|

市场调查报告书

商品编码

1750551

干式真空帮浦市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dry Vacuum Pumps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

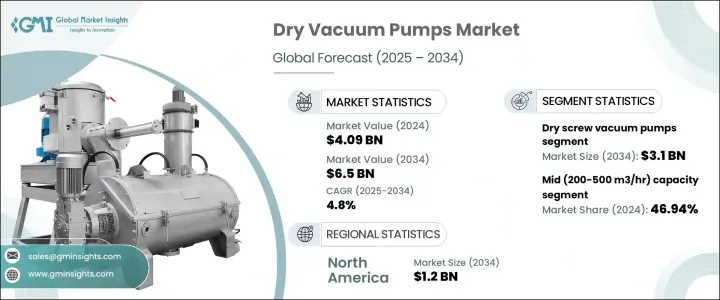

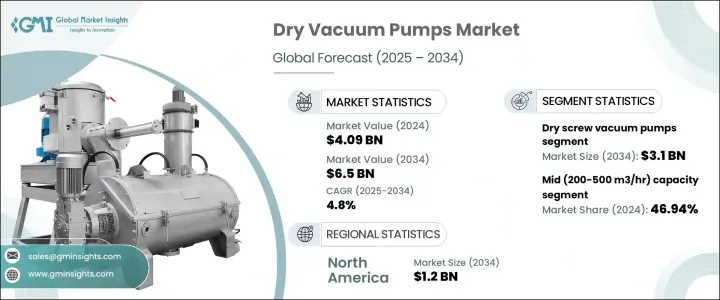

2024 年全球干式真空帮浦市场价值为 40.9 亿美元,预计到 2034 年将以 4.8% 的复合年增长率成长,达到 65 亿美元,这得益于汽车、电子和航太等各个製造业领域不断增长的需求。这些行业依靠干式真空泵进行涂层、成型和材料处理等基本应用。製药和生物技术领域也为市场扩张做出了重大贡献,将干式真空帮浦用于冷冻干燥、蒸馏和灭菌等製程。此外,化学工业对可靠、无污染真空解决方案的需求日益增长,进一步推动了需求,尤其是在溶剂回收和气体提取等应用方面。食品加工和包装行业也采用干式真空泵,因为它们操作清洁,从而支持了对加工和包装食品日益增长的需求。

虽然干式真空帮浦具有诸多优势,包括节能和低维护成本,但其技术复杂性也带来了挑战。安装、操作和故障排除需要专业知识和培训。此外,干式真空帮浦并非适合所有应用,尤其是在需要极高真空度或特定环境条件的应用,油封帮浦在这些情况下可能表现较佳。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 40.9亿美元 |

| 预测值 | 65亿美元 |

| 复合年增长率 | 4.8% |

2024年,干式螺桿真空帮浦占最大市场份额,产值达19亿美元。这类泵浦因其高抽速和高真空度而备受青睐,这在化学加工、半导体製造和冶金等行业中至关重要。其节能运作、高可靠性和长使用寿命使其成为注重降低能耗和营运成本的行业的理想选择。

2024年,中等容量干式真空帮浦(容量范围为200-500立方公尺/小时)占据了市场主导地位,占据了46.94%的份额。这些帮浦在食品包装和加工中至关重要,因为它们能够确保稳定的真空度,这对于保持产品完整性和延长保质期至关重要。製药和生物加工产业也依赖这些帮浦来提供符合严格监管标准的清洁、无油真空源。

2024年,北美干式真空帮浦市场规模达7亿美元。该地区的生物技术和製药行业推动了干式真空帮浦的需求,因为它们需要干式真空帮浦用于冷冻干燥和药品生产等关键应用。此外,美国的环境法规鼓励各行各业采用节能环保的技术,包括干式真空帮浦。

为了巩固市场地位,阿特拉斯·科普柯、阿法拉伐和安捷伦科技等主要参与者正专注于节能高效真空解决方案的创新。这些公司正在大力投资研发,以提高产品的效率和可靠性。为了扩大市场覆盖范围和客户群,策略合作伙伴关係、併购也很常见。此外,企业越来越多地采用数位技术来提供整合解决方案,以满足各行各业日益增长的自动化需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 零售商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 衝击力

- 成长动力

- 对能源效率的需求增加

- 技术进步

- 製药业需求不断成长

- 半导体产业的成长

- 产业陷阱与挑战

- 某些应用中的效能有限

- 维护和维修费用

- 成长动力

- 成长潜力分析

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 干式螺桿真空泵

- 干式涡旋真空泵

- 干式隔膜泵

- 干爪和钩泵

- 其他的

第六章:市场估计与预测:依产能,2021-2034

- 主要趋势

- 低(高达 200m3/小时)

- 中(200-500 立方米/小时)

- 高(超过 500 立方米/小时)

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 电子和半导体

- 製药

- 化工和石化

- 石油和天然气

- 食品和饮料

- 其他的

第八章:市场估计与预测:按配销通路,2021-2034 年

- 主要趋势

- 直销

- 间接销售

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Agilent Technologies

- Alfa Laval

- Atlas Copco

- Becker Vacuum Pumps

- DEKKER Vacuum Technologies

- Ebara Corporation

- Edwards Vacuum

- Flowserve Corporation

- Graham Corporation

- Grundfos

- KNF Neuberger

- Leybold GmbH

- Tuthill Corporation

- ULVAC

- Welch Vacuum

The Global Dry Vacuum Pumps Market was valued at USD 4.09 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 6.5 billion by 2034, driven by the increasing demand across various manufacturing industries, including automotive, electronics, and aerospace. These industries rely on dry vacuum pumps for essential applications such as coating, molding, and material handling. The pharmaceutical and biotechnology sectors also contribute significantly to market expansion, utilizing dry vacuum pumps for processes such as lyophilization, distillation, and sterilization. Additionally, the growing need for reliable and contamination-free vacuum solutions in the chemical industry further propels demand, especially for applications like solvent recovery and gas extraction. The food processing and packaging industries are also adopting dry vacuum pumps due to their clean operation, supporting the rising demand for processed and packaged foods.

While dry vacuum pumps offer several advantages, including energy efficiency and low maintenance, their complexity in terms of technology can pose challenges. Specialized knowledge and training are required for installation, operation, and troubleshooting. Moreover, dry vacuum pumps may not be the best fit for all applications, particularly those requiring extremely high vacuum levels or specific environmental conditions where oil-sealed pumps may perform better.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.09 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 4.8% |

In 2024, dry screw vacuum pumps held the largest market share, generating USD 1.9 billion. These pumps are preferred for high pumping speeds and deep vacuum levels, which are essential in sectors such as chemical processing, semiconductor manufacturing, and metallurgy. Their energy-efficient operation, combined with high reliability and long service life, makes them an attractive option for industries focused on reducing energy consumption and operational costs.

Mid-capacity dry vacuum pumps, with a capacity range of 200-500 m3/hr, dominated the market in 2024, capturing 46.94% share. These pumps are crucial in food packaging and processing, as they ensure consistent vacuum levels, which are essential for maintaining product integrity and extending shelf life. The pharmaceutical and bioprocessing industries also rely on these pumps for clean, oil-free vacuum sources that comply with stringent regulatory standards.

North America Dry Vacuum Pumps Market generated USD 700 million in 2024. The biotechnology and pharmaceutical industries in the region drive demand, as they require dry vacuum pumps for critical applications such as freeze-drying and pharmaceutical production. Furthermore, environmental regulations in the U.S. are encouraging industries to adopt energy-efficient, environmentally friendly technologies, including dry vacuum pumps.

To strengthen their presence in the market, key players such as Atlas Copco, Alfa Laval, and Agilent Technologies are focusing on innovations in energy-efficient and high-performance vacuum solutions. These companies are investing heavily in research and development to enhance the efficiency and reliability of their products. Strategic partnerships and mergers, and acquisitions are also common, as players aim to expand their market reach and customer base. Additionally, companies are increasingly adopting digital technologies to offer integrated solutions that cater to the growing demand for automation in various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.4.2.1 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 1.1 Industry ecosystem analysis

- 1.1.1 Factors affecting the value chain

- 1.1.2 Profit margin analysis

- 1.1.3 Disruptions

- 1.1.4 Future outlook

- 1.1.5 Manufacturers

- 1.1.6 Distributors

- 1.1.7 Retailers

- 1.2 Trump administration tariffs analysis

- 1.3 Impact on trade

- 1.3.1 Trade volume disruptions

- 1.3.2 Retaliatory measures

- 1.4 Impact on the industry

- 1.4.1 Supply-side impact (raw materials)

- 1.4.2 Price volatility in key materials

- 1.4.3 Supply chain restructuring

- 1.4.4 Production cost implications

- 1.4.5 Demand-side impact (selling price)

- 1.4.6 Price transmission to end markets

- 1.4.7 Market share dynamics

- 1.4.8 Consumer response patterns

- 1.5 Key companies impacted

- 1.6 Strategic industry responses

- 1.6.1 Supply chain reconfiguration

- 1.6.2 Pricing and product strategies

- 1.6.3 Policy engagement

- 1.7 Outlook and future considerations

- 1.8 Impact forces

- 1.8.1 Growth drivers

- 1.8.1.1 Increased demand for energy efficiency

- 1.8.1.2 Technological advancements

- 1.8.1.3 Rising demand in pharmaceutical industry

- 1.8.1.4 Growth of semiconductor industry

- 1.8.2 Industry pitfalls & challenges

- 1.8.2.1 Limited performance in certain applications

- 1.8.2.2 Maintenance and repair costs

- 1.8.1 Growth drivers

- 1.9 Growth potential analysis

- 1.10 Pricing analysis

- 1.11 Porter's analysis

- 1.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 2.1 Introduction

- 2.2 Company market share analysis

- 2.3 Competitive positioning matrix

- 2.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Million Units)

- 3.1 Key trends

- 3.2 Dry screw vacuum pump

- 3.3 Dry scroll vacuum pump

- 3.4 Dry diaphragm pump

- 3.5 Dry claw and hook pumps

- 3.6 Others

Chapter 6 Market Estimates & Forecast, By Capacity, 2021-2034 (USD Billion) (Million Units)

- 4.1 Key trends

- 4.2 Low (upto 200m3/hr)

- 4.3 Mid (200-500 m3/hr)

- 4.4 High (more than 500 m3/hr)

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Electronics and semiconductors

- 5.3 Pharmaceutical

- 5.4 Chemical and petrochemical

- 5.5 Oil and gas

- 5.6 Food and beverages

- 5.7 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Direct sales

- 6.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 10 Company Profiles

- 8.1 Agilent Technologies

- 8.2 Alfa Laval

- 8.3 Atlas Copco

- 8.4 Becker Vacuum Pumps

- 8.5 DEKKER Vacuum Technologies

- 8.6 Ebara Corporation

- 8.7 Edwards Vacuum

- 8.8 Flowserve Corporation

- 8.9 Graham Corporation

- 8.10 Grundfos

- 8.11 KNF Neuberger

- 8.12 Leybold GmbH

- 8.13 Tuthill Corporation

- 8.14 ULVAC

- 8.15 Welch Vacuum