|

市场调查报告书

商品编码

1766329

电力及蒸汽发电废热回收系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Electricity and Steam Generation Waste Heat Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

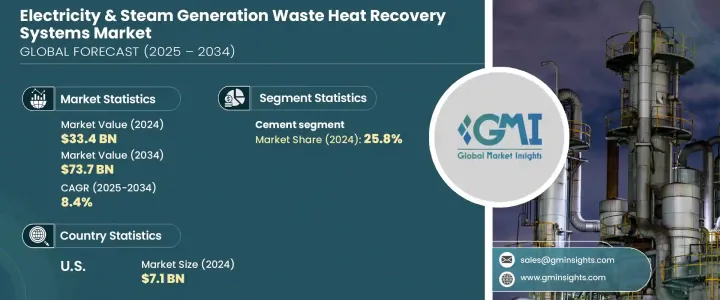

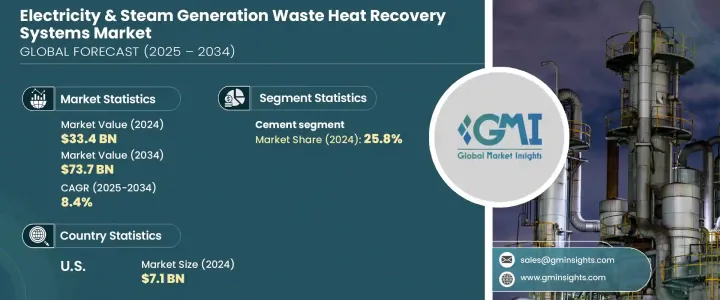

2024年,全球发电和蒸汽发电废热回收系统市场规模达334亿美元,预计到2034年将以8.4%的复合年增长率成长,达到737亿美元。这一增长主要得益于全球范围内强调能源效率和更严格环保要求的政策转变。事实证明,政府的支持在为废热回收技术的部署创造有利条件方面发挥了重要作用。随着企业力求在降低营运成本的同时提高整体能源效能,工业营运中废热回收技术的采用率持续成长。支持性法规加上不断上涨的能源成本,促使各产业将回收系统作为永续的解决方案进行整合。

余热回收在区域供热基础设施供电中的作用日益重要。这些系统利用了生产过程或发电过程中原本閒置的剩余热能。当这些能量被输送到集中供热网时,可以显着减少对传统燃料的依赖,从而降低排放。随着城市寻求实施更绿色的能源框架,这些解决方案为循环利用资源和更智慧的能源规划提供了途径。这些优势吸引了那些专注于减少浪费和提高全系统性能的能源规划人员,从而增强了市场潜力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 334亿美元 |

| 预测值 | 737亿美元 |

| 复合年增长率 | 8.4% |

蒸汽朗肯循环仍是玻璃、钢铁和水泥等高温製造业热回收的基石。监管机构日益重视降低工业碳强度,加速了这些系统的现代化进程。此外,在公共投资的支持下,有机朗肯循环因其适用于中低温环境而日益受到青睐。儘管卡利纳循环的份额较小,但它仍在持续获得资金,用于需要高热效率的特定应用。总而言之,这些循环表明,国际社会正更积极地实施更清洁的能源转换技术,以增强永续性。

2024年,水泥业占25.8%。作为能源密集型产业之一,水泥生产商正越来越多地采用余热回收系统来实现排放目标。各地区的奖励计画和再生能源义务(RPO)为企业投资余热回收系统提供了强大的动力。在某些司法管辖区,透过这些系统产生的能源符合再生能源的条件,从而为生产商带来额外的合规性和经济效益。

2024年,美国电力和蒸汽发电余热回收系统市场规模达71亿美元,其中北美占21.3%的份额。能源政策改革的重点,加上再生能源技术的整合,在该地区对余热回收解决方案的需求成长中发挥了关键作用。对清洁能源的追求,加上不断增长的工业能源需求,继续推动这些系统在电力和蒸汽发电应用中的应用。

影响电力和蒸汽发电废热回收系统市场的关键参与者包括西门子能源、Climeon、三菱重工有限公司、Thermax Limited、博世工业有限公司、Fortum、IHI 公司、福布斯马歇尔、通用电气、Ormat、HRS、AURA、Viessman、Promec Engineering、Exergy International SRL、BIHL、Rentech BoilHL、Viessman、Sinterof、Sinterdran、BIHL、Rentech BoilHL、Sinterof

电力和蒸汽发电余热回收系统市场的公司正专注于技术升级和整合解决方案,以巩固其市场地位。许多公司正在投资研发,以开发更紧凑、更有效率的系统,以满足高温和低温工业流程的需求。与钢铁、水泥和石化等能源密集产业的策略合作,使客製化安装能够满足客户需求。企业也透过併购和合作扩大其地理覆盖范围,尤其是在工业基础不断发展的地区。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依类型,2021 - 2034

- 主要趋势

- 蒸汽朗肯循环

- 有机朗肯循环

- 卡林纳循环

第六章:市场规模及预测:依温度,2021 - 2034 年

- 主要趋势

- 230 摄氏度

- 230 摄氏度 - 650 摄氏度

- > 650 摄氏度

第七章:市场规模及预测:依最终用途,2021 - 2034

- 主要趋势

- 石油精炼

- 水泥

- 重金属製造

- 化学

- 纸浆和造纸

- 食品和饮料

- 玻璃

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- AURA

- BIHL

- Bosch Industriekessel GmbH

- Climeon

- Cochran

- Durr Group

- Exergy International SRL

- Forbes Marshall

- Fortum

- General Electric

- HRS

- IHI Corporation

- Mitsubishi Heavy Industries Ltd.

- Ormat

- Promec Engineering

- Rentech Boilers

- Siemens Energy

- Sofinter Spa

- Thermax Limited

- Viessman

The Global Electricity and Steam Generation Waste Heat Recovery Systems Market was valued at USD 33.4 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 73.7 billion by 2034. This surge is largely supported by policy shifts emphasizing energy efficiency and stricter environmental compliance worldwide. Government support has proven instrumental in creating favorable conditions for the deployment of waste heat recovery technologies. Adoption across industrial operations continues to grow as businesses aim to cut operational expenses while improving overall energy performance. Supportive regulations, coupled with rising energy costs, are prompting industry to integrate recovery systems as a sustainable solution.

Waste heat recovery's role in powering district heating infrastructure is becoming increasingly relevant. These systems make use of residual thermal energy that would otherwise go unused during production processes or power generation. When redirected to centralized heating grids, this energy significantly reduces reliance on conventional fuels, thus lowering emissions. As cities seek to implement greener energy frameworks, these solutions offer a pathway to circular resource use and smarter energy planning. These benefits strengthen the market potential by appealing to energy planners focused on reducing waste and boosting system-wide performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $33.4 Billion |

| Forecast Value | $73.7 Billion |

| CAGR | 8.4% |

The steam Rankine cycle remains the cornerstone for recovering heat from high-temperature manufacturing sectors like glass, steel, and cement. Growing regulatory focus on lowering industrial carbon intensity is accelerating the modernization of these systems. Additionally, the Organic Rankine Cycle is gaining traction due to its suitability in low- to medium-temperature settings, supported by public investment. Although the Kalina Cycle holds a smaller share, it continues to receive funding for selective applications that require high thermal efficiency. Altogether, these cycles point to a broader international momentum around implementing cleaner energy conversion technologies for enhanced sustainability.

In 2024, the cement segment generated a 25.8% share. Known for being one of the most energy-intensive industries, cement producers are increasingly adopting waste heat recovery systems to meet emission goals. Incentive programs and renewable power obligations (RPOs) across various regions have provided strong motivation for companies to invest in WHRS. In some jurisdictions, energy generated through these systems qualifies as renewable, giving producers additional compliance and economic benefits.

United States Electricity & Steam Generation Waste Heat Recovery Systems Market reached USD 7.1 billion in 2024, with North America capturing a 21.3% share. A focus on energy policy reform, combined with the integration of renewable technologies, has played a pivotal role in increasing demand for waste heat recovery solutions across the region. The push for cleaner energy, coupled with rising industrial energy demand, continues to drive the adoption of these systems in electricity and steam generation applications.

Key players shaping the Electricity & Steam Generation Waste Heat Recovery Systems Market include Siemens Energy, Climeon, Mitsubishi Heavy Industries Ltd., Thermax Limited, Bosch Industriekessel GmbH, Fortum, IHI Corporation, Forbes Marshall, General Electric, Ormat, HRS, AURA, Viessman, Promec Engineering, Exergy International SRL, BIHL, Rentech Boilers, Sofinter S.p.A, Durr Group, and Cochran.

Companies in the electricity & steam generation waste heat recovery systems market are focusing on technology upgrades and integrated solutions to solidify their market presence. Many are investing in R&D to develop more compact, efficient systems that cater to both high- and low-temperature industrial processes. Strategic collaborations with energy-intensive sectors such as steel, cement, and petrochemicals are enabling customized installations tailored to client requirements. Firms are also expanding their geographic footprint through mergers, acquisitions, and partnerships, especially in regions with growing industrial bases.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiative

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Steam rankine cycle

- 5.3 Organic rankine cycle

- 5.4 Kalina cycle

Chapter 6 Market Size and Forecast, By Temperature, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 230 °C

- 6.3 230 °C - 650 °C

- 6.4 > 650 °C

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Petroleum refining

- 7.3 Cement

- 7.4 Heavy metal manufacturing

- 7.5 Chemical

- 7.6 Pulp & paper

- 7.7 Food & beverage

- 7.8 Glass

- 7.9 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 AURA

- 9.2 BIHL

- 9.3 Bosch Industriekessel GmbH

- 9.4 Climeon

- 9.5 Cochran

- 9.6 Durr Group

- 9.7 Exergy International SRL

- 9.8 Forbes Marshall

- 9.9 Fortum

- 9.10 General Electric

- 9.11 HRS

- 9.12 IHI Corporation

- 9.13 Mitsubishi Heavy Industries Ltd.

- 9.14 Ormat

- 9.15 Promec Engineering

- 9.16 Rentech Boilers

- 9.17 Siemens Energy

- 9.18 Sofinter S.p.a

- 9.19 Thermax Limited

- 9.20 Viessman