|

市场调查报告书

商品编码

1692523

越南金属罐包装:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Vietnam Metal Can Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

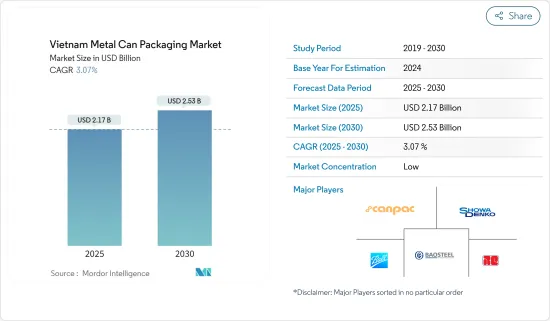

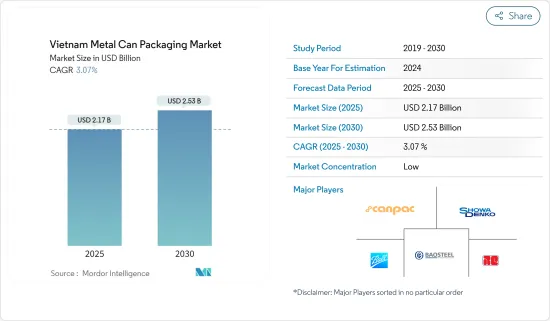

越南金属罐包装市场规模预计在2025年为21.7亿美元,预计到2030年将达到25.3亿美元,预测期内(2025-2030年)的复合年增长率为3.07%。

啤酒和碳酸饮料等酒精和非酒精饮料的消费量不断增加,导致该国对金属罐的需求增加,进而影响越南金属罐包装市场的成长。

主要亮点

- 金属罐具有刚性、稳定性、阻隔性等优点,因此常用于远距储存和运输货物。钢製和铝製金属罐在越南最受欢迎。这些材料具有柔软、轻巧的宝贵特性,可以帮助製造商降低与物流相关的成本。

- 金属罐的简单性使其成为该地区许多消费者所追求的移动生活方式的理想包装选择。玻璃一般是禁止携带的,因为玻璃很容易破碎。罐头的价格实惠、可回收性、能量饮料的日益普及以及新产品的推出都促进了市场的成长。

- 此外,越南生活方式的改变促使消费者选择易于准备的食物。年轻人和独居者消费更多的罐头食品。这些消费者时间紧迫、预算有限,因此选择成本更低、更方便的产品。

- 随着环境问题成为焦点,饮料公司必须采用永续包装来提供其产品。永续性是饮料行业的关键关注点。许多製造商正在转向更环保的包装替代品。 宝特瓶、由纤维素纤维材料製成的纸瓶和玻璃瓶被用作金属罐的替代品,可能会对产业成长构成挑战。

- 食品和饮料行业占金属罐包装市场的大部分份额,在新冠疫情期间需求庞大。疫情导致人们的消费习惯发生重大变化。人们对包装食品、肉类、蔬菜和水果的需求日益增长。

越南金属罐包装市场趋势

越南对简便食品的需求不断成长

- 越南政府计划透过发展高效、永续的产业,到 2030 年使该国成为世界领先的海鲜加工中心之一。因此,加工产品的出口比例应该会增加,越南水产品的价值也应该会增加。水产品出口额的成长显示全球对越南冷冻水产品包装的高需求带动了越南黄金罐包装市场的成长。预计中国都市化的加速将推动对包装食品的需求。

- 渔业是越南每年创收超过10亿美元的25个产业之一。根据越南水产品出口和生产者协会(VASEP)报道,越南水产品产业预计在 2024 年迎来良好开端。第一季出口额年增8%,达到约20亿美元。这一成长主要得益于美国、日本、中国和香港等重要市场不断增长的需求。 VASEP 预测,到 2024 年底,越南水产品出口额将比前一年增长 95 亿美元。

- 此外,许多以前只经营新鲜农产品的公司现在正在大力投资加工食品,增加了对金属罐包装的需求。越南不断增长的人口、不断变化的收入水平、文化偏好和新的贸易协定为其肉类产业的显着增长打开了大门。

- 根据美国农业部对外农业服务局(USDA)、越南统计总局和越南工业贸易部的调查,越南食品製造业成长了102.9%。越南加工食品业有近6000家企业。大部分市场占有率由 Vissan、CJ Cau Tre 和 Ha Long Canfoco 等老字型大小企业占据。

- 根据越南包装协会报告,越南包装产业约有1.4万家企业,其中专注于塑胶包装的企业有9,200家。越南有900多家包装工厂,其中70%集中在南部,尤其是胡志明市、平阳、同奈等重点省份。在经济和社会快速进步、电子商务产业蓬勃发展以及有利的自由贸易协定(FTA)的推动下,越南包装产业有望实现显着成长。

饮料业占最大市场占有率

- 金属饮料罐在国内饮料市场需求量大,包括包装啤酒和葡萄酒。消费者对使用环保和永续产品的意识不断增强、回收率不断提高以及金属罐的可重复使用性正在推动研究市场的发展。

- 由于多种製造涂层技术,越南的金属饮料罐市场正在显着扩张。钢和铝零件安全可靠,符合卫生饮料包装标准。金属饮料罐价格实惠、实用、无污染。

- 越南的葡萄酒市场正在成长,饭店、餐厅和零售商提供来自世界各地的各种葡萄酒。越南的各项自由贸易协定(FTA)使得葡萄酒市场更具竞争力,吸引外国投资者转移生产和开展业务。自由贸易协定的主要目标是透过大幅降低或完全放宽进口商品关税,在成员国之间建立一体化市场。

- 越南政府计划减少其在国有企业的股份,以鼓励该国私营部门的发展,这将为该国饮料业的前景带来积极影响。这与越南加入世贸组织以及CPTPP和EVFTA等一系列自由贸易协定一起,旨在吸引跨国公司投资饮料产业,并为越南企业增加出口创造机会。为了满足饮料产量的增加,企业加大了投资,金属罐的需求也正在扩大。

- 东南亚中阶的不断壮大以及消费者对饮料罐的偏好继续推动对金属罐的需求。软性饮料、冲泡茶粉、各种果汁和能量饮料占越南饮料市场年产量和消费量的相当大比例。根据越南统计总局预测,2022年饮料製造业收益将达68.5564亿美元,2023年将达76.9183亿美元。

越南金属罐包装产业概况

越南金属罐包装市场较为分散,许多主要企业不断竞争以抢占最大的市场占有率。主要公司包括Canpac Vietnam、Showa Aluminum Can Corporation、TBC-Ball Beverage Can VN Ltd、Ball Corporation、越南宝钢罐头(宝钢集团)和Royal Can Industries Company Limited。虽然许多市场参与者已经开发出高品质的金属罐包装解决方案,但其他市场参与者正在努力有效回收包装产品以满足行业需求。

- 2024 年 1 月,越南胡志明市的精酿啤酒厂 Rooster Beers 为其广受欢迎的金髮啤酒和黑啤酒推出了全新、更纤薄的罐体设计。公鸡啤酒 (Rooster Beer) 以酿造传统而又平易近人的啤酒而闻名,但现在它正在西方传统之外开闢自己的道路。该品牌推出时尚罐头设计的举动凸显了这一转变。精心挑选的设计元素赋予新罐子生动活泼的现代感。

- 2024 年 4 月:在越南,生产者延伸责任 (EPR) 政策要求生产商和进口商确保其一定比例的产品和包装得到回收。如果无法回收,他们必须向越南环境保护(VEP)基金捐款。自然资源与环境部(MONRE)在第 08/2022/ND-PC 号法令中概述了这些义务。自2024年1月起,电池、润滑油和轮胎将受新规约束;自2025年1月1日起,电气和电子产品将受新规约束;自2027年1月起,运输产品将受新规约束。 MONRE也负责在2025年1月前提案运输车辆处置法规。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 越南对方便食品的需求不断增加

- 提高回收率并增加最终用户製造需求

- 市场限制

- 对软塑胶等替代产品的需求不断增加

- 市场机会

- 越南食品饮料罐进出口分析

第六章市场区隔

- 按类型

- 铝罐

- 钢

- 按最终用户

- 食物

- 饮料

- 化妆品和个人护理

- 製药

- 画

- 汽车(润滑油)

- 其他最终用户

第七章竞争格局

- 公司简介

- Canpac Vietnam Co. Ltd

- Showa Aluminum Can Corporation

- TBC-Ball Beverage Can VN Ltd(Ball Corporation)

- Vietnam Baosteel Can Co. Ltd(Baosteel Group)

- Royal Can Industries Company Limited

- Hanacan JSC

- Superior Multi-packaging Limited(SMPL)

- Kian Joo Can(Vietnam)Co. Ltd

- Nam Viet Packaging Manufacturing Co. Ltd

- My Chau Printing & Packaging Corporation

第八章投资分析

第九章:市场的未来

The Vietnam Metal Can Packaging Market size is estimated at USD 2.17 billion in 2025, and is expected to reach USD 2.53 billion by 2030, at a CAGR of 3.07% during the forecast period (2025-2030).

The rising consumption of alcoholic and nonalcoholic beverages, such as beer and carbonated drinks, is attributed to increased demand for metal cans in the country, thereby influencing the Vietnamese metal can packaging market's growth.

Key Highlights

- Due to its many advantages, such as rigidity, stability, and high barrier qualities, metal cans are frequently used to store and transport commodities across great distances. Metal cans constructed of steel and aluminum are the most popular in Vietnam. These materials have valuable qualities, such as being softer and lighter, which enable the makers to reduce logistics-related expenses.

- Because of their simplicity, metal cans are among the best packaging options for the mobile lifestyle that many consumers in the area lead. These can be carried or transported easily to outdoor sporting events, festivals, and beaches, whereas glass is typically forbidden because of its breakability. The affordability and recyclability of cans, the rising popularity of energy drinks, and the launch of new goods all contribute to the market's growth.

- Moreover, changing lifestyles in Vietnam are resulting in consumers opting for easy-to-cook food. The younger population and individually living consumers are consuming more canned food. These users have less time and are budget-restrained, thus opting for products with lower costs and higher convenience.

- With environmental concerns at the forefront, it becomes imperative for beverage companies to offer their products in sustainable packaging. Sustainability is a significant concern in the beverage industry. Many manufacturing companies are switching to eco-friendly packaging alternatives. PET bottles, paper bottles made with cellulose-fiber material, and glass bottles are used as an alternative to metal cans and can challenge their growth in the industry.

- The food and beverage industry, with a significant share in the metal can packaging market, witnessed huge demand amidst the COVID-19 pandemic. The pandemic brought a significant change in consumption habits. There has been an increasing need for packaged food products, meat, vegetables, and fruits.

Vietnam Metal Can Packaging Market Trends

Growing Demand For Convenience Food in Vietnam

- The Vietnamese government intends to make the country one of the world's leading seafood processing centers by 2030 by developing an efficient and sustainable industry. This should result in a higher export ratio of processed products and an increase in the value of Vietnamese seafood. The increasing export value of seafood has demonstrated that the high demand for packaged frozen seafood from Vietnam worldwide has led to the growth of the Vietnamese metal can packaging market. The growing urbanization in the country is expected to drive the demand for packaged food.

- The fishery is one of the 25 products that bring the country an income of more than USD 1 billion each year. The Vietnam Association of Seafood Exporters and Producers (VASEP) reported a strong beginning for Vietnam's seafood industry in 2024. Exports have surged to almost USD 2 billion in Q1, reflecting an 8% year-on-year uptick. This growth is primarily fueled by heightened demands from pivotal markets such as the United States, Japan, China, and Hong Kong. VASEP projects that by the close of 2024, Vietnam's seafood exports could hit a notable USD 9.5 billion, surpassing the previous year's figures.

- Moreover, the demand for metal can packaging is increasing with the growing investments by many businesses that previously only traded fresh agricultural products and have invested heavily in processed foods. Vietnam's rising population, income levels, changing cultural preferences, and new trade agreements opened the door to significant growth in the meat industry.

- According to the study by the USDA Foreign Agricultural Service, General Statistics Office of Vietnam, and the Ministry of Industry and Trade (Vietnam), food product manufacturing grew by 102.9 % in the country. There are nearly 6,000 enterprises operating in Vietnam's processed food industry. Most of the market share is held by well-established players such as Vissan, CJ Cau Tre, or Ha Long Canfoco.

- The Vietnam Packaging Association reports that Vietnam's packaging industry is home to approximately 14,000 enterprises, with a significant emphasis on plastic packaging, to which 9,200 enterprises are dedicated. The country boasts over 900 packaging factories, with a notable 70% concentrated in the southern region, particularly in key areas like Ho Chi Minh City, Binh Duong, and Dong Nai. Driven by swift economic and social advancements, a booming e-commerce sector, and advantageous free trade agreements (FTAs), Vietnam's packaging sector is poised for substantial growth.

Beverages Sector to Hold the Largest Market Share

- The beverage metal cans find significant demand in beer and wine packaging and other beverage markets in the country. The growing consumer awareness of the need to use green and environmentally sustainable products, the increasing recycling rate, and the reusability of metal cans are driving the market studied.

- In Vietnam, the market for beverage metal cans is expanding significantly due to the various manufacturing coating technologies. The steel and aluminum components meet secure, dependable, and hygienic beverage packaging standards. Metal beverage cans are affordable, practical, and anti-contaminating.

- The Vietnamese wine market is growing, with hotels, restaurants, and retailers offering various wines from around the world. Vietnam's diverse free trade agreements (FTAs) have made the wine market competitive, attracting foreign investors to relocate production or set up operations. The main objective of FTAs is to create an integrated market among country members by significantly reducing or fully liberalizing custom tariffs for imported products.

- Vietnam's Government has planned to decrease its stake in state-owned enterprises to encourage the country's private sector, supporting the positive outlook for Vietnam's beverage industry. This, accompanied by Vietnam's membership in the WTO and many free trade agreements such as CPTPP and EVFTA, aims to attract multinational companies to invest in the drink sector and generate opportunities for Vietnamese companies to increase exports. With the increasing investment by the companies as the production of the beverage increases, the demand for metal cans is growing.

- The growth of the middle class in Southeast Asia and consumers' preference for beverage cans continue to increase demand for metal cans. A significant percentage of the annual production and consumption of Vietnam's beverage market is soft drinks, instant teas, fruit juices of all kinds, and energy drinks. According to the General Statistics Office of Vietnam, the revenue from manufacturing beverages in 2022 was estimated at USD 6,855.64 million, and it reached USD 7,691.83 million in 2023.

Vietnam Metal Can Packaging Industry Overview

The Vietnamese metal can packaging market is fragmented owing to many key players continually trying to gain maximum market share. Some of the major players are Canpac Vietnam Co. Ltd, Showa Aluminum Can Corporation, TBC-Ball Beverage Can VN Ltd, Ball Corporation, Vietnam Baosteel Can Co. Ltd (Baosteel Group), and Royal Can Industries Company Limited. Many market players are developing high-quality metal can packaging solutions while others are making efforts toward efficient recycling of packaging products to cater to the industry requirements.

- January 2024: Rooster Beers, a craft brewery hailing from Ho Chi Minh City, Vietnam, unveiled a fresh, slim can design for its popular Blonde and Dark brews. While Rooster Beers has built its reputation on crafting traditional yet approachable beers, it is now charting a unique path, diverging from Western norms. The brand's move to introduce a sleek can design underscores this departure. With meticulously chosen design elements, the new cans exude a lively, contemporary vibe.

- April 2024: In Vietnam, the "extended producer responsibility" (EPR) policy now requires producers and importers to ensure the recycling of a set portion of their products and packaging. If they cannot recycle, they must contribute financially to the Vietnam Environment Protection (VEP) Fund. The Ministry of Natural Resources and Environment (MONRE) outlined these mandates in Decree 08/2022/ND-PC. Companies have specific deadlines to start recycling different items: batteries, lubricants, and tires from January 2024; electrical and electronic products from January 1, 2025; and means of transportation from January 2027. MONRE is also tasked with proposing disposal regulations for transportation by January 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Convenience Food in Vietnam

- 5.1.2 Higher Recycling Rates Coupled with Higher End-user Manufacturing Demand

- 5.2 Market Restraints

- 5.2.1 Growing Demand for Alternative Products Such as Flexible Plastic

- 5.3 Market Opportunities

- 5.4 Import-Export Analysis of Food Cans and Beverage Cans in Vietnam

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Aluminum

- 6.1.2 Steel

- 6.2 By End User

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Cosmetic and Personal Care

- 6.2.4 Pharmaceuticals

- 6.2.5 Paints

- 6.2.6 Automotive (Lubricants)

- 6.2.7 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Canpac Vietnam Co. Ltd

- 7.1.2 Showa Aluminum Can Corporation

- 7.1.3 TBC-Ball Beverage Can VN Ltd (Ball Corporation)

- 7.1.4 Vietnam Baosteel Can Co. Ltd (Baosteel Group)

- 7.1.5 Royal Can Industries Company Limited

- 7.1.6 Hanacan JSC

- 7.1.7 Superior Multi-packaging Limited (SMPL)

- 7.1.8 Kian Joo Can (Vietnam) Co. Ltd

- 7.1.9 Nam Viet Packaging Manufacturing Co. Ltd

- 7.1.10 My Chau Printing & Packaging Corporation