|

市场调查报告书

商品编码

1750598

AIOps 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测AIOps Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

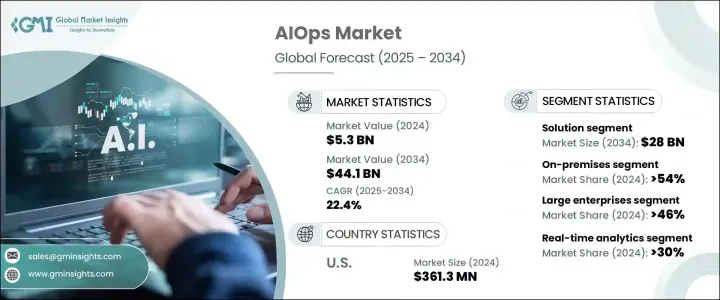

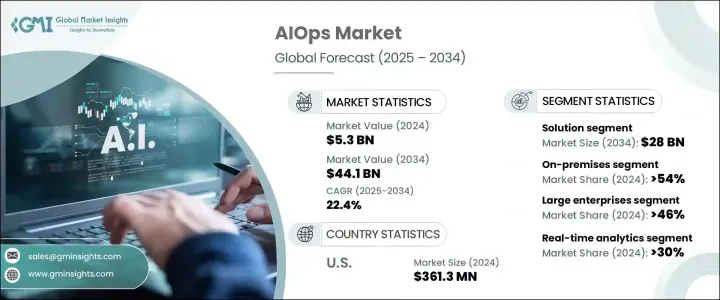

2024年,全球AIOps市场规模达53亿美元,预计2034年将以22.4%的复合年增长率成长,达到441亿美元。这得益于企业IT生态系统日益复杂的成长,以及对基础设施效能管理自动化的迫切需求。企业采用人工智慧驱动的平台来减少系统停机时间、加快事件解决速度,并即时洞察营运瓶颈。随着电信、医疗保健、零售和银行等产业的数位转型不断深入,AIOps平台已成为管理可扩展且敏捷的IT框架的核心。

科技将人工智慧与机器学习和巨量资料功能相结合,以持续监控、分析和改进 IT 营运。部署混合云和多云环境的企业会产生大量的遥测和事件资料,而 AIOps 解决方案可以快速处理和解读这些数据。这使组织能够预测中断、追踪依赖关係并简化跨分散式系统的效能监控。 AIOps 能够即时关联事件、侦测异常并找出根本原因,对于维护正常运作时间和营运连续性至关重要。随着 IT 堆迭日益分散,对能够提供预测性洞察和自主回应的智慧平台的需求正在迅速增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 53亿美元 |

| 预测值 | 441亿美元 |

| 复合年增长率 | 22.4% |

解决方案细分市场在2024年占据了60%的份额,预计到2034年将达到280亿美元。企业优先考虑可扩展的AIOps平台,以减少人工干预,并支援应用程式管理、事件解决和日誌分析的自动化。这些基于AI的工具越来越多地部署在混合云、本地部署和云端环境中,提供集中式可观察性和营运透明度。重点在于部署敏捷平台,以适应不断变化的基础设施需求,同时最大限度地减少复杂性和人为错误。解决方案产品的主导地位源自于其相容性、可扩展性以及即时应对高阶效能挑战的能力。

2024年,本地部署模式占据市场主导地位,占54%的份额。处理敏感工作负载的企业,尤其是在国防、医疗保健和金融等领域,更倾向于采用内部部署方案来保护资料、确保合规性并与传统系统整合。本地部署还能降低延迟,并为企业提供对IT基础架构的全面控制。这些优势使得本地部署成为那些承担严格监管义务和关键任务营运的公司的首选。

美国凭藉其尖端的IT格局和对AI技术的早期应用,在2024年创造了3.613亿美元的AIOps市场规模。强大的数位基础设施,加上Datadog、Elastic、IBM、思科和Dynatrace等科技巨头的高创新水平,共同打造了一个为高级AIOps部署做好准备的生态系统。敏捷框架、DevOps的采用以及混合IT环境的兴起,推动了美国企业对智慧自动化和即时决策的需求。

AIOps 市场主要参与者采用的关键策略包括持续的平台创新、策略性收购和 AI 模型优化,以确保竞争优势。 BigPanda、Moogsoft、Digitate、Aisera 和 Broadcom 等公司正在大力投资,扩展与云端原生和混合系统无缝整合的产品组合。建立强大的合作伙伴生态系统、增强多领域视觉性以及将即时分析嵌入现有 IT 工作流程,有助于这些公司推动企业采用 AIOps,并巩固其在不断发展的 AIOps 领域中的领导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 技术提供者

- OEM製造商

- 经销商

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 贸易影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(客户成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 贸易影响

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 用例

- 衝击力

- 成长动力

- 云端基础设施的激增

- IT营运对基于人工智慧的服务的需求不断增长

- 现代 IT 基础架构产生的资料量不断增加

- 各国政府推动人工智慧应用的倡议

- 产业陷阱与挑战

- 资料安全和隐私问题

- IT 营运中的变化日益增多

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 服务

第六章:市场估计与预测:依部署模型,2021 - 2034 年

- 主要趋势

- 本地

- 云

第七章:市场估计与预测:依企业规模,2021 - 2034 年

- 主要趋势

- 大型企业

- 中小企业

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 基础设施管理

- 即时分析

- 网路和安全管理

- 应用程式效能管理

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 金融服务业

- IT和电信

- 卫生保健

- 零售

- 政府

- 製造业

- 媒体与娱乐

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Aisera

- Amelia (IPsoft)

- Bigpanda

- BMC Software

- Broadcom CA

- Cisco

- Datadog

- Devo

- Digital.ai

- Digitate

- Dynatrace

- Elastic

- Espressive

- Extrahop

- harness

- IBM

- Interlink Software

- kentik

- Logz.io

- Moogsoft

The Global AIOps Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 22.4% to reach USD 44.1 billion by 2034, fueled by the rising complexity of enterprise IT ecosystems and the urgent demand for automation in managing infrastructure performance. Businesses adopt AI-driven platforms to reduce system downtime, accelerate incident resolution, and gain real-time visibility into operational bottlenecks. As digital transformation intensifies across sectors like telecommunications, healthcare, retail, and banking, AIOps platforms become central to managing scalable and agile IT frameworks.

Technology integrates artificial intelligence with machine learning and big data capabilities to continuously monitor, analyze, and improve IT operations. Enterprises deploying hybrid and multi-cloud environments generate vast telemetry and event data, which AIOps solutions can process and interpret quickly. This empowers organizations to forecast disruptions, trace dependencies, and streamline performance monitoring across distributed systems. The ability to correlate events, detect anomalies, and pinpoint root causes in real time has made AIOps indispensable for maintaining uptime and operational continuity. As IT stacks become more decentralized, the need for intelligent platforms that enable predictive insights and autonomous responses is rapidly accelerating.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $44.1 Billion |

| CAGR | 22.4% |

The solutions segment held a 60% share in 2024 and is projected to reach USD 28 billion by 2034. Businesses prioritize scalable AIOps platforms that reduce manual intervention and support automation across application management, incident resolution, and log analysis. These AI-powered tools are increasingly deployed across hybrid, on-premises, and cloud-based environments, offering centralized observability and operational transparency. The emphasis is on deploying agile platforms that adapt to evolving infrastructure demands while minimizing complexity and human error. The dominance of solution offerings is driven by their compatibility, scalability, and ability to address high-level performance challenges in real time.

The on-premises deployment model led the market with a 54% share in 2024. Enterprises dealing with sensitive workloads, particularly in sectors like defense, healthcare, and finance, prefer in-house setups for data protection, compliance adherence, and integration with legacy systems. On-premises installations also allow lower latency and provide organizations with total control over IT infrastructure. These advantages continue to make local deployments a preferred choice for companies with strict regulatory obligations and mission-critical operations.

U.S. AIOps Market generated USD 361.3 million in 2024, due to its cutting-edge IT landscape and early adoption of AI technologies. Robust digital infrastructure, combined with high innovation levels from tech giants like Datadog, Elastic, IBM, Cisco, and Dynatrace, has created an ecosystem primed for advanced AIOps deployment. The rise of agile frameworks, DevOps adoption, and hybrid IT environments fuels demand for intelligent automation and real-time decision-making across U.S. enterprises.

Key strategies adopted by major players in the AIOps Market include constant platform innovation, strategic acquisitions, and AI model refinement to ensure a competitive edge. Companies like BigPanda, Moogsoft, Digitate, Aisera, and Broadcom are investing heavily in expanding product portfolios that integrate seamlessly with cloud-native and hybrid systems. Building strong partner ecosystems, enhancing multi-domain visibility, and embedding real-time analytics into existing IT workflows help these companies drive enterprise adoption and solidify their leadership in the evolving AIOps landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Technology providers

- 3.1.1.2 OEM Manufacturers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Trade impact

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (Cost to customers)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook & future considerations

- 3.2.1 Trade impact

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Use cases

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Proliferation of cloud infrastructure

- 3.8.1.2 Growing demand for AI-based services in IT operations

- 3.8.1.3 Increasing volume of data generated by modern IT infrastructures

- 3.8.1.4 Government initiatives for AI adoption in various countries

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Data security and privacy concerns

- 3.8.2.2 Increasing number of changes in IT operations

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.3 Service

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Infrastructure management

- 8.3 Real-time analytics

- 8.4 Network & security management

- 8.5 Application performance management

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 BFSI

- 9.3 IT & telecom

- 9.4 Healthcare

- 9.5 Retail

- 9.6 Government

- 9.7 Manufacturing

- 9.8 Media & entertainment

- 9.9 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aisera

- 11.2 Amelia (IPsoft)

- 11.3 Bigpanda

- 11.4 BMC Software

- 11.5 Broadcom CA

- 11.6 Cisco

- 11.7 Datadog

- 11.8 Devo

- 11.9 Digital.ai

- 11.10 Digitate

- 11.11 Dynatrace

- 11.12 Elastic

- 11.13 Espressive

- 11.14 Extrahop

- 11.15 harness

- 11.16 IBM

- 11.17 Interlink Software

- 11.18 kentik

- 11.19 Logz.io

- 11.20 Moogsoft