|

市场调查报告书

商品编码

1750285

土聚物水泥市场机会、成长动力、产业趋势分析及2025-2034年预测Geopolymer Cement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

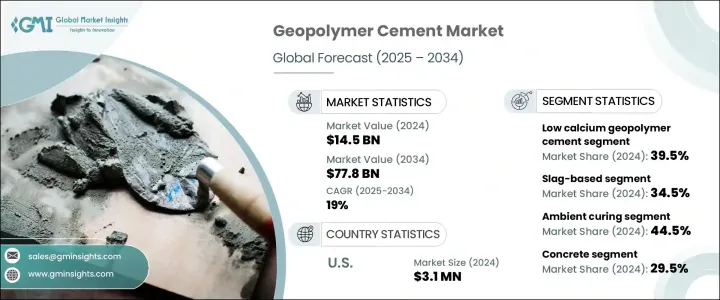

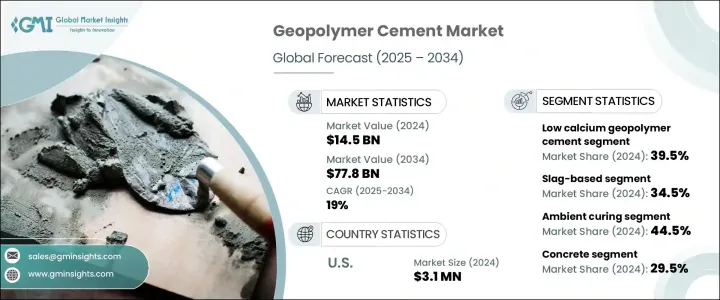

2024 年全球土聚物水泥市场规模为 145 亿美元,预计到 2034 年将以 19% 的复合年增长率增长至 778 亿美元。随着建筑业转向环保实践,低排放材料的吸引力持续成长。这一趋势在很大程度上受到应对气候变迁和遵守不断发展的环境法规日益紧迫的影响。随着各国政府推出更严格的永续发展规定,各行各业都在积极寻求更干净、更高性能的传统建筑材料替代品。土聚物水泥因其低碳足迹而脱颖而出,与传统波特兰水泥相比,其碳排放量可减少高达 90%。它不仅提供了更永续的解决方案,还具有卓越的机械和化学性能,使其成为基础设施建设的首选。各行各业都在推动脱碳,这推动了对支持长期生态目标的创新材料的需求,而土聚物水泥凭藉其能源效率和减少对原始原材料的依赖而符合这一要求。

除了监管压力之外,全球城市化进程的加速也推动了对耐用且经济高效的建筑材料的需求。随着世界各地,尤其是发展中国家的快速发展,对交通网络、商业空间和住宅项目的投资也激增。土聚物水泥因其满足现代建筑的技术和环境要求而日益受到市场青睐。其耐极端天气条件和持久耐用性使其特别适用于高应力应用。永续建筑规范的日益普及以及绿建筑激励措施的出台,进一步支持了市场扩张。随着各行各业和政府寻求符合循环经济目标的可靠替代方案,土聚物水泥正逐渐成为市场领跑者。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 145亿美元 |

| 预测值 | 778亿美元 |

| 复合年增长率 | 19% |

成本效益是该材料日益普及的关键因素。土聚物水泥利用粉煤灰和高炉矿渣等工业废料,降低了总生产成本,同时最大限度地减少了生产过程中的能耗。这些原材料通常来自其他工业流程,从而形成了一个支持永续发展目标的闭环系统。除了较低的生产成本外,该材料还具有出色的耐热性和耐化学性,使其成为满足各种建筑需求的经济环保的选择。

2024年,低钙土聚物水泥占了最高的市场份额,占全球收入的39.5%。此类水泥主要来自粉煤灰,以其优异的耐热性、化学稳定性和较低的环境影响而闻名。这些特性使其成为极端条件下高性能应用的首选。在原料方面,粉煤灰基和矿渣基水泥合计占据了整个市场的34.5%。这些材料不仅易于获取,而且具有优异的抗压强度和长期耐久性。利用这些材料有助于减少垃圾掩埋和温室气体排放,符合全球永续发展目标。

固化技术显着影响土聚物水泥的性能和适用性。 2024年,常温固化占据主导地位,市占率为44.5%。这种方法因其能耗低、工艺简便而备受青睐,是一般建筑和维护工作的理想选择。对于时间紧迫或结构要求高的项目,热固化是首选,因为它可以提高强度并缩短凝固时间。这两种技术都可根据项目规格灵活调整,从而拓宽了材料在各个领域的适用性。

从应用角度来看,混凝土以29.5%的市占率领先市场。土聚物混凝土具有优异的强度、低收缩性和高耐化学性,使其成为大型专案的首选材料。其符合绿色建筑标准,这增加了对寻求LEED认证或类似永续发展资质的承包商和开发商的吸引力。建筑和施工产业是2024年最大的终端使用产业,占了整个市场的34.5%。它在住宅、商业和工业环境中的广泛应用凸显了该材料的适应性以及在环保建筑实践中日益增长的重要性。

从地区来看,美国已成为领先市场,2024 年市场规模达 310 亿美元,占全球份额的 80% 以上。美国强劲的市场地位得益于不断增长的基础设施投资、严格的环境准则以及对永续发展日益增长的承诺。粉煤灰和矿渣等原料的便利取得也支持了美国国内的生产和应用,从而减少了供应链挑战并降低了碳排放。由于优惠的政策和永续建筑材料的技术进步,美国市场持续成长。

土聚物水泥市场的领导者正大力投入研发,以改善配方并提升产品性能。这些企业专注于专有技术和新一代製造工艺,旨在提供一致的品质并提升应用灵活性。他们不断创新,同时拓展分销网络,这使其能够满足多样化的客户需求,并在不断变化的全球格局中保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 市场介绍

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传输至终端市场。

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计资料(HS 编码) 註:以上贸易统计仅提供重点国家。

- 主要出口国

- 主要进口国

- 产业价值链分析

- 利润率分析

- 产品概述

- 地质聚合物化学与形成

- 与波特兰水泥的比较

- 环境效益和碳足迹

- 机械性能和性能特征

- 耐久性和抵抗性

- 凝固时间和可加工性

- 限制和挑战

- 市场动态

- 市场驱动因素

- 环境法规和永续发展措施。

- 基础设施建设不断增长,尤其是在新兴经济体。

- 与传统水泥相比具有成本优势,包括减少二氧化碳排放和能源消耗。

- 市场限制

- 煤炭、钢铁等重点业经营状况下滑。

- 某些应用领域的技术限制,限制了更广泛的使用。

- 承包商和建筑商缺乏意识和技术知识。

- 市场机会

- 越来越重视绿建筑材料。

- 对耐用和高效能基础设施解决方案的需求不断增长。

- 地质聚合物配方的技术进步。

- 市场挑战

- 标准化和认证问题。

- 来自现有水泥类型的竞争。

- 与传统水泥具有成本竞争力。

- 市场驱动因素

- 产业衝击力

- 成长潜力分析

- 产业陷阱与挑战

- 监管框架和标准

- 建筑规范及施工标准

- 环境法规

- 碳定价与排放交易

- 绿建筑认证

- 废弃物利用政策

- 製造流程分析

- 原料准备

- 碱性活化剂生产

- 混合和配方

- 固化方法

- 品质控製程式

- 原料分析与采购策略

- 定价分析

- 永续性和环境影响评估

- 杵分析

- 波特五力分析

第四章:竞争格局

- 市占率分析

- 战略框架

- 併购

- 合资与合作

- 新产品开发

- 扩张策略

- 竞争基准测试

- 供应商格局

- 竞争定位矩阵

- 战略仪表板

- 专利分析与创新评估

- 新参与者的市场进入策略

- 研发强度分析

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 低钙土聚水泥

- 高钙土聚水泥

- 磷酸盐基土聚物水泥

- 硅酸盐基土聚物水泥

- 其他的

第六章:市场估计与预测:依原料来源,2021 - 2034 年

- 主要趋势

- 粉煤灰基

- F级粉煤灰

- C类粉煤灰

- 其他粉煤灰类型

- 矿渣基

- 磨细粒化高炉矿渣(GGBFS)

- 其他矿渣类型

- 偏高岭土基

- 天然铝硅酸盐基

- 赤泥基

- 混合系统

- 其他的

第七章:市场估计与预测:按固化方法,2021 - 2034 年

- 主要趋势

- 室温固化

- 热固化

- 蒸气养护

- 其他的

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 具体的

- 预拌混凝土

- 预製混凝土

- 其他具体应用

- 砂浆和灌浆

- 预製构件

- 积木和砖块

- 板材和板坯

- 管道和柱子

- 其他预製构件

- 路面和覆盖层

- 修復与康復

- 废物封装和固定化

- 其他应用

第九章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 建筑与施工

- 住宅

- 商业的

- 工业的

- 基础设施

- 道路和桥樑

- 水坝和水资源管理

- 机场和港口

- 其他基础设施

- 石油和天然气

- 矿业

- 海洋与水下建筑

- 核与废料管理

- 其他的

第十章:市场估计与预测:按性能属性,2021 - 2034 年

- 主要趋势

- 高强度

- 耐化学性

- 防火

- 低收缩

- 快速设定

- 其他性能属性

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十二章:公司简介

- Alchemy Geopolymer Solutions, LLC

- Banah UK Ltd.

- BASF SE

- CEMEX SAB de CV

- Ceratech Inc.

- Concrete Canvas Ltd.

- Dow Chemical Company

- GCP Applied Technologies Inc.

- Geobeton Pty Ltd.

- Geopolymer Products

- Geopolymer Solutions, LLC

- Halliburton

- Imerys SA

- Kiran Global Chems Limited

- LafargeHolcim Ltd.

- Metna Co.

- Milliken Infrastructure Solutions, LLC

- Nu-Core

- PCI Augsburg GmbH

- Pyromeral Systems

- Reno Refractories, Inc.

- Rocla Pty Limited

- Schlumberger Limited

- Sika AG

- Siloxo Pty Ltd.

- Tech-Crete Processors Ltd.

- Uretek Worldwide

- Wagners

- Wollner GmbH

- Zeobond Pty Ltd.

The Global Geopolymer Cement Market was valued at USD 14.5 billion in 2024 and is estimated to grow at a CAGR of 19% to reach USD 77.8 billion by 2034. As the construction industry shifts toward environmentally responsible practices, the appeal of low-emission materials continues to grow. This trend is largely influenced by the increasing urgency to combat climate change and comply with evolving environmental regulations. As governments introduce stricter sustainability mandates, industries are actively seeking cleaner, high-performance alternatives to traditional construction materials. Geopolymer cement stands out in this regard due to its low carbon footprint, generating up to 90% fewer carbon emissions compared to conventional Portland cement. It offers not only a more sustainable solution but also superior mechanical and chemical properties, making it a preferred choice in infrastructure development. The push for decarbonization across sectors is driving demand for innovative materials that support long-term ecological goals, and geopolymer cement fits the bill with its energy efficiency and reduced reliance on virgin raw materials.

In addition to regulatory pressures, rising global urbanization is fueling the need for durable and cost-effective building materials. As development accelerates in various parts of the world, especially in growing economies, investment in transport networks, commercial spaces, and residential projects is surging. Geopolymer cement is gaining market traction as it meets both the technical and environmental demands of modern construction. Its resistance to extreme weather conditions and long-lasting durability make it particularly suitable for high-stress applications. The increasing adoption of sustainable building codes and incentives for green construction is further supporting market expansion. As industries and governments seek reliable alternatives that align with circular economy goals, geopolymer cement is emerging as a frontrunner.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.5 Billion |

| Forecast Value | $77.8 Billion |

| CAGR | 19% |

Cost efficiency plays a crucial role in the material's growing popularity. Geopolymer cement leverages industrial waste products like fly ash and blast furnace slag, which reduces the overall production cost while also minimizing energy consumption during manufacturing. These raw materials are often sourced from other industrial processes, creating a closed-loop system that supports sustainability goals. Alongside its lower production expenses, the material delivers excellent resistance to heat and chemicals, making it an economically and environmentally viable option for a wide range of construction needs.

In 2024, low calcium geopolymer cement captured the highest market share, accounting for 39.5% of global revenue. This type is primarily derived from fly ash and is recognized for its strong thermal resistance, chemical stability, and reduced environmental impact. These attributes make it a preferred choice in applications requiring high performance under extreme conditions. On the raw material front, the combined share of fly ash-based and slag-based segments reached 34.5% of the total market. These materials are not only readily accessible but also deliver excellent compressive strength and long-term durability. Their utilization contributes to reducing landfill waste and greenhouse gas emissions, aligning with global sustainability targets.

Curing techniques significantly influence the performance and applicability of geopolymer cement. In 2024, ambient curing held the dominant position, with a market share of 44.5%. This method is favored for its low energy requirement and simplified process, which makes it ideal for general construction and maintenance work. For time-sensitive or structurally demanding projects, heat curing is preferred as it enhances strength and reduces setting time. Both techniques offer flexibility depending on project specifications, broadening the material's applicability across sectors.

From an application perspective, concrete led the market with a 29.5% share. Geopolymer concrete offers excellent strength, low shrinkage, and high chemical resistance, making it a go-to material for large-scale projects. Its compliance with green building standards adds to its appeal among contractors and developers seeking LEED certifications or similar sustainability credentials. The building and construction sector represented the largest end-use industry in 2024, holding 34.5% of the total market. Its widespread use in residential, commercial, and industrial settings highlights the material's adaptability and growing importance in eco-conscious construction practices.

Regionally, the United States emerged as the leading market, valued at USD 3.1 million in 2024 and accounting for over 80% of the global share. The country's strong position is supported by rising infrastructure investment, strict environmental guidelines, and a growing commitment to sustainable development. Easy access to raw materials such as fly ash and slag also supports domestic production and adoption, reducing supply chain challenges and lowering carbon impact. The US market continues to grow due to favorable policies and technological advancements in sustainable building materials.

Leading companies in the geopolymer cement market are investing heavily in research and development to refine formulations and improve product performance. By focusing on proprietary technologies and next-generation manufacturing methods, these players aim to deliver consistent quality and enhance application flexibility. Their efforts to innovate while expanding distribution networks are enabling them to address varied customer needs and maintain a competitive edge in an evolving global landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research Methodology

- 1.2 Research Objectives

- 1.3 Market Definition and Scope

- 1.4 Market Segmentation

- 1.5 Data Sources

- 1.5.1 Primary Research

- 1.5.2 Secondary Research

- 1.6 Market Estimation Approach

- 1.7 Research Assumptions and Limitations

- 1.8 Base Year and Forecast Period

Chapter 2 Executive Summary

- 2.1 Market Snapshot

- 2.2 Segment Highlights

- 2.3 Competitive Landscape Snapshot

- 2.4 Regional Market Outlook

- 2.5 Key Market Trends

- 2.6 Future Market Outlook

Chapter 3 Industry Insights

- 3.1 Market Introduction

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1.1 Supply-side impact (raw materials)

- 3.2.2.1.2 Price volatility in key materials

- 3.2.2.1.3 Supply chain restructuring

- 3.2.2.1.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets.

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Industry value chain analysis

- 3.5 Profit margin analysis

- 3.6 Product overview

- 3.6.1 Geopolymer chemistry & formation

- 3.6.2 Comparison with Portland cement

- 3.6.3 Environmental benefits & carbon footprint

- 3.6.4 Mechanical properties & performance characteristics

- 3.6.5 Durability & resistance properties

- 3.6.6 Setting time & workability

- 3.6.7 Limitations & challenges

- 3.7 Market dynamics

- 3.7.1 Market drivers

- 3.7.1.1 Environmental regulations and sustainability initiatives.

- 3.7.1.2 Growing infrastructure development, particularly in emerging economies.

- 3.7.1.3 Cost advantages over traditional cement, including reduced CO2 emissions and energy consumption.

- 3.7.2 Market restraints

- 3.7.2.1 Declining operations in key industries like coal and steel.

- 3.7.2.2 Technical limitations in certain applications, restricting wider use.

- 3.7.2.3 Lack of awareness and technical knowledge among contractors and builders.

- 3.7.3 Market opportunities

- 3.7.3.1 Increasing focus on green building materials.

- 3.7.3.2 Rising demand for durable and high-performance infrastructure solutions.

- 3.7.3.3 Technological advancements in geopolymer formulations.

- 3.7.4 Market challenges

- 3.7.4.1 Standardization and certification issues.

- 3.7.4.2 Competition from established cement types.

- 3.7.4.3 Cost competitiveness with conventional cement.

- 3.7.1 Market drivers

- 3.8 Industry impact forces

- 3.8.1 Growth potential analysis

- 3.8.2 Industry pitfalls & challenges

- 3.9 Regulatory framework & standards

- 3.9.1 Building codes & construction standards

- 3.9.2 Environmental regulations

- 3.9.3 Carbon Pricing & Emissions Trading

- 3.9.4 Green building certifications

- 3.9.5 Waste material utilization policies

- 3.10 Manufacturing process analysis

- 3.10.1 Raw material preparation

- 3.10.2 Alkaline activator production

- 3.10.3 Mixing & formulation

- 3.10.4 Curing methods

- 3.10.5 Quality control procedures

- 3.11 Raw material analysis & procurement strategies

- 3.12 Pricing analysis

- 3.13 Sustainability & environmental impact assessment

- 3.14 Pestle analysis

- 3.15 Porter's five forces analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Patent analysis & innovation assessment

- 4.8 Market entry strategies for new players

- 4.9 Research & development intensity analysis

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Low calcium geopolymer cement

- 5.3 High calcium geopolymer cement

- 5.4 Phosphate-based geopolymer cement

- 5.5 Silicate-based geopolymer cement

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Raw Material Source, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fly Ash-Based

- 6.2.1 Class F fly ash

- 6.2.2 Class C fly ash

- 6.2.3 Other fly ash types

- 6.3 Slag-Based

- 6.3.1 Ground granulated blast furnace slag (GGBFS)

- 6.3.2 Other slag types

- 6.4 Metakaolin-based

- 6.5 Natural aluminosilicate-based

- 6.6 Red mud-based

- 6.7 Hybrid & blended systems

- 6.8 Others

Chapter 7 Market Estimates and Forecast, By Curing Method, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Ambient curing

- 7.3 Heat curing

- 7.4 Steam curing

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Concrete

- 8.2.1 Ready-mix concrete

- 8.2.2 Precast concrete

- 8.2.3 Other concrete applications

- 8.3 Mortar & grouts

- 8.4 Precast elements

- 8.4.1 Blocks & bricks

- 8.4.2 Panels & slabs

- 8.4.3 Pipes & columns

- 8.4.4 Other precast elements

- 8.5 Pavements & overlays

- 8.6 Repair & rehabilitation

- 8.7 Waste encapsulation & immobilization

- 8.8 Other applications

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Building & construction

- 9.2.1 Residential

- 9.2.2 Commercial

- 9.2.3 Industrial

- 9.3 Infrastructure

- 9.3.1 Roads & bridges

- 9.3.2 Dams & water management

- 9.3.3 Airports & ports

- 9.3.4 Other infrastructure

- 9.4 Oil & gas

- 9.5 Mining

- 9.6 Marine & underwater construction

- 9.7 Nuclear & waste management

- 9.8 Others

Chapter 10 Market Estimates and Forecast, By Performance Attribute, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 High strength

- 10.3 Chemical resistance

- 10.4 Fire resistance

- 10.5 Low shrinkage

- 10.6 Rapid setting

- 10.7 Other performance attributes

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.2.3 Mexico

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 Alchemy Geopolymer Solutions, LLC

- 12.2 Banah UK Ltd.

- 12.3 BASF SE

- 12.4 CEMEX S.A.B. de C.V.

- 12.5 Ceratech Inc.

- 12.6 Concrete Canvas Ltd.

- 12.7 Dow Chemical Company

- 12.8 GCP Applied Technologies Inc.

- 12.9 Geobeton Pty Ltd.

- 12.10 Geopolymer Products

- 12.11 Geopolymer Solutions, LLC

- 12.12 Halliburton

- 12.13 Imerys S.A.

- 12.14 Kiran Global Chems Limited

- 12.15 LafargeHolcim Ltd.

- 12.16 Metna Co.

- 12.17 Milliken Infrastructure Solutions, LLC

- 12.18 Nu-Core

- 12.19 PCI Augsburg GmbH

- 12.20 Pyromeral Systems

- 12.21 Reno Refractories, Inc.

- 12.22 Rocla Pty Limited

- 12.23 Schlumberger Limited

- 12.24 Sika AG

- 12.25 Siloxo Pty Ltd.

- 12.26 Tech-Crete Processors Ltd.

- 12.27 Uretek Worldwide

- 12.28 Wagners

- 12.29 Wollner GmbH

- 12.30 Zeobond Pty Ltd.