|

市场调查报告书

商品编码

1750469

复合罐市场机会、成长动力、产业趋势分析及2025-2034年预测Composite Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

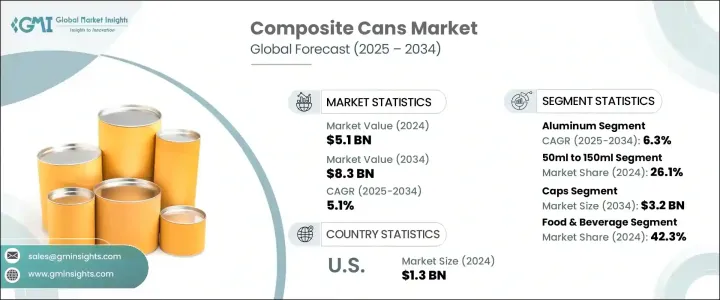

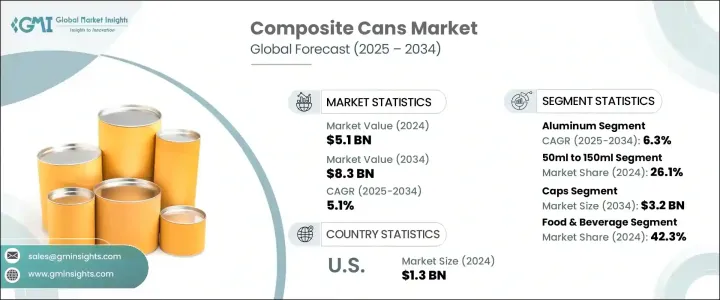

2024年,全球复合罐市场规模达51亿美元,预计到2034年将以5.1%的复合年增长率增长,达到83亿美元,这得益于零食、即食食品和营养保健品行业的快速扩张。都市化进程加快、可支配收入成长以及消费者生活方式的转变,是推动兼具耐用性、便利性和更长保质期的包装需求的关键驱动因素。复合罐采用多层结构,具有优异的防潮防氧性能,是维持敏感产品新鲜度和品质的理想选择。

贸易相关政策,例如对进口铝和钢征收的关税,已经扰乱了美国复合罐製造商的定价和采购格局。这些转变导致成本上升和材料采购挑战,促使生产商重新评估其供应链。为此,许多公司正在转向国内原材料和本地化生产策略,以保持获利能力并降低未来风险。这种回流趋势不仅有助于製造商应对贸易中断,也符合更广泛的永续性和韧性目标。透过在更靠近生产中心的地方采购材料,企业可以缩短交货时间、降低物流成本,并增强对品质和当地法规合规性的控制。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 51亿美元 |

| 预测值 | 83亿美元 |

| 复合年增长率 | 5.1% |

在材料领域,预计到2034年,铝基复合槽的复合年增长率将达到6.3%,这得益于其轻质、耐腐蚀和可回收等优良特性。这些特性与食品饮料产业对永续包装日益增长的偏好相契合。铝具有防潮、防风、避光等特性,使其成为需要延长保质期的产品的理想选择。此外,政府对环保实践和循环经济的支持也增强了这一领域,鼓励製造商从传统塑胶转向更永续的金属包装解决方案。

以容量计算,50毫升至150毫升复合槽在2024年的市占率为26.1%。这款尺寸在保健品、化妆品和试用装等紧凑型包装领域正日益受到青睐。不断增长的城市人口、便利的生活方式以及消费者对高端单份产品的兴趣,持续支撑着复合罐的成长。这些罐子便于携带且使用方便,是旅行用品和衝动消费的理想选择。品牌透过创新的包装设计提升视觉吸引力,满足消费者对个人化和美感的需求。

2024年,美国复合槽市场规模达13亿美元。对永续和可回收塑胶替代品的追求极大地影响了美国消费者和製造商的行为。饮料、零食和补充剂领域对环保包装的需求日益增长,这塑造了美国市场的发展动态,尤其是在註重环保的消费者群体中。各大企业纷纷推出强调可堆肥成分、易于回收和低碳足迹的产品线。

全球复合罐产业的主要参与者包括 Smurfit Kappa 集团、Irwin Packaging、Sonoco Products、Corex 集团和 Mondi 集团。为了提升市场定位,领先的公司专注于透过可持续的材料整合和先进的製造技术进行产品创新。与食品和饮料品牌建立策略合作伙伴关係、投资环保设计以及在高需求地区扩大产能,这些倡议有助于製造商在保持竞争力的同时满足不断变化的客户需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 包装食品和零食产业的扩张

- 扩大零售和电子商务通路

- 提高货架吸引力和品牌机会

- 宠物食品包装需求不断增加

- 营养保健品和保健品市场的成长

- 产业陷阱与挑战

- 生产成本高

- 可重复使用性有限且一次性使用

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依材料,2021-2034

- 主要趋势

- 铝

- 纸板

- 塑胶

- 钢

第六章:市场估计与预测:依封罐类型,2021-2034

- 主要趋势

- 帽子

- 卡扣

- 插头

- 盖子

- 铝膜

- 塑胶膜

- 纸板末端

第七章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 少于50毫升

- 50毫升至150毫升

- 150毫升至250毫升

- 250毫升至500毫升

- 500毫升至1000毫升

- 大于1000毫升

第八章:市场估计与预测:依产业垂直,2021-2034

- 主要趋势

- 食品和饮料

- 製药

- 个人护理

- 工业和化学品

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Ace Paper Tube

- Bharath Paper Conversions

- Canfab Packaging

- Corex Group

- Heartland Products Group

- Irwin Packaging

- Hangzhou Qunle Packaging

- Mondi Group

- PTS Manufacturing

- Quality Container Company

- Shetron Group

- Smurfit Kappa Group

- Sonoco Products Company

The Global Composite Cans Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 8.3 billion by 2034, fueled by the rapid expansion of the snack food, ready-to-eat meals, and nutraceutical sectors. Rising urbanization, growing disposable incomes, and a shift in consumer lifestyles are key drivers of demand for packaging that combines durability, convenience, and extended shelf life. Composite cans, with their multi-layer construction, offer excellent moisture and oxygen barriers, making them ideal for preserving the freshness and quality of sensitive products.

Trade-related policies, such as the tariffs applied to imported aluminum and steel, have disrupted the pricing and sourcing landscape for composite can manufacturers in the U.S. These shifts have resulted in cost increases and material sourcing challenges, prompting producers to reevaluate their supply chains. In response, many companies are shifting towards domestic raw materials and localized production strategies to maintain profitability and mitigate future risks. This movement toward reshoring is not only helping manufacturers navigate trade disruptions aligns with broader sustainability and resilience goals. By sourcing materials closer to production hubs, firms are reducing lead times, lowering logistics costs, and enhancing their control over quality and compliance with local regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 5.1% |

Among materials, aluminum-based composite cans are expected to grow at a CAGR of 6.3% through 2034, driven by favorable properties such as light weight, corrosion resistance, and recyclability. These characteristics align well with the rising preference for sustainable packaging in food and beverage segments. Aluminum's ability to protect against moisture, air, and light makes it an ideal choice for products requiring extended shelf life. Additionally, government support for environmentally friendly practices and circular economies strengthens this segment, encouraging manufacturers to switch from conventional plastics to more sustainable metal-based packaging solutions.

Based on capacity, composite cans in the 50ml to 150ml segment held a 26.1% share in 2024. This size is gaining traction in compact packaging needs across health supplements, cosmetic products, and trial-size offerings. Growing urban populations, on-the-go lifestyles, and consumer interest in premium, single-serve products continue to support segment growth. These cans offer portability and convenience, making them ideal for travel-friendly goods and impulse buys. Brands enhance their visual appeal with innovative packaging designs, tapping into consumer demand for personalization and aesthetic appeal.

U.S. Composite Cans Market was valued at USD 1.3 billion in 2024. The push for sustainable and recyclable alternatives to plastic has significantly influenced consumer and manufacturer behavior in the country. Growing demand for eco-friendly packaging in beverages, snacks, and supplements shapes U.S. market dynamics, especially among environmentally conscious consumers. Companies are responding with product lines that highlight compostable components, easy recyclability, and reduced carbon footprints.

Key players in the Global Composite Cans Industry include Smurfit Kappa Group, Irwin Packaging, Sonoco Products, Corex Group, and Mondi Group. To enhance market positioning, leading companies focus on product innovation through sustainable material integration and advanced manufacturing technologies. Strategic partnerships with food and beverage brands, investments in eco-friendly design, and capacity expansions in high-demand regions are helping manufacturers meet evolving customer needs while staying competitive.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side Impact (raw Materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-Side Impact (raw Materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Expansion of the packaged food and snack industry

- 3.3.1.2 Expansion of retail and e-commerce channels

- 3.3.1.3 Improved shelf appeal and branding opportunities

- 3.3.1.4 Increasing demand in pet food packaging

- 3.3.1.5 Growth in the nutraceuticals and health supplements market

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of production

- 3.3.2.2 Limited reusability and single-use nature

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million & units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Paperboard

- 5.4 Plastic

- 5.5 Steel

Chapter 6 Market Estimates & Forecast, By Closure Type, 2021-2034 (USD Million & units)

- 6.1 Key trends

- 6.2 Caps

- 6.2.1 Snap on

- 6.2.2 Plug

- 6.3 Lids

- 6.3.1 Aluminum membrane

- 6.3.2 Plastic membrane

- 6.3.3 Paperboard ends

Chapter 7 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Million & units)

- 7.1 Key trends

- 7.2 Less than 50ml

- 7.3 50ml to 150ml

- 7.4 150ml to 250ml

- 7.5 250ml to 500ml

- 7.6 500ml to 1000ml

- 7.7 Greater than 1000ml

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021-2034 (USD Million & units)

- 8.1 Key trends

- 8.2 Food and beverage

- 8.3 Pharmaceutical

- 8.4 Personal care

- 8.5 Industrial & chemicals

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Ace Paper Tube

- 10.2 Bharath Paper Conversions

- 10.3 Canfab Packaging

- 10.4 Corex Group

- 10.5 Heartland Products Group

- 10.6 Irwin Packaging

- 10.7 Hangzhou Qunle Packaging

- 10.8 Mondi Group

- 10.9 PTS Manufacturing

- 10.10 Quality Container Company

- 10.11 Shetron Group

- 10.12 Smurfit Kappa Group

- 10.13 Sonoco Products Company