|

市场调查报告书

商品编码

1755267

人工智慧和机器学习操作化软体市场机会、成长动力、产业趋势分析和 2025 - 2034 年预测AI and Machine Learning Operationalization Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

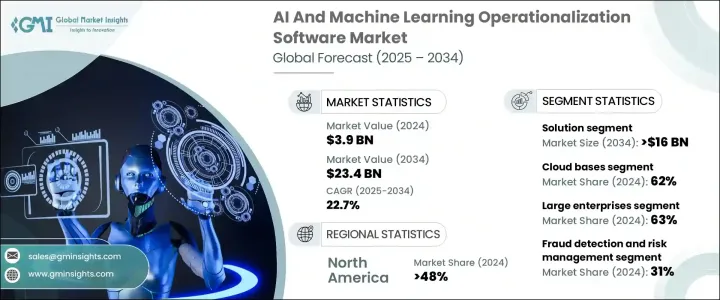

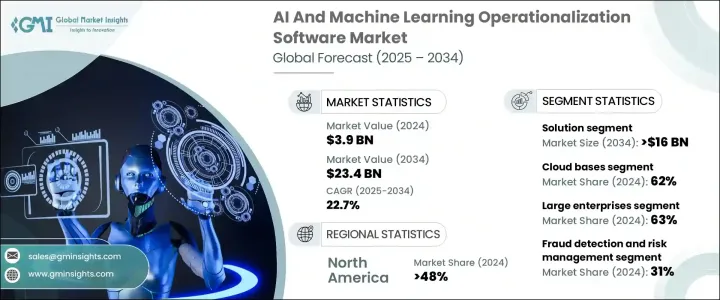

2024年,全球人工智慧和机器学习运营化软体市场规模达39亿美元,预计到2034年将以22.7%的复合年增长率成长,达到234亿美元。这得益于数据驱动决策需求的不断增长,以及企业对可扩展、自动化模型部署的需求日益增长。各组织机构正在迅速采用这些解决方案,以简化人工智慧工作流程、减少营运摩擦、确保合规性并加速创新,尤其是在製造业、金融业、医疗保健业和电子商务业等行业。

随着人工智慧和机器学习应用成为核心业务营运不可或缺的一部分,企业寻求强大的平台来即时部署、监控和维护模型。手动模型管理的低效率正推动市场向能够提供大规模人工智慧全生命週期支援的平台发展,以确保所有营运环节的准确性和速度始终保持一致。企业寻求能够在不断变化的营运环境中保持一致性、韧性和灵活性的平台。企业明显转向使用能够简化机器学习工作流程复杂性的工具,从而使组织能够有效率地从实验阶段过渡到全面实施。企业现在正在寻求能够消除技术障碍并简化资料撷取、特征工程、模型验证和部署后监控等流程的平台。这种转变正在减少对大型资料科学团队的依赖,并赋能跨职能使用者(从分析师到 IT 团队)进行人工智慧专案协作。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 39亿美元 |

| 预测值 | 234亿美元 |

| 复合年增长率 | 22.7% |

2024年,解决方案细分市场创造了23亿美元的收入,到2034年将达到160亿美元。这一势头凸显了人们对全週期人工智慧软体的日益依赖,这些软体能够简化从资料准备到即时模型监控的所有流程。企业正在转向这些解决方案,以加快部署进度并更快地创造价值,尤其是在内部资料科学专业知识有限的环境中。透过提供自动化和可扩展性,这些平台对于财务、营运、行销和客户体验等业务部门至关重要。

2024年,云端部署领域占据了62%的份额,这得益于其适应性、成本效益以及与现有数位生态系统的无缝整合。云端基础设施使企业能够集中和协调分散式团队中的AI功能(例如模型版本控制、治理和协作),从而确保一致的效能和更快的迭代周期。它在推动AI访问民主化方面发挥的作用,使其成为在不同业务环境中扩展营运的首选。

2024年,北美人工智慧和机器学习运营化软体市场占据了48%的市场份额,这得益于成熟的人工智慧实施、强劲的云端运算应用以及对人工智慧研发的持续投入。在美国,对监管合规性、营运透明度和竞争敏捷性的高度关注,促使企业在企业规模的人工智慧营运方面投入大量资金。

DataRobot、Google云端、IBM、H2O.ai、微软、SAS Institute、亚马逊网路服务 (AWS)、Dataiku、Databricks、C3.ai。领先的公司在平台整合、使用者介面改进和云端原生功能方面投入大量资金。许多公司专注于建立统一的环境,提供涵盖模型训练、部署、治理和监控的全生命週期 AI 支援。此外,公司正在与云端服务供应商和企业软体供应商建立策略联盟,以扩大覆盖范围并增强功能。对自动化 MLOps 功能、无程式码/低程式码环境和预先建置 AI 工作流程的投资,使非技术团队能够更广泛地采用该技术。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 製造商

- 零件供应商

- 技术提供者

- 服务提供者

- 最终用途

- 利润率分析

- 技术与创新格局

- 重要新闻和倡议

- 专利分析

- 监管格局

- 衝击力

- 成长动力

- 各行各业对人工智慧/机器学习的采用日益增多

- 需要可扩展且自动化的机器学习工作流程

- 云端原生人工智慧解决方案的兴起

- 透过人工智慧投资创造商业价值的压力

- 产业陷阱与挑战

- 缺乏模型透明度和可解释性

- 与现有基础设施的整合复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体

- 模型开发和训练软体

- 模型部署软体

- 模型监控管理软体

- 资料管理软体

- 服务

- 专业服务

- 託管服务

第六章:市场估计与预测:依部署模式,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

第七章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 中小企业

- 大型企业

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 预测分析

- 诈欺侦测和风险管理

- 客户体验管理

- 自然语言处理 (NLP) 和文本分析

- 其他的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 银行、金融服务和保险(BFSI)

- 医疗保健和生命科学

- 零售与电子商务

- IT和电信

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第 11 章:公司简介

- Alteryx

- Amazon Web Services (AWS)

- Aporia

- C3.ai

- Cloudera

- Databricks

- Dataiku

- DataRobot

- Domino Data Lab

- Google Cloud

- H2O.ai

- IBM Watson

- Infosys Nia

- Microsoft Azure

- Oracle

- Palantir Technologies

- Qlik

- RapidMiner

- SAS Institute

- Seldon

The Global AI and Machine Learning Operationalization Software Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 22.7% to reach USD 23.4 billion by 2034, propelled by increasing demand for data-driven decision-making and the growing need for scalable, automated model deployment across enterprises. Organizations are rapidly adopting these solutions to streamline AI workflows, reduce operational friction, ensure regulatory compliance, and accelerate innovation-especially within sectors like manufacturing, finance, healthcare, and e-commerce.

As artificial intelligence and machine learning applications become integral to core business operations, companies seek robust platforms to deploy, monitor, and maintain models in real-time. The inefficiency of manual model management is driving the market toward platforms that offer full lifecycle support for AI at scale, ensuring consistent accuracy and speed across operations. Enterprises seek platforms that maintain consistency, resilience, and flexibility across evolving operational landscapes. There's a clear shift toward tools that simplify the complexities of machine learning workflows, allowing organizations to move from experimentation to full-scale implementation efficiently. Businesses are now seeking platforms that abstract technical hurdles and streamline processes such as data ingestion, feature engineering, model validation, and post-deployment monitoring. This transition is reducing reliance on large data science teams and empowering cross-functional users-from analysts to IT teams-to collaborate on AI initiatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $23.4 Billion |

| CAGR | 22.7% |

In 2024, the solutions segment generated USD 2.3 billion and will reach USD 16 billion by 2034. This momentum underscores the increasing reliance on full-cycle AI software that streamlines everything from data preparation to real-time model monitoring. Enterprises are turning to these solutions to accelerate deployment timelines and drive value faster, particularly in environments where in-house data science expertise is limited. By offering automation and scalability, these platforms are becoming essential for business units across finance, operations, marketing, and customer experience.

Cloud-based deployment segment held a 62% share in 2024, driven by its adaptability, cost-effectiveness, and seamless integration with existing digital ecosystems. Cloud infrastructure allows enterprises to centralize and coordinate AI functions-like model versioning, governance, and collaboration-within distributed teams, ensuring consistent performance and faster iteration cycles. Its role in democratizing AI access has made it the preferred choice for scaling operations across diverse business environments.

North America AI and Machine Learning Operationalization Software Market held a 48% share in 2024, bolstered by mature AI implementation, robust cloud adoption, and continuous investment in AI R&D. In the U.S., heightened focus on regulatory compliance, operational transparency, and competitive agility is prompting companies to invest heavily in operationalizing AI at enterprise scale.

DataRobot, Google Cloud, IBM, H2O.ai, Microsoft, SAS Institute, Amazon Web Services (AWS), Dataiku, Databricks, C3.ai. Leading firms invest heavily in platform integration, user interface improvements, and cloud-native functionality. Many focus on building unified environments that offer full-lifecycle AI support-spanning model training, deployment, governance, and monitoring. Additionally, companies are forming strategic alliances with cloud providers and enterprise software vendors to expand reach and enhance functionality. Investments in automated MLOps capabilities, no-code/low-code environments, and prebuilt AI workflows enable wider adoption across non-technical teams.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.3.1 Manufacturers

- 3.3.2 Component suppliers

- 3.3.3 Technology providers

- 3.3.4 Service providers

- 3.3.5 End use

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Patent analysis

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of ai/ml across industries

- 3.9.1.2 Need for scalable and automated ml workflows

- 3.9.1.3 Rise of cloud-native ai solutions

- 3.9.1.4 Pressure to generate business value from ai investments

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Lack of model transparency and explainability

- 3.9.2.2 Integration complexity with existing infrastructure

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Model development and training software

- 5.2.2 Model deployment software

- 5.2.3 Model monitoring and management software

- 5.2.4 Data management software

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud based

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Small and medium enterprises (SMEs)

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Predictive analytics

- 8.3 Fraud detection and risk management

- 8.4 Customer experience management

- 8.5 Natural language processing (NLP) and text analytics

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Banking, financial services, and insurance (BFSI)

- 9.3 Healthcare and life sciences

- 9.4 Retail and e-commerce

- 9.5 IT and telecommunications

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Alteryx

- 11.2 Amazon Web Services (AWS)

- 11.3 Aporia

- 11.4 C3.ai

- 11.5 Cloudera

- 11.6 Databricks

- 11.7 Dataiku

- 11.8 DataRobot

- 11.9 Domino Data Lab

- 11.10 Google Cloud

- 11.11 H2O.ai

- 11.12 IBM Watson

- 11.13 Infosys Nia

- 11.14 Microsoft Azure

- 11.15 Oracle

- 11.16 Palantir Technologies

- 11.17 Qlik

- 11.18 RapidMiner

- 11.19 SAS Institute

- 11.20 Seldon