|

市场调查报告书

商品编码

1750474

电动车声音产生器市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electric Vehicle Sound Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

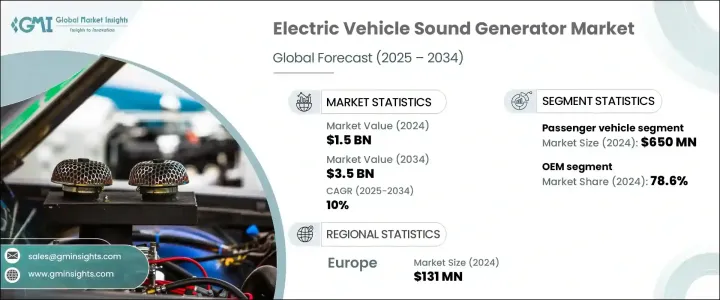

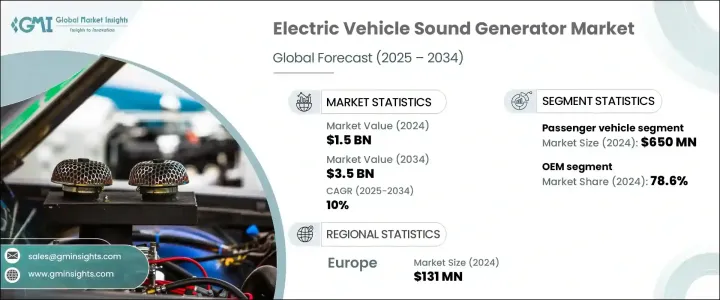

2024 年全球电动车声音产生器市场规模达 15 亿美元,预计到 2034 年将以 10% 的复合年增长率成长,达到 35 亿美元。随着电动车 (EV) 的普及,对声音产生器的需求也将持续成长。电动车低速行驶时几乎无声,这在城市和行人密集的地区构成安全隐患。为此,世界各地的监管机构要求电动车必须发出合成声音,以提醒行人,尤其是视障人士。日益增长的监管压力促使汽车製造商将电动车声音产生器 (EVSG) 作为标准配备。电动车产量的不断增长和安全隐患的日益加剧,共同推动了这一需求,尤其是在人口稠密的城市。

随着电动车在多个领域(从个人乘用车到商用车队和公共交通)的不断扩展,电动车声音产生器 (EVSG) 正在从可选功能演变为强制性安全组件。随着城市交通拥堵加剧和步行区不断扩大,电动车低速行驶时近乎无声的运作对公共安全构成了切实的威胁。声音产生器透过发出声音提示,提醒行人、骑乘者和其他道路使用者註意驶近的车辆,从而弥合这一差距。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 35亿美元 |

| 复合年增长率 | 10% |

乘用车领域在电动车声音产生器市场中占了40%的份额,2024年的估值达到6.5亿美元,因为这些车辆最常用于行人频繁互动的城市地区。随着驾驶员行驶距离的增加,确保合规性和增强安全性的需求促使汽车製造商在这些车辆中整合声音产生器。製造商也开始转向客製化设计的电动车声音,不仅是为了满足法律要求,也是为了打造独特的品牌形象。安全与品牌行销的融合正在加速先进的电动车声音产生器系统在乘用电动车中的应用。

2024年,原始设备製造商 (OEM) 占据了最大的市场份额,达到 78.6%。在车辆生产过程中安装电动车音响系统,可与车载电子设备和系统(包括动力总成和资讯娱乐单元)无缝整合。这种方法从一开始就确保了合规性,有助于维护保固并简化认证流程。 OEM 可以透过大规模采购和组装来降低成本,在保持生产效率的同时,为消费者提供符合法规要求的内建音响解决方案。监管机构青睐OEM安装,因为它可以在车辆上路前保证合规性。

2024年,德国电动车声音产生器市场产值达1.31亿美元。该国的主导地位得益于其强大的汽车製造基础和积极的电气化。德国製造商是最早采用电动车声音产生器系统的国家之一,他们利用监管要求和创新技术在竞争中保持领先。他们的方法将严格遵守欧盟声音法规与注重声学品牌建立相结合,使汽车製造商能够创建与品牌形象相符的标誌性声音配置文件。电动车的高产量,加上大规模生产设施和先进的研发能力,进一步刺激了对无缝整合电动车声音产生器解决方案的需求。

电动车声音系统 (EVSG) 市场的领导者包括现代、ECCO、意法半导体、大陆集团、哈曼国际、安波福、电装、Forvia Hella、Brigade Electronics 和 Ansys。为了保持竞争力,这些公司正在采取关键策略,例如改进数位声音架构、扩大与原始设备製造商的合作伙伴关係以及投资基于人工智慧的声音生成技术。许多公司专注于为不同类型的电动车提供可扩展的解决方案,同时增强车载整合度和使用者体验。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 软体开发人员和声学工程师

- 系统整合商

- 最终用途

- 利润率分析

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 价格趋势

- 地区

- 产品

- 成本細項分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 行人安全监理规定

- 电动车的普及率不断提高

- 声音设计和技术的进步

- OEM整合与品牌差异化

- 产业陷阱与挑战

- 先进系统成本高昂

- 技术和标准化障碍

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品,2021 - 2034 年

- 主要趋势

- 外部声音产生器

- 内部声音产生器

- 可客製化的音响系统

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 纯电动车(BEV)

- 混合动力电动车(HEV)

- 插电式混合动力车(PHEV)

- 燃料电池电动车(FCEV)

第七章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 轿车

- 越野车

- 掀背车

- 商用车

- 轻型商用车

- 平均血红素 (MCV)

- 丙型肝炎病毒

- 两轮车和三轮车

- 非公路车辆

第八章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第九章:市场估计与预测:依组件,2021 - 2034

- 主要趋势

- 硬体

- 演讲嘉宾

- 扩大机

- 控制器

- 执行器

- 线束

- 软体

- 声音设计应用

- 控制系统

- 使用者介面系统

第十章:市场估计与预测:按速度范围,2021 - 2034 年

- 主要趋势

- 低速声音产生器(0-30 公里/小时)

- 全速范围声音产生器(超过 30 公里/小时)

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十二章:公司简介

- Ansys

- Aptiv

- Brigade Electronics

- Continental

- Denso

- ECCO

- ESI Group (Keysights)

- Forvia Hella

- General Motors

- Harman International

- Hyundai

- Mercedes-Benz

- Softeq

- Soundracer

- STMicroelectronics

- Thor

- TVS

- Volkswagen

- Volvo

The Global Electric Vehicle Sound Generator Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 10% to reach USD 3.5 billion by 2034, as electric vehicles (EVs) become more widespread, the demand for sound generators continues to rise. EVs are almost silent at low speeds, which poses safety risks in urban and pedestrian-heavy areas. Regulatory bodies worldwide have responded by requiring EVs to produce synthetic sounds to alert pedestrians, especially those who are visually impaired. This growing regulatory pressure pushes automakers to adopt EVSGs as a standard feature. The convergence of rising EV production and increasing safety concerns fuels this demand, particularly in densely populated cities.

As electric mobility continues to expand across multiple segments-from individual passenger cars to commercial fleets and public transit-electric vehicle sound generators (EVSGs) are evolving from optional features to mandatory safety components. With cities growing more congested and pedestrian zones increasing, the near-silent operation of EVs at low speeds poses a real risk to public safety. Sound generators help bridge this gap by producing audible cues that alert pedestrians, cyclists, and other road users to an approaching vehicle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $3.5 Billion |

| CAGR | 10% |

The passenger vehicles segment in the electric vehicle sound generator market held a 40% share, reaching a valuation of USD 650 million in 2024, as these vehicles are most often used in urban areas where pedestrian interaction is frequent. As drivers travel longer distances, the need to ensure regulatory compliance and enhance safety prompts automakers to integrate sound generators in these vehicles. Manufacturers are also turning to custom-designed EV sounds not only to meet legal mandates but also to build distinctive brand identities. The fusion of safety and brand marketing is accelerating the adoption of advanced EVSG systems in passenger electric vehicles.

Original equipment manufacturers (OEMs) held the largest market share of 78.6% in 2024. Installing EV sound systems during vehicle production allows for seamless integration with onboard electronics and systems, including powertrains and infotainment units. This approach ensures legal compliance from the outset, which helps preserve warranties and streamline certification processes. OEMs benefit by reducing costs through large-scale purchasing and assembly, offering consumers built-in, regulation-ready sound solutions while maintaining manufacturing efficiency. Regulatory bodies favor OEM installation since it guarantees adherence before the vehicle hits the road.

Germany Electric Vehicle Sound Generator Market generated USD 131 million in 2024. The country's dominance is attributed to its strong automotive manufacturing base and aggressive push toward electrification. German manufacturers are among the earliest adopters of EVSG systems, leveraging regulatory requirements and innovation to stay ahead in the competitive landscape. Their approach blends strict adherence to EU sound regulations with a focus on acoustic branding, allowing automakers to create signature sound profiles that align with brand identity. The high output of electric vehicles, supported by large-scale production facilities and advanced R&D capabilities, further fuels demand for seamlessly integrated EVSG solutions.

Leading players in the EVSG market include Hyundai, ECCO, STMicroelectronics, Continental, Harman International, Aptiv, Denso, Forvia Hella, Brigade Electronics, and Ansys. To stay competitive, these companies are adopting key strategies such as advancing digital sound architecture, expanding partnerships with OEMs, and investing in AI-based sound generation. Many focus on scalable solutions for different EV types while enhancing in-vehicle integration and user experience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material supplier

- 3.2.2 Component manufacturers

- 3.2.3 Software developers and acoustic engineers

- 3.2.4 System integrators

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price trend

- 3.7.1 Region

- 3.7.2 Product

- 3.8 Cost breakdown analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Regulatory mandates for pedestrian safety

- 3.11.1.2 Increasing adoption of EVs

- 3.11.1.3 Advancements in sound design and technology

- 3.11.1.4 OEM integration and brand differentiation

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High cost of advanced systems

- 3.11.2.2 Technical and standardization barriers

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 External sound generators

- 5.3 Internal sound generators

- 5.4 Customizable sound systems

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Battery electric vehicles (BEV)

- 6.3 Hybrid electric vehicles (HEV)

- 6.4 Plug-in hybrid electric vehicles (PHEV)

- 6.5 Fuel cell electric vehicles (FCEV)

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicle

- 7.2.1 Sedan

- 7.2.2 SUV

- 7.2.3 Hatchback

- 7.3 Commercial vehicle

- 7.3.1 LCV

- 7.3.2 MCV

- 7.3.3 HCV

- 7.4 Two and three wheelers

- 7.5 Off-highway vehicles

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Hardware

- 9.2.1 Speakers

- 9.2.2 Amplifiers

- 9.2.3 Controllers

- 9.2.4 Actuators

- 9.2.5 Wiring harnesses

- 9.3 Software

- 9.3.1 Sound design applications

- 9.3.2 Control systems

- 9.3.3 User interface systems

Chapter 10 Market Estimates & Forecast, By Speed Range, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Low-speed sound generators (0-30 km/h)

- 10.3 Full-speed range sound generators (more than 30 km/h)

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Ansys

- 12.2 Aptiv

- 12.3 Brigade Electronics

- 12.4 Continental

- 12.5 Denso

- 12.6 ECCO

- 12.7 ESI Group (Keysights)

- 12.8 Forvia Hella

- 12.9 General Motors

- 12.10 Harman International

- 12.11 Hyundai

- 12.12 Mercedes-Benz

- 12.13 Softeq

- 12.14 Soundracer

- 12.15 STMicroelectronics

- 12.16 Thor

- 12.17 TVS

- 12.18 Volkswagen

- 12.19 Volvo