|

市场调查报告书

商品编码

1755226

超级自动化市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Hyper Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

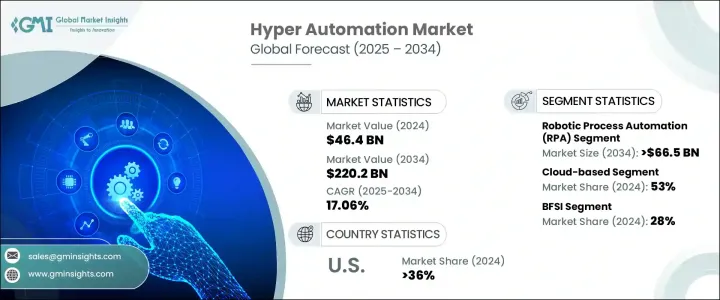

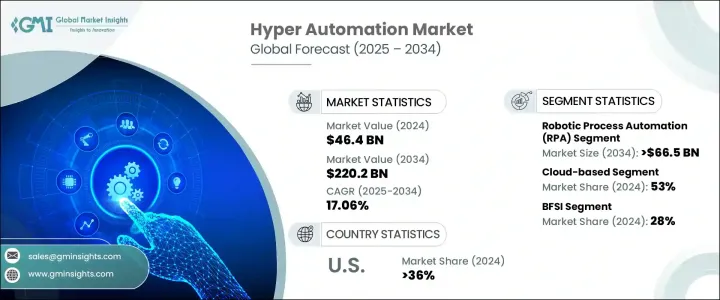

2024年,全球超级自动化市场规模达464亿美元,预计2034年将以17.06%的复合年增长率成长,达到2,202亿美元。随着企业努力提升效率并最大限度地减少资源消耗,超级自动化正逐渐成为关键解决方案。透过利用人工智慧、机器学习和机器人流程自动化 (RPA),超级自动化可以自动执行重复的劳动密集型任务,帮助企业消除瓶颈、减少错误并提高工作流程的精确度。这使得企业能够快速回应市场变化,提高营运效率,从而提升生产力并推动更智慧的营运。

随着各行各业经历数位转型,超级自动化发挥着至关重要的作用,它能够实现流程自动化,促进即时决策,从而推动从传统手动方法转向更灵活的数位化工作流程。无论是在客户服务或供应链管理领域,超级自动化都能加速营运。其可扩展的特性使企业无需进行大规模系统改造即可实现成长,使其成为企业紧跟技术进步和不断变化的客户期望的必备工具。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 464亿美元 |

| 预测值 | 2202亿美元 |

| 复合年增长率 | 17.06% |

2024年,机器人流程自动化 (RPA) 领域创造了超过 156 亿美元的收入,预计到 2034 年将超过 665 亿美元。 RPA 透过自动化资料输入和发票处理等日常任务来增强超自动化,使企业能够更有效率地运营,避免人为错误的风险。 RPA 工具可以无缝整合到现有工作流程中,使企业无需彻底改造其技术基础设施即可享受自动化的优势。这使得 RPA 成为银行和物流等重复性任务繁重且营运效率至关重要的行业的理想解决方案。

2024年,基于云端的细分市场占据了53%的份额。基于云端的超级自动化解决方案提供灵活性和可访问性,使其成为寻求快速部署和远端功能的企业的理想选择。这些系统无需大量基础设施投资,使企业能够扩展其自动化策略,同时降低硬体成本。此外,自动更新功能使团队能够即时协作,从而提高营运敏捷性和回应能力。

由于强大的数位基础设施和政府对新兴技术的大力支持,北美超级自动化市场在2024年占据了36%的市场份额。各行各业的公司正在整合人工智慧、机器学习和机器人流程自动化,以增强营运灵活性并降低成本。这种转变使企业能够快速回应市场动态和不断变化的客户需求。教育机构、科技公司和产业领袖之间的合作促进了持续创新,而高技能劳动力的可用性则加速了实施。

全球超级自动化产业的主要参与者包括Google、甲骨文、ServiceNow、UiPath、Honeywell国际、微软、SAP SE、Automation Anywhere、TCS 和 WorkFusion。为了维持并扩大市场份额,超级自动化产业的公司专注于多项策略性倡议。其中一个主要策略是扩展产品组合,整合先进的人工智慧、机器学习和机器人流程自动化 (RPA) 功能,以满足多样化的客户需求。此外,各公司也与製造业、医疗保健业和物流业等行业的领导者建立策略合作伙伴关係,以打造客製化解决方案,以应对自动化领域的特定挑战。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- RPA提供者

- AI/ML解决方案供应商

- BPM和工作流程平台

- 云端与整合推动者

- ERP 和企业自动化供应商

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 提高营运效率的需求

- 跨产业快速数位转型

- 对降低成本和可扩展性的需求日益增加

- 业务流程日益复杂

- 产业陷阱与挑战

- 大规模实施超自动化

- 破坏超级自动化计划的有效性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依技术类型,2021 - 2034 年

- 机器人流程自动化(RPA)

- 人工智慧 (AI) 与机器学习 (ML)

- 业务流程管理 (BPM)

- 智慧型文檔处理(IDP)

- 低程式码/无程式码平台

第六章:市场估计与预测:按部署,2021 - 2034 年

- 基于云端

- 本地

第七章:市场估计与预测:按解决方案,2021 - 2034 年

- 软体

- 自动化软体

- 智慧型文件处理(IDP)解决方案

- 云端自动化平台

- 进阶分析和报告工具

- 服务

- 专业服务

- 部署与集成

- 咨询

- 支援与维护

- 託管服务

- 专业服务

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- BFSI(银行、金融服务和保险)

- 卫生保健

- 製造业

- 零售

- 资讯科技和电信

- 政府和公共部门

- 运输和物流

- 其他的

第九章:市场估计与预测:依组织规模,2021 - 2034 年

- 大型企业

- 中小企业(SME)

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- Allerin Tech

- Appian

- Automation Anywhere

- Catalytic

- Celonis

- Fortra

- Honeywell International

- Microsoft Corporation

- Mitsubishi Electric Corporation

- OneGlobe

- Oracle Corporation

- Redwood Software

- SAP SE

- ServiceNow

- SolveXia

- Tata Consultancy Services (TCS)

- UiPath

- Wipro Ltd

- WorkFusion

The Global Hyper Automation Market was valued at USD 46.4 billion in 2024 and is estimated to grow at a CAGR of 17.06% to reach USD 220.2 billion by 2034 as businesses strive to enhance efficiency and minimize resource consumption, hyper automation is emerging as a crucial solution. By leveraging AI, machine learning, and robotic process automation (RPA), it automates repetitive, labor-intensive tasks, helping organizations eliminate bottlenecks, reduce errors, and improve workflow precision. This allows companies to respond quickly to market changes and operate more efficiently, increasing productivity and driving smarter operations.

As industries undergo digital transformation, hyper automation plays a vital role by enabling the automation of processes and fostering real-time decision-making, facilitating a shift from traditional manual methods to more flexible, digital workflows. Whether in customer service or supply chain management, hyper automation accelerates operations. Its scalable nature enables businesses to grow without major system overhauls, making it an essential tool for companies aiming to keep pace with technological advancements and evolving customer expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $46.4 Billion |

| Forecast Value | $220.2 Billion |

| CAGR | 17.06% |

In 2024, the robotic process automation (RPA) segment generated over USD 15.6 billion in revenue and is expected to surpass USD 66.5 billion by 2034. RPA enhances hyper automation by automating mundane tasks, such as data entry and invoice processing, allowing organizations to run more efficiently without the risk of human error. RPA tools integrate seamlessly into existing workflows, offering organizations the benefits of automation without requiring a complete overhaul of their technological infrastructure. This makes RPA an attractive solution for industries burdened with repetitive tasks, such as banking and logistics, where operational efficiency is critical.

The cloud-based segment held a 53% share in 2024. Cloud-based hyper automation solutions offer flexibility and ease of access, making them ideal for businesses looking for fast deployment and remote capabilities. These systems eliminate the need for heavy infrastructure investments and enable organizations to scale their automation strategies while reducing hardware costs. Additionally, automatic updates allow teams to collaborate in real time, improving operational agility and responsiveness.

North America Hyper Automation Market held 36% share in 2024 fueled by robust digital infrastructure and strong government support for emerging technologies. Companies across various industries are integrating AI, machine learning, and robotic process automation to enhance operational flexibility and reduce costs. This shift enables businesses to respond rapidly to market dynamics and evolving customer demands. Collaborations between educational institutions, technology firms, and industry leaders foster continuous innovation, while the availability of a highly skilled workforce accelerates implementation.

Key players in the Global Hyper Automation Industry include Google, Oracle, ServiceNow, UiPath, Honeywell International, Microsoft Corporation, SAP SE, Automation Anywhere, TCS, and WorkFusion. To maintain and grow their market presence, companies in the hyper automation industry are focused on several strategic initiatives. One of the primary strategies is the expansion of their product portfolios, incorporating advanced AI, machine learning, and RPA capabilities to meet diverse customer needs. Companies are also forming strategic partnerships with industry leaders across sectors like manufacturing, healthcare, and logistics to create tailored solutions that address specific challenges in automation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.3.1 RPA Providers

- 3.3.2 AI/ML Solution Vendors

- 3.3.3 BPM & Workflow Platforms

- 3.3.4 Cloud & Integration Enablers

- 3.3.5 ERP & Enterprise Automation Vendors

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Demand for enhanced operational efficiency

- 3.9.1.2 Rapid digital transformation across industries

- 3.9.1.3 Increasing need for cost reduction and scalability

- 3.9.1.4 Rising complexity of business processes

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Implementing hyper automation at scale

- 3.9.2.2 Undermining the effectiveness of hyper automation initiatives

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology Type, 2021 - 2034 (USD, Mn)

- 5.1 Robotic process automation (RPA)

- 5.2 Artificial intelligence (AI) and machine learning (ML)

- 5.3 Business process management (BPM)

- 5.4 Intelligent document processing (IDP)

- 5.5 Low-code/No-code platforms

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 (USD, Mn)

- 6.1 Cloud-based

- 6.2 On-premises

Chapter 7 Market Estimates & Forecast, By Solution, 2021 - 2034 (USD, Mn)

- 7.1 Software

- 7.1.1 Automation software

- 7.1.2 Intelligent document processing (IDP) solutions

- 7.1.3 Cloud automation platforms

- 7.1.4 Advanced analytics & reporting tools

- 7.2 Services

- 7.2.1 Professional services

- 7.2.1.1 Deployment & integration

- 7.2.1.2 Consulting

- 7.2.1.3 Support & maintenance

- 7.2.2 Managed services

- 7.2.1 Professional services

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Mn)

- 8.1 BFSI (Banking, Financial Services, and Insurance)

- 8.2 Healthcare

- 8.3 Manufacturing

- 8.4 Retail

- 8.5 IT and Telecom

- 8.6 Government and public sector

- 8.7 Transportation and logistics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 (USD, Mn)

- 9.1 Large enterprises

- 9.2 SME (Small and Medium Enterprises)

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Allerin Tech

- 11.2 Appian

- 11.3 Automation Anywhere

- 11.4 Catalytic

- 11.5 Celonis

- 11.6 Fortra

- 11.7 Google

- 11.8 Honeywell International

- 11.9 Microsoft Corporation

- 11.10 Mitsubishi Electric Corporation

- 11.11 OneGlobe

- 11.12 Oracle Corporation

- 11.13 Redwood Software

- 11.14 SAP SE

- 11.15 ServiceNow

- 11.16 SolveXia

- 11.17 Tata Consultancy Services (TCS)

- 11.18 UiPath

- 11.19 Wipro Ltd

- 11.20 WorkFusion