|

市场调查报告书

商品编码

1750623

蜘蛛式升降机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Spider Lift Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

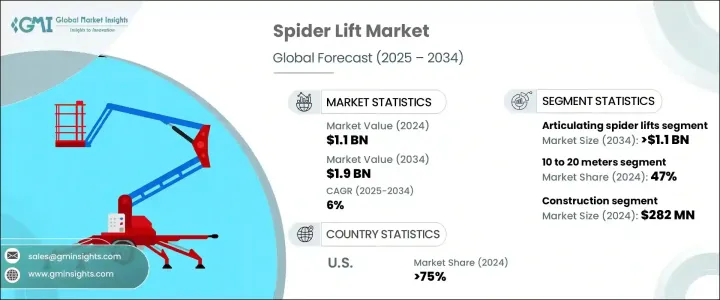

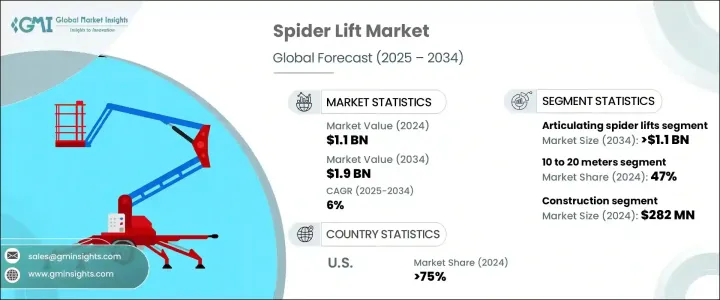

2024年,全球蜘蛛式升降机市场规模达11亿美元,预计到2034年将以6%的复合年增长率成长,达到19亿美元,这得益于物联网整合、远端资讯处理和自动化等技术的快速进步。这些创新技术能够实现更精准的即时追踪、预测性维护和简化操作,从而提高效率和安全性。受日益严格的环境法规以及城市和室内应用对低排放设备需求的影响,混合动力和电动蜘蛛式升降机设计的发展势头日益强劲。

随着建筑工程对更高通行高度的要求越来越高,各行各业都在寻求能够在复杂环境下兼顾提升和稳定性的解决方案,对长臂蜘蛛式升降机的需求也显着增长。这些升降机如今已成为大型专案的关键组成部分,而传统高空作业设备在这些专案中显得力不从心,尤其是在高层建筑维护、外部建筑工程和公用设施安装方面。长臂蜘蛛式升降机能够在狭窄或难以触及的区域作业,使其成为当今现代化施工现场不可或缺的工具。为了满足这些需求,製造商专注于设计坚固耐用、灵活多变的升降机型号,在不影响安全性和易操作性的情况下提供更大的作业范围。为了满足不断变化的监管环境,各公司正在整合智慧安全和监控系统,包括负载感测技术、自动控制和先进的远端资讯处理等功能。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 11亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 6% |

铰接式蜘蛛式升降机占据了51%的市场份额,预计到2034年将创造11亿美元的价值,其紧凑的设计、轻巧的构造以及跨行业的多功能性使其备受青睐。它们能够在狭窄空间内通行并适应不平坦的地形,这使其在具有挑战性的环境中更加重要。随着製造商不断改进型号以满足独特的应用需求,维护、安装和城市公用事业项目的需求激增。其灵活的臂架和精确的机动性使其特别适合在交通不便的地区开展项目,而其便携性使其能够在各个场地高效部署。

2024年,平台高度在10公尺至20公尺之间的蜘蛛式升降机占据了47%的市场份额,这得益于对可及性和移动性的平衡需求。这一高度范围为园林绿化、轻型建筑和公共设施维护等任务提供了理想的可用性。防滑平台、紧急下降系统和自动过载保护等增强型安全功能正在成为标准配置,帮助操作员在密集或高流量环境中更自信地工作。随着工作场所安全法规的日益严格,这些功能正成为必不可少的要求。

美国蜘蛛式升降机市场规模达3.338亿美元,占2024年市场份额的75%,这得益于工业的快速发展、商业建筑的激增以及基础设施升级投资的增加。联邦和州政府对永续发展的大力推动加速了向电动和混合动力蜘蛛式升降机的转变,这些设备现场零排放,并且在敏感区域或室内区域运行更安静。在北美,随着各城市实施更严格的排放标准和噪音限制,承包商和租赁公司纷纷转向电池供电或混合动力蜘蛛升降机。

塑造产业格局的关键参与者包括 CTE SpA、Dinolift、Platform Basket、Cela、山东托罗斯机械股份有限公司、奥什科甚集团、特雷克斯、Niftylift、Imer 和湖北高曼重工科技。领先企业正优先考虑策略合作伙伴关係和产品创新。许多公司在研发方面投入巨资,设计出配备先进控制系统的轻量化、紧凑型、环保车型。透过区域分销网路和经销商合作伙伴关係进行的全球扩张,正在帮助他们开拓新兴市场。各公司也正在加强售后服务,并提供灵活的租赁和融资方案,以满足租赁业务和大型车队营运商的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原料和零件供应商

- 技术提供者

- 製成品

- 经销商

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 对贸易的影响

- 定价和产品策略

- 技术与创新格局

- 自动化和机器人技术

- 环保电力系统

- 物联网与远端资讯处理的集成

- 先进的控制系统与安全机制

- 专利分析

- 监管格局

- 用例

- 重要新闻和倡议

- 成本分解分析

- 首次购买

- 维护和维修

- 营运成本

- 运输

- 折旧

- 价格趋势分析

- 产品

- 地区

- 监管格局

- 对部队的影响

- 成长动力

- 建筑和基础设施项目对高空作业平台的需求不断增长

- 技术进步和安全性能的改进

- 工人安全法规意识不断增强

- 租赁设备需求不断成长

- 产业陷阱与挑战

- 初期投资及维护成本高

- 法规遵从性和安全标准

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 伸缩式蜘蛛升降机

- 铰接式蜘蛛升降机

- 履带式蜘蛛升降机

- 电动或混合动力蜘蛛式升降机

第六章:市场估计与预测:依平台高度,2021 - 2034 年

- 主要趋势

- 10米以下

- 10至20米

- 20至25米

- 25米以上

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 政府

- 电信和公用事业

- 工业和製造公司

- 设施管理公司

- 租赁

- 娱乐和媒体製作

第八章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Airo

- Almac

- Cela

- CMC Lift

- CTE

- Dinolift

- Easy Lift

- Falcon Lift

- HINOWA

- Imer

- JLG Industries

- Niftylift

- Omme Lift

- Palazzani Industrie

- Platform Basket

- SHANDONG HIMOR MACHINERY

- Socageworld

- Teejan Equipment

- Terex Corporation

- Teupen

The Global Spider Lift Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 1.9 billion by 2034, driven by rapid technological advancements, including IoT integration, telematics, and automation. These innovations allow for better real-time tracking, predictive maintenance, and simplified operation, improving efficiency and safety. There is a growing momentum around hybrid and electric spider lift designs, influenced by increasingly stringent environmental regulations and the need for low-emission equipment in urban and indoor applications.

With construction projects requiring heights of greater access, longer-reach spider lifts are seeing a noticeable rise in demand as industries seek solutions that offer both elevation and stability in complex environments. These lifts are now a critical part of large-scale projects where conventional access equipment falls short, especially in high-rise maintenance, exterior building work, and utility installation. The ability of longer-reach spider lifts to operate in confined or difficult-to-reach areas makes them indispensable for today's modern job sites. In response to these needs, manufacturers focus on engineering robust and flexible lift models that offer greater reach without compromising safety or ease of operation. To meet the evolving regulatory landscape, companies are integrating intelligent safety and monitoring systems, including features like load-sensing technology, automated controls, and advanced telematics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 6% |

Articulating spider lifts segment held 51% share and is projected to generate USD 1.1 billion in value by 2034, favored by their compact design, lightweight build, and versatility across industries. Their ability to navigate narrow spaces and adapt to uneven terrain has increased their relevance in challenging environments. As manufacturers continue to refine models to meet unique application needs, demand has surged across maintenance, installation, and urban utility projects. Their flexible arms and precise maneuverability make them especially suitable for projects in areas with limited access, while their portability enables efficient deployment across sites.

Spider lifts with platform heights ranging from 10 to 20 meters held a 47% share in 2024, driven by the balanced need for reach and mobility. This height range offers ideal usability for tasks across landscaping, light construction, and public facility maintenance. Enhanced safety features such as anti-slip platforms, emergency descent systems, and automatic overload protection are becoming standard, helping operators work more confidently in dense or high-traffic environments. With stricter regulations around workplace safety, these features are becoming essential requirements.

United States Spider Lift Market generated USD 333.8 million, accounting for a 75% share in 2024, driven by rapid industrial development, a surge in commercial construction, and increased investments in infrastructure upgrades. The push for sustainability across federal and state levels accelerates the shift toward electric and hybrid spider lifts, which produce zero on-site emissions and operate more quietly in sensitive or indoor areas. In North America, contractors and rental companies turn to battery-powered or hybrid units as cities enforce stricter emissions standards and noise restrictions.

Key players shaping the industry include CTE SpA, Dinolift, Platform Basket, Cela, Shandong Toros Machinery Corporation, Oshkosh Corporation, Terex, Niftylift, Imer, and Hubei Goman Heavy Industry Technology. Leading companies are prioritizing strategic partnerships and product innovation. Many invest heavily in R&D to design lightweight, compact, eco-friendly models with advanced control systems. Global expansion through regional distribution networks and dealer partnerships is helping them tap into emerging markets. Companies are also enhancing after-sales services and offering flexible leasing and financing options to cater to rental businesses and large fleet operators.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material and component suppliers

- 3.1.1.2 Technology providers

- 3.1.1.3 Manufactures

- 3.1.1.4 Distributors

- 3.1.1.5 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.1 Impact on trade

- 3.3 Pricing and product strategies

- 3.4 Technology & innovation landscape

- 3.4.1 Automation and robotics

- 3.4.2 Eco-Friendly power systems

- 3.4.3 Integration of IoT and telematics

- 3.4.4 Advanced control systems and safety mechanisms

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Use cases

- 3.8 Key news & initiatives

- 3.9 Cost break-down analysis

- 3.9.1 Initial purchase

- 3.9.2 Maintenance & repairs

- 3.9.3 Operational costs

- 3.9.4 Transportation

- 3.9.5 Depreciation

- 3.10 Price trend analysis

- 3.10.1 Product

- 3.10.2 Region

- 3.11 Regulatory landscape

- 3.12 Impact on forces

- 3.12.1 Growth drivers

- 3.12.1.1 Rising demand for aerial work platforms in construction and infrastructure projects

- 3.12.1.2 Technological advancements and improved safety features

- 3.12.1.3 Growing awareness of worker safety regulations

- 3.12.1.4 Growing demand for rental equipment

- 3.12.2 Industry pitfalls & challenges

- 3.12.2.1 High initial investment and maintenance costs

- 3.12.2.2 Regulatory compliance and safety standards

- 3.12.1 Growth drivers

- 3.13 Growth potential analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Telescopic spider lifts

- 5.3 Articulating spider lifts

- 5.4 Crawler-based spider lifts

- 5.5 Electric or hybrid spider lifts

Chapter 6 Market Estimates & Forecast, By Platform Height, 2021 - 2034 ($Mn Units)

- 6.1 Key trends

- 6.2 Below 10 meters

- 6.3 10 to 20 meters

- 6.4 20 to 25 meters

- 6.5 Above 25 meters

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Government

- 7.3 Telecommunications & utility

- 7.4 Industrial and manufacturing firms

- 7.5 Facility management companies

- 7.6 Rental

- 7.7 Entertainment & media production

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 North America

- 8.1.1 U.S.

- 8.1.2 Canada

- 8.2 Europe

- 8.2.1 UK

- 8.2.2 Germany

- 8.2.3 France

- 8.2.4 Italy

- 8.2.5 Spain

- 8.2.6 Russia

- 8.3 Asia Pacific

- 8.3.1 China

- 8.3.2 India

- 8.3.3 Japan

- 8.3.4 Australia

- 8.3.5 South Korea

- 8.3.6 Southeast Asia

- 8.4 Latin America

- 8.4.1 Brazil

- 8.4.2 Mexico

- 8.4.3 Argentina

- 8.5 MEA

- 8.5.1 South Africa

- 8.5.2 Saudi Arabia

- 8.5.3 UAE

Chapter 9 Company Profiles

- 9.1 Airo

- 9.2 Almac

- 9.3 Cela

- 9.4 CMC Lift

- 9.5 CTE

- 9.6 Dinolift

- 9.7 Easy Lift

- 9.8 Falcon Lift

- 9.9 HINOWA

- 9.10 Imer

- 9.11 JLG Industries

- 9.12 Niftylift

- 9.13 Omme Lift

- 9.14 Palazzani Industrie

- 9.15 Platform Basket

- 9.16 SHANDONG HIMOR MACHINERY

- 9.17 Socageworld

- 9.18 Teejan Equipment

- 9.19 Terex Corporation

- 9.20 Teupen