|

市场调查报告书

商品编码

1750485

高温超导体 (HTS) 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测High-Temperature Superconductors (HTS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

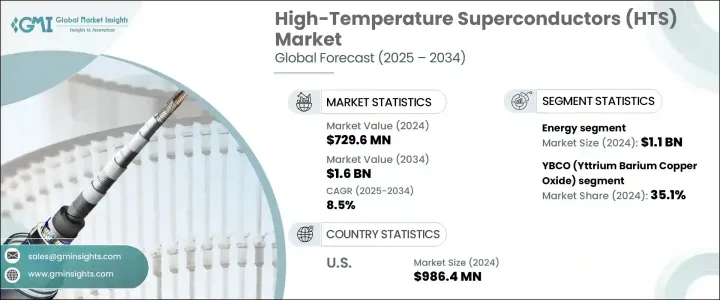

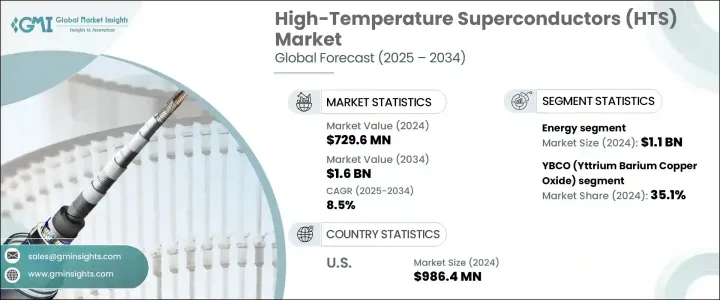

2024年全球高温超导体市场规模为7.296亿美元,预估年复合成长率为8.5%,2034年将达16亿美元。高温超导体(通常简称为HTS)是一种先进材料,能够在远高于传统超导体的温度下实现无阻力导电。与在接近绝对零度的温度下工作的传统超导体不同,HTS材料的工作温度在77开尔文或以上,这使得它们能够与液态氮冷却系统相容,既经济高效又易于管理。这一关键特性使HTS成为高能量效应用的理想选择,包括下一代电力系统、交通运输和先进的医学影像技术。

各行各业对增强电气性能的需求日益增长,这在推动高温超导材料的应用方面发挥关键作用。这些超导体正被整合到现代化能源基础设施中,特别是用于升级输电网和最大限度地减少能源损耗。世界各国政府和公用事业公司都高度重视老化系统的改造,而基于高温超导的解决方案因其高效性以及能够以更低的运行损耗处理更高功率负载的能力而被视为必不可少。全球对永续能源的追求以及对能够适应不断增长的电力消耗和分散式能源的弹性电力基础设施的需求进一步推动了这些倡议。超导设备在限制故障电流、提高电能品质和优化电网性能方面的应用也进一步推动了这一发展势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.296亿美元 |

| 预测值 | 16亿美元 |

| 复合年增长率 | 8.5% |

在众多高温超导材料中,钇钡铜氧化物 (YBCO) 继续占据市场主导地位。 2024 年,该领域占据全球市场份额的 35.1%,估值达到 11 亿美元。 YBCO 因其在近 90 开尔文温度下的稳定性能而备受青睐,这简化了冷却物流,同时提供了卓越的电流密度和耐受强磁场的能力。这些特性使其非常适合用于高功率和以磁铁为中心的应用。与传统超导体相比,YBCO 具有更佳的热管理和运作效率,这使其在商业和实验部署中得到了广泛的应用。

预计2034年,第一代高温超导线市场规模将达7.618亿美元,复合年增长率高达11.6%。第一代导线基于BSCCO化合物,得益于诸如「粉末管内法」等成熟的生产技术,已实现商业化应用。该工艺将超导粉末放入银基管中,并将其製成导线,从而生产出高效且易于规模生产的导体。这些导线在与液态氮相容的温度下也能高效运行,从而降低了冷却总成本,使其成为能源系统和科学研究中中试规模和小批量应用的理想选择。

能源仍是高温超导材料最大的应用领域,2024 年估值为 11 亿美元,预计 2025 年至 2034 年的复合年增长率将达到 12%,占整个市场的 35.4%。全球电力基础设施的转型在很大程度上依赖能够无损耗传输电力的材料。与传统的铜或铝电缆相比,采用高温超导技术的电力线路和组件能够长距离传输更大的电流,尤其是在城市人口密集、新设施物理空间有限的地区。它们的部署可以减少能量损耗并提高系统可靠性,使其成为现代配电网路不可或缺的一部分。

在美国,该市场在2024年的估值达到9.864亿美元,预计到2034年将以12.4%的复合年增长率成长。增加联邦机构、私人实体和研究机构之间的资金投入和合作,对于美国实现电网现代化以及探索国防和清洁能源新技术至关重要。投资正被引导至专注于超导功率装置的项目,这些装置能够提供更高的性能,同时解决系统漏洞。这些投资是旨在加强国家基础设施和推动能源独立的更广泛策略的一部分。

高温超导市场竞争格局适中,既有成熟企业,也有利基市场创新者。涉足该领域的公司通常拥有垂直整合的营运模式、先进的研发能力以及合作伙伴关係,以保持竞争力。大型企业拥有丰富的製造经验和基础设施,而小型企业则透过专业技术和材料开发做出贡献。持续创新以及产学研政府之间的策略联盟,对于满足医疗保健、能源和运输等领域不断变化的需求至关重要。预计这种持续的合作将塑造高温超导技术发展的下一个阶段。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链结构

- 生产成本影响

- 供应方影响(原料)

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计资料(HS 编码) 註:以上贸易统计仅提供重点国家。

- 2021-2024年主要出口国

- 2021-2024年主要进口国

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 对节能解决方案的需求不断增加

- 低温技术的进步

- 医疗保健领域的应用日益增多

- 聚变能研究投资不断增加

- 产业陷阱与挑战

- 製造成本高

- 大规模生产的技术挑战

- 冷却系统的复杂性

- 成长动力

- 市场机会

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 市占率分析

- 全球製造商市场份额

- 各製造商的区域市场份额

- 竞争基准测试

- 产品组合比较

- 技术能力比较

- 研发投入对比

- 製造能力比较

- 策略倡议和发展

- 併购

- 伙伴关係与合作

- 产品发布和创新

- 扩张计划

- 竞争定位矩阵

- 战略仪表板

第五章:市场估计与预测:依材料类型,2021-2034

- 主要趋势

- YBCO(钇钡铜氧化物)

- BSCCO(铋锶钙铜氧化物)

- REBCO(稀土钡铜氧化物)

- MgB2(二硼化镁)

- 铁基超导

- 镍酸盐

- 其他的

第六章:市场估计与预测:依产品形式,2021-2034

- 主要趋势

- 第一代(1G)高温超导导线

- 第二代(2G)HTS磁带

- 高温超导块体材料

- HTS薄膜

- 其他的

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 活力

- 电源线

- 变形金刚

- 电动机和发电机

- 故障电流限制器

- 储能係统

- 卫生保健

- MRI系统

- 核磁共振设备

- 其他的

- 运输

- 磁浮列车

- 电动飞机

- 船舶推进

- 电子与通信

- 微波滤波器

- 射频和微波设备

- 量子运算组件

- 研究与科学仪器

- 高场磁铁

- 粒子加速器

- 聚变反应器

- 工业应用

- 感应加热器

- 磁选

- 其他的

- 其他的

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- American Superconductor

- Bruker

- Fujikura

- High Temperature Superconductors

- IBM

- Japan Superconductor Technology

- Nexans

- SuperOx

- SuperPower

- Theva

The Global High-Temperature Superconductors Market was valued at USD 729.6 million in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 1.6 billion by 2034. High-temperature superconductors, often referred to as HTS, are advanced materials capable of conducting electricity without resistance at temperatures significantly higher than traditional superconductors. Unlike conventional counterparts that operate near absolute zero, HTS materials function at or above 77 Kelvin, making them compatible with liquid nitrogen cooling systems, which are both cost-effective and easier to manage. This key attribute positions HTS as a favorable option in applications requiring high energy efficiency, including next-generation power systems, transportation, and advanced medical imaging technologies.

Growing demand for enhanced electrical performance across sectors is playing a pivotal role in driving the adoption of HTS materials. These superconductors are being integrated into modern energy infrastructures, particularly for upgrading transmission grids and minimizing energy losses. Governments and utilities worldwide are placing emphasis on revamping aging systems, and HTS-based solutions are being considered essential due to their efficiency and ability to handle higher power loads with lower operational losses. These initiatives are further encouraged by the global push for sustainable energy and the need for resilient power infrastructures that can accommodate rising electricity consumption and distributed energy resources. The use of superconducting devices in limiting fault currents, enhancing power quality, and optimizing grid performance is adding to the momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $729.6 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.5% |

Among various HTS types, Yttrium Barium Copper Oxide (YBCO) continues to dominate the market. This segment accounted for 35.1% of the global share in 2024 and reached a valuation of USD 1.1 billion. YBCO remains preferred due to its stable performance at nearly 90 Kelvin, which simplifies cooling logistics while providing superior current density and the ability to withstand strong magnetic fields. These features make it suitable for use in high-power and magnet-centric applications. Compared to older superconductors, YBCO delivers better thermal management and operational efficiency, which has led to its wide-scale use in commercial and experimental deployments.

The first-generation HTS wires segment is projected to hit USD 761.8 million by 2034, growing at an impressive CAGR of 11.6%. First-generation wires, based on BSCCO compounds, have achieved commercial availability thanks to mature production techniques like the Powder-In-Tube method. This process involves placing superconducting powder into silver-based tubes and forming them into wires, resulting in conductors that are both effective and easier to produce at scale. These wires function efficiently at temperatures compatible with liquid nitrogen, reducing the overall cost of cooling and making them an attractive option for pilot-scale and low-volume applications in energy systems and scientific research.

Energy remains the largest application segment for HTS materials, with a valuation of USD 1.1 billion in 2024 and expected to grow at a CAGR of 12% from 2025 to 2034, capturing 35.4% of the total market. The transformation of global power infrastructure relies heavily on materials that can transmit electricity without losses. HTS-enabled power lines and components are capable of transmitting higher currents over long distances compared to conventional copper or aluminum cables, particularly in areas with dense urban populations and limited physical space for new installations. Their deployment reduces energy dissipation and enhances system reliability, making them essential for modern electricity distribution networks.

In the United States, the market reached a valuation of USD 986.4 million in 2024 and is set to expand at a CAGR of 12.4% through 2034. Increased funding and collaboration between federal agencies, private entities, and research institutions are central to the country's efforts to modernize its power grid and explore new technologies for defense and clean energy. Investments are being channeled into projects focusing on superconducting power devices that can deliver greater performance while addressing system vulnerabilities. These investments are part of broader strategies aimed at reinforcing national infrastructure and advancing energy independence.

The market landscape for high-temperature superconductors is moderately competitive, with a mix of established corporations and niche innovators. Companies involved in this field often possess vertically integrated operations, advanced research capabilities, and collaborative partnerships to remain competitive. Larger enterprises bring in extensive manufacturing experience and infrastructure, while smaller players contribute through specialized technologies and materials development. Continued innovation, along with strategic alliances between industry, academia, and government, is vital for keeping pace with evolving demands in sectors such as healthcare, energy, and transportation. This ongoing collaboration is expected to shape the next phase of high-temperature superconductivity advancements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain structure

- 3.2.2.1.3 Production cost implications

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Demand-side impact (selling price)

- 3.2.3.1 Price transmission to end markets

- 3.2.3.2 Market share dynamics

- 3.2.3.3 Consumer response patterns

- 3.2.4 Key companies impacted

- 3.2.5 Strategic industry responses

- 3.2.5.1 Supply chain reconfiguration

- 3.2.5.2 Pricing and product strategies

- 3.2.5.3 Policy engagement

- 3.2.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries, 2021-2024 (kilo tons)

- 3.3.2 Major importing countries, 2021-2024 (kilo tons)

- 3.4 Supplier landscape

- 3.5 Profit margin analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for energy-efficient solutions

- 3.8.1.2 Advancements in cryogenic technologies

- 3.8.1.3 Growing applications in healthcare sector

- 3.8.1.4 Rising investments in fusion energy research

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High manufacturing costs

- 3.8.2.2 Technical challenges in large-scale production

- 3.8.2.3 Cooling system complexities

- 3.8.1 Growth drivers

- 3.9 Market opportunities

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Market share analysis

- 4.2.1 Global market share by manufacturer

- 4.2.2 Regional market share by manufacturer

- 4.3 Competitive benchmarking

- 4.3.1 Product portfolio comparison

- 4.3.2 Technological capabilities comparison

- 4.3.3 R&D investment comparison

- 4.3.4 Manufacturing capacity comparison

- 4.4 Strategic initiatives & developments

- 4.4.1 Mergers & acquisitions

- 4.4.2 Partnerships & collaborations

- 4.4.3 Product launches & innovations

- 4.4.4 Expansion plans

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 YBCO (Yttrium Barium Copper Oxide)

- 5.3 BSCCO (Bismuth Strontium Calcium Copper Oxide)

- 5.4 REBCO (Rare Earth Barium Copper Oxide)

- 5.5 MgB2 (Magnesium Diboride)

- 5.6 Iron-based superconduct

- 5.7 Nickelates

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Product Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 First-generation (1G) HTS wires

- 6.3 Second-generation (2G) HTS tapes

- 6.4 HTS bulk materials

- 6.5 HTS thin films

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Energy

- 7.2.1 Power cables

- 7.2.2 Transformers

- 7.2.3 Motors & generators

- 7.2.4 Fault current limiters

- 7.2.5 Energy storage systems

- 7.3 Healthcare

- 7.3.1 MRI systems

- 7.3.2 NMR equipment

- 7.3.3 Others

- 7.4 Transportation

- 7.4.1 Maglev trains

- 7.4.2 Electric aircraft

- 7.4.3 Ship propulsion

- 7.5 Electronics & communication

- 7.5.1 Microwave filters

- 7.5.2 RF & microwave devices

- 7.5.3 Quantum computing components

- 7.6 Research & scientific instruments

- 7.6.1 High-field magnets

- 7.6.2 Particle accelerators

- 7.6.3 Fusion reactors

- 7.7 Industrial applications

- 7.7.1 Induction heaters

- 7.7.2 Magnetic separation

- 7.7.3 Others

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 American Superconductor

- 9.2 Bruker

- 9.3 Fujikura

- 9.4 High Temperature Superconductors

- 9.5 IBM

- 9.6 Japan Superconductor Technology

- 9.7 Nexans

- 9.8 SuperOx

- 9.9 SuperPower

- 9.10 Theva