|

市场调查报告书

商品编码

1766251

车辆声音合成技术市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Vehicle Sound Synthesis Technology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

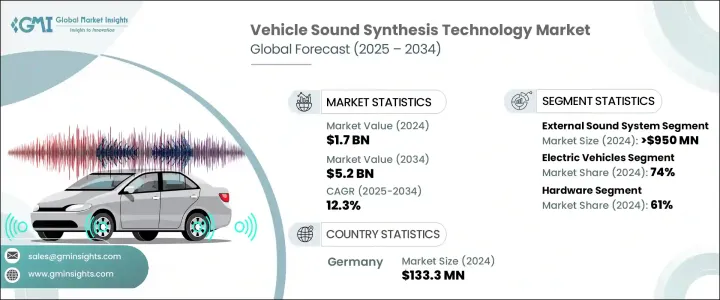

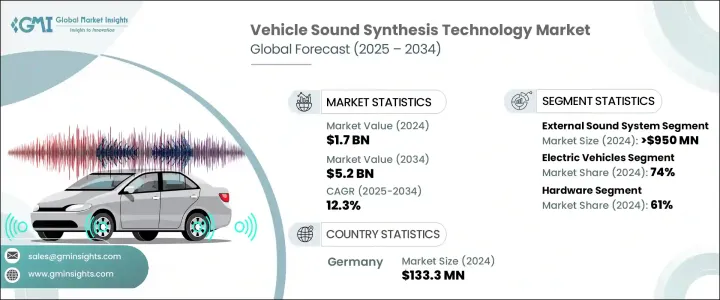

2024 年全球车辆声音合成技术市场价值为 17 亿美元,预计到 2034 年将以 12.3% 的复合年增长率成长,达到 52 亿美元。电动和混合动力汽车的广泛采用在推动市场成长方面发挥着重要作用。电动车 (EV) 由于采用电动马达而极其安静,这为车厢舒适度提供了优势。然而,这种安静也对行人构成风险,特别是老年人和残疾人,因为他们可能听不到车辆靠近。因此,声学车辆警报系统 (AVAS) 现在在美国、欧盟、日本和中国等多个地区都是强制要求的,用于在低速行驶时产生人工声音并提醒行人电动车的存在。全球电动车产量的激增进一步刺激了对这些车辆声音合成系统的需求。

汽车製造商也正在利用声音设计来提升品牌形象,并与客户建立情感连结。车辆声音合成技术已超越安全范畴,如今在品牌塑造和丰富电动车感官体验方面发挥关键作用。许多汽车製造商正在与声音设计师合作,为他们的车辆开发独特的音讯配置,从类似引擎的轰鸣声到舒缓的旋律,这些都有助于增强品牌联想。这一趋势正在帮助拓展车辆声音合成技术的应用范围。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 52亿美元 |

| 复合年增长率 | 12.3% |

2024年,外部音响系统市值达9.5亿美元。随着自动驾驶系统的进步和共享经济模式的普及,外部音响对于人机互动的需求日益重要。无人驾驶汽车(例如自动驾驶汽车)通常依靠声音合成来提醒行人,并用合成声音取代传统的喇叭。这种必要性使得外部音响系统成为汽车中至关重要的创收功能,製造商投入了大量研发和法律资源来遵守监管标准。由于这些系统是法律强制要求的,汽车製造商正在增加对量产的投资,使其价格更实惠、普及程度更高。

2024年,电动车领域占据市场主导地位,占74%的份额,预计在预测期内将大幅成长。纯电动车 (BEV) 无需内燃机,因此本质上噪音较小,对行人构成安全隐患。为了降低这一风险,BEV 高度依赖 AVAS 技术来产生人工引擎声音,确保行人更安全的驾驶条件。作为车辆声音合成技术最先进的细分市场,随着全球电动车需求的不断增长,预计该细分市场将继续成长。

2024年,德国车辆声音合成技术市场占21%的市场份额,产值达1.333亿美元。德国在电动车声音合成系统的应用方面一直处于领先地位,许多製造商引领潮流。这些公司不仅遵守安全标准,还运用声音设计来更有效地推广其电动车。德国强大的汽车工业,以及博世、大陆和海拉等主要参与者,加速了AVAS系统在欧洲的广泛应用,使其在短时间内实现了标准化和可扩展性。

车辆声音合成技术市场的主要公司包括 Aptiv、通用汽车、特斯拉、哈曼国际、电装、大陆集团、现代汽车公司、大众汽车、德尔福科技和宝马集团。在车辆声音合成市场,各公司专注于开发先进的声音设计和声学解决方案,以增强安全性、品牌形像以及与客户的情感连结。许多製造商已经与声音设计师和作曲家建立了战略合作关係,为他们的车辆创建客製化的音讯檔案。此外,他们正在增加研发投入,以确保遵守不断变化的法规。与关键一级供应商在硬体和控制系统开发方面的合作也有助于公司扩展其能力。此外,正在采用大规模生产策略,以使声音合成系统更经济实惠且更易于消费者使用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 电动和混合动力车的普及率不断上升

- 政府有关行人安全的规定

- 数位声音设计的技术进步

- 车内声学体验的需求日益增长

- 产业陷阱与挑战

- 与传统平台和电动车转换的集成

- 小型原始设备製造商和二线市场的认知度有限

- 市场机会

- 电动和混合动力汽车的扩张

- 行人安全监理规定

- 对可定製品牌声音特征的需求

- 与先进车辆架构集成

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 按产品

- 生产统计

- 生产中心

- 消费中心

- 汇出和汇入

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 内部音响系统

- 外部音响系统

第六章:市场估计与预测:以推进方式,2021 - 2034 年

- 主要趋势

- 内燃机(ICE)

- 电动车(EV)

- 纯电动车(BEV)

- 插电式混合动力车(PHEV)

- 混合动力电动车(HEV)

第七章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 硬体

- 声音产生器/模组

- 扬声器/换能器

- 扩大机

- 控制器/ECU

- 软体

- 声音设计和设定檔软体

- 声音合成演算法

- 车辆整合软体

- 声学模拟和调音工具

- 服务

- 部署与集成

- 咨询

- 支援与维护

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- 原始设备製造商

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 马来西亚

- 新加坡

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Aptiv

- Audi

- BMW Group

- Brigade Electronics

- BYD Auto Co.

- Continental

- Delphi Technologies

- Denso Corporation

- ECCO Safety Group

- Ford Motor Company

- General Motors Company

- Harman International

- Honda Motor Co.

- Hyundai Motor Company

- KUFATEC

- Mando Hella Electronics Corp

- Nissan Motor Corporation

- STMicroelectronics

- Tesla

- Volkswagen

The Global Vehicle Sound Synthesis Technology Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 12.3% to reach USD 5.2 billion by 2034. The widespread adoption of electric and hybrid vehicles plays a major role in driving market growth. Electric vehicles (EVs) are incredibly quiet due to their electric motor, which provides an advantage in cabin comfort. However, this silence also poses a risk to pedestrians, particularly the elderly and disabled, as they may not hear the vehicle approaching. As a result, Acoustic Vehicle Alerting Systems (AVAS) are now mandatory in several regions, including the US, EU, Japan, and China, to generate artificial sounds at low speeds and alert pedestrians of an EV's presence. The surge in global EV production further boosts the demand for these vehicle sound synthesis systems.

Automotive manufacturers are also using sound design to enhance brand identity and create emotional connections with customers. Vehicle sound synthesis has evolved beyond safety and now plays a key role in branding and enriching the sensory experience of electric vehicles. Many car manufacturers are working with sound designers to develop unique audio profiles for their vehicles, ranging from engine-like roars to calming melodies, which also serve to strengthen brand association. This trend is helping expand the scope of vehicle sound synthesis technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 12.3% |

The external sound system segment was valued at USD 950 million in 2024. As autonomous driving systems progress and the shared economy model gains ground, the need for exterior sounds is becoming more critical for human-machine interactions. Vehicles that lack a driver, such as self-driving cars, often rely on sound synthesis to alert pedestrians, replacing the traditional horn with synthetic sounds. This necessity has made external sound systems a crucial, revenue-generating feature in vehicles, with manufacturers dedicating significant research, development, and legal resources to comply with regulatory standards. Since these systems are legally required, automakers are increasingly investing in mass production, making them more affordable and widely available.

The electric vehicle segment dominated the market in 2024, capturing a 74% share, and it is expected to grow significantly during the forecast period. Battery Electric Vehicles (BEVs) operate without an internal combustion engine and are therefore silent by nature, posing a safety concern for pedestrians. To mitigate this risk, BEVs rely heavily on AVAS technology to produce artificial engine sounds, ensuring safer driving conditions for pedestrians. This market segment, which is the most advanced adopter of vehicle sound synthesis, is expected to see continued growth as the demand for EVs expands worldwide.

Germany Vehicle Sound Synthesis Technology Market held a 21% share in 2024 and generated USD 133.3 million. The country has been at the forefront of adopting sound synthesis systems for electric vehicles, with many manufacturers leading the charge. Not only do these companies comply with safety standards, but they also use sound design to market their electric vehicles more effectively. Germany's strong automotive industry, with key players such as Bosch, Continental, and HELLA, has accelerated the widespread adoption of AVAS systems across Europe, making them standardized and scalable within a short period.

Major companies in the Vehicle Sound Synthesis Technology Market include Aptiv, General Motors, Tesla, Harman International, Denso, Continental, Hyundai Motor Company, Volkswagen, Delphi Technologies, and BMW Group. In the vehicle sound synthesis market, companies are focusing on developing advanced sound design and acoustic solutions that enhance the safety, branding, and emotional connection with customers. Many manufacturers have adopted strategic collaborations with sound designers and composers to create bespoke audio profiles for their vehicles. Additionally, they are increasing investments in research and development to ensure compliance with evolving regulations. Partnerships with key Tier 1 suppliers for hardware and control system development are also helping companies expand their capabilities. Furthermore, mass production strategies are being employed to make sound synthesis systems more affordable and widely accessible to consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Propulsion

- 2.2.4 Component

- 2.2.5 Application

- 2.2.6 Sales channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of electric and hybrid vehicles

- 3.2.1.2 Regulations by the government for pedestrian safety

- 3.2.1.3 Technological advancements in digital sound design

- 3.2.1.4 Increasing demands for in-car acoustic experiences

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Integration with legacy platforms and EV conversions

- 3.2.2.2 Limited awareness among smaller OEMs and tier-2 markets

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of electric and hybrid vehicles

- 3.2.3.2 Regulatory mandates for pedestrian safety

- 3.2.3.3 Demand for customizable brand sound signatures

- 3.2.3.4 Integration with advanced vehicle architectures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD, Million, Units)

- 5.1 Key trends

- 5.2 Internal sound system

- 5.3 External sound system

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 (USD, Million, Units)

- 6.1 Key trends

- 6.2 Internal combustion engine (ICE)

- 6.3 Electric vehicles (EV)

- 6.3.1 Battery electric vehicles (BEV)

- 6.3.2 Plug-in hybrid electric vehicles (PHEV)

- 6.3.3 Hybrid electric vehicles (HEV)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 (USD, Million, Units)

- 7.1 Key trends

- 7.2 Hardware

- 7.2.1 Sound generators/modules

- 7.2.2 Speakers/transducers

- 7.2.3 Amplifiers

- 7.2.4 Controllers / ECUs

- 7.3 Software

- 7.3.1 Sound design & profile software

- 7.3.2 Sound synthesis algorithms

- 7.3.3 Vehicle integration software

- 7.3.4 Acoustic simulation & tuning tools

- 7.4 Services

- 7.4.1 Deployment & integration

- 7.4.2 Consulting

- 7.4.3 Support & maintenance

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD, Million, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Hatchbacks

- 8.2.2 Sedan

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicles (LCV)

- 8.3.2 Medium commercial vehicles (MCV)

- 8.3.3 Heavy commercial vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By Sales channel, 2021 - 2034 (USD, Million, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Singapore

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Audi

- 11.3 BMW Group

- 11.4 Brigade Electronics

- 11.5 BYD Auto Co.

- 11.6 Continental

- 11.7 Delphi Technologies

- 11.8 Denso Corporation

- 11.9 ECCO Safety Group

- 11.10 Ford Motor Company

- 11.11 General Motors Company

- 11.12 Harman International

- 11.13 Honda Motor Co.

- 11.14 Hyundai Motor Company

- 11.15 KUFATEC

- 11.16 Mando Hella Electronics Corp

- 11.17 Nissan Motor Corporation

- 11.18 STMicroelectronics

- 11.19 Tesla

- 11.20 Volkswagen