|

市场调查报告书

商品编码

1851624

奈米纤维素:全球市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Global Nanocellulose - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

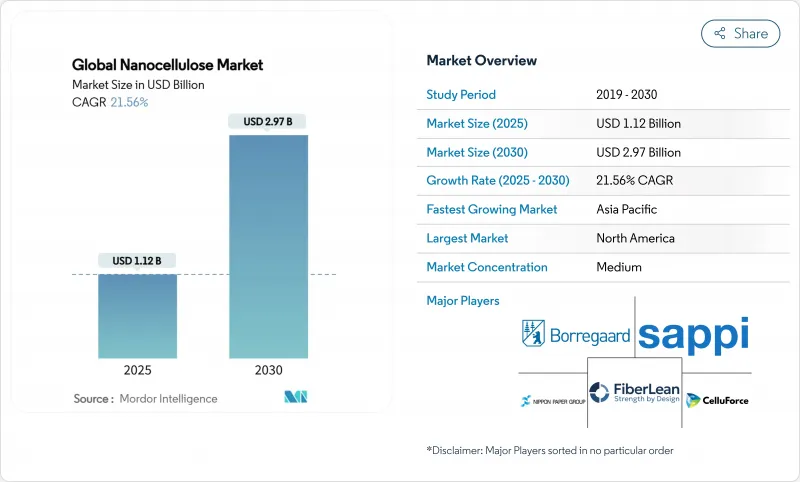

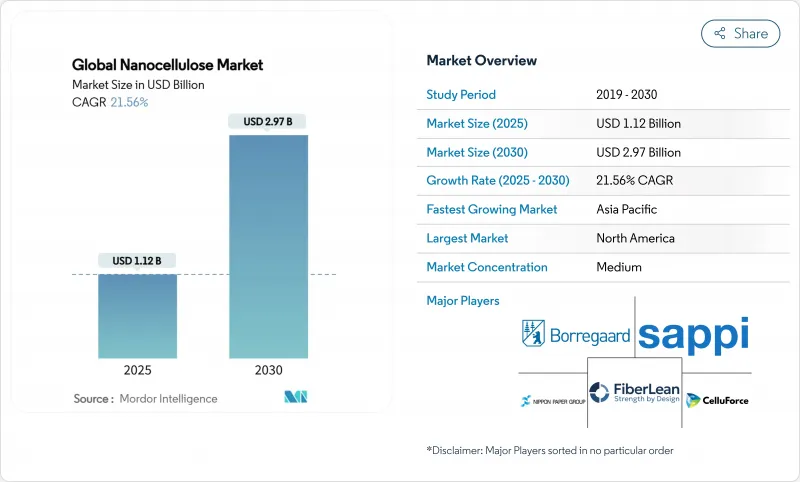

2025 年全球奈米纤维素市场规模估计为 11.2 亿美元,预计到 2030 年将达到 29.7 亿美元,预测期(2025-2030 年)复合年增长率为 21.56%。

日益增长的永续性需求、动态的石化产品价格以及材料科学的快速突破,共同为两位数增长铺平了道路。汽车轻量化、回收阻隔薄膜和生物医学支架将推动近期需求,而酵素法低能耗製程将释放未来成本竞争力。北美现有企业凭藉着成熟的中试生产线和与目标商标产品製造商 (OEM) 的紧密合作关係,正凭藉更低的转化成本和接近性电子及包装丛集的优势,缩小与北美企业的差距。原料来源从木浆转向农业废弃物,进一步降低了供应链风险,并支持了循环经济经营模式。在竞争激烈的市场环境下,现有大型纸浆企业不断扩大产能,而生物技术新兴企业专注于高端治疗领域,由此形成了一个充满活力的伙伴关係与许可生态系统,加速了应用推广。

全球奈米纤维素市场趋势与洞察

优异的机械性质和阻隔性能

奈米纤维素的拉伸强度为 4.9–7.5 GPa(吉帕),弹性模量为 100–200 GPa,使其在对重量要求严格的部件中性能接近碳纤维,因此在汽车车身面板和飞机内饰领域极具吸引力。橡树岭国家实验室 (ONL) 于 2025 年检验了奈米纤维素的潜力,结果表明,碳奈米纤维增强奈米纤维素复合复合材料的拉伸强度比传统玻璃纤维替代品高 50%,韧性几乎是后者的两倍。其高长宽比和表面积有助于与聚合物基体形成牢固的结合,从而最大限度地降低分层风险并提高疲劳寿命。日本汽车製造商预计,当奈米纤维素取代某些金属和塑胶零件时,每辆车可减重 20 公斤,从而显着节省燃油并减少生命週期排放。除了承重零件外,超薄奈米纤维素薄膜还比乙烯-乙烯醇共聚物 (EVOH) 和聚偏二氯乙烯 (PVDC) 具有更好的氧气和水蒸气阻隔性能,并且可回收和可堆肥。这种材料的机械性能和阻隔性能的双重优势,使其能够应用于广泛的市场,从家电外壳到药品泡壳包装。

对永续包装的需求激增

零售商、电商公司和食品品牌正迅速取代石油基薄膜,迅速推高了对生物基阻隔材料的需求。在2024年的R3PACK试验中,比利时、法国和卢森堡的欧洲连锁店用纤维素包装取代了试验规模的塑胶托盘,减少了数千吨一次性塑胶的使用。欧盟指令要求到2030年所有包装都必须可重复使用或可回收,这促使加工商对奈米纤维素涂层进行认证,以升级传统的纸板。细菌纤维素薄膜具有优异的紫外线阻隔性能和拉伸强度,既能减少光敏食品的腐败,又能承受低温运输物流的考验。瑞典一家Start-Ups公司透过优化干燥能耗和捲对卷涂布速度,实现了与低密度聚乙烯(LDPE)包装膜的成本持平,从而消除了最后一个经济障碍。美国食品药物管理局(FDA)核准原纤化纤维素作为食品接触的公认安全物质(GRAS),进一步加速了北美供应商对这种材料的采用。随着品牌所有者签订多年供应协议,奈米纤维素市场为产能扩张提供了可预测的收入基础。

生产成本高且规模化风险

即使采用最佳化的水解工艺,最低销售价格仍高于大宗聚合物基准价格-酸法製程每干吨10,031美元,而以目前的酵素法产率计算,每干吨可达65,740美元。连续造纸试点计画可将每公斤产量的资本支出减半,但持续的品管仍面临挑战,品质维持率最高仅为73%。高昂的资本支出限制了大型工厂的建设,使其仅限于大型纸浆企业和国有企业,从而疏远了缺乏资本资源的新兴市场创新者。生命週期评估表明,年产量超过2万吨的工厂可提供6.5倍的环境回报,但此类工厂的建设需要强劲的下游用户需求,而目前很少有下游用户具备这样的能力。这种先有鸡还是先有蛋的难题抑制了其他强劲的需求讯号,并促使企业采取逐步消除瓶颈的策略,而不是待开发区工厂。

细分市场分析

奈米纤维素(NFC)预计到2024年将占据41.93%的市场份额,这反映了其成熟的生产基础设施以及在造纸和复合材料应用领域的广泛适用性。然而,细菌纤维素凭藉其超高的纯度以及在医药和生物医学应用领域的高端定位,成为成长最快的细分市场,预计到2030年将以37.02%的复合年增长率成长。这种生产模式的分化揭示了细菌纤维素的策略定位,其目标应用领域是能够抵消发酵成本的高价值应用,而NFC则利用了机械加工的可扩展性。

由于其优异的结晶结构,奈米晶纤维素(NCC)的应用持续稳定成长,尤其是在对尺寸稳定性和耐热性要求较高的增强材料领域。微纤化纤维素(MFC)是一种过渡性技术,它在纸张和包装应用中,在提供优于传统纤维素的性能的同时,也能保持与传统添加剂的成本竞争力。

凭藉数十年来纸浆和造纸行业发展所建立的供应链和加工基础设施,木浆将在2024年继续保持其主导地位,市场份额将达到58.36%。然而,农业废弃物作为一种原料,将展现出最强劲的成长势头,年复合成长率将达到23.68%,其成本优势和与循环经济的契合度将从根本上挑战木浆的长期主导地位。农业废弃物转型反映了经济优化和永续性的要求,即优先考虑有效利用废弃物而非消耗原生资源。

微藻类、海藻和细菌宿主为化妆品精华液和眼科溶液提供特定数量的原料,在这些产品中,绝对纯度比成本更为重要。这些生物资源能够实现闭合迴路培养,最大限度地减少农药残留,并有助于获得非基因改造认证。欧洲的联盟正在探索大麻秸秆和亚麻为原料,利用当地纤维作物来解决纸浆木材短缺的问题。然而,残渣的物流仍然复杂,利用季节性残渣需要湿式储存筒仓和緻密化颗粒,这会带来隐性的资本投资。木浆生产商则透过监管链认证和全年供应保证来应对,强调其散装包装的可靠性。这种竞争确保了技术的不断创新,并引领奈米纤维素市场走向多元化原料的未来。

区域分析

北美在奈米纤维素市场占据领先地位,预计2024年将占43.92%的市场份额。这得益于美国和能源部早期提供的津贴,推出试点生产线,以及汽车和航太目标商标产品製造商(OEM)的强劲需求。该地区高度一体化的纸浆和造纸物流使造纸厂能够快速改造蒸煮器,用于纤维素奈米纤维,而无需新增资本支出(CAPEX)。一级供应商正与州立大学合作,优化汽车片状成型化合物,以满足美国公路安全保险协会(IIHS)的碰撞测试标准。虽然永续包装的法律规范不如美国严格,但大型零售商的品牌承诺确保了稳定的供应。因此,北美奈米纤维素市场规模仍是全球生产商设定价格目标的重要参考。

亚太地区预计到2030年将以24.36%的复合年增长率成长,挑战北美市场的领先地位。日本企业正透过改造利用折旧免税额造纸设备,率先实现纤维素奈米纤维的商业化;而中国新兴企业则部署国产低成本高压均质机,以避免进口关税。深圳的电子组装指定使用奈米纤维素阻隔膜来保护有机发光二极体(OLED)模组免受氧气渗入,这催生了强劲的需求,并缩短了供应商的资质认证週期。在印度和泰国,丰富的农业残余物使原料成本降低了40%,而酵素许可协议则加速了奈米纤维素技术的应用。因此,奈米纤维素市场正吸引东协港口周边地区(出口物流集中地)不断涌现新的工厂。

儘管欧洲对一次性塑胶製品实施了全球最严格的禁令,但仍保持着两位数以上的成长。比利时和北欧的加工商已证实,奈米纤维素涂层符合95%的纸张可回收标准。虽然能源价格上涨挤压了利润净利率,但欧盟的创新津贴降低了试点投资的风险,展现了其在循环生物经济领域的领先地位。南美洲拥有丰富的甘蔗渣资源,一旦其CelOCE酶工厂实现商业化,南美洲正崛起为低成本出口中心。中东和非洲正在转向使用奈米纤维素增强水泥复合材料来抑製沙漠建筑扬尘,跨国水泥巨头正在资助海湾地区计划附近的试点建设。这种地域上的多元化发展反映了政策、资源和产业结构的差异,从而支撑了奈米纤维素市场的全球均衡成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 优异的机械性质和阻隔性

- 对永续包装的需求激增

- 监管部门呼吁寻找一次性塑胶的替代品

- 增加研发试点设施和资金

- 酵素低能耗生产取得突破

- 市场限制

- 生产成本高且规模化风险

- 与其他生物奈米材料的竞争

- 食品接触安全与吸入问题

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 奈米纤维素(NFC)

- 奈米晶纤维素(NCC)

- 细菌纤维素

- 微纤化纤维素(MFC)

- 其他的

- 按原料

- 木浆

- 农业残余物

- 微藻类和其他生物资源

- 其他的

- 按形式

- 干粉

- 凝胶

- 暂停

- 按最终用途行业划分

- 纸张加工

- 油漆和涂料

- 石油和天然气

- 饮食

- 合成的

- 药品和化妆品

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Axcelon Biopolymers Corporation

- Borregaard AS

- CelluComp

- CelluForce

- Chuetsu Pulp & Paper Co., Ltd.

- Daicel Corporation

- FiberLean

- GranBio Technologies

- Melodea

- NIPPON PAPER INDUSTRIES CO., LTD.

- Norske Skog ASA

- Oji Holdings Corporation

- Sappi Ltd

- Stora Enso

- UPM

第七章 市场机会与未来展望

The Global Nanocellulose Market size is estimated at USD 1.12 Billion in 2025, and is expected to reach USD 2.97 Billion by 2030, at a CAGR of 21.56% during the forecast period (2025-2030).

Escalating sustainability mandates, volatile petrochemical prices, and rapid material science breakthroughs converge to create a clear runway for double-digit expansion. Automotive lightweighting, recyclable barrier films, and biomedical scaffolds headline near-term demand, while enzymatic low-energy processes unlock future cost competitiveness. North American incumbents leverage mature pilot lines and close original equipment manufacturer (OEM) ties, yet Asian producers narrow the gap through lower conversion costs and proximity to electronics and packaging clusters. Raw-material flexibility shifting from wood pulp to agricultural residues further de-risks supply chains and anchors circular-economy business models. Established pulp majors expand tonnage on the competitive front, whereas biotech start-ups chase premium therapeutic niches, resulting in an active partnership and licensing landscape that accelerates application rollout.

Global Nanocellulose Market Trends and Insights

Superior Mechanical and Barrier Properties

Nanocellulose's tensile strength of 4.9-7.5 GPa (Gigapascals) and elastic modulus of 100-200 GPa position it close to carbon fiber in weight-sensitive components, making it attractive for automotive body panels and aircraft interiors. Oak Ridge National Laboratory validated this potential in 2025 by showing 50% higher tensile strength and nearly double toughness in carbon-nanofiber-enhanced nanocellulose composites versus conventional glass-fiber alternatives. The high aspect ratio and surface area foster tight bonding with polymer matrices, minimizing delamination risk and boosting fatigue life. Japanese automakers project a 20 kg per-vehicle weight cut when nanocellulose substitutes selected metal and plastic parts, translating into meaningful fuel savings and lower lifecycle emissions. Beyond load-bearing parts, ultrathin nanocellulose films block oxygen and water vapor better than Ethylene Vinyl Alcohol (EVOH) or Polyvinylidene Chloride (PVDC), yet remain recyclable and compostable. These dual mechanical and barrier advantages underpin the material's broad addressable market, from consumer electronics casings to pharmaceutical blister packs.

Sustainable Packaging Demand Surge

Retail, e-commerce, and food brands rush to replace petroleum films, driving a steep demand curve for bio-based barriers. European chains in Belgium, France, and Luxembourg replaced pilot-scale plastic trays with cellulose packs in the 2024 R3PACK trial, eliminating thousands of tonnes of single-use plastics. European Union (EU) directives mandate that all packaging be reusable or recyclable by 2030, prompting converters to qualify nanocellulose coatings that upgrade ordinary paperboard. Bacterial cellulose films show superior ultraviolet (UV) shielding and tensile strength, reducing spoilage in light-sensitive foods while holding up under cold-chain logistics. Swedish start-up lines achieved cost parity with Low Density Polyethylene (LDPE) wrap by optimizing drying energy and roll-to-roll coating speeds, removing the final economic roadblock. Food and Drug Administration (FDA)'s Generally Recognized As Safe (GRAS) nod for fibrillated cellulose in food contact further derisks adoption for North American suppliers . As brand owners lock in multi-year supply contracts, the nanocellulose market secures a predictable revenue base for capacity expansions.

High Production Cost and Scale-up Risk

Even with hydrolysis optimization, minimum selling prices hover at USD 10,031 per dry tonne for acid routes, and USD 65,740 per dry tonne for current enzymatic yields, dwarfing commodity polymer benchmarks. Continuous papermaking pilots halve capex per output kilogram, yet sustained quality control remains elusive as retention tops out at 73%. Capex intensity restricts large-scale units to pulp majors and state-backed entities, marginalizing innovators in emerging markets that lack patient capital. Life-cycle assessments show a 6.5-fold environmental win once plants exceed 20,000 tpa, but financing such nameplates requires off-take certainty that few downstream users can underwrite today. This chicken-and-egg dynamic tempers otherwise strong demand signals and prompts phased debottlenecking rather than greenfield mega-mills.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push to Replace Single-use Plastics

- Rising R&D Pilot Facilities and Funding

- Competition From Other Bio-nanomaterials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Nanofibrillated Cellulose (NFC) commands 41.93% market share in 2024, reflecting its established production infrastructure and broad applicability across paper processing and composites applications. However, Bacterial Cellulose is the fastest-growing segment with 37.02% CAGR through 2030, driven by its ultra-pure properties and premium positioning in pharmaceuticals and biomedical applications. The production dichotomy reveals strategic positioning where NFC leverages mechanical processing scalability, while bacterial cellulose targets high-value applications, justifying fermentation costs.

Nanocrystalline Cellulose (NCC) maintains steady growth through its crystalline structure advantages in reinforcement applications, particularly where dimensional stability and thermal resistance prove critical. Microfibrillated Cellulose (MFC) is a bridge technology, offering enhanced properties over conventional cellulose while remaining cost-competitive with traditional additives in paper and packaging applications.

Wood Pulp maintains its dominant position with 58.36% market share in 2024, leveraging established supply chains and processing infrastructure developed over decades of pulp and paper industry evolution. Yet, Agricultural Residues as a source demonstrate the strongest growth trajectory at 23.68% CAGR, fundamentally challenging wood pulp's long-term dominance through cost advantages and circular economy alignment. The shift toward agricultural residues reflects economic optimization and sustainability mandates favoring waste valorization over virgin resource consumption.

Micro-algae, seaweed, and bacterial hosts supply specialty volumes for cosmetic serums and ophthalmic solutions where absolute purity trumps cost. These bio-sources allow closed-loop cultivation, minimizing pesticide carry-over and easing Genetically Modified Organism (GMO)-free certification. European consortiums study hemp hurd and flax shive feedstocks, leveraging regional fiber crops to offset pulpwood shortages. However, residue logistics remain complex: seasonal availability demands wet-storage silos or densification pellets, adding hidden capex. Wood pulp producers counter with chain-of-custody certification and guaranteed year-round supply, arguing reliability for mass-market packaging volumes. The competitive dance ensures continuous innovation and locks the nanocellulose market into a multi-feedstock future.

The Nanocellulose Market Report is Segmented by Product Type (Nanofibrillated Cellulose, Bacterial Cellulose, and More), Source (Wood Pulp, Agricultural Residues, and More), Form (Dry, Gel, and Suspension), End-Use Industry (Paper Processing, Oil and Gas, Composites, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America leads the Nanocellulose market with a 43.92% revenue share in 2024, backed by early USDA and DOE grants that underwrote pilot lines and strong pull from automotive and aerospace original equipment manufacturers (OEMs). The region enjoys deeply integrated pulp-and-paper logistics, letting mills quickly pivot digesters toward cellulose nanofibrils without greenfield capital expenditure (CAPEX). Tier-1 suppliers collaborate with state universities to optimize automotive sheet-molding compounds that meet Insurance Institute for Highway Safety (IIHS) crash standards. Regulatory frameworks on sustainable packaging are less stringent than in the European Union (EU), yet brand commitments by big box retailers ensure stable offtake. As a result, the nanocellulose market size across North America remains the anchor against which global producers benchmark pricing.

Asia-Pacific records a 24.36% CAGR that challenges North America's leadership by 2030. Japanese corporations commercialized cellulose nanofiber years ahead of rivals by repurposing depreciated paper machines, while Chinese start-ups deploy low-cost, high-pressure homogenizers built domestically to evade import duties. Electronics assemblers in Shenzhen specify nanocellulose barrier films to protect Organic Light Emitting Diode (OLED) modules from oxygen ingress, creating captive demand and shortening supplier qualification cycles. Agricultural residue abundance in India and Thailand cuts feedstock bills by 40%, and enzyme licensing deals accelerate adoption. Consequently, the Nanocellulose market attracts continuous plant announcements around ASEAN ports where export logistics converge.

Europe secures mid-teen growth on the back of the world's strictest single-use-plastic bans. Converters in Belgium and the Nordics qualify Nanocellulose coatings to meet 95% paper recyclability thresholds. While higher energy prices squeeze margins, EU innovation grants de-risk pilot investments that showcase circular-bioeconomy leadership. South America, buoyed by sugarcane bagasse supplies, emerges as a low-cost export hub once CelOCE enzyme plants go commercial. Middle East and Africa start from a small base yet eye nanocellulose enhanced cement composites to curb desert construction dust, with multinational cement majors funding test pours near Gulf megaprojects. This geographic mosaic mirrors differing policy, resource, and industrial profiles, underpinning a balanced global growth picture for the nanocellulose market.

- Axcelon Biopolymers Corporation

- Borregaard AS

- CelluComp

- CelluForce

- Chuetsu Pulp & Paper Co., Ltd.

- Daicel Corporation

- FiberLean

- GranBio Technologies

- Melodea

- NIPPON PAPER INDUSTRIES CO., LTD.

- Norske Skog ASA

- Oji Holdings Corporation

- Sappi Ltd

- Stora Enso

- UPM

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Superior Mechanical and Barrier Properties

- 4.2.2 Sustainable Packaging Demand Surge

- 4.2.3 Regulatory Push to Replace Single-use Plastics

- 4.2.4 Rising R&D Pilot Facilities and Funding

- 4.2.5 Enzymatic Low-energy Production Breakthroughs

- 4.3 Market Restraints

- 4.3.1 High Production Cost and Scale-up Risk

- 4.3.2 Competition From Other Bio-nanomaterials

- 4.3.3 Food-contact Safety and Inhalation Concerns

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Nanofibrillated Cellulose (NFC)

- 5.1.2 Nanocrystalline Cellulose (NCC)

- 5.1.3 Bacterial Cellulose

- 5.1.4 Microfibrillated Cellulose (MFC)

- 5.1.5 Others

- 5.2 By Source

- 5.2.1 Wood Pulp

- 5.2.2 Agricultural Residues

- 5.2.3 Micro-algae & Other Bio-sources

- 5.2.4 Others

- 5.3 By Form

- 5.3.1 Dry (Powder)

- 5.3.2 Gel

- 5.3.3 Suspension

- 5.4 By End-use Industry

- 5.4.1 Paper Processing

- 5.4.2 Paints and Coatings

- 5.4.3 Oil and Gas

- 5.4.4 Food and Beverage

- 5.4.5 Composites

- 5.4.6 Pharmaceuticals and Cosmetics

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 NORDIC Countries

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Nigeria

- 5.5.5.4 Qatar

- 5.5.5.5 Egypt

- 5.5.5.6 United Arab Emirates

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Axcelon Biopolymers Corporation

- 6.4.2 Borregaard AS

- 6.4.3 CelluComp

- 6.4.4 CelluForce

- 6.4.5 Chuetsu Pulp & Paper Co., Ltd.

- 6.4.6 Daicel Corporation

- 6.4.7 FiberLean

- 6.4.8 GranBio Technologies

- 6.4.9 Melodea

- 6.4.10 NIPPON PAPER INDUSTRIES CO., LTD.

- 6.4.11 Norske Skog ASA

- 6.4.12 Oji Holdings Corporation

- 6.4.13 Sappi Ltd

- 6.4.14 Stora Enso

- 6.4.15 UPM

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

- 7.2 Enzymatic and Biological Methods for Nanocellulose Production