|

市场调查报告书

商品编码

1750415

非公路电动车零件市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Off-highway EV Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

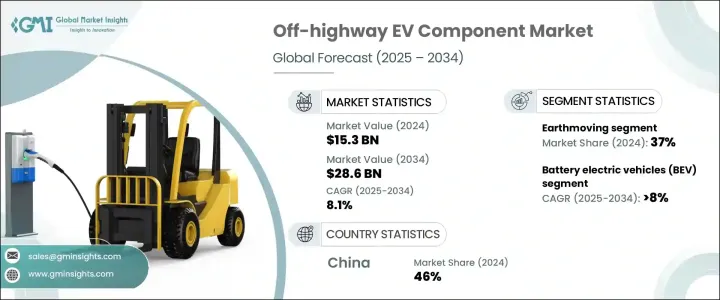

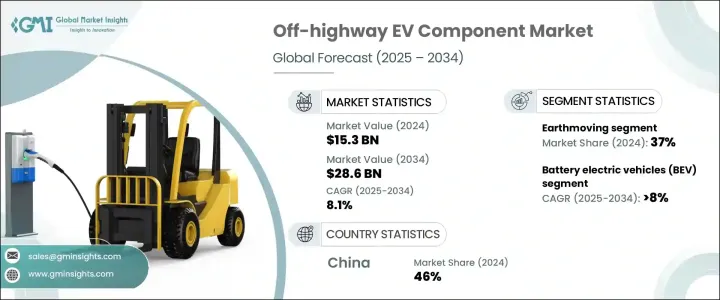

2024年,全球非公路用电动车零件市场规模达153亿美元,预计到2034年将以8.1%的复合年增长率成长,达到286亿美元,这得益于建筑、采矿和农业机械向电气化转型的加速。随着各行各业优先考虑采用更清洁的替代传统内燃机,电动设备因其减少排放、降低油耗和降低维护成本的优势而日益受到青睐。监管规定、排放控制法规以及日益增强的环保意识正迫使原始设备製造商投资电动解决方案。此外,政府和私营部门正在大力投资智慧基础设施和绿色发展,这进一步增加了对非公路用电动车零件的需求。

采用装载机、推土机和起重机等电动设备对于减少大型城市发展和基础设施项目的环境足迹至关重要。除了电气化之外,预测性诊断、车队互联和智慧远端资讯处理等数位技术的整合正在重新定义非公路用车领域的营运效率。这些进步推动了对专为恶劣高负载环境量身定制的高度专业化电子元件的需求。具备远端监控和即时资料功能的设备能够支援更佳的正常运作时间和生命週期成本控制,进而帮助车队营运商优化现场作业绩效。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 153亿美元 |

| 预测值 | 286亿美元 |

| 复合年增长率 | 8.1% |

在应用类别中,土方机械在2024年占据最大份额,达到37%,这得益于电动挖土机、装载机及类似设备在不同专案现场的广泛使用。土方机械因其稳定的使用模式以及在排放管制区域内作业的需求日益增长,非常适合电气化。原始设备製造商和系统供应商正在推出下一代电池组、电动传动系统和冷却系统,以满足公共和私人专案日益增长的需求。

2024年,纯电动车 (BEV) 占据了非公路用电动车零件市场的最大份额,达到66%,这得益于其零废气排放的特性,这在当今倡导绿色建筑和采矿作业的背景下是一项重要优势。由于油耗更低、机械复杂性降低以及维修需求极低,BEV 还具有营运效率和长期成本效益。它们与隧道、人口密集的城市施工现场和室内农业设施等封闭或受限环境的兼容性进一步提升了其实用性。 BEV 的安静运行也使其在噪音管制环境中越来越受欢迎,从而支持其在多个非公路用车领域中得到更广泛的应用。

2024年,中国非公路用电动车零件市场占46%的市场份额,产值达32.5亿美元,这得益于国家持续推行的旨在减少工业排放和提高设备效率的政策。中国拥有先进的製造能力,尤其是在电池生产和电动动力总成技术方面,能够大规模供应高性能电动车零件。中国完善的电动车基础设施,加上其在农业、采矿业和建筑业的广泛部署,将继续巩固其领先地位,并加速该地区整体市场的扩张。

为了巩固市场地位,塔塔Elxsi、沃尔沃集团、小松、利勃海尔和迪尔公司等公司正专注于垂直整合和长期合作。对下一代电池系统、电力电子和数位平台的策略性投资使这些公司能够引领电气化趋势。与技术提供者的合作以及共同开发客製化解决方案,使这些公司能够满足特定行业的需求,同时保持成本竞争力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 一级汽车供应商

- 专业非公路系统整合商

- 非公路车辆OEM

- 技术提供者

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 价格趋势

- 地区

- 成分

- 成本細項分析

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 世界各国政府正在实施越来越严格的法规来遏制温室气体排放

- 建筑、采矿和农业设备的电气化

- 电池和马达技术的进步

- 增加对智慧城市、采矿自动化和机械化农业的投资

- OEM和一级供应商合作

- 产业陷阱与挑战

- 初始购买成本高

- 电池技术限制

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 电池组

- 电动机

- 控制器

- 逆变器

- 电力电子

- 热管理系统

- 车用充电器

- 电动辅助转向系统

- 其他的

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 插电式混合动力车(PHEV)

- 混合动力电动车(HEV)

- 燃料电池电动车(FCEV)

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 物料处理

- 土方工程

- 收穫

- 运输和拖运

- 钻孔和爆破

第八章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 电动工程车辆

- 挖土机

- 推土机

- 装载机

- 电动农用车

- 联结机

- 收割机

- 喷雾器

- 电动采矿车

- 运输卡车

- 钻头

- 其他的

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 原始设备製造商(OEM)

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Bell Equipment

- Caterpillar

- CNH Industrial

- Dana

- Deere & Company

- Doosan

- Epiroc

- Hitachi Construction Machinery

- JCB

- Komatsu

- Kubota

- Liebherr

- Manitou Group

- Sandvik

- Sona Comstar

- Sumitomo Heavy Industries

- Tata AutoComp

- Tata Elxsi

- Terex

- Volvo AB

The Global Off-highway EV Component Market was valued at USD 15.3 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 28.6 billion by 2034, fueled by the accelerating transition toward electrified construction, mining, and agricultural machinery. As industries prioritize cleaner alternatives to traditional combustion engines, electric-powered equipment is gaining traction for reduced emissions, lower fuel consumption, and minimized maintenance costs. Regulatory mandates, emission control laws, and rising environmental awareness are pressuring original equipment manufacturers to invest in electric solutions. Additionally, governments and private sectors are investing heavily in smart infrastructure and green development, further increasing the demand for off-highway EV components.

The adoption of electric equipment such as loaders, dozers, and cranes is essential in reducing the environmental footprint of major urban development and infrastructure projects. Beyond electrification, the integration of digital technologies-such as predictive diagnostics, fleet connectivity, and smart telematics-is redefining operational efficiency in off-highway segments. These advancements fuel demand for highly specialized electronic components tailored for rugged, high-duty environments. Equipment with remote monitoring and real-time data capabilities supports better uptime and lifecycle cost control, helping fleet operators optimize performance in field operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.3 Billion |

| Forecast Value | $28.6 Billion |

| CAGR | 8.1% |

Among application categories, the earthmoving segment captured the largest share in 2024, accounting for 37% share, driven by the high usage of electric excavators, loaders, and similar equipment across diverse project sites. Earthmoving machinery is well-suited for electrification, given its consistent usage patterns and the increasing need to operate in emission-regulated zones. OEMs and system suppliers are responding with next-gen battery packs, electric drivetrains, and cooling systems to meet growing demand in both public and private projects.

In 2024, battery electric vehicles (BEVs) captured the largest portion in the off-highway EV component market, making up 66% share, driven by their ability to operate without tailpipe emissions, a major advantage in today's push for greener construction and mining operations. BEVs also offer operational efficiency and long-term cost benefits, thanks to lower fuel consumption, reduced mechanical complexity, and minimal maintenance requirements. Their compatibility with closed or restricted environments, such as tunnels, dense urban job sites, and indoor agriculture facilities, further enhances their utility. The quiet operation of BEVs also makes them increasingly favored in noise-regulated environments, supporting broader adoption across multiple off-highway sectors.

China Off-highway EV Component Market held 46% share and generated USD 3.25 billion in 2024, underpinned by consistent support from national policies aimed at reducing industrial emissions and improving equipment efficiency. With advanced manufacturing capabilities, especially in battery production and electric powertrain technologies, China supplies high-performance EV components at scale. The nation's comprehensive EV infrastructure, combined with widespread deployment across agriculture, mining, and construction sectors, continues to reinforce its leadership and accelerate the region's overall market expansion.

To reinforce their market positions, companies such as Tata Elxsi, Volvo AB, Komatsu, Liebherr, and Deere & Company are focusing on vertical integration and long-term collaborations. Strategic investments in next-gen battery systems, power electronics, and digital platforms enable these firms to lead electrification trends. Partnerships with tech providers and co-development of customized solutions allow these players to cater to sector-specific needs while maintaining cost competitiveness.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Tier 1 automotive suppliers

- 3.2.3 Specialized off-highway system integrators

- 3.2.4 Off-highway vehicle OEM

- 3.2.5 Technology providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.6.1 Region

- 3.6.2 Component

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Governments worldwide are implementing increasingly strict regulations to curb greenhouse gas emissions

- 3.11.1.2 Electrification of construction, mining & agriculture equipment

- 3.11.1.3 Advancements in battery & motor technologies

- 3.11.1.4 Increased investments in smart cities, mining automation, and mechanized agriculture

- 3.11.1.5 OEM & tier-1 supplier collaborations

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial purchase cost

- 3.11.2.2 Battery technology limitations

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Battery packs

- 5.3 Electric motors

- 5.4 Controllers

- 5.5 Inverters

- 5.6 Power electronics

- 5.7 Thermal management systems

- 5.8 Onboard chargers

- 5.9 Electric power steering systems

- 5.10 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Plug-in hybrid electric vehicles (PHEV)

- 6.4 Hybrid electric vehicles (HEV)

- 6.5 Fuel cell electric vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Material handling

- 7.3 Earthmoving

- 7.4 Harvesting

- 7.5 Transport & hauling

- 7.6 Drilling & blasting

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Electric construction vehicles

- 8.2.1 Excavators

- 8.2.2 Bulldozers

- 8.2.3 Loaders

- 8.3 Electric agricultural vehicles

- 8.3.1 Tractors

- 8.3.2 Harvesters

- 8.3.3 Sprayers

- 8.4 Electric mining vehicles

- 8.4.1 Haul trucks

- 8.4.2 Drills

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Original Equipment Manufacturers (OEM)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Bell Equipment

- 11.2 Caterpillar

- 11.3 CNH Industrial

- 11.4 Dana

- 11.5 Deere & Company

- 11.6 Doosan

- 11.7 Epiroc

- 11.8 Hitachi Construction Machinery

- 11.9 JCB

- 11.10 Komatsu

- 11.11 Kubota

- 11.12 Liebherr

- 11.13 Manitou Group

- 11.14 Sandvik

- 11.15 Sona Comstar

- 11.16 Sumitomo Heavy Industries

- 11.17 Tata AutoComp

- 11.18 Tata Elxsi

- 11.19 Terex

- 11.20 Volvo AB