|

市场调查报告书

商品编码

1687202

无机聚合物:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Geopolymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

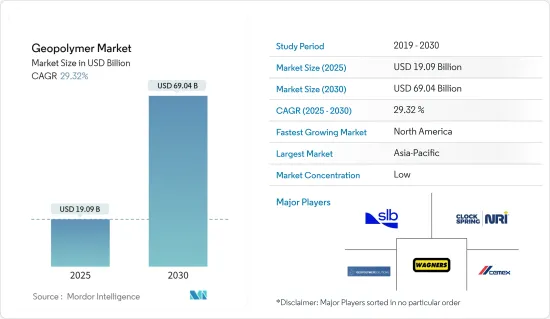

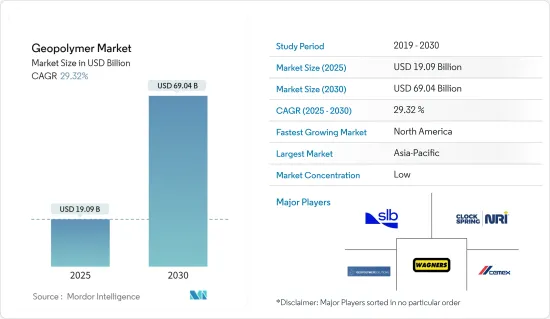

预计 2025 年无机聚合物市场规模为 190.9 亿美元,到 2030 年将达到 690.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 29.32%。

COVID-19 的爆发无机聚合物业务产生了不利影响。建筑业是受打击最严重的行业之一,由于工人短缺以及政府为防止2020年疫情蔓延而出台的严格标准,在建计划被迫停止,所有新计画也被推迟。然而,由于建筑建设活动的活性化,预计2021年市场将稳定成长。

关键亮点

- 短期内,水泥产业的环境法规和排放负担以及修復和恢復市场不断增长的需求是推动研究市场成长的关键因素。

- 然而,缺乏统一的法规和标准是预测期内减缓产业成长的主要因素之一。

- 儘管如此,消费者越来越意识到无机聚合物产品的好处,这可能在不久的将来为全球市场带来成长机会。

- 亚太地区的建设活动日益增多,占据着全球市场的主导地位。

无机聚合物市场趋势

建筑业占市场主导地位

- 无机聚合物在建筑施工中的使用发挥重要作用。全球迅速扩张的建设活动和不断增长的人口向大气中释放了大量的温室气体,对环境造成了重大影响。随着水泥生产和其他方法产生的温室气体排放对环境的影响越来越大,无机聚合物在建筑整体的建材中具有开发和使用的空间。

- 近年来,建筑业经历了快速成长。根据世界银行预测,2020年全球建筑业规模将达22.36兆美元,2021年将成长至27.18兆美元。

- 建筑业绿色技术的发展可以追溯到几年前。近年来,全球环保意识不断增强,除了建筑材料的技术特性外,人们也积极评估其对环境的影响。

- 无机聚合物混凝土、无机聚合物水泥、黏合剂、无机聚合物砖和板材等多种类型的无机聚合物材料因其多功能特性(包括减少温室气体和节约能源)而被用于建筑施工。

- 无机聚合物在建筑领域的最新应用包括 2021 年 1 月在伦敦竖立的首根桩。这些桩采用瓦格纳地球友善混凝土(EFC) 製造,EFC 是无机聚合物的领先製造商之一,与英国两家领先公司 Keltbray Group 和 Capital Concrete 合作。

- 再在澳大利亚,昆士兰大学的全球变迁实验室(GCI)由 Hassell 与 Bligh Tanner 和 Wagners 合作设计,是世界上第一座使用无机聚合物混凝土作为结构材料的建筑。

- 此外,随着无机聚合物在建筑施工中的使用越来越多,公众和政府越来越意识到使用无机聚合物混凝土的好处。这与图文巴威尔坎普机场有关,该机场使用了大部分无机聚合物混凝土。

- 总体而言,无机聚合物在建筑施工中的使用正在增加。因为无机聚合物有很多优点。

中国主导亚太市场

- 在亚太地区,由于建设活动的活性化和对建筑材料的需求增加,中国占据了全球市场占有率的主导地位。

- 为加速经济成长以弥补疫情期间的损失,中国财政部和国家发展部计划在 2022 年第三季投资 5,000 亿元人民币(718.6 亿美元),设立国家基础设施基金,旨在增加基础设施支出。

- 此外,中国也正在扩建 30 个机场,以改善与中国第四大国际枢纽成都天府国际机场的连结性。

- 根据中国民航局介绍,中国第一个三年计画包括在2020年扩大低收入地区的航空运输服务,以减轻贫困。未来五年(至2025年),中国将投资1.43兆美元用于特高压能源计划、巨量资料中心、高速铁路、城际线路和车站、5G基地台、电动车充电站等一系列重大建设计划。

- 据国家发展和改革委员会称,上海计划在未来三年投资 387 亿美元。

- 此外,中国计划在未来五年内(到2025年)兴建5G基地台500万个,是目前数量的25倍。这些大型基础设施建设计划正在推动中国对无机聚合物的需求。

- 该国也正在推动2020年动工的公路计划,包括投资16.1亿美元的广南讷沙至夏侯兴街市之间的高速公路、投资18.6亿美元的澄江至华宁市之间的高速公路以及投资15.4亿美元的广南省曲北至燕山市之间的高速公路,预计2023年竣工。

- 此外,贵州省纳雍至晴隆、柳江至安龙两条新高速公路计划的投资额达86.8亿美元,预计将对中国无机聚合物市场产生正面影响。

- 预计这将增加该国的住宅,进而对该国的无机聚合物市场产生正面影响。

无机聚合物产业概况

无机聚合物市场高度分散。无机聚合物市场的主要企业包括 Wagners、Geopolymer Solutons LLC、SLB、ClockSpring|NRI、CEMEX SAB de CV 等(不分先后顺序)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 环境法规和排放给水泥业带来压力。

- 修復和修復市场需求不断增长

- 限制因素

- 缺乏统一的标准和规定

- COVID-19疫情造成的不利状况

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 产品类型

- 水泥、混凝土、预铸面板

- 水泥浆和黏合剂

- 其他的

- 应用

- 建筑学

- 道路和人行道

- 跑道

- 管道和混凝土修復

- 桥樑

- 隧道衬砌

- 铁路枕木

- 涂层应用

- 防火涂料

- 核废料和其他危险废弃物的固化

- 特定模具产品

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 其他的

- 南美洲

- 中东和非洲

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Banah UK Ltd

- CEMEX SAB de CV

- Ceskych Lupkovych Zavodech AS

- ClockSpring|NRI

- Geopolymer Solutions LLC

- IPR

- Murray & Roberts

- PCI Augsburg GMBH

- Rocla Pty Limited

- Schlumberger Limited

- Wagners

- Zeobond Pty Ltd

第七章 市场机会与未来趋势

- 提高消费者对无机聚合物产品益处的认知

The Geopolymer Market size is estimated at USD 19.09 billion in 2025, and is expected to reach USD 69.04 billion by 2030, at a CAGR of 29.32% during the forecast period (2025-2030).

The introduction of COVID-19 had a negative influence on the geopolymer business. The construction industry was one of the hardest hit, with ongoing projects halted and all new projects postponed due to a shortage of workers and government-imposed rigorous standards aimed at preventing the spread of the disease by the year 2020. However, the market is projected to grow steadily, owing to increased building and construction activities in 2021.

Key Highlights

- Over the short term, environmental regulations and emission strain on the cement industry and higher demand from the repair and rehabilitation market are major factors driving the growth of the market studied.

- But the lack of uniform rules and standards is one of the main things that is expected to slow the growth of the target industry during the forecast period.

- Still, consumers are becoming more aware of the benefits of geopolymer products, which is likely to lead to growth opportunities for the global market in the near future.

- With rising construction activity in the region, Asia-Pacific dominated the global market.

Geopolymer Market Trends

Building Segment to Dominate the Market

- The use of geopolymers in building construction has a vital role. Due to the rapidly growing construction activities and the overgrowing population across the world, large amounts of greenhouse gases are being emitted into the atmosphere, causing a huge environmental impact. With the increasing impact of greenhouse gases on the environment emitted either during cement manufacturing or in other alternate ways, the overall construction of building materials has created scope for the development and use of geopolymers in building construction.

- It has been noted that the building and construction sector has experienced rapid growth in the past few years. According to the World Bank, the value of the global construction industry reached USD 22.36 trillion in 2020 and registered growth compared to USD 27.18 trillion in 2021.

- The development of green technology in the construction industry dates back years. The increase in environmental awareness in recent years around the world has led to a positive assessment of the environmental impact of building materials in addition to their technical properties.

- Several types of geopolymer materials, such as geopolymer concrete, geopolymer cement, binders, geopolymer bricks, panels, and many others, are being used during building construction, owing to their versatile properties in reducing greenhouse emissions as well as energy savings.

- One of the recent applications of geopolymers in the building is cited as the first ever pile constructed in London, dated January 2021, using one of the leading geopolymer manufacturers, Wagner's Earth Friendly Concrete (EFC), by working with two leading UK firms, Keltbray Group and Capital Concrete.

- Additionally, in Australia, the University of Queensland's Global Change Institute (GCI), designed by Hassell in conjunction with Bligh Tanner and Wagners, is the world's first building to use geopolymer concrete for structural purposes.

- Moreover, with such growing usage of geopolymers in building construction, awareness has been growing among the public and governments over the advantages of using geopolymer concrete, and this can be related to Toowoomba Wellcamp Airport, in which mostly geopolymer concrete was used; approximately 23.000 m3 were used.

- Overall, the use of geopolymers in building construction has been growing. This is because geopolymers have a lot of benefits.

China to Dominate the Asia-Pacific Market

- In the Asia-Pacific region, China dominated the global market share with growing construction activities and increasing demand for construction materials.

- To fasten up its economic growth to recover the losses during the pandemic period, China's Ministry of Finance and National Development has planned to invest CNY 500 billion (USD 71.86 billion) in building up a state infrastructure fund in the third quarter of 2022, aimed at promoting infrastructure spending.

- Additionally, the country is working on the expansion of 30 airports to improve the connectivity to the country's fourth largest international hub Chengdu Tianfu International Airport.

- According to CAAC, China's 13th five-year plan include the expansion of air transportation services in low-income areas for poverty alleviation in 2020. The country is investing USD 1.43 trillion in the next five year till 2025, in major construction projects which includes ultra-high voltage energy projects, big data centers, high-speed railway, and intercity tracks & stations, 5G base stations, electric vehicle charging station, and various others.

- According to National Development and Reform Commission (NDRC), Shanghai plan includes the investment of USD 38.7 billion in the next three years, whereas Guangzhou has signed 16 new infrastructure projects with and investment of USD 8.09 billion.

- Additionally, the country is targeting to build five million 5G base stations in the next five years till 2025, a growth of 25 times from the current number of 5G base stations. These massive infrastructure development projects in the country are propelling the demand for geopolymers in China.

- The country is also working on road projects initiated in 2020 which include the construction of an expressway between the cities such as Guangnan Nasa and Xiahou Xingjie with an investment of USD 1.61 billion, Chengjiang and Huaning with an investment of USD 1.86 billion, and Quibei and Yanshan in Yunan province with an investment of USD 1.54 billion which are estimated to get completed in 2023.

- Additionally, the construction of two new highway projects connecting Nayong with Qinglong, andLiuzzii with Anlong in Guizhou Province with and investment of USD 8.68 billion is expected to positively impact the geopolymers market in China.

- Thereby, increasing the residential construction in the country which in turn will have a positive effect on the geopolymers market in the country.

Geopolymer Industry Overview

The geopolymer market is highly fragmented in nature. The major players in the geopolymers market are Wagners, Geopolymer Solutons LLC, SLB, ClockSpring|NRI, and CEMEX S.A.B. de C.V., among others (not in particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Environmental Regulations and Emission Strain on the Cement Industry

- 4.1.2 Higher Demand from the Repair and Rehabilitation Market

- 4.2 Restraints

- 4.2.1 Lack of Uniform Standards and Regulations

- 4.2.2 Unfavorable Conditions Arising Due to the COVID-19 Outbreak

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Cement, Concrete, and Precast Panel

- 5.1.2 Grout and Binder

- 5.1.3 Other Product Types

- 5.2 Application

- 5.2.1 Building

- 5.2.2 Road and Pavement

- 5.2.3 Runway

- 5.2.4 Pipe and Concrete Repair

- 5.2.5 Bridge

- 5.2.6 Tunnel Lining

- 5.2.7 Railroad Sleeper

- 5.2.8 Coating Application

- 5.2.9 Fireproofing

- 5.2.10 Nuclear and Other Toxic Waste Immobilization

- 5.2.11 Specific Mold Products

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Banah UK Ltd

- 6.4.2 CEMEX SAB de CV

- 6.4.3 Ceskych Lupkovych Zavodech AS

- 6.4.4 ClockSpring|NRI

- 6.4.5 Geopolymer Solutions LLC

- 6.4.6 IPR

- 6.4.7 Murray & Roberts

- 6.4.8 PCI Augsburg GMBH

- 6.4.9 Rocla Pty Limited

- 6.4.10 Schlumberger Limited

- 6.4.11 Wagners

- 6.4.12 Zeobond Pty Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Consumer Awareness Regarding Benefits of Geopolymer Products