|

市场调查报告书

商品编码

1750519

非包装泡棉市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Nonpackaging Foam Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

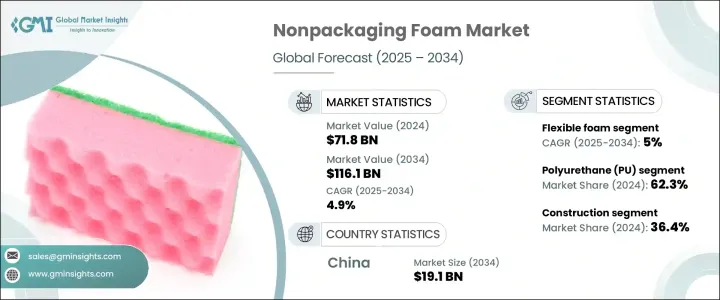

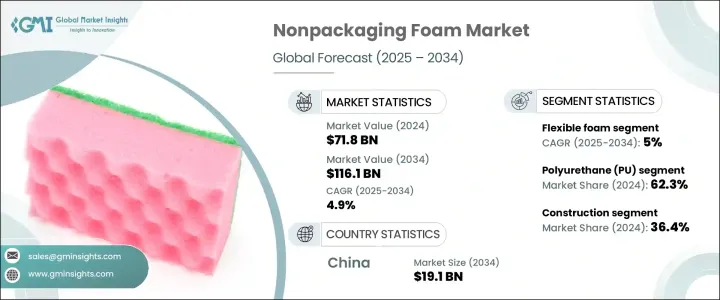

2024年,全球非包装泡棉市场规模达718亿美元,预计到2034年将以4.9%的复合年增长率成长,达到1161亿美元,这主要得益于建筑、汽车、家具、电子和医疗保健等行业对轻质耐用绝缘材料日益增长的需求。随着工业的不断发展,非包装泡棉因其多功能性、高性能以及满足各种应用特定需求的能力而变得至关重要。製造商越来越注重开发可持续的泡沫解决方案,例如生物基、可回收和可生物降解的泡沫,以应对环境问题并满足北美、欧洲以及亚太新兴市场的严格法规要求。

永续发展措施在塑造非包装泡沫市场方面发挥重要作用。企业正在投资闭环回收系统,以减少对石化原料的依赖,并支持循环经济措施。这一趋势在北美和欧洲尤为突出,这些国家的政府正在加强环境政策,鼓励开发环保产品。在亚太地区,受基础设施和製造业扩张的推动,非包装泡沫的需求正在快速增长,尤其是在中国等国家,建筑业和汽车业是主要的成长动力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 718亿美元 |

| 预测值 | 1161亿美元 |

| 复合年增长率 | 4.9% |

市场依产品类型细分,主要分为软质泡棉和硬质泡棉两大类。软质泡棉2024年的市场规模为477亿美元,预计到2034年将达到778亿美元,复合年增长率为5%,这得益于其广泛的应用领域,包括家具、床上用品、汽车内装和隔音材料。人体工学床垫和轻量化汽车零件等注重舒适性的产品需求日益增长,推动了软性泡棉的扩张。此外,消费者日益转向永续、低VOC配方以及电子商务的兴起,也进一步刺激了对软质泡棉的需求。

2024年,聚氨酯 (PU) 泡棉在非包装泡棉市场中占据了62.3%的份额,这得益于其在隔热、汽车内饰和家具缓衝等应用领域的卓越多功能性。该材料轻质且耐热性优异,使其成为注重能源效率和舒适度的行业的理想选择。聚氨酯泡棉易于客製化,可满足不同行业的特定需求,这进一步推动了其需求。聚氨酯泡沫能够模製成各种密度和形状,既可用于刚性用途,也可用于柔性用途,从而扩大了其在各个市场的用途。

2024年,中国非包装泡棉市场规模达117亿美元,预计年复合成长率将达5.1%,到2034年将达到191亿美元,主要得益于建筑和汽车产业需求的激增。政府加大对基础建设的投资,刺激了对隔热、隔音和结构泡沫等材料的需求。此外,电动车(EV)的兴起也为泡棉的应用带来了新的机会,尤其是在汽车产业,该产业对轻质节能材料的需求正在不断增长。随着这些产业的持续扩张,中国非包装泡棉市场,尤其是聚氨酯泡棉市场,将持续成长。

全球非包装泡棉市场的领导者包括亨斯迈集团、巴斯夫、井上集团和科思创。这些公司正致力于扩大产能、丰富产品线并推动永续发展计画。透过利用泡沫生产领域的技术进步并专注于环保解决方案,这些企业旨在巩固其在竞争激烈的市场中的地位。此外,他们还在投资策略合作伙伴关係、收购和区域扩张,以满足全球对非包装泡棉日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计

- 主要进口国

- 国家 1

- 国家 2

- 国家 3

- 主要出口国

- 国家 1

- 国家 2

- 国家 3

- 主要进口国

- 利润率分析

- 监管格局

- 衝击力

- 成长动力

- 节能建筑材料需求不断成长

- 汽车和家具行业的轻量化和舒适性要求

- 新兴市场工业化与基础设施快速发展

- 产业陷阱与挑战

- 泡沫废料和VOC排放的环境问题和法规

- 原物料价格波动

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 价值链分析

- 原物料供应商

- 泡沫製造商

- 製造商和转换商

- 分销商和零售商

- 最终用途产业

- 价值链优化策略

- 成本结构分析

- 定价分析

- 环境法规和合规要求

- 产品标准和认证

- 进出口法规

- 监管对市场成长的影响

- 未来监理趋势

- 永续性和环境影响

- 按材料类型评估价格点

- 非包装泡棉的环境足迹

- 永续泡沫解决方案

- 生物基泡沫

- 可回收泡沫

- 可生物降解泡沫

- 回收和废弃物管理

- 循环经济倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 柔性泡沫

- 硬质泡沫

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 聚氨酯(PU)

- 聚苯乙烯(PS)

- 聚乙烯(PE)

- 聚丙烯(PP)

- 橡胶泡沫

- 其他的

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 建造

- 汽车

- 家具和床上用品

- 电子产品

- 卫生保健

- 其他的

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- BASF

- Armacell International

- Covestro

- Dow

- FXI Holdings

- Huntsman Corporation

- INOAC Corporation

- JSP Corporation

- Recticel

- Saint-Gobain

- Sheela Foam

- UFP Technologies

- Wanhua Chemical Group

- Woodbridge Group

- Zotefoams

The Global Nonpackaging Foam Market was valued at USD 71.8 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 116.1 billion by 2034, driven by the increasing demand for lightweight, durable insulating materials in sectors such as construction, automotive, furniture, electronics, and healthcare. As industries continue to expand, nonpackaging foam has become essential due to its versatility, performance, and ability to meet the specific needs of various applications. Manufacturers are increasingly focusing on developing sustainable foam solutions, such as bio-based, recyclable, and biodegradable options, to address environmental concerns and meet stringent regulations in North America, Europe, and emerging markets in Asia-Pacific.

Sustainability efforts are playing a significant role in shaping the nonpackaging foam market. Companies are investing in closed-loop recycling systems, which reduce the reliance on petrochemical feedstocks and support circular economy initiatives. This trend is particularly prominent in North America and Europe, where governments are tightening environmental policies and encouraging the development of eco-friendly products. In Asia-Pacific, the demand for nonpackaging foam is growing rapidly, driven by the expansion of infrastructure and manufacturing sectors, especially in countries such as China, where construction and automotive industries are key growth drivers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $71.8 Billion |

| Forecast Value | $116.1 Billion |

| CAGR | 4.9% |

The market is segmented by product type, with flexible and rigid foam being the two main categories. Flexible foam generated USD 47.7 billion in 2024 and is projected to reach USD 77.8 billion by 2034, growing at a 5% CAGR due to its broad range of applications, including furniture, bedding, automotive interiors, and acoustic insulation. The growing demand for comfort-focused products, such as ergonomic mattresses and lightweight vehicle components, is driving the expansion of flexible foam. Additionally, the increasing shift toward sustainable, low-VOC formulations and the rise of e-commerce have further boosted the demand for flexible foam.

Polyurethane (PU) foam segment in the nonpackaging foam market held 62.3% share in 2024, attributed to its exceptional versatility in applications such as thermal insulation, automotive interiors, and cushioning for furniture. The material's lightweight nature and excellent thermal resistance make it an ideal choice for industries that prioritize energy efficiency and comfort. PU foam is easily customizable to meet the specific needs of different sectors, which further drives its demand. Its capacity to be molded into a wide range of densities and forms enables it to serve both rigid and flexible purposes, expanding its utility across various markets.

China Nonpackaging Foam Market generated USD 11.7 billion in 2024 and is expected to grow at a CAGR of 5.1%, reaching USD 19.1 billion by 2034, driven by the surging demand in the construction and automotive sectors. Increased government investment in infrastructure development is fueling the need for materials like insulation, soundproofing, and structural foam. Additionally, the rise of electric vehicles (EVs) has introduced new opportunities for foam usage, particularly in the automotive industry, where demand for lightweight, energy-efficient materials is on the rise. As these sectors continue to expand, the market for nonpackaging foam, especially PU foam, is poised for sustained growth in China.

Leading players in the Global Nonpackaging Foam Market include Huntsman Corporation, BASF, INOAC Corporation, and Covestro. These companies are focusing on expanding their production capacities, enhancing product offerings, and advancing sustainability initiatives. By leveraging technological advancements in foam production and focusing on eco-friendly solutions, these players aim to strengthen their position in the competitive market. Moreover, they are investing in strategic partnerships, acquisitions, and regional expansions to meet the growing demand for nonpackaging foam globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade Statistics

- 3.3.1 Major importing countries

- 3.3.1.1 Country 1

- 3.3.1.2 Country 2

- 3.3.1.3 Country 3

- 3.3.2 Major exporting countries

- 3.3.2.1 Country 1

- 3.3.2.2 Country 2

- 3.3.2.3 Country 3

- 3.3.1 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for energy-efficient building materials

- 3.6.1.2 Lightweight and comfort requirements in automotive and furniture sectors

- 3.6.1.3 Rapid industrialization and infrastructure development in emerging markets

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental concerns and regulations on foam waste and VOC emissions

- 3.6.2.2 Volatility in raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Value chain analysis

- 3.10.1 Raw material suppliers

- 3.10.2 Foam manufacturers

- 3.10.3 Fabricators and converters

- 3.10.4 Distributors and retailers

- 3.10.5 End-use industries

- 3.10.6 Value chain optimization strategies

- 3.10.7 Cost structure analysis

- 3.11 Pricing Analysis

- 3.11.1 North America

- 3.11.2 Europe

- 3.11.3 Asia Pacific

- 3.11.4 Latin America

- 3.11.5 Middle East and Africa

- 3.12 Environmental regulations and compliance requirements

- 3.12.1 Product standards and certifications

- 3.12.2 Import/export regulations

- 3.12.3 Regulatory impact on market growth

- 3.12.4 Future regulatory trends

- 3.13 Sustainability and environmental impact

- 3.13.1 Price point assessment by material type

- 3.13.2 Environmental footprint of nonpackaging foam

- 3.13.3 Sustainable foam solutions

- 3.13.4 Bio-based foams

- 3.13.5 Recyclable foams

- 3.13.6 Biodegradable foams

- 3.13.7 Recycling and waste management

- 3.13.8 Circular economy initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.2 Flexible foam

- 5.3 Rigid foam

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Polyurethane (PU)

- 6.3 Polystyrene (PS)

- 6.4 Polyethylene (PE)

- 6.5 Polypropylene (PP)

- 6.6 Rubber foam

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Construction

- 7.3 Automotive

- 7.4 Furniture & bedding

- 7.5 Electronics

- 7.6 Healthcare

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BASF

- 9.2 Armacell International

- 9.3 Covestro

- 9.4 Dow

- 9.5 FXI Holdings

- 9.6 Huntsman Corporation

- 9.7 INOAC Corporation

- 9.8 JSP Corporation

- 9.9 Recticel

- 9.10 Saint-Gobain

- 9.11 Sheela Foam

- 9.12 UFP Technologies

- 9.13 Wanhua Chemical Group

- 9.14 Woodbridge Group

- 9.15 Zotefoams