|

市场调查报告书

商品编码

1750554

水泥余热回收系统市场机会、成长动力、产业趋势分析及2025-2034年预测Cement Waste Heat Recovery System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

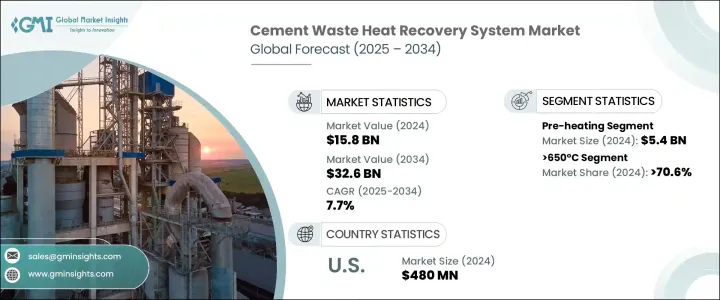

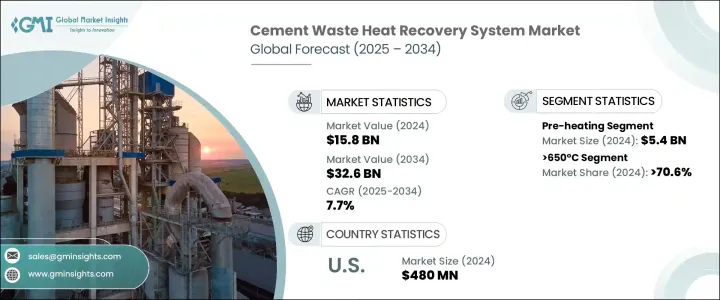

2024年全球水泥余热回收系统市场规模达158亿美元,预计2034年将以7.7%的复合年增长率成长至326亿美元。水泥生产製程是能源密集型工业製程之一,在生产过程中会产生大量热量,且经常会损失。余热回收系统正逐渐成为一种重要的解决方案,可以捕获这些未利用的热能并将其用于发电或製程加热,从而大幅节省成本并减少对外部能源的依赖。随着水泥製造商持续面临优化能耗、减少排放和提高利润率的压力,对节能係统的需求正在稳步增长。这些回收解决方案在提高工厂效率方面发挥关键作用,它们可以减少营运所需的燃料量,同时提升整体永续性指标。环境法规和监管框架鼓励在重工业中使用更清洁的技术,这进一步推动了余热回收系统的普及。

余热回收系统应用于水泥生产流程的多个阶段。关键应用领域包括预热、发电和蒸汽生产以及其他製程改进。其中,预热环节在2024年的市场规模达54亿美元。此环节回收高温废气,用于在原料进入窑炉之前加热。采用这种方法可以显着降低燃料消耗、缩短生产时间并提高营运效率。透过优化生产早期阶段的能源再利用,製造商能够维持稳定的产量,同时降低整体生产成本。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 158亿美元 |

| 预测值 | 326亿美元 |

| 复合年增长率 | 7.7% |

就温度类别而言,市场细分为运行温度为 230°C、230°C 至 650°C 之间以及 650°C 以上的系统。 2024 年,捕获 650°C 以上温度的系统占据了最大的收入份额,占全球市场的 70.6% 以上。由于熟料生产阶段会产生极高的热量,这些高温系统对水泥厂特别有效。同时,运作温度较低的系统通常用于材料预干燥或设施内的环境空间加热等任务。虽然它们不能提供与高温系统相同水平的能量回收,但它们相对简单且经济实惠,因此对于那些仍希望在不进行大量资本支出的情况下降低能源成本的小型水泥企业来说,它们是一个实用的选择。

在北美,美国水泥余热回收系统的采用率稳定成长。该国市场估值从2022年的4.4亿美元成长至2023年的4.6亿美元,并在2024年达到4.8亿美元。日益增长的减碳压力以及水泥基础设施的老化,促使企业升级到更节能的系统。联邦政府的支持和激励措施也在推动热回收技术融入老旧工厂方面发挥着至关重要的作用。随着企业努力满足能源合规要求并提高营运产出,先进热能回收系统的采用率持续上升。

全球水泥余热回收系统市场格局适度整合,少数几家关键企业占了相当大的市场。西门子能源、三菱重工、Thermax Limited和川崎重工等领导企业在2024年合计占据了约30%的市场。这些公司专注于提供高效的系统,将水泥窑产生的热量转化为可用的电能或蒸汽。他们的产品支持水泥生产商最大限度地减少能源浪费,同时帮助他们达到国际节能减排标准。透过技术创新和客製化解决方案,这些製造商在塑造水泥产业能源使用的未来方面发挥着重要作用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 对贸易的影响

- 展望与未来考虑

- 产业衝击力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率

- 策略倡议

- 竞争基准测试

- 战略仪表板

- 创新与技术格局

第五章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 预热

- 电力和蒸汽发电

- 蒸汽朗肯循环

- 有机朗肯循环

- 卡林纳循环

- 其他

第六章:市场规模及预测:依温度,2021 - 2034 年

- 主要趋势

- 230°C

- 230°C - 650°C

- > 650 摄氏度

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第八章:公司简介

- AURA

- Bosch Industriekessel GmbH

- Climeon

- CTP TEAM SRL

- Cochran

- Forbes Marshall

- IHI Corporation

- John Wood Group PLC

- Kawasaki Heavy Industries Ltd.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Promec Engineering

- Sofinter Spa

- Siemens Energy

- Turboden SpA

- Thermax Limited

The Global Cement Waste Heat Recovery System Market was valued at USD 15.8 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 32.6 billion by 2034. The cement manufacturing process is one of the most energy-intensive industrial operations, with massive quantities of heat generated and often lost during production. Waste heat recovery systems are emerging as an essential solution to capture this unused thermal energy and redirect it toward power generation or process heating, resulting in substantial cost savings and reduced reliance on external energy sources. As cement manufacturers continue to face pressure to optimize energy consumption, minimize emissions, and increase profit margins, the demand for energy-efficient systems is experiencing steady growth. These recovery solutions play a critical role in improving plant efficiency by reducing the amount of fuel needed for operations while enhancing overall sustainability metrics. Their adoption is being further boosted by environmental mandates and regulatory frameworks encouraging the use of cleaner technologies in heavy industries.

Waste heat recovery systems find application across several stages of the cement production process. Key application areas include pre-heating, electricity and steam generation, and other process enhancements. Among these, the pre-heating segment accounted for USD 5.4 billion in 2024. This segment involves recovering high-temperature exhaust gases to heat raw materials before they enter the kiln. Utilizing this approach significantly cuts down on fuel consumption, shortens production times, and improves operational efficiency. By optimizing energy reuse at earlier stages of production, manufacturers are able to maintain consistent output while trimming down overall production costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $32.6 Billion |

| CAGR | 7.7% |

In terms of temperature categories, the market is segmented into systems operating at 230°C, between 230°C and 650°C, and those above 650°C. The segment capturing temperatures greater than 650°C held the largest revenue share in 2024, accounting for more than 70.6% of the global market. These high-temperature systems are particularly effective for cement plants due to the extreme heat levels generated during the clinker production stage. Meanwhile, systems that operate at lower temperatures are generally implemented for tasks such as material pre-drying or ambient space heating within facilities. While they do not offer the same level of energy recapture as high-temperature systems, they are relatively simple and budget-friendly, making them a practical option for smaller-scale cement operations that still aim to reduce energy costs without undertaking large capital expenditures.

In North America, the United States has shown a steady increase in the adoption of cement waste heat recovery systems. Market valuation in the country grew from USD 440 million in 2022 to USD 460 million in 2023 and reached USD 480 million in 2024. A growing emphasis on reducing carbon emissions, along with aging cement infrastructure, is encouraging companies to upgrade to more energy-efficient systems. Federal support and incentives are also playing a vital role in driving the integration of heat recovery technologies into older plants. As companies strive to meet energy compliance requirements and enhance operational output, the adoption of advanced thermal energy recovery systems continues to rise.

The global cement waste heat recovery system market is moderately consolidated, with a few key players holding a significant portion of the industry share. Leading companies such as Siemens Energy, Mitsubishi Heavy Industries, Ltd., Thermax Limited, and Kawasaki Heavy Industries Ltd. collectively accounted for approximately 30% of the market share in 2024. These companies focus on delivering high-efficiency systems capable of converting heat generated from cement kilns into usable electricity or steam. Their offerings support cement producers in minimizing energy waste while helping them meet international standards for energy efficiency and emissions reduction. Through technological innovation and customized solutions, these manufacturers are instrumental in shaping the future of energy use in the cement industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data Collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculations

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share

- 4.3 Strategic initiative

- 4.4 Competitive benchmarking

- 4.5 Strategic dashboard

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Pre-heating

- 5.3 Electricity & steam generation

- 5.3.1 Steam rankine cycle

- 5.3.2 Organic rankine cycle

- 5.3.3 Kalina cycle

- 5.4 Other

Chapter 6 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 230°C

- 6.3 230°C - 650 °C

- 6.4 > 650 °C

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 AURA

- 8.2 Bosch Industriekessel GmbH

- 8.3 Climeon

- 8.4 CTP TEAM S.R.L

- 8.5 Cochran

- 8.6 Forbes Marshall

- 8.7 IHI Corporation

- 8.8 John Wood Group PLC

- 8.9 Kawasaki Heavy Industries Ltd.

- 8.10 MITSUBISHI HEAVY INDUSTRIES, LTD.

- 8.11 Promec Engineering

- 8.12 Sofinter S.p.a

- 8.13 Siemens Energy

- 8.14 Turboden S.p.A.

- 8.15 Thermax Limited