|

市场调查报告书

商品编码

1750446

车载太阳能板市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vehicle-Integrated Solar Panels Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

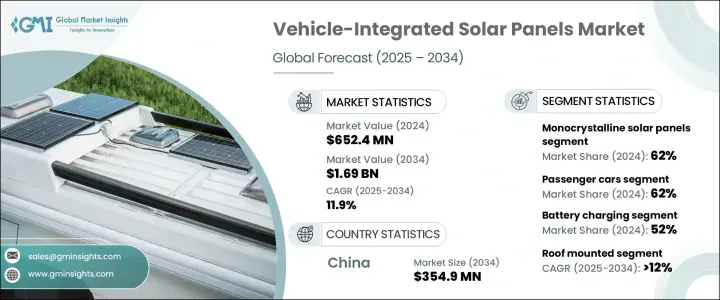

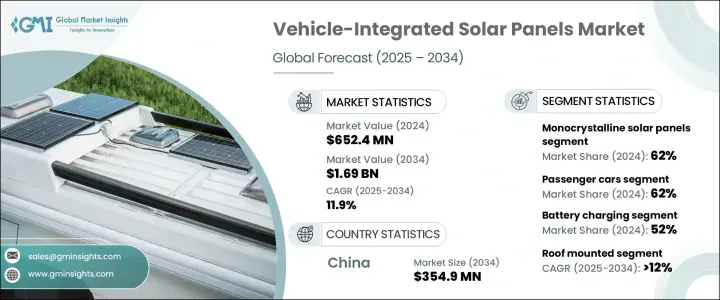

2024年,全球车载太阳能板市场规模达6.524亿美元,预计到2034年将以11.9%的复合年增长率成长,达到16.9亿美元。这主要得益于电动车的广泛普及以及全球对再生能源日益增长的需求,推动了车载太阳能板市场的需求。随着交通运输系统的现代化,汽车製造商越来越希望将太阳能直接整合到车辆中,以减少对外部充电系统的依赖。车载太阳能光电系统 (VISP) 能够实现清洁、自给自足的能源生产,有助于延长电动车的续航里程,同时减轻车载电池的压力。

环保意识的增强、燃油价格的波动以及政府对低碳交通解决方案日益增长的支持,共同推动了市场的成长。汽车製造商正透过创新更有效率的太阳能材料、增强其与车辆设计的融合度以及优化能量转换率来应对这项挑战。消费者的兴趣正在不断增长,尤其是在阳光充足的地区,太阳能汽车可以实现更高的能源独立性。买家更重视车辆的先进功能,例如耐热太阳能材料、无缝设计整合以及即时能量追踪。直销数位销售管道的不断发展提升了太阳能汽车及相关售后套件的曝光度,使製造商能够覆盖更广泛的人群。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.524亿美元 |

| 预测值 | 16.9亿美元 |

| 复合年增长率 | 11.9% |

2024年,乘用车占62%的市场份额,引领市场,预计到2034年将以12.3%的复合年增长率成长。这些车辆凭藉其平坦的空气动力学表面,为VISP技术提供了理想的平台。这种设计使太阳能係统能够在有限的空间内产生更高的电力输出。在日照充足的地区,自充电能力对于城市和城际旅行尤其重要。由于对注重环保的驾驶者俱有强烈的吸引力,太阳能整合系统正迅速成为电动车领域的差异化因素。

单晶太阳能板市场占据62%的市场份额,预计到2034年将以12.2%的复合年增长率成长。这些电池板因其卓越的能量转换效率和视觉均匀性而备受青睐。单晶电池板以其在阴凉和高温环境下的良好运作而闻名,是汽车车顶和引擎盖的理想选择。其光滑的外观和一致的纹理使其在註重性能和美观的高端电动车中广受欢迎。

2024年,亚太地区车载太阳能板市场占48%的市场。强大的国内生产能力、经济高效的製造流程以及政府主导的可再生能源出行政策,推动了中国在车载太阳能板应用领域的领先地位。此外,中国强劲的基础建设、智慧物流网路的扩展以及快速的都市化进程,也刺激了对车载折臂起重机等多功能起重解决方案的需求。本土製造商受益于规模经济和精简的供应链,从而实现了更快的生产速度和更具竞争力的价格。

Sono Motors、大众汽车、丰田汽车、比亚迪、日产汽车、Lightyear、Planet Solar、Aptera Motors、通用汽车和福特汽车等主要行业参与者正在寻求战略合作和技术升级,以保持竞争力。许多公司投资研发,以提高太阳能电池的耐用性、能源效率以及与电动车平台的整合度。与太阳能科技公司建立策略合作伙伴关係并在目标市场推出试点车辆也很常见。有些公司优化了直接面向消费者的线上销售模式,而有些公司则专注于模组化VISP解决方案,以满足车队采用和最后一哩物流应用的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件供应商

- 製造商

- 服务提供者

- 经销商

- 最终用途

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 定价趋势

- 产品

- 地区

- 成本細項分析

- 对部队的影响

- 成长动力

- 电动车普及率不断上升

- 太阳能板效率的技术进步

- 降低太阳能技术成本

- 消费者对再生能源的认识不断提高

- 环境法规与减碳目标

- 产业陷阱与挑战

- 整合的初始成本高

- 耐用性和安全性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车

- 中型商用车

- 重型商用车

- 电动车(EV)

- 特种车辆

- 休閒车(RV)

- 高尔夫球车

- 军用或紧急车辆

第六章:市场估计与预测:按太阳能板,2021 - 2034 年

- 主要趋势

- 单晶太阳能板

- 多晶太阳能板

- 薄膜太阳能板

- 柔性太阳能板

第七章:市场估计与预测:依安装方式,2021 - 2034 年

- 主要趋势

- 车顶安装

- 引擎盖安装

- 一体式车身面板

- 可拆卸面板

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 发电

- 电池充电

- 辅助电源

- 暖气系统

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Aptera Motors

- BYD

- Cruise Car

- Ford Motor

- General Motors

- Hanergy Thin Film

- Honda Motor

- Hyundai Motor

- Lightyear

- LOMOcean

- Mahindra & Mahindra

- Nissan Motor

- Planet Solar

- Sono Motors

- Surat Exim

- Tesla

- Toyota Motor

- Venturi Automobiles

- Volkswagen

- Weifang Guangsheng New Energy

The Global Vehicle-Integrated Solar Panels Market was valued at USD 652.4 million in 2024 and is estimated to grow at a CAGR of 11.9% to reach USD 1.69 billion by 2034, driven by the demand for vehicle-integrated solar systems with the widespread shift toward electric mobility and the growing global push for renewable energy. As transportation systems modernize, vehicle manufacturers are increasingly looking to integrate solar power directly into vehicles to reduce reliance on external charging systems. VISPs enable clean, self-sustaining energy generation, helping extend the operational range of electric vehicles while alleviating pressure on onboard batteries.

Environmental awareness, volatile fuel prices, and growing government support for decarbonized transportation solutions contribute to market growth. Automakers are responding by innovating more efficient solar materials, enhancing their integration with vehicle designs, and optimizing energy conversion rates. Consumer interest is expanding, especially in sunny regions, where solar-powered cars can deliver greater energy independence. Buyers prioritize advanced vehicle features such as thermal-resistant solar materials, seamless design integration, and real-time energy tracking. The evolution of direct-to-consumer digital sales channels boosts visibility for solar-enabled vehicles and related aftermarket kits, allowing manufacturers to reach a broader demographic base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $652.4 Million |

| Forecast Value | $1.69 Billion |

| CAGR | 11.9% |

Passenger vehicles led the market in 2024, making up 62% share, and are expected to grow at 12.3% CAGR through 2034. These vehicles provide ideal platforms for VISP technology due to their flat, aerodynamic surfaces. This design allows solar systems to generate higher electricity outputs from limited space. In regions with high solar exposure, the ability to self-charge becomes especially valuable for urban and intercity mobility. With a strong appeal among environmentally conscious drivers, solar-integrated systems are rapidly becoming a differentiator in the EV space.

The monocrystalline solar panels segment held 62% share and is expected to grow at a CAGR of 12.2% through 2034. These panels are favored for their superior energy conversion efficiency and visual uniformity. Known for operating well in shaded and high-temperature environments, monocrystalline panels are ideal for vehicle rooftops and hoods. Their sleek appearance and consistent texture make them popular for premium EVs where performance and aesthetics matter.

Asia Pacific Vehicle- Integrated Solar Panels Market held a 48% share in 2024. Strong domestic production capabilities, cost-effective manufacturing, and government-led renewable mobility policies have propelled China's leadership in VISP adoption. Additionally, the country's robust infrastructure development, expansion of smart logistics networks, and rapid urbanization have fueled the need for versatile lifting solutions like truck-mounted knuckle boom cranes. Local manufacturers benefit from economies of scale and streamlined supply chains, enabling faster production and competitive pricing.

Key industry participants such as Sono Motors, Volkswagen, Toyota Motor, BYD, Nissan Motor, Lightyear, Planet Solar, Aptera Motors, General Motors, and Ford Motor are pursuing strategic collaborations and technology upgrades to stay competitive. Many invest in R&D to enhance solar cell durability, energy efficiency, and integration with EV platforms. Strategic partnerships with solar tech firms and the rollout of pilot vehicles in target markets are also common. Some players optimize direct-to-consumer online sales models, while others focus on modular VISP solutions for fleet adoption and last-mile logistics applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component supplier

- 3.2.3 Manufacturer

- 3.2.4 Service provider

- 3.2.5 Distributor

- 3.2.6 End use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing trend

- 3.9.1 Product

- 3.9.2 Region

- 3.10 Cost breakdown analysis

- 3.11 Impact on forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising adoption of electric vehicles

- 3.11.1.2 Technological advancements in solar panel efficiency

- 3.11.1.3 Decreasing cost of solar technology

- 3.11.1.4 Growing consumer awareness of renewable energy

- 3.11.1.5 Environmental regulations and carbon reduction goals

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial cost of integration

- 3.11.2.2 Durability and safety concerns

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Passenger cars

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles

- 5.3.2 Medium commercial vehicles

- 5.3.3 Heavy commercial vehicles

- 5.4 Electric vehicles (EVs)

- 5.5 Specialty Vehicles

- 5.5.1 Recreational vehicles (RVs)

- 5.5.2 Golf carts

- 5.5.3 Military or emergency vehicles

Chapter 6 Market Estimates & Forecast, By Solar Panel, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Monocrystalline solar panels

- 6.3 Polycrystalline solar panels

- 6.4 Thin-film solar panels

- 6.5 Flexible solar panels

Chapter 7 Market Estimates & Forecast, By Installation Method, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Roof mounted

- 7.3 Hood mounted

- 7.4 Integrated body panels

- 7.5 Removable panels

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Power generation

- 8.3 Battery charging

- 8.4 Auxiliary power supply

- 8.5 Heating systems

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Aptera Motors

- 10.2 BYD

- 10.3 Cruise Car

- 10.4 Ford Motor

- 10.5 General Motors

- 10.6 Hanergy Thin Film

- 10.7 Honda Motor

- 10.8 Hyundai Motor

- 10.9 Lightyear

- 10.10 LOMOcean

- 10.11 Mahindra & Mahindra

- 10.12 Nissan Motor

- 10.13 Planet Solar

- 10.14 Sono Motors

- 10.15 Surat Exim

- 10.16 Tesla

- 10.17 Toyota Motor

- 10.18 Venturi Automobiles

- 10.19 Volkswagen

- 10.20 Weifang Guangsheng New Energy