|

市场调查报告书

商品编码

1750488

纤维素奈米晶体与奈米纤维市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cellulose Nanocrystals and Nanofibers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

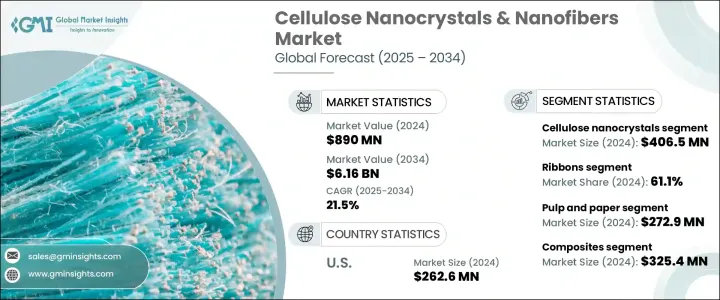

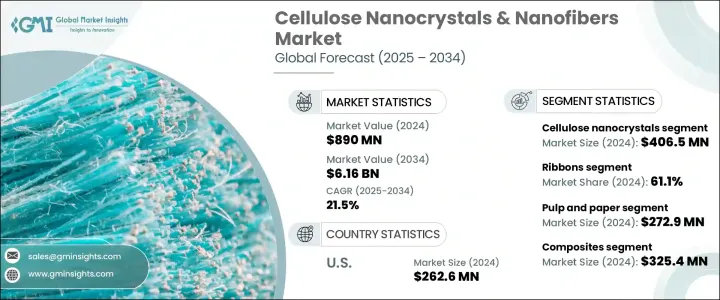

2024年,全球纤维素奈米晶体和奈米纤维市场价值为8.9亿美元,预计2034年将以21.5%的复合年增长率成长,达到61.6亿美元。这得益于产业对再生、可生物降解材料日益增长的需求,这些材料可作为石油基产品的可持续替代品。奈米纤维素源自木浆和农业废弃物,正成为众多旨在减少碳足迹并采取环保做法的行业的诱人选择。这些植物性奈米材料不仅具有环保效益,还具备卓越的功能性,能够满足复合材料、电子、医疗器材和绿色包装等新兴应用的性能需求。

材料科学的持续进步将纤维素奈米材料的性能推向了新的领域。其高抗拉强度、高刚性、低热膨胀性,以及优异的阻隔性能(例如耐油和耐氧性),使其适用于要求严苛的应用场景。各行各业也正在转向多功能配方,使材料集抗菌保护、耐热性甚至导电性于一体。这些不断发展的特性使其在航太、建筑、电子和生命科学等领域获得了更广泛的商业应用。监管支持力度的增强以及公众对可持续替代品日益增长的需求,持续推动该领域的广泛创新。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.9亿美元 |

| 预测值 | 61.6亿美元 |

| 复合年增长率 | 21.5% |

纤维素奈米晶体细分市场在2024年创造了4.065亿美元的收入,预计到2034年复合年增长率将达到22.1%。其透过酸水解获得的高度结晶结构,具有优异的增强性能。这些特性使CNC成为高级涂料、薄膜和结构复合材料的理想选择。另一方面,透过机械或酵素製程生产的纤维素奈米纤维具有柔韧性,非常适合用于包装、过滤和个人护理产品。其网络结构在保持生物降解性的同时,也具有耐久性,为注重环保性能的终端市场增添了价值。

2024年,纸浆和造纸细分市场占市场份额的2.729亿美元,预计复合年增长率为22.4%。该细分市场将持续利用奈米纤维素的轻质、坚固和可堆肥特性。奈米纤维素在永续包装中的应用与消费品和工业领域对可生物降解替代品日益增长的需求相契合。企业越来越多地在纸张涂层、阻隔层和模塑包装解决方案中采用纤维素奈米材料,以减少对塑胶的依赖,同时保持产品的耐用性和性能。随着一次性塑胶监管的收紧,食品、饮料和零售业对标籤、包装和容器中基于奈米纤维素的替代品的需求持续增长。

2024年,美国纤维素奈米晶体和奈米纤维市场价值达2.626亿美元,预计到2034年将以20.9%的复合年增长率成长。这一增长得益于创新中心、研究合作以及电子、医疗保健和永续包装领域的应用。雄厚的联邦研究资金、大学与私人企业之间的战略合作伙伴关係以及向循环经济模式的转变,共同推动着这一领域的发展。美国市场拥有强大的技术商业化生态系统,受益于医疗设备、智慧包装和柔性电子基板领域的早期应用,从而在奈米纤维素创新领域保持全球领先地位。

Sappi Limited、日本製纸株式会社、Borregaard ASA、CelluForce Inc. 和 American Process Inc. 等主要公司正在透过扩建研发设施、开发可扩展的生产流程以及与终端产业建立策略合作伙伴关係来巩固其市场地位。这些公司正在投资下一代配方和大量生产,以满足全球市场不断变化的需求,并推动具有成本效益的商业化。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 市场定义与演变

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计资料(HS 编码) 註:以上贸易统计仅提供重点国家。

- 主要出口国

- 国家 1

- 国家 2

- 国家 3

- 主要进口国

- 国家 1

- 国家 2

- 国家 3

- 主要出口国

- 产业价值链分析

- 原料格局与供应链动态

- 原料分析

- 永续采购实践

- 供应链挑战与解决方案

- 定价分析和成本结构

- 生产成本分析

- 定价趋势

- 降低成本策略

- 技术格局

- 萃取和生产技术

- 机械方法

- 化学方法

- 酶促方法

- 综合方法

- 表征技术

- 技术进步与创新

- 萃取和生产技术

- 市场动态

- 市场驱动因素

- 对永续材料的需求不断增长

- 卓越的机械性能和阻隔性能

- 增加研发投入

- 政府法规有利于生物基材料

- 市场限制

- 生产成本高

- 可扩展性挑战

- 处理中的技术限制

- 来自传统材料的竞争

- 市场机会

- 医疗保健和电子领域的新兴应用

- 表面改质技术的进展

- 与其他奈米材料的整合

- 尚未开发的区域市场

- 市场挑战

- 标准化问题

- 分散性和相容性挑战

- 湿气敏感性

- 监管障碍

- 市场驱动因素

- 监管框架和标准

- 区域监管机构

- 认证和品质标准

- 环境法规的影响

- 创新与永续发展倡议

- 循环经济一体化

- 减少碳足迹策略

- 废弃物价值化方法

- PESTEL分析

- 波特五力分析

- 永续性和 ESG 分析

第四章:竞争格局

- 市占率分析

- 主要利害关係人和策略定位

- 公司市场定位及热图分析

- 竞争策略和策略倡议

- 合併、收购和合作

- 新产品发布和创新

- 投资和融资场景

- 新创企业生态系统分析

- 专利分析与智慧财产权格局

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 纤维素奈米晶体(CNC)

- 硫酸化CNCs

- 羧化CNCs

- 磷酸化CNCs

- 其他改装的CNC

- 纤维素奈米纤维(CNF)

- 机械纤维化的CNF

- TEMPO氧化CNF

- 酵素预处理的CNF

- 其他改性CNF

- 细菌奈米纤维素(BNC)

- 纤维素奈米原纤维(CNF)

- 其他奈米纤维素产品

第六章:市场估计与预测:按来源,2021 - 2034 年

- 主要趋势

- 木头

- 软木

- 硬木

- 非木质植物来源

- 农业残留物

- 棉布

- 麻

- 亚麻

- 其他植物来源

- 细菌合成

- 藻类和被囊动物

- 回收资源

- 废纸

- 纺织废料

- 其他回收资源

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 复合材料

- 聚合物基复合材料

- 水泥复合材料

- 其他复合材料

- 纸张和包装

- 纸张增强

- 阻隔膜

- 食品包装

- 其他包装应用

- 涂料和薄膜

- 光学薄膜

- 阻隔涂层

- 抗菌涂层

- 其他涂料

- 生物医学和製药

- 药物输送系统

- 伤口癒合材料

- 组织工程支架

- 其他生物医学应用

- 电子和感测器

- 柔性电子产品

- 生物感测器

- 储能设备

- 其他电子应用

- 流变改质剂

- 石油和天然气应用

- 油漆和涂料

- 个人护理产品

- 其他流变学应用

- 过滤和分离

- 气凝胶和泡沫

- 其他应用

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 纸浆和造纸

- 包装

- 食品和饮料

- 医疗保健和製药

- 电子与光电子

- 汽车和运输

- 建筑和建筑材料

- 纺织品和服装

- 个人护理和化妆品

- 石油和天然气

- 油漆、涂料和黏合剂

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Celluforce

- American Process Inc.

- Borregaard

- Nippon Paper Industries Co., Ltd.

- Stora Enso

- UPM-Kymmene Oyj

- Sappi Limited

- Kruger Inc.

- Daicel Corporation

- Weidmann Fiber Technology

- Melodea Ltd.

- Blue Goose Biorefineries Inc.

- Oji Holdings Corporation

- VTT Technical Research Centre of Finland

- FPInnovations

- Cellucomp Ltd.

- Forest Products Laboratory (FPL)

- Nanografi Nano Technology

- Asahi Kasei Corpo

The Global Cellulose Nanocrystals and Nanofibers Market was valued at USD 890 million in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 6.16 billion by 2034, driven by increasing industry demand for renewable, biodegradable materials that serve as sustainable alternatives to petroleum-based products. Nanocellulose, derived from wood pulp and agricultural residues, is becoming an attractive choice for multiple industries aiming to reduce their carbon footprint and adopt eco-conscious practices. These plant-based nanomaterials not only offer environmental benefits but also deliver superior functionality that supports the performance needs of emerging applications in composites, electronics, medical devices, and green packaging.

Ongoing advances in material science have pushed the capabilities of cellulose nanomaterials into new territories. Their high tensile strength, stiffness, and low thermal expansion, combined with impressive barrier properties-such as oil and oxygen resistance-make them suitable for demanding use cases. Industries are also turning to multifunctional formulations, where the material integrates antimicrobial protection, heat resistance, and even conductivity. These evolving features lead to broader commercial adoption across sectors like aerospace, construction, electronics, and life sciences. Supportive regulatory momentum and growing public pressure for sustainable alternatives continue to drive widespread innovation in this space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $890 Million |

| Forecast Value | $6.16 Billion |

| CAGR | 21.5% |

Cellulose nanocrystals segment generated USD 406.5 million in 2024 and is expected to witness a CAGR of 22.1% through 2034. Their highly crystalline structure, obtained through acid hydrolysis, provides excellent reinforcement capabilities. These properties make CNCs ideal for advanced coatings, films, and structural composites. On the other hand, cellulose nanofibers-produced through mechanical or enzymatic processes-offer flexibility and are well-suited for packaging, filtration, and personal care products. Their network-forming structure supports durability while maintaining biodegradability, adding value in end-use markets focused on eco-friendly performance.

The pulp and paper segment accounted for USD 272.9 million of the market in 2024 and is projected to grow at a CAGR of 22.4%. This segment continues to leverage nanocellulose for its lightweight, strong, and compostable nature. Its application in sustainable packaging aligns with the rising demand for biodegradable alternatives across consumer and industrial sectors. Companies are increasingly adopting cellulose nanomaterials in paper coatings, barrier layers, and molded packaging solutions to reduce reliance on plastics while maintaining durability and performance. As regulations tighten around single-use plastics, demand for nanocellulose-based alternatives in labeling, wrapping, and containers continues to rise across food, beverage, and retail industries.

United States Cellulose Nanocrystals and Nanofibers Market was valued at USD 262.6 million in 2024 and is projected to grow at a 20.9% CAGR through 2034. This growth is supported by innovation hubs, research collaborations, and applications in electronics, healthcare, and sustainable packaging. Strong federal research funding, strategic partnerships between universities and private firms, and a shift toward circular economy models fuel development. With a robust ecosystem for technology commercialization, the U.S. market benefits from early adoption across medical devices, smart packaging, and flexible electronic substrates, helping it maintain a leading position globally in nanocellulose innovation.

Key companies such as Sappi Limited, Nippon Paper Industries Co., Ltd., Borregaard ASA, CelluForce Inc., and American Process Inc. are strengthening their market position by expanding R&D facilities, developing scalable production processes, and forming strategic partnerships across end-use industries. These players are investing in next-gen formulations and high-volume production to meet the evolving needs of global markets and drive cost-effective commercialization.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Market definition and evolution

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.1 Price transmission to end markets

- 3.2.2.2 Market share dynamics

- 3.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.1.1 Country 1

- 3.3.1.2 Country 2

- 3.3.1.3 Country 3

- 3.3.2 Major importing countries

- 3.3.2.1 Country 1

- 3.3.2.2 Country 2

- 3.3.2.3 Country 3

- 3.3.1 Major exporting countries

- 3.4 Industry value chain analysis

- 3.5 Raw material landscape and supply chain dynamics

- 3.5.1 Feedstock analysis

- 3.5.2 Sustainable sourcing practices

- 3.5.3 Supply chain challenges and solutions

- 3.6 Pricing analysis and cost structure

- 3.6.1 Production cost analysis

- 3.6.2 Pricing trends

- 3.6.3 Cost reduction strategies

- 3.7 Technology landscape

- 3.7.1 Extraction and production technologies

- 3.7.1.1 Mechanical methods

- 3.7.1.2 Chemical methods

- 3.7.1.3 Enzymatic methods

- 3.7.1.4 Combined approaches

- 3.7.2 Characterization techniques

- 3.7.3 Technological advancements and innovations

- 3.7.1 Extraction and production technologies

- 3.8 Market dynamics

- 3.8.1 Market drivers

- 3.8.1.1 Growing demand for sustainable materials

- 3.8.1.2 Superior mechanical and barrier properties

- 3.8.1.3 Increasing R&D investments

- 3.8.1.4 Government regulations favoring bio-based materials

- 3.8.2 Market restraints

- 3.8.2.1 High production costs

- 3.8.2.2 Scalability challenges

- 3.8.2.3 Technical limitations in processing

- 3.8.2.4 Competition from conventional materials

- 3.8.3 Market opportunities

- 3.8.3.1 Emerging applications in healthcare and electronics

- 3.8.3.2 Advancements in surface modification techniques

- 3.8.3.3 Integration with other nanomaterials

- 3.8.3.4 Untapped regional markets

- 3.8.4 Market challenges

- 3.8.4.1 Standardization issues

- 3.8.4.2 Dispersion and compatibility challenges

- 3.8.4.3 Moisture sensitivity

- 3.8.4.4 Regulatory hurdles

- 3.8.1 Market drivers

- 3.9 Regulatory framework and standards

- 3.9.1 Regional regulatory landscape

- 3.9.2 Certification and quality standards

- 3.9.3 Environmental regulations impact

- 3.10 Innovation and sustainability initiatives

- 3.10.1 Circular economy integration

- 3.10.2 Carbon footprint reduction strategies

- 3.10.3 Waste valorization approaches

- 3.11 PESTEL analysis

- 3.12 Porter's five forces analysis

- 3.13 Sustainability and ESG analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis, 2024

- 4.2 Key stakeholders and strategic positioning

- 4.3 Company market positioning and heat map analysis

- 4.4 Competitive strategies and strategic initiatives

- 4.5 Mergers, acquisitions, and collaborations

- 4.6 New product launches and innovations

- 4.7 Investment and funding scenario

- 4.8 Start-up ecosystem analysis

- 4.9 Patent analysis and intellectual property landscape

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cellulose nanocrystals (CNCs)

- 5.2.1 Sulfated CNCs

- 5.2.2 Carboxylated CNCs

- 5.2.3 Phosphorylated CNCs

- 5.2.4 Other Modified CNCs

- 5.3 Cellulose nanofibers (CNFs)

- 5.3.1 Mechanically fibrillated CNFs

- 5.3.2 TEMPO-oxidized CNFs

- 5.3.3 Enzymatically pretreated CNFs

- 5.3.4 Other modified CNFs

- 5.4 Bacterial nanocellulose (BNC)

- 5.5 Cellulose nanofibrils (CNF)

- 5.6 Other nanocellulose products

Chapter 6 Market Estimates and Forecast, By Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Wood

- 6.2.1 Softwood

- 6.2.2 Hardwood

- 6.3 Non-wood plant sources

- 6.3.1 Agricultural residues

- 6.3.2 Cotton

- 6.3.3 Hemp

- 6.3.4 Flax

- 6.3.5 Other plant sources

- 6.4 Bacterial synthesis

- 6.5 Algae and tunicates

- 6.6 Recycled sources

- 6.6.1 Paper waste

- 6.6.2 Textile waste

- 6.6.3 Other recycled sources

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Composites

- 7.2.1 Polymer matrix composites

- 7.2.2 Cement composites

- 7.2.3 Other composites

- 7.3 Paper and packaging

- 7.3.1 Paper strengthening

- 7.3.2 Barrier films

- 7.3.3 Food packaging

- 7.3.4 Other packaging applications

- 7.4 Coatings and films

- 7.4.1 Optical films

- 7.4.2 Barrier coatings

- 7.4.3 Antimicrobial coatings

- 7.4.4 Other coatings

- 7.5 Biomedical and pharmaceutical

- 7.5.1 Drug delivery systems

- 7.5.2 Wound healing materials

- 7.5.3 Tissue engineering scaffolds

- 7.5.4 Other biomedical applications

- 7.6 Electronics and sensors

- 7.6.1 Flexible electronics

- 7.6.2 Biosensors

- 7.6.3 Energy storage devices

- 7.6.4 Other electronic applications

- 7.7 Rheology modifiers

- 7.7.1 Oil and gas applications

- 7.7.2 Paints and coatings

- 7.7.3 Personal care products

- 7.7.4 Other rheological applications

- 7.8 Filtration and separation

- 7.9 Aerogels and foams

- 7.10 Other applications

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pulp and paper

- 8.3 Packaging

- 8.4 Food and beverage

- 8.5 Healthcare and pharmaceuticals

- 8.6 Electronics and optoelectronics

- 8.7 Automotive and transportation

- 8.8 Construction and building materials

- 8.9 Textiles and apparel

- 8.10 Personal care and cosmetics

- 8.11 Oil and gas

- 8.12 Paints, coatings, and adhesives

- 8.13 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Celluforce

- 10.2 American Process Inc.

- 10.3 Borregaard

- 10.4 Nippon Paper Industries Co., Ltd.

- 10.5 Stora Enso

- 10.6 UPM-Kymmene Oyj

- 10.7 Sappi Limited

- 10.8 Kruger Inc.

- 10.9 Daicel Corporation

- 10.10 Weidmann Fiber Technology

- 10.11 Melodea Ltd.

- 10.12 Blue Goose Biorefineries Inc.

- 10.13 Oji Holdings Corporation

- 10.14 VTT Technical Research Centre of Finland

- 10.15 FPInnovations

- 10.16 Cellucomp Ltd.

- 10.17 Forest Products Laboratory (FPL)

- 10.18 Nanografi Nano Technology

- 10.19 Asahi Kasei Corpo