|

市场调查报告书

商品编码

1750286

电致变色与液晶聚合物市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electrochromic and Liquid Crystal Polymer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

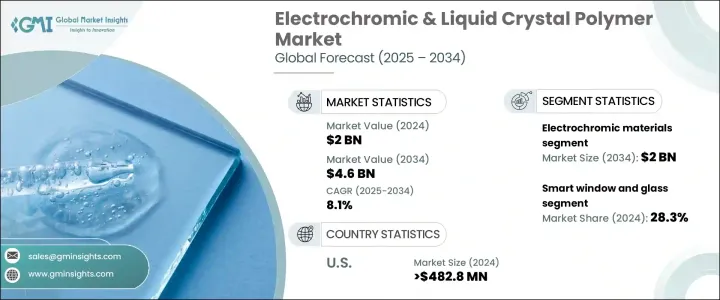

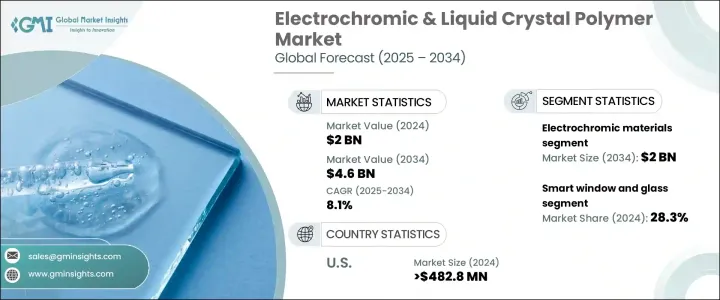

2024年,全球电致变色和液晶聚合物市场价值为20亿美元,预计到2034年将以8.1%的复合年增长率增长,达到46亿美元,这得益于汽车和建筑等行业对节能解决方案日益增长的需求。电致变色材料能够根据电讯号改变其光学特性,对于先进的窗户技术至关重要。智慧窗户对车辆和建筑物至关重要,它透过管理太阳能吸收和最大限度地减少眩光来实现能源优化。这有助于减少对空调的需求,与全球改善能源管理和降低温室气体排放的努力一致。随着各行各业寻求采用更多永续技术,电致变色材料在提高能源效率方面的作用不断扩大。

在汽车领域,这些材料用于后视镜和天窗,以提高驾驶员的舒适性和安全性。它们还促进了高级驾驶辅助系统 (ADAS) 和自动驾驶技术的发展。电致变色材料有助于保持车内最佳温度,从而有助于节能。电信和电子产业对高性能材料的需求也推动了液晶聚合物产品需求的不断增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 20亿美元 |

| 预测值 | 46亿美元 |

| 复合年增长率 | 8.1% |

2024年,电致变色材料市场规模达9.015亿美元,这得益于该材料在施加电压后能够改变颜色或透明度的多功能性,使其能够控制热量和光线穿过窗户、镜子和显示器。这些材料节能效果显着,是各种功能性和美观应用的理想选择。 PDLC(聚合物分散液晶)等更先进技术的开发,透过提供更多颜色选择和更高的能源效率,进一步提升了市场潜力。

智慧窗户和玻璃占据最大的应用领域,占28.3%。节能建筑和车辆的需求日益增长,推动了这一趋势,因为这些窗户能够自动调节光线和热量的流通。这减少了对人工照明和空调的依赖。在智慧窗户中整合电致变色或液晶元件有助于实现全球永续发展目标,同时提升高端住宅和商业房地产的舒适度和隐私。

2024年,美国电致变色和液晶聚合物市场规模达4.828亿美元。政府的激励措施,例如安装智慧玻璃的税收抵免,在推动商业和住宅建筑采用电致变色窗户方面发挥了关键作用。这些窗户可降低约20%的能耗,有助于减少碳排放,并支持向永续能源解决方案的过渡。

东丽工业、住友化学、索尔维、圣戈班和旭硝子等行业公司致力于透过投资研发来扩大市场份额。他们致力于提升电致变色产品的性能和价格,以满足各行各业日益增长的需求。此外,各公司也与建筑承包商和汽车製造商建立策略合作伙伴关係,以确保这些先进材料在新建筑和新车型中得到广泛应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 市场介绍

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要进口国

- 产业价值链分析

- 技术概述

- 电致变色材料

- 液晶聚合物

- 聚合物分散液晶(PDLC)

- 技术比较分析

- 市场动态

- 市场驱动因素

- 市场限制

- 市场机会

- 市场挑战

- 产业衝击力

- 成长潜力分析

- 产业陷阱与挑战

- 监管框架和标准

- 电致变色设备的 ASTM 标准

- 能源效率法规

- 建筑规范和认证

- 汽车业标准

- 製造流程分析

- 电致变色材料生产

- 液晶聚合物合成

- 装置製造技术

- 原料分析与采购策略

- 定价分析

- 永续性和环境影响评估

- 杵分析

- 波特五力分析

第四章:竞争格局

- 市占率分析

- 战略框架

- 併购

- 合资与合作

- 新产品开发

- 扩张策略

- 竞争基准测试

- 供应商格局

- 竞争定位矩阵

- 战略仪表板

- 技术采用与创新评估

- 新参与者的市场进入策略

第五章:市场规模及预测:依技术,2021-2034

- 主要趋势

- 电致变色材料

- 无机电致变色材料

- 有机电致变色材料

- 混合电致变色材料

- 液晶聚合物(LCP)

- 热致液晶多醣

- 溶致性LCPS

- 聚合物分散液晶(PDLC)

- 普通模式PDLC

- 反向模式PDLC

- 悬浮颗粒物检测装置(SPD)

- 其他

第六章:市场规模及预测:依应用,2021-2034

- 主要趋势

- 智慧窗户和玻璃

- 建筑窗户

- 汽车车窗和天窗

- 飞机窗户

- 船用窗户

- 电子元件

- 连接器

- 电路板

- 天线

- 微电子封装

- 显示器和视觉设备

- 智慧显示器

- 穿戴式显示器

- 标誌和资讯显示

- 汽车零件

- 镜子

- 照明系统

- 感测器和控制器

- 结构部件

- 医疗器材及设备

- 航太和国防应用

- 其他

第七章:市场规模及预测:依最终用途产业,2021-2034

- 主要趋势

- 建筑与建筑

- 住宅建筑

- 商业建筑

- 机构建筑

- 工业设施

- 汽车与运输

- 搭乘用车

- 商用车

- 电动车

- 铁路和公共交通

- 电子与电信

- 消费性电子产品

- 电信设备

- 运算和 IT 硬体

- 5G基础设施

- 航太与国防

- 医疗保健

- 能源与发电

- 其他的

第八章:市场规模及预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Saint-Gobain

- AGC

- Gentex Corporation

- Gauzy

- Halio

- ChromoGenics

- Polytronix

- Research Frontiers

- Celanese Corporation

- Solvay

- Toray Industries

- Sumitomo Chemical Company

- Kuraray

- Murata Manufacturing

- Chiyoda Integre

- RTP Company

- SABIC

- Ynvisible Interactive

- Crown Electrokinetics

- Smart Glass Group

- Smart Films International

- Corning Incorporated

- Continental

- Panasonic Holdings Corporation

The Global Electrochromic and Liquid Crystal Polymer Market was valued at USD 2 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 4.6 billion by 2034, driven by the increasing demand for energy-efficient solutions in industries like automotive and construction. Electrochromic materials, which change their optical properties in response to electrical signals, are essential for advanced window technologies. Smart windows are crucial in vehicles and buildings, enabling energy optimization by managing solar energy absorption and minimizing glare. This helps reduce the need for air conditioning, aligning with global efforts to improve energy management and lower greenhouse gas emissions. As industries seek to incorporate more sustainable technologies, the role of electrochromic materials continues to expand in improving energy efficiency.

In the automotive sector, these materials are used in rearview mirrors and sunroofs to enhance driver comfort and safety. They also contribute to the evolution of advanced driver-assistance systems (ADAS) and autonomous driving technologies. Electrochromic materials help maintain an optimal temperature inside vehicles, contributing to energy savings. The increasing demand for liquid crystal polymer products is also fueled by the telecommunications and electronics industries, where high-performance materials are required.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 8.1% |

The electrochromic materials segment generated USD 901.5 million in 2024, attributed to the materials' versatility in changing colors or transparency when voltage is applied, allowing them to control heat and light passage through windows, mirrors, and displays. These materials are highly energy-efficient, making them ideal for various applications in both functional and aesthetic settings. The development of more sophisticated technology, such as PDLC (polymer-dispersed liquid crystal), further enhances the market's potential by offering more color options and increased energy efficiency.

Smart windows and glass hold the largest application segment, representing 28.3% share. The increasing demand for energy-efficient buildings and vehicles has driven this trend, as these windows are capable of automatically regulating light and heat passage. This results in reduced reliance on artificial lighting and air conditioning. The integration of electrochromic or liquid crystal devices in smart windows helps meet global sustainability goals while also improving comfort and privacy in high-end residential and commercial real estate.

United States Electrochromic and Liquid Crystal Polymer Market generated USD 482.8 million in 2024. Government incentives like tax credits for installing smart glass have played a key role in promoting the adoption of electrochromic windows in commercial and residential buildings. These windows can reduce energy consumption by approximately 20%, contributing to reducing carbon emissions and supporting the transition toward sustainable energy solutions.

Companies in this industry, such as Toray Industries, Sumitomo Chemical Company, Solvay, Saint-Gobain, and AGC, focus on expanding their market share by investing in research and development. They are working on enhancing the performance and affordability of electrochromic products to meet the growing demand across various industries. Companies are also forging strategic partnerships with building contractors and vehicle manufacturers to ensure widespread adoption of these advanced materials in new constructions and vehicle models.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Report scope and objectives

- 1.2 Research design and approach

- 1.3 Data collection methods

- 1.3.1 Primary research

- 1.3.2 Secondary research

- 1.4 Market estimation and forecasting methodology

- 1.5 Assumptions and limitations

- 1.6 Data validation and triangulation techniques

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Market Introduction

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries, 2021-2024 (USD Mn)

- 3.3.2 Major importing countries, 2021-2024 (USD Mn)

- 3.4 Industry value chain analysis

- 3.5 Technology overview

- 3.5.1 Electrochromic materials

- 3.5.2 Liquid crystal polymers

- 3.5.3 Polymer dispersed liquid crystals (PDLC)

- 3.5.4 Comparative analysis of technologies

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.2 Market restraints

- 3.6.3 Market opportunities

- 3.6.4 Market challenges

- 3.7 Industry impact forces

- 3.7.1 Growth potential analysis

- 3.7.2 Industry pitfalls & challenges

- 3.8 Regulatory framework & standards

- 3.8.1 ASTM standards for electrochromic devices

- 3.8.2 Energy efficiency regulations

- 3.8.3 Building codes & certifications

- 3.8.4 Automotive industry standards

- 3.9 Manufacturing process analysis

- 3.9.1 Electrochromic materials production

- 3.9.2 Liquid crystal polymer synthesis

- 3.9.3 Device fabrication techniques

- 3.10 Raw material analysis & procurement strategies

- 3.11 Pricing analysis

- 3.12 Sustainability & environmental impact assessment

- 3.13 Pestle analysis

- 3.14 Porter's five forces analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Technology adoption & innovation assessment

- 4.8 Market entry strategies for new players

Chapter 5 Market Size and Forecast, By Technology, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Electrochromic materials

- 5.2.1 Inorganic electrochromic materials

- 5.2.2 Organic electrochromic materials

- 5.2.3 Hybrid electrochromic materials

- 5.3 Liquid crystal polymers (LCP)

- 5.3.1 Thermotropic LCPS

- 5.3.2 Lyotropic LCPS

- 5.4 Polymer dispersed liquid crystals (PDLC)

- 5.4.1 Normal mode PDLC

- 5.4.2 Reverse mode PDLC

- 5.5 Suspended particle devices (SPD)

- 5.6 Other

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Smart windows & glass

- 6.2.1 Architectural windows

- 6.2.2 Automotive windows & sunroofs

- 6.2.3 Aircraft windows

- 6.2.4 Marine windows

- 6.3 Electronic components

- 6.3.1 Connectors

- 6.3.2 Circuit boards

- 6.3.3 Antennas

- 6.3.4 Microelectronic packaging

- 6.4 Displays & visual devices

- 6.4.1 Smart displays

- 6.4.2 Wearable displays

- 6.4.3 Signage & information displays

- 6.5 Automotive components

- 6.5.1 Mirrors

- 6.5.2 Lighting systems

- 6.5.3 Sensors & controls

- 6.5.4 Structural components

- 6.6 Medical devices & equipment

- 6.7 Aerospace & defense applications

- 6.8 Other

Chapter 7 Market Size and Forecast, By End Use Industry, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Construction & architecture

- 7.2.1 Residential buildings

- 7.2.2 Commercial buildings

- 7.2.3 Institutional buildings

- 7.2.4 Industrial facilities

- 7.3 Automotive & transportation

- 7.3.1 Passenger vehicles

- 7.3.2 Commercial vehicles

- 7.3.3 Electric vehicles

- 7.3.4 Railways & mass transit

- 7.4 Electronics & telecommunications

- 7.4.1 Consumer electronics

- 7.4.2 Telecommunications equipment

- 7.4.3 Computing & IT hardware

- 7.4.4 5g infrastructure

- 7.5 Aerospace & defense

- 7.6 Healthcare & medical

- 7.7 Energy & power generation

- 7.8 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Saint-Gobain

- 9.2 AGC

- 9.3 Gentex Corporation

- 9.4 Gauzy

- 9.5 Halio

- 9.6 ChromoGenics

- 9.7 Polytronix

- 9.8 Research Frontiers

- 9.9 Celanese Corporation

- 9.10 Solvay

- 9.11 Toray Industries

- 9.12 Sumitomo Chemical Company

- 9.13 Kuraray

- 9.14 Murata Manufacturing

- 9.15 Chiyoda Integre

- 9.16 RTP Company

- 9.17 SABIC

- 9.18 Ynvisible Interactive

- 9.19 Crown Electrokinetics

- 9.20 Smart Glass Group

- 9.21 Smart Films International

- 9.22 Corning Incorporated

- 9.23 Continental

- 9.24 Panasonic Holdings Corporation