechnology, Inc.

- Semiconductor Components Industries, LLC

- Diodes Incorporated

- STMicroelectronics

- Comchip Technology Co., Ltd.

- Microchip Technologies

- Infineon Technologies AG

- ASI Semiconductor, Inc

- SHINDENGEN ELECTRIC MANUFACTURING CO., LTD.

- Micro Commercial Components(MCC)

- Vicor Corporation

- Toshiba Corporation

- ROHM CO., LTD.

- PANJIT International Inc.

- Semiconductor Components Industries, LLC

第八章投资分析

第九章:市场的未来

The Global Rectifier Market is expected to register a CAGR of 10.61% during the forecast period.

Rectifiers are commonly used as circuit guards to prevent supply voltage reversal in electronic components due to human error. Furthermore, the increased use of high-frequency rectification and better energy efficiency in consumer devices such as laptops, cellphones, and PCs boosts market development.

The increasing sales of consumer electronic products further support the studied market's growth. For instance, according to the Retailers Association of India, in the third quarter of FY21, sales of consumer electronics and appliances increased by 23.5%, as compared with the same period in the last fiscal year.

The growing use of vehicle electronics such as automotive central body control, sophisticated electric power steering, brake systems, charging, and seat control is favorably boosting market development. Other factors, such as rising electronic component downsizing and the adoption of different government efforts on modern power distribution and generating infrastructure, are projected to drive the market forward.

However, factors such as technical issues, including distorted input line current due to harmonic contents and high costs associated with semiconductor rectifiers, are challenging the growth of the studied market.

COVID-19 has impacted the global supply chain of major electronic brands. China is one of the largest producers and exporters of various electronics input supplies such as rectifiers, capacitors, diodes, etc. Due to the continuous production standstill in China, several electronic manufacturers in the United States and Europe have been compelled to halt production manufacturing of finished items, resulting in a demand-supply gap in electronic products.

Rectifier Market Trends

Automotive Segment to Hold Significant Market Share

One of the major end-user for the rectifier industry is automotive. The rectifier market is being influenced by the automobile industry's rising technical improvements as cars using traditional IC engines require only a few electrical components.

The majority of the market's vendors are boosting their investments in the automobile industry, owing to the rising adoption of electric vehicles (EVs) and autonomous vehicle technology. As rectifiers are increasingly being used in the On-Board Charging and Battery Management Systems (BMS) of electric vehicles (EVs), the demand is expected to grow. Additionally, government regulations for mandatory (Advanced Driver Assistant System) ADAS systems and the rising adoption of smart technologies for automotive manufacturing are also supporting the growth of the studied market.

For instance, according to the IEA, worldwide sales of electric automobiles had reached 6.6 million in 2021. Electric vehicles accounted for 9% of all vehicle sales worldwide.

While the number of Battery Electric Vehicles (BEV) sold worldwide is still small, technological advancements, charging infrastructure development, and the variety of BEV models available may continue to rise faster than the entire vehicle industry. Even if total car sales stay unchanged, this rise may drive rectifier usage.

To respond to the growing demand for eco-friendly solutions, most countries are promoting the use of electric automobiles. For instance, the EU has set up an ambitious goal to become a climate-neutral continent by 2050. This is evident from the fact that the EU recently announced a EUR 750 billion stimulus package, including EUR 20 billion, to boost the sales of clean vehicles.

Additionally, the EU is also planning to install about 1 million electric and hydrogen vehicle charging stations by 2025 as rectifiers play an important role in EV chargers. Such trends are expected to support the growth of the studied market.

Asia-Pacific Region to Witness Significant Growth

The Asia-Pacific is among the fastest-growing rectifier market, owing to the significant rise in demand for rectifier-based electronic components and renewable energy products in the automotive industry across the region.

With a significant presence of local enterprises, China is one of the leading manufacturers of rectifiers. Furthermore, Chinese rectifier producers have been quickly expanding during the past several years while focusing on the supply of consumer electronic products.

According to the International Energy Agency, electric cars would account for 70% of global vehicle sales in 2030 and 42% in China, excluding two- and three-wheelers. Additionally, Japan will retain 21% of the EV market, followed by Europe with 26% and United Kindom with 57%, by 2030.

Various governments are framing several regulations across the Asia Pacific region to promote the use of electric vehicles, which is creating a favorable market scenario for the growth of the studied market. For instance, the Chinese government has already begun to phase out diesel fuel used in the latest commercial vehicles, such as trucks. By 2040, the country intends to eliminate all diesel and gasoline automobiles.

Furthermore, according to Business Korea, the continuing trade war between China and the United States is affecting Korean rectifier manufacturers such as Samsung Electro-Mechanics, which relies on China for 40% of its revenues.

Many businesses are establishing manufacturing facilities in Asia-Pacific in response to rising demand for rectifiers and other essential consumer electronics items from China, the Republic of Korea, India, and Singapore. The vast supply of raw materials and inexpensive startup and labor costs are supporting factors for enterprises in establishing manufacturing facilities in this region.

Rectifier Industry Overview

The Global Rectifier Market is competitive owing to the presence of several rectifier manufacturers providing the product. The vendors continuously invest in product and technology innovations to further expand their market presence. Additionally, the vendors are also acquiring other companies that specifically deal with these products to boost the market's share. Some of the major players operating in the market include Vishay Intertechnology, Inc., Semiconductor Components Industries, LLC, Diodes Incorporated, and STMicroelectronics.

April 2022 - Diodes Incorporated launched a new set of high Schottky rectifiers in ultra-compact chip size packaging (CSPs). According to the company, the DIODES SDM5U45EP3 (5A, 45V), DIODESTM SDM4A40EP3 (4A, 40V), and DIODES SDT4U40EP3 (4A, 40V) reach the greatest current densities in their class in the industry and meet market needs for smaller and more powerful electronic systems.

April 2022 - Diodes Incorporated launched The DIODES APR34910, a low secondary-side synchronous rectifier switch that can be found in power adaptors for cellphones, laptops, and set-top boxes. The APR34910 lowers secondary-side rectifier power losses, boosts efficiency, and delivers a high-performance solution with its low 10mΩ RDS(ON) and 100V N channel MOSFET.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand For Rectifier Diodes for Various Applications in the Automotive Sector

- 5.1.2 Growth in Deployment of Smart Grids Across the Developing Countries

- 5.2 Market Restraints

- 5.2.1 Affect in Supply Chain Distribution Due to Covid-19 Pandemic

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Single Phase Rectifier

- 6.1.2 Three Phase Rectifier

- 6.2 By Range

- 6.2.1 0.5 - 3.0 Amps

- 6.2.2 3.1 - 35 Amps

- 6.2.3 Above 35 Amps

- 6.3 By Application

- 6.3.1 Power & Utility

- 6.3.2 Automotive

- 6.3.3 IT/Telecom

- 6.3.4 Consumer Electronics

- 6.3.5 Others

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Middle-East and Africa

- 6.4.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vishay Intertechnology, Inc.

- 7.1.2 Semiconductor Components Industries, LLC

- 7.1.3 Diodes Incorporated

- 7.1.4 STMicroelectronics

- 7.1.5 Comchip Technology Co., Ltd.

- 7.1.6 Microchip Technologies

- 7.1.7 Infineon Technologies AG

- 7.1.8 ASI Semiconductor, Inc

- 7.1.9 SHINDENGEN ELECTRIC MANUFACTURING CO., LTD.

- 7.1.10 Micro Commercial Components (MCC)

- 7.1.11 Vicor Corporation

- 7.1.12 Toshiba Corporation

- 7.1.13 ROHM CO., LTD.

- 7.1.14 PANJIT International Inc.

- 7.1.15 Semiconductor Components Industries, LLC