|

市场调查报告书

商品编码

1750532

燃料电池堆市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fuel Cell Stack Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

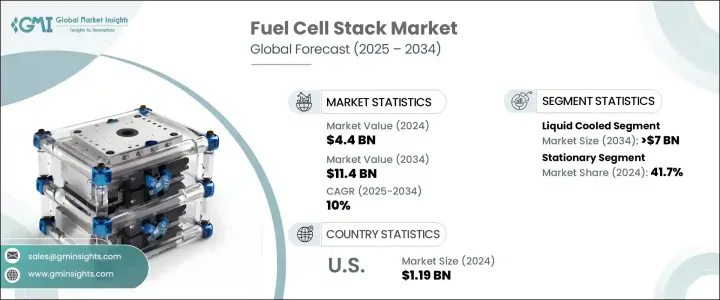

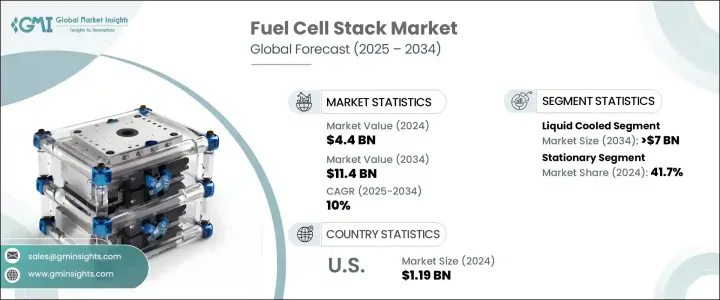

2024 年全球燃料电池堆市场价值为 44 亿美元,预计到 2034 年将以 10% 的复合年增长率增长至 114 亿美元。这一成长主要得益于支持永续能源技术(包括燃料电池)的监管框架的不断加强。随着各国和各产业加强应对气候变迁和控制温室气体排放的力度,燃料电池堆在各种应用领域正获得显着发展。世界各国政府正透过税收优惠、补贴和研究计画积极推动清洁能源的应用,为市场成长创造有利环境。人们日益意识到传统能源对环境的影响,促使各行各业转向零排放解决方案,这进一步刺激了对燃料电池技术的需求。此外,氢能基础设施的扩建和燃料电池与交通运输(尤其是高性能和重型车辆)的整合预计将为市场发展开闢新的途径。旨在提高性能、成本效益和可扩展性的技术进步也在加速市场发展势头。

燃料电池堆的需求在很大程度上受到工业、商业和住宅领域持续推动清洁能源替代能源的影响。随着脱碳成为策略重点,燃料电池在能源系统中的作用日益扩大。它们能够支援混合电力系统、提高电网可靠性并提供高效的备用电源,使其成为各行各业都极具吸引力的选择。此外,包括能源公司、研究机构和製造商在内的利害关係人之间的合作正在加速产品创新和部署。透过改进材料和生产技术来简化製造流程并降低成本的努力预计将提高燃料电池的经济性和可及性,从而在未来几年实现更广泛的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 44亿美元 |

| 预测值 | 114亿美元 |

| 复合年增长率 | 10% |

就产品类型而言,市场细分为风冷和液冷燃料电池堆。该产业在2022年达到38亿美元,2023年达到41亿美元,2024年达到44亿美元。其中,液冷市场预计到2034年将超过70亿美元。这一成长主要得益于燃料电池在高功率和高负载应用中的日益普及,以及先进的热管理技术带来的性能提升。液冷系统支援更稳定的运作条件、更好的散热性能和更长的使用寿命,使其成为需要稳定可靠电力输出的行业的理想选择。液冷系统的不断发展使其越来越适用于性能和耐用性至关重要的工业和商业备用系统。

根据应用,燃料电池堆市场可分为汽车、固定式、发电和其他。 2024年,固定式燃料电池占最大份额,占整体市场的41.7%。这种主导地位可归因于固定式燃料电池系统的进步以及对可持续和分散式能源解决方案日益增长的需求。随着各行各业寻求减少碳足迹,固定式燃料电池系统正被用于为建筑物、工厂和偏远设施供电,以最大限度地降低排放。它们与再生能源的兼容性也支援创建混合系统,以确保能源效率、可靠性和备用能力。

从区域来看,北美在2024年占据了全球燃料电池电堆市场的28.7%。光是美国市场,其市场规模在2022年就达到10.5亿美元,2023年达到11.1亿美元,2024年达到11.9亿美元。该地区的成长得益于加氢基础设施的建设和燃料电池汽车的普及。公共和私营部门对加氢分销网络建设的持续投资预计将进一步增强该地区市场,使北美成为全球燃料电池领域的关键参与者。

燃料电池堆市场的竞争格局由成熟企业和新兴创新企业共同构成。排名前五的参与者——普拉格能源、巴拉德动力系统、FuelCell Energy、Bloom Energy 和斗山燃料电池——合计占据了超过 45% 的市场份额。虽然主导企业专注于扩大生产规模和降低系统成本,但新创公司则瞄准利基应用,并探索与再生能源技术的整合。随着企业努力提高製造效率并采用替代材料,提供经济高效且可扩展的燃料电池解决方案的竞争日益激烈。战略投资、政府支持以及与清洁能源目标的契合持续重塑着市场动态,促进了整个产业的创新和竞争。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 策略倡议

- 公司市占率

- 公司标竿分析

- 战略仪表板

- 创新与技术格局

第五章:市场规模与预测:依类型,2021 年至 2034 年

- 主要趋势

- 风冷

- 液冷

第六章:市场规模及预测:依产能,2021 年至 2034 年

- 主要趋势

- <5千瓦

- 5千瓦 – 100千瓦

- >100千瓦 – 200千瓦

- >200千瓦

第七章:市场规模及预测:依应用,2021 年至 2034 年

- 主要趋势

- 汽车

- 固定式

- 发电

- 其他的

第八章:市场规模及预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 奥地利

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 菲律宾

- 越南

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 墨西哥

- 秘鲁

第九章:公司简介

- Advent Technologies Holding

- Ballard Power Systems

- Commonwealth Automation Technologies

- Dana Incorporated

- ElringKlinger

- FuelCell Energy Solutions

- Freudenberg Group

- Horizon Fuel Cell Technologies

- Intelligent Energy Limited

- Nedstack Fuel Cell Technology

- Nuvera Fuel Cells

- PowerCell Sweden

- Plug Power

- Robert Bosch

- Schunk Bahn-und Industrietechnik

- TW Horizon Fuel Cell Technologies

The Global Fuel Cell Stack Market was valued at USD 4.4 billion in 2024 and is estimated to grow at a CAGR of 10% to reach USD 11.4 billion by 2034. This growth is largely fueled by the increasing enforcement of regulatory frameworks that support sustainable energy technologies, including fuel cells. As nations and industries intensify efforts to combat climate change and curb greenhouse gas emissions, fuel cell stacks are gaining significant traction across various applications. Governments around the world are actively promoting clean energy adoption through tax incentives, subsidies, and research initiatives, creating a favorable environment for market growth. Growing awareness of the environmental impact of conventional energy sources is prompting industries to shift toward zero-emission solutions, which is further bolstering the demand for fuel cell technology. Additionally, the expansion of hydrogen infrastructure and the integration of fuel cells into transportation-especially for high-performance and heavy-duty vehicles-are expected to create new avenues for market development. Technological advances aimed at improving performance, cost-efficiency, and scalability are also accelerating market momentum.

The demand for fuel cell stacks is heavily influenced by the continuous push for clean energy alternatives in the industrial, commercial, and residential sectors. As decarbonization becomes a strategic priority, the role of fuel cells in energy systems is expanding. Their ability to support hybrid setups, improve grid reliability, and provide efficient backup power makes them an attractive choice across sectors. Moreover, collaborations among stakeholders-including energy companies, research institutes, and manufacturers-are helping accelerate product innovation and deployment. Efforts to streamline manufacturing processes and reduce costs through improved materials and production techniques are expected to enhance affordability and accessibility, enabling broader adoption in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 10% |

In terms of product type, the market is segmented into air-cooled and liquid-cooled fuel cell stacks. The industry recorded USD 3.8 billion in 2022, USD 4.1 billion in 2023, and USD 4.4 billion in 2024. Among these, the liquid-cooled segment is projected to surpass USD 7 billion by 2034. This growth is being driven by the increasing use of fuel cells in high-power and intensive-duty applications, along with enhanced performance enabled by advanced thermal management. Liquid cooling systems support more stable operating conditions, better heat dissipation, and extended lifespan-making them ideal for sectors that demand consistent and reliable power output. The ongoing development of liquid-cooled systems is making them increasingly suitable for industrial and commercial backup systems where performance and durability are critical.

On the basis of application, the fuel cell stack market is categorized into automotive, stationary, power generation, and others. In 2024, the stationary segment held the largest share, accounting for 41.7% of the overall market. This dominance can be attributed to advancements in stationary fuel cell systems and the growing demand for sustainable and decentralized energy solutions. As industries seek to reduce their carbon footprints, stationary fuel cell systems are being adopted to power buildings, factories, and remote facilities with minimal emissions. Their compatibility with renewable energy sources also supports the creation of hybrid systems that ensure energy efficiency, reliability, and backup capabilities.

Regionally, North America held a 28.7% share of the global fuel cell stack market in 2024. The U.S. market alone was valued at USD 1.05 billion in 2022, USD 1.11 billion in 2023, and USD 1.19 billion in 2024. Growth in this region is supported by the development of hydrogen refueling infrastructure and increased deployment of fuel cell-powered vehicles. Continued public and private investment in building out hydrogen distribution networks is expected to strengthen the regional market further, positioning North America as a key player in the global fuel cell landscape.

The competitive landscape of the fuel cell stack market is marked by a combination of established companies and emerging innovators. The top five players- Plug Power, Ballard Power Systems, FuelCell Energy, Bloom Energy, and Doosan Fuel Cell-collectively contribute over 45% of the total market share. While dominant firms focus on scaling up production and reducing system costs, startups are targeting niche applications and exploring integration with renewable energy technologies. As companies strive to enhance manufacturing efficiency and adopt alternative materials, the race to provide cost-effective and scalable fuel cell solutions is intensifying. Strategic investments, government support, and alignment with clean energy goals continue to reshape market dynamics, encouraging innovation and competition throughout the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic initiatives

- 4.3 Company market share

- 4.4 Company benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 – 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Air Cooled

- 5.3 Liquid Cooled

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 <5 kW

- 6.3 5 kW – 100 kW

- 6.4 >100 kW – 200 kW

- 6.5 >200 kW

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Stationary

- 7.4 Power generation

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Philippines

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Mexico

- 8.6.3 Peru

Chapter 9 Company Profiles

- 9.1 Advent Technologies Holding

- 9.2 Ballard Power Systems

- 9.3 Commonwealth Automation Technologies

- 9.4 Dana Incorporated

- 9.5 ElringKlinger

- 9.6 FuelCell Energy Solutions

- 9.7 Freudenberg Group

- 9.8 Horizon Fuel Cell Technologies

- 9.9 Intelligent Energy Limited

- 9.10 Nedstack Fuel Cell Technology

- 9.11 Nuvera Fuel Cells

- 9.12 PowerCell Sweden

- 9.13 Plug Power

- 9.14 Robert Bosch

- 9.15 Schunk Bahn-und Industrietechnik

- 9.16 TW Horizon Fuel Cell Technologies