|

市场调查报告书

商品编码

1871082

用于包装应用的纤维素奈米晶体市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Cellulose Nanocrystals for Packaging Applications Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

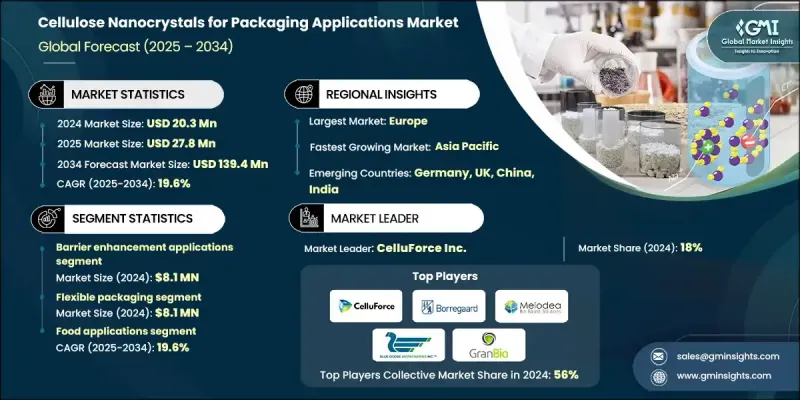

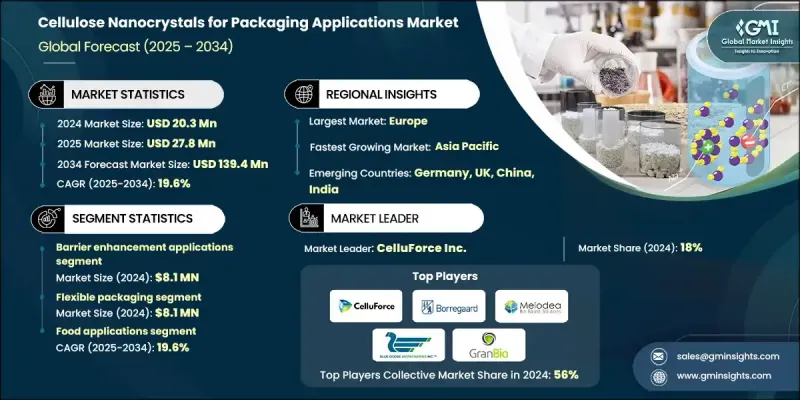

2024 年全球包装应用纤维素奈米晶体市场价值为 2,030 万美元,预计到 2034 年将以 19.6% 的复合年增长率增长至 1.394 亿美元。

由于其卓越的机械强度、生物降解性和优异的阻隔性能,包装产业对奈米纤维素(CNC)的需求正在迅速增长。这些奈米材料显着提高了包装薄膜的抗氧性和抗油性,为石油基涂料提供了环保替代品。包装和造纸应用约占微奈米纤维素产品市场份额的60%。酶法和机械加工方法的技术创新已将能源需求降低了近90%,使大规模CNC生产更加可行且经济高效。全球向永续和循环包装解决方案的转型仍然是关键的成长动力,消费者和企业越来越重视环保材料。增强型阻隔涂层已显示出可衡量的性能提升,在CNC含量为5-10%时,氧气透过率降低了21-36%。这种可持续性和性能的平衡使CNC基涂层成为食品、药品和消费品包装的首选材料,这些行业都需要延长产品寿命并防止环境因素的影响。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2030万美元 |

| 预测值 | 1.394亿美元 |

| 复合年增长率 | 19.6% |

2024年,阻隔增强应用领域占39.9%的市场份额,凸显了CNC材料相比传统材料在阻隔氧气、水分和紫外线辐射方面的卓越性能。由于高阻隔性能对于维持产品新鲜度和安全性至关重要,尤其是在食品、消费品和药品包装领域,因此该领域将继续保持领先地位。

2024年,软包装品类占39.9%的市场份额,涵盖薄膜、包装膜、软包装袋及其他软包装容器。此品类受惠于数控加工技术在提升阻隔性能的同时,也能维持产品的柔韧性与加工性能。食品包装、吸塑包装和永续消费品包装等应用都依赖数控加工技术,在不影响产品功能性和设计灵活性的前提下,实现产品的耐用性、防护性和环保优势。

2024年,北美纤维素奈米晶体包装应用市场占据27.6%的市场份额,预计到2034年将以19%的复合年增长率成长。该地区受益于强大的研究生态系统、成熟的包装产业以及企业对永续发展日益增长的承诺。美国和加拿大是领先的应用市场,这得益于各大学和国家实验室的积极研究计画。奈米材料应用领域的监管进步和行业专业知识进一步巩固了北美在该新兴市场的领先地位。

全球包装用纤维素奈米晶体市场的主要企业包括 FiberLean Technologies、GranBio、Kruger Inc.、CelluForce Inc.、Anomera Inc.、Blue Goose Biorefineries、Melodea Ltd.、Reinste Nano Ventures Pvt. Ltd.、Borregaard ASA 和 Nanoverse。这些领先企业正透过创新、合作和技术进步不断巩固其市场地位。许多企业正在投资先进的奈米纤维素加工技术,以提高规模化生产能力、降低能源成本并改善材料品质。包装生产商与研究机构之间的策略合作正在加速产品开发,并扩大纤维素奈米晶体在食品、药品和消费品包装领域的应用。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对永续包装解决方案的需求日益增长

- 监理机关大力推动生物基食品接触包装材料的发展

- 加大包装奈米技术研究的投资

- 产业陷阱与挑战

- 生产成本高,商业规模有限。

- 疏水包装聚合物整合的技术挑战

- 包装应用中的湿度敏感度限制

- 市场机会

- 用于增强包装相容性的表面改质技术

- 多层封装架构开发

- 主动式和智慧包装应用成长

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 包装功能

- 包装规格

- 终端包装产业

- 未来市场趋势

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估价与预测:依包装功能划分,2021-2034年

- 主要趋势

- 屏障增强应用

- 氧气阻隔应用

- 防潮层应用

- 油脂阻隔应用

- 气体阻隔应用

- 机械加固应用

- 拉伸强度增强

- 刚度和尺寸稳定性

- 抗撕裂性能提升

- 涂层应用

- 表面阻隔涂层

- 功能涂层

- 保护涂层

- 主动包装功能

- 抗菌包装应用

- 抗氧化包装应用

- 控释系统

- 智慧包装功能

- 感测器整合应用

- 指标系统

- 响应式包装材料

第六章:市场估价与预测:依包装形式划分,2021-2034年

- 主要趋势

- 软包装

- 薄膜和片材

- 收纳袋和包包

- 包膜和衬垫

- 多层柔性结构

- 硬质包装

- 容器和瓶子

- 罐子和瓶子

- 结构包装组件

- 纸和纸板包装

- 折迭纸盒

- 食品包装

- 瓦楞纸包装

- 纸板容器

- 多层复合包装

- 屏障层应用

- 黏合层集成

- 复杂的多层结构

第七章:市场估计与预测:依最终用途包装产业划分,2021-2034年

- 主要趋势

- 食品包装

- 直接食品接触应用

- 间接食品接触应用

- 新鲜食品包装

- 加工食品包装

- 冷冻食品包装

- 饮料包装

- 非酒精饮料包装

- 酒精饮料包装

- 乳製品饮料包装

- 药品包装

- 药品初级包装

- 二级药品包装

- 医疗器材包装

- 消费品包装

- 个人护理包装

- 家居用品包装

- 电子封装

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- CelluForce Inc.

- Borregaard ASA

- Reinste Nano Ventures Pvt. Ltd.

- Melodea Ltd.

- Blue Goose Biorefineries

- FiberLean Technologies

- Anomera Inc.

- Kruger Inc

- GranBio

- Nanoverse

The Global Cellulose Nanocrystals for Packaging Applications Market was valued at USD 20.3 million in 2024 and is estimated to grow at a CAGR of 19.6% to reach USD 139.4 million by 2034.

The demand for CNCs in the packaging industry is rapidly increasing due to their exceptional mechanical strength, biodegradability, and advanced barrier performance. These nanomaterials significantly improve resistance to oxygen and oil in packaging films, providing an eco-friendly substitute for petroleum-based coatings. Packaging and paper applications represent around 60% share for micro and nanocellulose products. Technological innovations in enzymatic and mechanical processing methods have lowered energy requirements by nearly 90%, making large-scale CNC production more feasible and cost-efficient. The global shift toward sustainable and circular packaging solutions remains the key growth drive, with consumers and corporations increasingly prioritizing environmentally friendly materials. Enhanced barrier coatings have shown measurable performance improvements, with oxygen transmission rates reduced by 21-36% at 5-10% CNC loadings. This balance of sustainability and performance positions CNC-based coatings as a preferred material in food, pharmaceutical, and consumer goods packaging, all requiring extended product life and protection against environmental factors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $20.3 Million |

| Forecast Value | $139.4 Million |

| CAGR | 19.6% |

The barrier enhancement applications segment held 39.9% share in 2024, highlighting CNC's superior ability to protect against oxygen, moisture, and UV radiation compared to conventional materials. This segment continues to dominate as high-barrier properties are essential for maintaining product freshness and safety, especially in food, consumer goods, and pharmaceutical packaging.

The flexible packaging category held a 39.9% share in 2024, covering films, wraps, pouches, and other flexible containers. This segment benefits from CNC's ability to improve barrier performance while maintaining flexibility and processability. Applications such as food packaging, blister packs, and sustainable consumer goods packaging rely on CNCs to deliver durability, protection, and environmental advantages without compromising functionality or design versatility.

North America Cellulose Nanocrystals for Packaging Applications Market held 27.6% share in 2024 and is expected to grow at a CAGR of 19% through 2034. The region benefits from a strong research ecosystem, a mature packaging sector, and growing corporate commitments to sustainability. The United States and Canada are leading adopters, supported by active research programs across universities and national laboratories. Regulatory advancements and industry expertise in nanomaterial applications have further reinforced North America's leadership in this emerging market.

Key companies operating in the Global Cellulose Nanocrystals for Packaging Applications Market include FiberLean Technologies, GranBio, Kruger Inc., CelluForce Inc., Anomera Inc., Blue Goose Biorefineries, Melodea Ltd., Reinste Nano Ventures Pvt. Ltd., Borregaard ASA, and Nanoverse. Leading companies in the cellulose nanocrystals for packaging applications market are strengthening their market foothold through innovation, collaborations, and technological advancement. Many are investing in advanced nanocellulose processing technologies to enhance scalability, reduce energy costs, and improve material quality. Strategic partnerships between packaging producers and research institutions are accelerating product development and expanding CNC applications across food, pharmaceutical, and consumer goods packaging.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Packaging function

- 2.2.3 Packaging format

- 2.2.4 End use packaging sector

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing Demand for Sustainable Packaging Solutions

- 3.2.1.2 Regulatory Push for Bio-based Food Contact Packaging Materials

- 3.2.1.3 Increasing Investment in Packaging Nanotechnology Research

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & limited commercial scale

- 3.2.2.2 Technical challenges in hydrophobic packaging polymer integration

- 3.2.2.3 Moisture sensitivity limitations in packaging applications

- 3.2.3 Market opportunities

- 3.2.3.1 Surface modification technologies for enhanced packaging compatibility

- 3.2.3.2 Multilayer packaging architecture development

- 3.2.3.3 Active & smart packaging applications growth

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Packaging Function

- 3.7.3 Packaging Format

- 3.7.4 End use Packaging Sector

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Packaging Function, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Barrier enhancement applications

- 5.2.1 Oxygen barrier applications

- 5.2.2 Moisture barrier applications

- 5.2.3 Grease & oil barrier applications

- 5.2.4 Gas barrier applications

- 5.3 Mechanical reinforcement applications

- 5.3.1 Tensile strength enhancement

- 5.3.2 Stiffness & dimensional stability

- 5.3.3 Tear resistance improvement

- 5.4 Coating applications

- 5.4.1 Surface barrier coatings

- 5.4.2 Functional coatings

- 5.4.3 Protective coatings

- 5.5 Active packaging functions

- 5.5.1 Antimicrobial packaging applications

- 5.5.2 Antioxidant packaging applications

- 5.5.3 Controlled release systems

- 5.6 Smart packaging functions

- 5.6.1 Sensor integration applications

- 5.6.2 Indicator systems

- 5.6.3 Responsive packaging materials

Chapter 6 Market Estimates and Forecast, By Packaging Format, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Flexible packaging

- 6.2.1 Films & sheets

- 6.2.2 Pouches & bags

- 6.2.3 Wraps & liners

- 6.2.4 Multilayer flexible structures

- 6.3 Rigid packaging

- 6.3.1 Containers & bottles

- 6.3.2 Jars & cans

- 6.3.3 Structural packaging components

- 6.4 Paper & paperboard packaging

- 6.4.1 Folding cartons

- 6.4.2 Food service packaging

- 6.4.3 Corrugated packaging

- 6.4.4 Paperboard containers

- 6.5 Multilayer & laminated packaging

- 6.5.1 Barrier layer applications

- 6.5.2 Adhesive layer integration

- 6.5.3 Complex multilayer structures

Chapter 7 Market Estimates and Forecast, By End Use Packaging Sector, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food packaging

- 7.2.1 Direct food contact applications

- 7.2.2 Indirect food contact applications

- 7.2.3 Fresh food packaging

- 7.2.4 Processed food packaging

- 7.2.5 Frozen food packaging

- 7.3 Beverage packaging

- 7.3.1 Non-alcoholic beverage packaging

- 7.3.2 Alcoholic beverage packaging

- 7.3.3 Dairy beverage packaging

- 7.4 Pharmaceutical packaging

- 7.4.1 Primary pharmaceutical packaging

- 7.4.2 Secondary pharmaceutical packaging

- 7.4.3 Medical device packaging

- 7.5 Consumer goods packaging

- 7.5.1 Personal care packaging

- 7.5.2 Household products packaging

- 7.5.3 Electronics packaging

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 CelluForce Inc.

- 9.2 Borregaard ASA

- 9.3 Reinste Nano Ventures Pvt. Ltd.

- 9.4 Melodea Ltd.

- 9.5 Blue Goose Biorefineries

- 9.6 FiberLean Technologies

- 9.7 Anomera Inc.

- 9.8 Kruger Inc

- 9.9 GranBio

- 9.10 Nanoverse